CHICAGO – Northern Illinois University’s private student housing bonds lost their investment grade status over struggles to fill rooms.

Moody’s Investor’s Service this week dropped its rating on CHF Dekalb II LLC’s bonds to Ba1 from Baa3 and the rating remains on review for a further downgrade. The action impacts $130 million of outstanding bonds.

The downgrade reflects a combined occupancy rate of 90% at its two student housing facilities on the main campus of Northern Illinois University in Dekalb.

“The drop in project occupancy is attributed to enrollment pressures at the university, largely due to lower than budgeted first-time freshmen for Fall 2016,” Moody’s said.

Moody’s is still reviewing the underlying student housing project’s rating as well as Northern Illinois University’s ratings of Baa3 on its auxiliary facilities revenue bonds and Ba1 on its certificates of participation.

Northern was among seven state public universities Moody’s put on review for a downgrade on April 17. The state’s nearly two-year-old budget impasse has forced the state’s public universities to cope without full aid levels. The delays which have forced cuts, tuition hikes, layoffs and other actions, have damaged the schools’ reputations and balance sheets.

The university, which serves in the role of project manager for CHF Dekalb II, ensures an average occupancy rate of at least 95% per semester, or it provides an equivalent funding level from the university's legally available funds under a management agreement. The terms also require the university guarantee rent for a related dining facility in case of sub-lease termination.

A weakness of the agreement during times of fiscal strains for university is a provision that allows for both the occupancy and dining commitments to be terminated and canceled without penalty in the absence of legally available funds.

A further downgrade could occur if the university’s credit takes another hit, if the university fails to fund occupancy shortfalls, honor any of its commitments, or debt service coverage erodes.

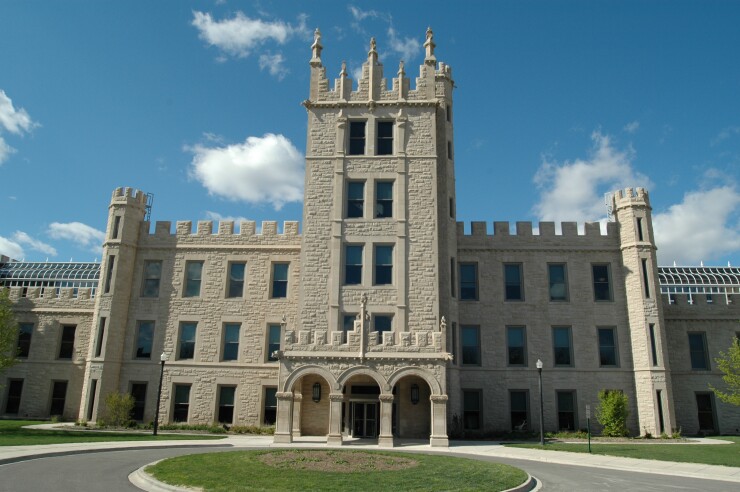

The bonds are limited obligations of the issuer, secured by trust estate assets and payments to be made under the loan agreement. The proceeds financed construction of New Hall, an on-campus student housing facility with 1,008 beds for undergraduate freshmen students and a 31,564 square foot community center with a full service dining facility.

Bond proceeds also went to refinance debt on Northern View Apartments, a 120-unit, 240-bed privatized student housing project for families with children, graduate students and older undergraduate students.

CHF-DeKalb II LLC is a single member limited liability company established for the purpose of assisting Northern on housing projects. The sole member is Collegiate Housing Foundation, an Alabama not-for-profit that assists colleges and universities on housing projects.