New York’s two baseball stadiums and a Louisville, Kentucky, basketball arena received more rating agency warning shots because of projected cash-flow hits from the COVID-19 pandemic.

S&P Global Ratings placed Queens Ballpark Co. LLC (Citi Field) and Yankee Stadium LLC — the respective homes of the Mets and Yankees — and Louisville Arena Authority LLC on credit watch with negative implications.

“Stadiums and arenas are already facing canceled events and suspended sports seasons due to the coronavirus outbreak,” S&P said. “As a result, cash flows in the related project financings are under pressure.”

S&P rates both New York ballpark bonds BBB, and assigns its AA rating to the Louisville Arena Authority, which owns the downtown KFC Yum! Center, where the University of Louisville basketball teams play.

The Barclays Center arena in Brooklyn, which S&P rates a junk-level B-plus, was already on credit watch negative due to unrelated problems, “but now faces this challenge as well,” S&P added.

S&P also cited environmental, social and governance, or ESG, credit factors, because it considers the pandemic a social risk in its analysis.

Moody’s Investors Service last week cited additional credit risk to Barclays Center because of its closing. Moody’s in October downgraded the bonds to speculative-grade Ba1 from Baa3, affecting roughly $524 million of PILOT Revenue Bonds issued by the Brooklyn Arena Local Development Corp.

Major League Baseball, originally scheduled to start its season Thursday, has delayed the start of its season at least until mid-May.

“Currently, we do not know how much the coronavirus pandemic or recessionary headwinds will affect our forecasts, but we doubt the baseball season could endure a further significant delay without shortening the season and losing some revenues,” S&P said.

Both New York ballparks opened in 2009. Louisville's arena opened one year later.

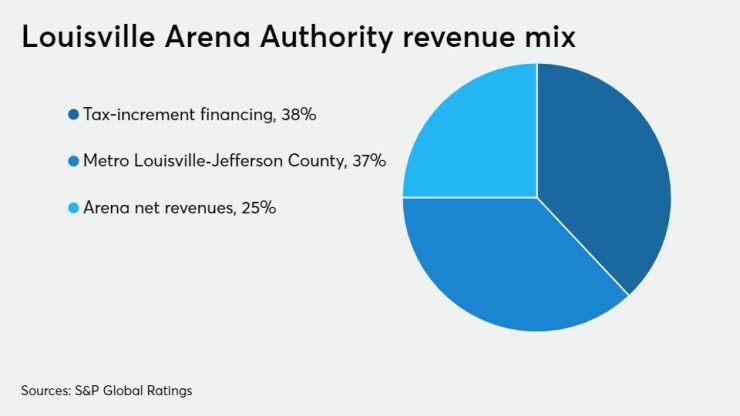

According to S&P, Louisville's exposure to both team and non-team events is lower than the other two stadiums and depends more on Kentucky state sales and property tax, or tax-increment financing revenues.

The mix of revenues over the debt term is about 25% arena net revenues, 37% Metro Louisville‐Jefferson County payments, and 38% TIF payments. According to S&P, a one-year lag exists between tax receipts from the state and payout to the arena.

“Given there are no principal payments due in 2020 we see the pressure occurring in 2021,” S&P said.