Gov. Phil Murphy’s call for New Jersey to make its first full pension contribution in 25 years is generating questions about retirement-system overhaul in one of the nation's lowest-rated states, and how might the capital markets respond.

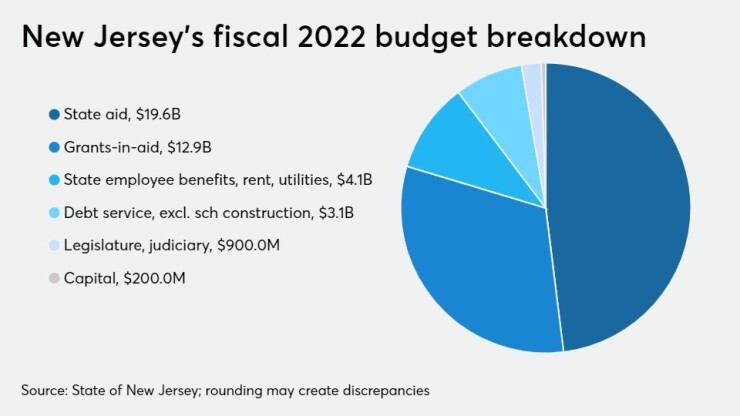

Murphy on Tuesday revealed the proposal to pay toward pensions roughly $6.4 billion, or about 14% of his $44.8 billion fiscal 2022

Making the full actuarially required contribution will need an additional $1.6 billion expense, according to Murphy. New Jersey was initially scheduled to earmark 90% of its full contribution this year under a ramp-up plan.

“We’re now on the road to fixing one of the biggest financial problems of any state in America,” Murphy said during his fourth budget address, this time pre-recorded in an empty Trenton War Memorial. He bypassed the traditional speech to lawmakers because of COVID-19 protocols. “And when we keep making this pension payment, we will go from a pension system that many said was destined for bankruptcy to one that is solvent, healthy and sustainable.”

Postponing or reducing pension contributions would risk a collapse of New Jersey's retirement system,

"Pew was not overstating the reality," said Tom Kozlik, head of municipal strategy and credit at

Murphy said his plan projects $861 million in savings over 30 years. Administration officials say under Murphy, New Jersey's contributions over four years will have reached $18 billion, or $9.4 billion more than Republican predecessor Chris Christie contributed over two terms.

New Jersey officials and observers await reaction from the rating agencies.

"It is what they have harped on for about a decade, through the downgrades and the negative outlooks," said Regina Egea, a Christie administration veteran who is president of think tank Garden State Initiative. Of Murphy's plan, she said: "How sustainable is it?"

While praising the initiative, Ralph Albert Thomas, executive director for the New Jersey Society of Certified Public Accountants, urged that “real reforms be made to public worker pension and benefits plans so that we don’t have to continue to dedicate such a large chunk of the budget to pay for these benefits.”

NJCPA supports a package of bills by Senate President Stephen Sweeney, D-Gloucester, that would shift from the current defined-benefit system to a hybrid system and change benefits for new public workers. The organization said the change would save the state hundreds of millions of dollars a year.

Unfunded pension liability has been long a sticking point for the rating agencies.

The multi-year burden of rapidly-rising pension contributions is "the result of significant historic pension underfunding,” Moody’s Investors Service said in November, when the Garden State issued about $4 billion in COVID-19 emergency general obligation bonds. Moody’s rates New Jersey’s GOs A3.

S&P Global Ratings downgraded New Jersey to BBB-plus from A-minus right before that sale. Fitch Ratings and Kroll Bond Rating Agency rate Garden State debt A-minus and A, respectively.

The pension payment “might sound like good news, but it is anything but that in the absence of genuine pension reform,” said Steven Malanga, a senior fellow with the Manhattan Institute for Policy Research, a

“A single one-time payment of $6.4 billion doesn't solve the pension problem,” Malanga said. “New Jersey would have to devote at least that much every year for the next 20 years, at least, to stabilize its deeply underfunded pensions. That's why cost-saving reforms remain essential.”

State-level funding is just part of the dilemma, according to Villanova School of Business professor David Fiorenza.

"There is also the amounts of cities, counties and local municipalities that may come forward with unfunded liabilities," he said. "These other taxing authorities will look to both the state and federal government for assistance. Gov. Murphy wants to be re-elected so he will be treading water and trying to please unions and the citizens, a very hard balance."

The spending plan calls for no new broad-based taxes, according to Murphy. The $44.8 billion assumes 2.4% growth in total revenue and includes a surplus of $2.193 billion, or just under 5% of budgeted appropriations.

Murphy cited improving revenue projections partly due to record-high stock markets, federal stimulus that directly aided individuals and businesses, and a so-called K-shaped recession under which middle and high-income households recover more quickly while low-income households continue to struggle.

His proposal includes $319 million in direct tax relief for middle-class families, which he said resulted from last year’s millionaires tax enactment, and features $1.25 billion in funding to support various property tax relief programs.

Separately, Murphy on Monday signed three bills establishing a framework for legalized marijuana.

Murphy's fellow Democrats control the legislature but the relationship

Paul Sarlo, D-Wood-Ridge, who chairs the Senate’s Budget and Appropriations Committee, struck a cautious tone.

“The economy continues to be fragile so we should not be near-sighted about fiscal conditions,” he said. “Because we have been relying on federal aid with a limited lifespan and on long-term borrowing to bridge the gap, we should put this spending plan into a two-year perspective so we avoid a ‘fiscal cliff’ with the drop-off of revenue in the near future.”

Republicans accused Murphy of election-year posturing.

“The governor’s budget is increasing spending by 11% since last year and by about 30% since he took office three years ago,” said Sen. Declan O’Scanlon, R-Little Silver, who sits on the budget committee. “It’s fueled by one time windfalls of federal revenue, massive one-time borrowings, and spending down surplus.”

Egea criticized Murphy for balancing the budget through one-shot maneuvers such as borrowing and federal cash.

“[It] bodes poorly for all New Jerseyans in the very near future,” said Egea, former chief of staff under Christie. “Unless there’s more borrowing or further federal bailouts, get ready New Jersey, you just got stuck with the bill.”