Want unlimited access to top ideas and insights?

S&P Global Ratings on Monday

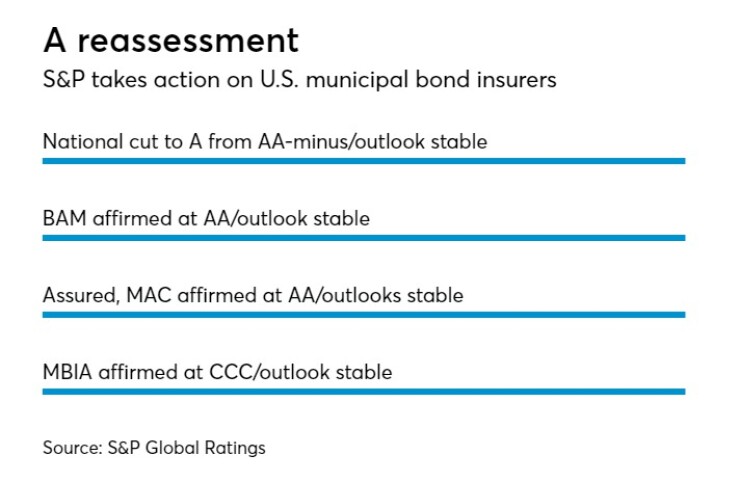

S&P said it lowered its financial strength rating on National to A from AA-minus and its long-term counterparty credit rating on its parent company, MBIA Inc., to BBB from A-minus. MBIA's financial strength was affirmed by S&P at CCC.

Some market analysts said the cuts will prevent National from writing new business, which would leave only two active bond insurers.

“The insurance companies are at the mercy of the rating agencies,” said Howard Cure, director of municipal bond research at Evercore Wealth Management, LLC. “The downgrade effectively disqualifies National from underwriting any new deals. The concern for the other insurers is if the rating agencies change the rules and toughen the criteria for capital reserves or types of business and are also subject to downgrades in the future. The current interest rate environment also makes underwriting difficult as spreads are so tight.”

Matt Fabian, partner at Municipal Market Analytics, said the downgrade doesn't put National out of business.

“It could and probably will at least temporarily stop their new business generation, but their guaranty on outstanding, wrapped bonds doesn’t go away,” he said. “Frankly, National still has balance sheet ratios that show credit strength in excess of S&P’s triple-A standard, so National’s guaranty to policyholders is not in jeopardy.”

This downgrade and the [previous] threatened downgrade of BAM suggest that the bond insurance rating business will ultimately move to Kroll Bond Rating Agency, which has higher ratings on the insurers and may have a better model for assessing the insurers, Fabian said.

The move came less than a month after S&P

"S&P’s decision to downgrade National’s financial strength rating is both frustrating and disappointing” said Bill Fallon, MBIA’s chief operating officer and National’s chief executive, in a

Fallon said that market acceptance has been growing, even though S&P’s rating on National has been one notch lower than its competitors.

S&P also said it affirmed its AA financial strength rating on BAM and removed it from CreditWatch Negative where it was placed it June 6. The outlook is stable.

“S&P’s review confirmed what we’ve known from the start at BAM: A mutual bond insurer focused only on guaranteeing U.S. municipal bonds from issuers that deliver essential public services has unique strengths,” said Seán McCarthy, BAM’s CEO, in a

S&P said it reviewed BAM’s first five years of performance and that the decision reflects BAM’s transition from a startup to a mature company under the rating agency's criteria for financial guaranty insurers.

“Maintaining strong, durable ratings has been part of BAM’s mission throughout our history, and we appreciate that S&P’s in-depth review concluded by affirming BAM’s financial strength. We thank everyone in the market who contributed feedback to S&P as they conducted their review, and look forward to continuing to work with our members and additional issuers of municipal bonds to help tackle the nation’s infrastructure investment challenges in the years to come,” said Bob Cochran, BAM’s chairman.

Unlike National and BAM, Assured Guaranty, the largest municipal bond insurer, wasn't put on CreditWatch negative. S&P on Monday affirmed its AA rating.

Assured has been aggressively buying up legacy insurers and this news might lead to another opportunity, says Cure.

“The National book may now be a target for purchase by Assured, which would result in an upgrade, particularly if Assured can cherry pick some of the more vulnerable holdings such as National's' exposure to Puerto Rico,” he said.

“Once again, S&P reaffirmed Assured Guaranty’s AA stable rating,” said Dominic Frederico, president and CEO of Assured. “The affirmation validates not only our financial strength but also our proven business model, profitable financial results and the success of our strategic choices. Our size and experience allow us to lead the U.S. municipal bond market by participating broadly, regularly insuring large municipal transactions, including public-private partnerships, as well as small and mid-size transactions, while achieving favorable average premium rates.”

In

“Our insured portfolio has amortized significantly in recent years while our claims-paying resources have remained substantially the same at approximately $12 billion, significantly reducing our leverage ratios. As a result, based on our understanding of S&P’s capital adequacy model, we estimate that Assured Guaranty had $2.8 billion of capital in excess of S&P’s AAA requirement at year-end 2016.”