Municipals were better to start the week in constructive secondary trading while U.S. Treasuries pared back earlier gains to close the session mixed and equities ended in the red.

Triple-A yields fell three to five basis points along the curve while UST were little changed to weaker by a basis point on the short end.

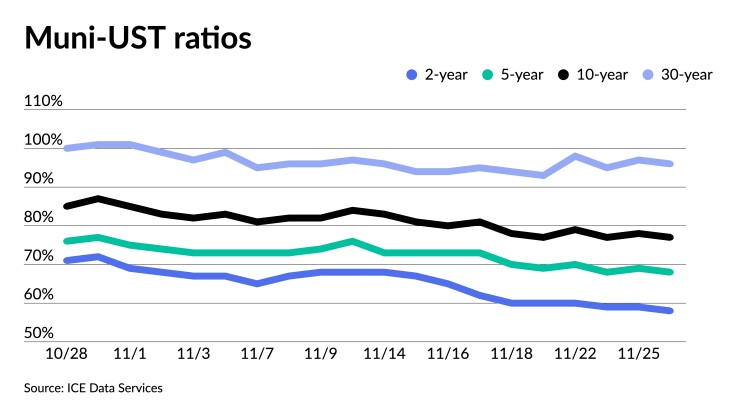

The three-year muni-UST ratio Monday was at 63%, the five-year at 70%, the 10-year at 76% and the 30-year at 95%, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the three at 63%, the five at 68%, the 10 at 77% and the 30 at 96% at a 3 p.m. read.

Municipals have hit a high note in November with the asset class outperforming other fixed income markets, despite ongoing macroeconomic uncertainties.

"Munis are on pace to have their best month since 1986, which is positive news with November having the lightest month of issuance this year, as well as investors sentiment towards higher inflation, seems to be waning," said Jason Wong, vice president of municipals at AmeriVet Securities.

Month-to-date, munis have fallen more than 50 basis points across the curve and have made gains of more than 4%, which is the largest monthly gain for munis since August 1986, Wong noted.

"This rally has helped the ease of the losses munis have had this year, prior to November munis were down by over 12%" but are now down by about 9.32%, he said.

The Bloomberg Municipal Index is at positive 4.06% as of Friday. Bloomberg indices show high-yield returning 4.17%, taxable munis returning 4.38% in November while the Impact Index is at positive 4.66%.

Yields have come down from their 11-year highs as Wongnoted that "investors have started to buy as it appears that the Fed's policy to bring down inflation is working."

However, outflows returned last week as Refinitiv Lipper reported $438.381 million was pulled from municipal bond mutual funds for the week ending Wednesday after $604.704 million of inflows the week prior.

Fund flows have sent conflicting signals about demand, said CreditSights strategists Pat Luby and John Ceffalio.

High-yield reported $34.610 million of outflows after $386.352 million of inflows the week prior while exchange-traded funds saw more inflows of $845.078 million after $1.791 billion of inflows the previous week.

Net flows into muni exchange-traded funds have been consistently positive while mutual fund flows have been consistently negative, Luby and Ceffalio said.

They expect weekly net flows to continue to be negative into mid-December. Since several municipal bond mutual funds "expect to distribute capital gains before year-end, some investors and financial advisors are likely to hold off on putting money into mutual funds in order to avoid the risk of immediately receiving a taxable distribution," they said.

"Weekly net mutual fund flows will continue to be negative for at least the next several weeks until the record dates for December distributions have passed," they said.

Consequently, they expect that starting in mid-December, "net mutual fund demand will begin to be better aligned with ETF demand." They noted that improved net flows into mutual funds should also reduce selling pressure in the secondary market.

New-issue supply has recently been mostly below average and "any possible post-Thanksgiving surge in supply would be short-lived," they said.

Bond Buyer 30-day visible supply sits at $12.43 billion while Bloomberg data shows $13.824 billion of net negative supply.

November is poised to disappoint on the supply front and

Coming up this week, issuance is higher, but still below average. The Commonwealth of Massachusetts (Aa1/AA/AA+/) kicks off the competitive market Tuesday with two sales: $200 million of general obligation bonds and $500 million of GOs.

They expect the primary market to pause during the next Federal Open Market Committee meeting, "giving issuers just two full weeks in which to sell bonds this year."

Demand will get an immediate boost this week, they said, when investors receive $31 billion of principal and interest payments.

Last week, secondary trading was very light due to the Thanksgiving holiday on Thursday and Friday being an early close, Wong said.

Secondary trading totaled $27.9 billion with 52% of all trading being clients buying. Additionally, bids-wanteds were also down for the week with $4.61 billion.

Despite a holiday-shortened week, muni yields continued to fall with "10-year notes falling by 4.8 basis points to 2.83% as it appears that inflation pressure seems to be easing amongst investors as well as limited new issue supply and the rally in Treasuries has helped yields come down from their highs," Wong said.

Secondary trading

Maryland 5s of 2023 at 2.50% versus 2.53%-2.51% Wednesday. New York City TFA 5s of 2023 at 2.61% versus 2.63%-2.62% Wednesday. NYC 5s of 2024 at 2.68%-2.67%.

Delaware 5s of 2027 at 2.72%-2.68%. Maryland 5s of 2027 at 2.71%-2.69%. California 5s of 2028 at 2.65%-2.61%.

New York City waters 5s of 2031 at 2.87%. Montgomery County, Maryland, 5s of 2032 at 2.80%. Maryland 5s of 2035 at 3.11%-3.08%.

Ohio waters 5s of 2042 at 3.56%. Los Angeles DWP 5s of 2047 at 3.73%.

New York UDC 5s of 2050 at 4.16%-4.15%. California 5s of 2052 at 3.66%-3.60%.

AAA scales

Refinitiv MMD's scale was bumped up to five basis points: the one-year at 2.58% (-3) and 2.62% (-3) in two years. The five-year at 2.73% (unch), the 10-year at 2.81% (-5) and the 30-year at 3.56% (-3).

The ICE AAA yield curve was bumped three to four basis points: 2.59% (-4) in 2023 and 2.64% (-4) in 2024. The five-year at 2.70% (-3), the 10-year was at 2.84% (-3) and the 30-year yield was at 3.63% (-4) at a 3:30 p.m. read.

The IHS Markit municipal curve was bumped three basis points: 2.58% (-3) in 2023 and 2.64% (-3) in 2024. The five-year was at 2.73% (-3), the 10-year was at 2.82% (-3) and the 30-year yield was at 3.56% (-3) at a 4 p.m. read.

Bloomberg BVAL was bumped two to three basis points: 2.62% (-3) in 2023 and 2.65% (-3) in 2024. The five-year at 2.70% (-3), the 10-year at 2.80% (-3) and the 30-year at 3.54% (-3) at 3:30 p.m.

Treasuries were mixed.

The two-year UST was yielding 4.461% (flat), the three-year was at 4.220% (+2), the five-year at 3.881% (+2), the seven-year 3.798% (+1), the 10-year yielding 3.689% (+1), the 20-year at 3.961% (flat) and the 30-year Treasury was yielding 3.735% (flat) near the close.

Mutual fund details

Refinitiv Lipper reported $438.381 million of outflows for the week ending Wednesday following $604.704 million of inflows the previous week.

Exchange-traded muni funds reported inflows of $845.078 million after inflows of $1.791 billion in the previous week. Ex-ETFs, muni funds saw outflows of $1.283 billion after outflows of $1.186 billion in the prior week.

Long-term muni bond funds had outflows of $156.260 million in the latest week after inflows of $1.153 billion in the previous week. Intermediate-term funds had outflows of $131.407 million after outflows of $178.040 million in the prior week.

National funds had outflows of $229.443 million after inflows of $764.236 million the previous week while high-yield muni funds reported outflows of $34.610 million after inflows of $386.352 million the week prior.

Primary to come:

Connecticut (Aa3/AA-/AA-/AA) is set to price on Wednesday $900 million of general obligation bonds in three series: $400 million of GOs, $250 million of social GO bonds, and $250 million of GO refunding bonds. Citigroup Global Markets.

The San Jose Financing Authority (/AAA/AAA/AAA) is set to price on Thursday $275.575 million of wastewater revenue green bonds Climate Bond Certified, serials 2023-2042; terms 2047, 2052. Wells Fargo Bank.

The Texas Department of Housing and Community Affairs (Aaa/AA+//) is set to price on Thursday $190 million of single-family mortgage revenue bonds (non-AMT), serials 2024-2034; terms 2037, 2042, 2047, 2052, 2053 (PAC bonds). Barclays Capital.

School District No. 58, Illinois, (/AA//) is set to price Wednesday $130.92 million of general obligation school bonds, serials 2023-2041. Oppenheimer & Co.

The School Board of Sarasota County, Florida, (Aa2///) is set to price $123.465 million of certificates of participation on Tuesday. Raymond James & Associates.

The New Jersey Turnpike Authority (A1/AA-/A+/) is set to price on Tuesday $115.035 million of turnpike revenue refunding bonds, serials 2024-2030. RBC Capital Markets.

The Aurora Highlands Community Authority Board, Colorado, (NR/NR/NR/NR) is set to price on Wednesday $103.788 million of special tax revenue capital appreciation bonds. Piper Sandler & Co.

Competitive:

Massachusetts (Aa1/AA/AA+/) is set to sell $200 million of general obligation bonds at 10:15 am. Eastern Tuesday. The issuer will also sell $500 million of GOs at 10:30 a.m. Tuesday.

Alexandria, Virginia, (/AAA//) is set to sell $144.175 million of unlimited tax general obligation bonds at 10:30 a.m. Wednesday.

Westchester County, New York, is set to sell $142.375 million of tax-exempt GOs at 11 a.m. Thursday. The issuer will also sell $71.662 million of taxable general obligations bonds at 11:30 a.m. Thursday.