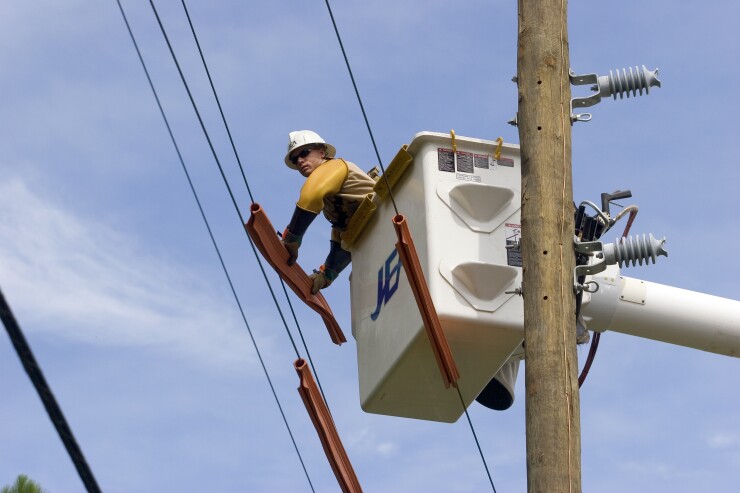

Florida’s largest municipal utility has begun negotiating with private companies eager to buy all or portions of its electric and water systems in northeast Florida.

Officials with Jacksonville-based JEA determined that nine of the 16 bidders who responded to the utility's invitation to negotiate were qualified to begin discussions that could lead to recapitalization of the asset owned by the city for 125 years.

Among the bidders are American Public Infrastructure LLC; American Water Works Company Inc.; North Carolina-based Duke Energy; Halifax, Nova Scotia, Canada-based Emera Energy Services Inc., which owns Tampa, Florida-based TECO Energy; and JEA Public Power Partners — a consortium of Bernhard Capital Partners, Emera Inc., and Suez.

The other bidders are the Australian investment management company IFM Investors; Macquarie Infrastructure and Real Assets Inc.; Florida-based NextEra Energy, owner of Florida Power & Light Co.; and a respondent that didn’t consent to having its name released.

JEA’s board of directors expects to make a recommendation to the Jacksonville City Council in March on whether the utility should be privatized, according to a rating agency

If the 19-member City Council decides that selling the utility is a good idea, residents must approve it in a referendum expected to be held in mid-2020.

Council members, conducting their own due diligence, voted Oct. 22 to spend up to $1.85 million to hire outside legal counsel with expertise in mergers and acquisitions, corporate finance and utilities on the potential recapitalization. On Nov. 6, a series of bi-monthly workshops begins to examine the implications of a sale.

City Council member Matt Carlucci, who owns an insurance agency, said he’s opposed to privatizing the electric and water systems.

“Local control to me is really priceless,” Carlucci said in an interview with The Bond Buyer.

As an insurance agent for more than 40 years, he’s seen the damage hurricanes and tropical storms can cause, he said, adding that having the ability to be reimbursed for damages from the Federal Emergency Management Agency is crucial for the city.

“A private utility cannot collect damages from FEMA,” he said. “JEA can."

Carlucci was complimentary of the energy utility’s response especially in a bad storm. He also said JEA does many things besides generate electricity, provide drinking water and treat sewage, such as purchasing land that benefits the community.

“They also make a wonderful contribution to our general fund in lieu of taxes,” he added.

In fiscal 2018, JEA’s energy system transferred to the city $91.5 million as payment in lieu of taxes. The water and sewer system transferred $25.15 million.

“The pendulum seems to be swinging throughout the country for more municipalities wanting to buy back private utilities [and] it’s very expensive to do that,” Carlucci said. “If we ever sold JEA and wanted it back, it’s gone or it’s going to cost an arm and a leg to get it back.”

Carlucci also said he’s concerned about what will happen to rates if the utility is privatized.

According to

Without privatization there will be no rebates and base rates will increase if the status quo is maintained, the website says.

In contrast, the rating agency presentation JEA posted on EMMA says the electrical system has “maintained excellent financial and operational metrics.” Some $233 million of debt was repaid in fiscal 2019, while total debt has been reduced by $2.1 billion since 2009 as the utility continues its “commitment to aggressively accelerate deleveraging.”

The energy system’s capital program calls “$1 billion of projects over the next five years without the need of issuance of new debt and modest base rate increase at end of five-year horizon.” JEA also says its rates are at the median in Florida, and are expected to remain stable for at least four years while other utilities are experiencing rising costs.

For the water and wastewater systems, the presentation says “all financial metrics are a fortress,” including a strong balance sheet, ample liquidity, and “superior debt service coverage” expected to range between 2.7 times to 4.9 times over the next five years.

The water system also expects to have a “$1 billion capital program over the next five years with ability to be substantially cash funded with no rate changes.”

Carlucci said residents are confused about JEA's explanations concerning the need to restructure itself or sell to private investor-owned utilities.

“Lots of people in this community have seen so many mixed signals from JEA that the trust level is low. Many people are asking why they want to sell,” he said. “On the other side, JEA is saying they’re losing big industrial customers and they’re in a death spiral because of more efficient appliances and lightbulbs, and solar plants. They’re losing revenue and the sky is falling.”

Carlucci said he believes JEA’s customer base can continue to grow because “all of this country and Florida are only getting hotter,” due to climate change. And as more people drive electric vehicles, he said charging stations will be needed.

JEA’s customer base could grow even further if Jacksonville and the local school board overcome a stalemate about the school board’s request to hold a referendum asking voters to increase the local sales tax by a half-cent in order to bring aging schools “into the 21st century,” he said.

The City Council voted to reject the request to hold a referendum, leading the school board to file a lawsuit in the dispute over how much authority the school board has under the city’s charter due to the fact that Jacksonville is a consolidated government with Duval County.

According to Carlucci, up to 45% of people who work in Jacksonville live in nearby Clay and St. Johns counties because they perceive that the schools are better there. JEA would have more customers if those workers lived in Jacksonville, he said.

Carlucci also said he believes that the dispute between the city, JEA and the Municipal Electric Authority of Georgia over a power purchase agreement has factored into JEA’s decision to seek privatization bids. Jacksonville and JEA are continuing to

“If that’s such a huge problem, why are so many companies trying to buy JEA?” he asked. “The utility belongs to ratepayers of city of Jacksonville.

“I think when the chips are down the value of local control is immeasurable.”

Formerly the Jacksonville Electric Utility, JEA has 466,000 electric customers and 900 square miles of service area. JEA also has 348,000 drinking water customers and 271,000 wastewater system customers.

As of July 31, JEA had $1.79 billion of energy-related fixed and variable-rate debt, and $406.4 million of synthetically fixed bonds. The water system had $1.29 billion of outstanding fixed and variable-rate bonds and $111 million of synthetically fixed bonds.