The New York Metropolitan Transportation Authority's preliminary financial plan predicts the agency will have balanced budgets through 2027.

With the additional aid provided in the state' fiscal 2024 state budget, the MTA now projects a balanced budget through 2027, the first time in more than 20 years it has forecast a balanced budget for five straight years.

The July financial plan reflects updates since the MTA warned last year of a $600 million deficit as it headed into 2023 amid ridership that remains below pre-pandemic levels and the short life of federal COVID-19 relief funding.

Gov. Kathy Hochul said that the $229 billion

Additionally the state will contribute $300 million in one-time aid while the city will contribute $165 million for paratransit service funding.

Fare hikes will also resume next month.

"Having a new revenue stream and returning to a regular cycle of transit and toll increases will lend a relatively high degree of support to the credit," John Hallacy, founder of John Hallacy Consulting LLC, told The Bond Buyer. "The fare and toll increases are always beholden to take into account the differing impacts on various groups among the ridership."

MTA Chair Janno Lieber said he was satisfied with the way things turned out for the transit agency this year.

"We are incredibly grateful to the Legislature, along with the governor, for this effort to assure the MTA's long-term financial stability, and we look forward to working with them as we deliver essential mass transit service for New Yorkers," he said.

In addition to new dedicated revenue sources, MTA agencies have begun identifying operating efficiencies. Part of the state's budget counted on the MTA achieving $400 million in annual operating efficiencies to reduce expenses.

New York City Transit, Long Island Rail Road and Metro-North Railroad have identified $250 million by such means as using new sensors to reduce heating and cooling costs at its buildings and asking Access-A-Ride users to book trips though its app instead of using a call center.

Beginning in 2025, the MTA said it will look for an additional $100 million in efficiencies, targeting a goal of $500 million in annual savings.

"The best way to avoid a fiscal cliff is to have a balanced budget solution with new dedicated revenue streams, find areas to be more efficient, and continue to bring riders back," said MTA CFO Kevin Willens.

"The revenue generated from new dedicated taxes, a modest increase in tolls and fares and identifying operational efficiencies will keep the budget balanced through 2027," he said. "To stay on track, we must continue to deliver great service and build ridership."

A proposed 5.5% toll increase and 4% fare increase for 2023 are expected to take effect by the end of August and are expected to generate $117 million of revenue in 2023. The five-year plan assumes an additional 4% increase in 2025 and in 2027.

The MTA said car and truck traffic has returned with bridge and tunnel crossings back at or above pre-pandemic levels.

Paid ridership across subways, buses, commuter railroads and paratransit continues to trend towards the midpoint scenario analyzed by consulting firm McKinsey, which has the MTA reaching 80% of its pre-pandemic ridership by 2027.

"The MTA's July financial plan projects the budget for all five years of the plan period will be balanced on a recurring basis, a remarkable achievement given the dire state of the MTA's fiscal affairs at the start of the year," said state Comptroller Thomas DiNapoli.

"Substantial new funding from the state has stabilized the MTA's revenue picture, allowing for budget balance even amid weakness in real estate transaction taxes, a concern my office raised last year," he said. "It is now up to the MTA to execute on the initiatives necessary to achieve the ongoing budget balance offered in its plan."

He noted that the MTA had already taken steps toward identifying $400 million in annual savings, with more than $200 million already found.

"The MTA must finalize these savings plans to achieve its goal and communicate any impact on services and its workforce to the public," DiNapoli said. "The plan also anticipates the MTA will reach 80% of pre-pandemic ridership by 2027. The delivery of safe, reliable and frequent service will be critical for achieving that goal."

The MTA has won

The MTA's Central Business District Tolling Program, commonly known as congestion pricing, got the green light after years of delay, clearing the last federal regulatory hurdle before the MTA can move forward with its plan to toll drivers south of 60th Street in Manhattan. The MTA has said it

Andrew Rein, president of the Citizens Budget Commission, said the CBC has long supported congestion pricing to further three important goals: reduce congestion, reduce emissions, and support the MTA's capital plan.

However, he urged the MTA Board to follow CBC's five recommendations to ensure balanced progress on these goals.

He urged the MTA to:

- Limit exemptions to transit providers, those specified in the law, and those agreed to in the Final Environmental Assessment;

- Not provide credit for payment of MTA or Port Authority of New York and New Jersey tolls;

- Vary the congestion charge by time of day and day of the week, and ensure the charge is easy to understand and well communicated;

- Consider charging a vehicle-miles travelled fee for those that stay inside of the zone; and

- Monitor and report congestion pricing outcomes and operational metrics to inform future policy adjustments.

"The effective

Congestion pricing is a bit of an unknown, Hallacy noted.

"There will be a real test for those who need to travel to Midtown. Perhaps the greatest test will be the elasticity of demand. The pandemic taught us that those who could stay away did so," Hallacy said. "There is not a perfect analogy here, but the degree of return to office [RTO] may prove to be a factor. Commercial enterprises that need to access the zone will just pass along the costs to their customers. In the end, what is good for London still needs to be borne out here."

Congestion pricing opponents are still fighting a rear-guard battle.

On Friday, New Jersey, a state that operates its own large system of toll roads, filed a federal lawsuit against the United States Department of Transportation and the Federal Highway Administration to block congestion procing.

Also on Friday, U.S. Rep. Nicole Malliotakis, R-N.Y., announced she added a provision to a bill passed by the Appropriations Committee last week that would prevent its implementation.

She said the provision would prohibit federal funding from being used for activities related to the implementation of priced zones, which would stop the program in its tracks.

In the meantime, ridership on transit is slowly recovering, but the bridges appear to be at capacity every day.

"How much leverage is enough remains an important question over the longer term. What debt is out there is much more secure with the recent improvements. It is human behavior that is the wild card," Hallacy said.

DiNapoli urged the MTA to use its improved fiscal outlook to better manage debt and not burden future riders and taxpayers.

"In 2023, the MTA estimates that 17.9% of revenue will go towards servicing debt, even as it has pushed out payments to manage its fiscal challenges," DiNapoli said. "Ultimately, the path to long-term structural balance will require paying down debt and continued vigilance in the face of uncertainty, but good fiscal discipline now will ensure it is well-prepared for the challenges that will emerge later."

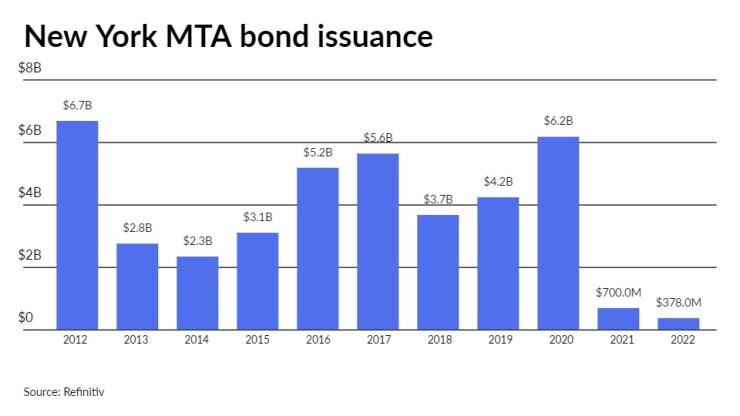

Since 2012, the MTA has sold almost $41 billion of bonds, with the most issuance occurring in 2012 when it offered $6.7 billion and the least in 2022 when it sold $378 million.

The MTA's revenue bonds carry ratings of A3 from Moody's Investors Service and AA from S&P Global Ratings, Fitch Ratings and Kroll Bond Rating Agency. All four rating agencies assign stable outlooks to the credit.

The New York Triborough Bridge and Tunnel Authority also issued bonds for the MTA. In March, Ramirez & Co. priced $600 million of Series 2023B climate bond certified payroll mobility tax senior lien green bonds for MTA bridges and tunnels.

The TBTA bonds were rated AA-plus by S&P, Fitch and KBRA.