Munis were slightly weaker to start the holiday-shortened week ahead of several large new issues, but the asset class outperformed U.S. Treasuries on the day. Equities saw losses.

Muni yields were cut up to four basis points, depending on the scale, while UST yields rose eight to 11 basis points.

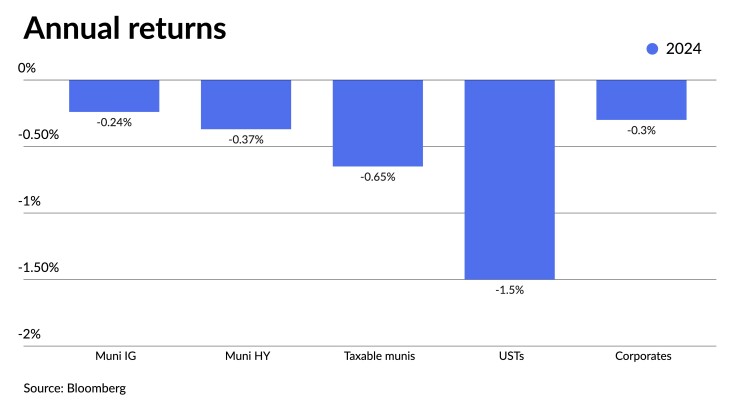

Munis have "struggled to get out of starting gate" to start 2024 as munis are returning negative 0.24% so far this year, said Jason Wong, vice president of municipals at AmeriVet Securities.

This is a far cry from the end of 2023 where there were record month-to-date returns for November and December, he noted.

"This weakness in the markets could be seen as a correction as ratios had been increasingly expensive compared to Treasuries over the past couple of years, especially in the front end," Wong said.

And "given the historically rich valuations that have been in place since mid-December when the desks began shutting down for the year, the return of the primary calendar alongside the strength in Treasuries did little to wake up the muni market," said Birch Creek Capital strategists in a weekly report.

Instead, the AAA MMD curve flattened this past week with the two-year rising 15 basis points last week, while most of the curve outside of five years was unchanged sans the 30-year being cut two basis points, they noted.

"High grade traders reported slow activity, particularly in the 5-10yr area where even after the rate rally," the MMD-UST ratio was only around 58%, they noted.

The two-year muni-to-Treasury ratio Tuesday is at 63%, the three-year at 63%, the five-year at 58%, the 10-year at 57% and the 30-year at 81%, according to Refinitiv Municipal Market Data's 3 p.m. EST read. ICE Data Services had the two-year at 65%, the three-year at 64%, the five-year at 62%, the 10-year at 59% and the 30-year at 82% at 3:30 p.m.

Birch Creek strategists said that accounts last week focused on "adding additional yield/spread by either buying callable 4% coupon bonds in that part of the curve or extending out to the 15-20y area where they can pick up 13-15 ratio percentages in exchange for just a slightly higher option-adjusted duration given 4s and 5s are still deep in the money at current yield levels."

Away from that, accounts were squarely focused on the new-issue calendar that was larger than usual for this time of year.

The

The high demand for the issue led Jefferson Country to price the 2053 bonds at 4.51% versus the initial offering yield of 4.69%, he noted.

The accelerated and upsized

Last week, munis saw "modest inflows" as investors added $38.7 million to muni mutual funds after $558 million of outflows the week prior.

Over the past several years muni mutual funds have struggled with outflows, Wong noted.

Elsewhere, secondary trading picked up last week "as trading totaled to just over $36.16 billion with 54% of trading being dealer sells," he said.

Bid wanted also picked up with clients putting up around $5.2 billion up for the bid, according to Bloomberg.

AAA scales

Refinitiv MMD's scale was cut two to four basis points: The one-year was at 2.93% (+3) and 2.65% (+3) in two years. The five-year was at 2.29% (+4), the 10-year at 2.30% (+2) and the 30-year at 3.47% (+2) at 3 p.m.

The ICE AAA yield curve was cute two to four basis points: 2.93% (+2) in 2025 and 2.71% (+2) in 2026. The five-year was at 2.38% (+4), the 10-year was at 2.33% (+4) and the 30-year was at 3.45% (+3) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was cut up to three basis points: The one-year was at 2.92% (+3) in 2025 and 2.68% (+2) in 2026. The five-year was at 2.30% (+1), the 10-year was at 2.32% (unch) and the 30-year yield was at 3.45% (+3), according to a 3 p.m. read.

Bloomberg BVAL was cut two to three basis points: 2.82% (+3) in 2025 and 2.67% (+3) in 2026. The five-year at 2.31% (+2), the 10-year at 2.35% (+2) and the 30-year at 3.45% (+2) at 3:30 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.225% (+8), the three-year was at 4.015% (+8), the five-year at 3.940% (+10), the 10-year at 4.065% (+11), the 20-year at 4.420% (+11) and the 30-year Treasury was yielding 4.305% (+10) near the close.

Primary to come

The California Health Facilities Financing Authority (/AA-/AA/) is set to price Thursday $532.415 million of Scripps Health revenue bonds, Series 2024A. Morgan Stanley.

The authority is also set to price Thursday $270.030 million of Scripps Health revenue bonds, Series 2024B, consisting of $135.015 million of Series 2024B-1 and $135.015 million of Series 2024B-2. Morgan Stanley.

Additionally, the authority (//A-/) is set to price Wednesday $107.740 million of Episcopal Communities & Services revenue bonds, consisting of $30 million of Series 2024A, serial 2027; and $77.740 million of Series 2024B, serials 2028-2033, terms 2043, 2048, 2053, 2058. KeyBanc Capital Markets.

The Dallas Independent School District, Texas, (Aaa/AAA/AAA/) is set to price Thursday $502.965 million of PSF-insured unlimited tax school building and refunding bonds, Series 2024, serials 2025-2054. Siebert Williams Shank & Co.

The Pennsylvania Turnpike Commission (Aa3/AA-/AA-/AA-/) is set to price Thursday $435.120 million of turnpike revenue bonds, Series A of 2024. Goldman Sachs.

The North Carolina Turnpike Authority (/AA/BBB+/) is set to price Wednesday $348.943 million of Assured Guaranty-insured Triangle Expressway System senior lien turnpike revenue bonds, Series 2024, consisting of $277.120 million of bonds, Series A, serials 2055-2058, and $71.823 million of capital appreciation bonds, Series B, serials 2041-2055. BofA Securities.

The Los Angeles Department of Water and Power (Aa2/AA+//AA+/) is set to price Thursday $345 million of water system revenue bonds, 2024 Series A, serials 2029-2044, terms 2049, 2054. Wells Fargo Bank.

The Massachusetts Development Finance Agency (Aa3/AA-//) is set to price Wednesday $309.130 million of Mass General Brigham Issue revenue refunding bonds, Series 2024D, serials 2030-2038, 2042-2043, 2047, 2054. RBC Capital Markets.

The Connecticut Health and Educational Facilities Authority is set to price Wednesday $275 million, consisting of $125 million of Series X-2 and $150 million of Series A-3. J.P. Morgan Securities.

The San Juan Unified School District, California, (Aa2///) is set to price Thursday $231.490 million of GOs, consisting of $125 million of Election of 2016 bonds, serials 2025-2027, 2030-2049, and $106.490 million of refunding bonds, serials 2024-2031. Raymond James & Associates.

The Health, Educational and Housing Facility Board of the County of Knox, Tennessee, (/AA//) is set to price Wednesday $220.810 million of BAM-insured University of Tennessee Project student housing revenue bonds, consisting of $218.290 million of tax-exempts, Series 2024A-1, serials 2031-2044, terms 2049, 2054, 2059, 2064; and $2.520 million of taxables, Series 2024A-2, term 2031. RBC Capital Markets.

Riverside, California, (/AA-/AA-/) is set to price Wednesday $214.610 million of electric revenue bonds, Issue of 2024A. J.P. Morgan Securities.

The Harris County Cultural Education Facilities Finance Corp., Texas, (/A//) is set to price Wednesday $100 million of Baylor College of Medicine medical facilities mortgage revenue bonds, Series 2024A, serial 2029. Barclays.

Competitive

Illinois is set to sell $300 million

The Mankato Independent School District No. 77, Minnesota, (A1///) is set to sell $105 million of GO school building bonds, at 11 a.m. Wednesday.

The Triborough Bridge and Tunnel Authority is set to sell $294.855 million of MTA bridges and tunnels climate bond certified payroll mobility tax senior lien green bonds, Series 2024A, at 10:15 a.m. Thursday.

The South Washington County Independent School District No. 833, Minnesota, is set to sell $133.115 million of GO school building, facilities maintenance and refunding bonds, Series 2024A, at 11 a.m. Thursday.