The municipal market saw rare burst of issuance for a Monday, led by a sale of taxable refunding bonds by New York State ahead of the two-day Federal Open Market Committee meeting, due to start Tuesday.

New York State (Aa1/AA+/AA+) sold three separate sales of taxable refunding general obligation bonds totaling $915.75 million in the competitive arena.

JP Morgan won $211.055 million of bidding group 1 bonds with a true interest cost of 1.9508%.

JP Morgan also won $317.785 million of bidding group 2 bonds with a true interest cost of 2.4127%.

Morgan Stanley won $386.91 million of bidding group 3 bonds with a TIC of 3.0342%.

“We bumped our issuance estimate for 2020 as the new trend of taxable advance refunding is taking off fast," Yingchen Li and Ian Rogow, municipal research strategists at Bank of America Securities, said in a report. "We see little to no increase of tax-exempt issuance.”

The New York City Transitional Finance Authority also sold two separate sales of building aid revenue bonds totaling $250 million.

BofAS won $124.885 million of series S-1 subseries S-1A bonds with a TIC of 2.6549%.

BofAS also won $125.115 million of series S-1 Subseries S-1B bonds with a TIC of 3.1592%.

The NYC TFA announced today the successful sale of $250 million of BARBS, with proceeds from the bond sale will be used to fund education capital projects.

The Fiscal 2020 Subseries S-1A bonds, maturing in 2021 through 2039, attracted eleven bidders. The cover bid from Citigroup was 2.663%.

The Fiscal 2020 Subseries S-1B bonds, maturing in 2040 through 2045 and in 2049, attracted ten bidders. The cover bid from Citigroup was 3.176%.

Jefferies is scheduled to price the Tobacco Securitization Authority of Southern California’s $415.109 million of tobacco settlement asset-backed refunding bonds on Tuesday. The deal is expected to consist of three series and carries ratings from S&P Global Ratings as follows: In the 2019A series, the 2020 through 2029 maturities carry an A rating, the 2030 through 2039 maturities are rated A-minus, and the 2048 maturity is rated BBB plus; In the series 2019B-1, the 2029 maturity is rated BBB plus and the 2048 maturity is rated BBB minus, Series 2019B-2 is not rated.

“The House Ways and Means Committee approved a bill to federally tax e-cigarettes," Li and Rogow said. "A tax on e-cigarettes would be a credit positive for tobacco bonds.”

Peak supply/demand pressure should be soon behind us, according to the Bank of America Securities research team.

“The disconnect between the Fed's posture and economic reality will be the driver of a muni market rally for the final two months of the year,” they said. “The Fed is widely expected to cut 25 basis point [this] week,” they said. “However, at this point, the probability of a December Fed rate cut is only priced in with a 34% probability. Our U.S. economists expect the Fed to cut 25bp in both October and December.”

They also said that they expect AMT bonds to grow moderately, and taxable bonds to have a large increase. Transportation and healthcare should grow significantly. Housing and utilities should increase moderately, in their view.

Additionally, they expect the muni supply/demand picture will improve when October comes to a close. Mutual fund inflows continue to be large. Retail activities in October have been better than August and September. Dealer inventories remained low.

“Although muni rates inched higher this week, we observed that spreads have narrowed slightly after 5 to 10 basis points widening over prior weeks,” they said. “This behavior may signal that peak pressure is likely behind us. Investors should enter the market this and next week, we think.”

Weakness leads to price cuts

Improvement in overseas trade talks had an impact on the municipal market Monday, with necessary price cuts by dealers.

“Municipal bonds are weaker this morning as the Treasury market is trading heavy due to the indications of progress on the trade talks between China and the U.S.,” Michael Pietronico, chief executive officer of Miller Tabak Associates said Monday.

“Dealer inventories seem a bit stale and as such, price cuts are the norm to get trades done,” he added. “We would suggest buying into this weakness as supply is likely to wane as the month progresses and the holidays approach.”

Monday’s bond sales

Secondary market

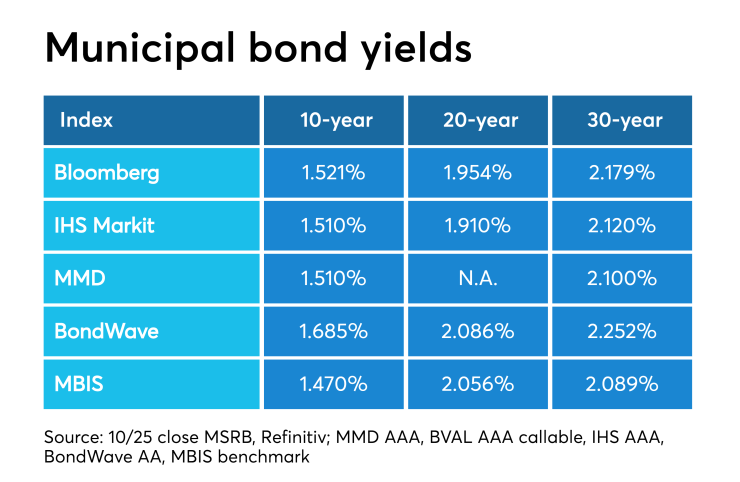

Munis were weaker on the MBIS benchmark scale, with yields rising by three basis points in the 10-year maturity and by seven basis points in the 30-year maturity. The MBIS AAA scale was also weaker, with yields increasing by two basis points in the 10-year maturity and by three basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10-year and 30-year maturities were three basis points higher to 1.54% and to 2.13%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 83.1% while the 30-year muni-to-Treasury ratio stood at 90.7%, according to MMD.

Treasuries yields were mostly trading higher and stocks were in the green. The Treasury three-month was down and yielding 1.656%, the two-year was up and yielding 1.655%, the five-year was up and yielding 1.668%, the 10-year was up and yielding 1.851% and the 30-year was up and yielding 2.344%.

Last week's activate traded issues

Revenue bonds made up 52.78% of total new issuance in the week ended Oct. 25, down from 53.01% in the prior week, according to

Some of the most actively traded munis by type in the week were from Texas, New York and New Jersey issuers.

In the GO bond sector, the Cypress-Fairbanks Independent School District, Texas, 4s of 2044 traded 33 times. In the revenue bond sector, the New York State Thruway Authority, 3s of 2053 traded 94 times. In the taxable bond sector, the Rutgers University 3.27s of 2043 traded 79 times.

Previous session's activity

The MSRB reported 25,662 trades Friday on volume of $11.09 billion. The 30-day average trade summary showed on a par amount basis of $10.75 million that customers bought $5.93 million, customers sold $2.93 million and interdealer trades totaled $1.89 million.

New York, California and Texas were most traded, with the Empire State taking 14.982% of the market, the Golden State taking 13.385% and the Lone Star State taking 10.701%.

The most actively traded security was the New York State Urban Development Corp. sales tax revenue 4s of 2042, which traded 6 times on volume of $30 million.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were mixed, as the $45 billion of three-months incurred a 1.620% high rate, down from 1.630% the prior week, and the $42 billion of six-months incurred a 1.610% high rate, up from 1.600% the week before.

Coupon equivalents were 1.654% and 1.650%, respectively. The price for the 91s was 99.590500 and that for the 182s was 99.186056.

The median bid on the 91s was 1.590%. The low bid was 1.570%.

Tenders at the high rate were allotted 18.38%. The bid-to-cover ratio was 3.10.

The median bid for the 182s was 1.590%. The low bid was 1.570%.

Tenders at the high rate were allotted 51.10%. The bid-to-cover ratio was 3.23.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.