Municipals were weaker outside of 10 years but largely ignored a U.S. Treasury market selloff that saw cuts up to 10 basis points, while equities ended in the black.

Triple-A benchmarks rose up to three basis points on the long end, depending on the scale. This is the first time since May 18 that yields have risen more than a basis point and is a contrast from the dramatic rally witnessed in the tax-exempt market in the last two weeks.

The triple-A benchmark curve is down 50-plus basis points, something Vikram Rai, head of Citi's Municipal Strategy group, describes as unexpected and abnormal.

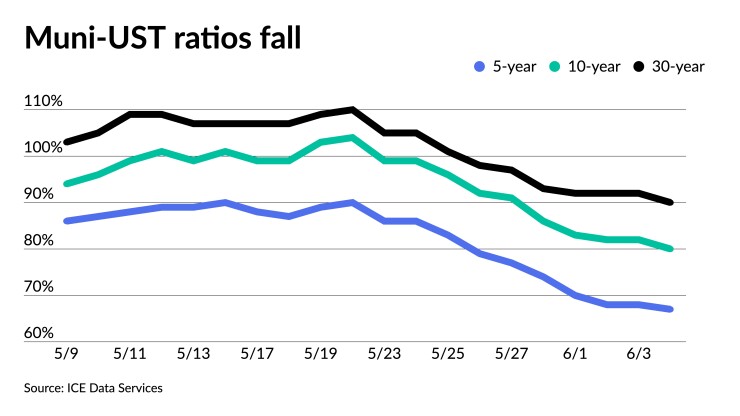

The municipal outperformance to UST has moved ratios much lower.

Muni-to-UST ratios on Friday were at 66% in five years, 81% in 10 years and 88% in 30, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the five at 67%, the 10 at 80% and the 30 at 90% at a 4 p.m. read.

The 10-year ratio fell from 104% on May 20 to 80% on Monday.

As a result of muni-UST ratios dropping significantly, Rai expects some correction over the next couple of weeks as supply picks up and ratios near-equilibrium levels.

“The recent selloff in rates and the lack of movement by tax-exempts could throw cold water” on munis’ rally, said Eric Kazatsky, head of municipal strategy at Bloomberg Intelligence.

“Though USTs and tax-exempts are somewhat correlated, they rarely move in lockstep,” he said. “It's the shifts in broader rates market that influence the direction of munis, though frequently on a lagged basis.”

There are times, he said, that “munis are strongly bid and outperform taxable counterparts, and there are times when the exempt market has decent interest and proceeds to ignore any issues the UST market seems to be implying for bonds.”

Last week was the latter, as “both equity markets and Treasuries fell as the latest jobs report came in better than expected, a signal that the Federal Reserve will continue to raise interest rates,” according to Kazatsky.

He said that “the selloff in Treasuries and the continued strength of municipals have done their part to richen” muni-UST ratios.

The next three months, Kazatsky said, “will be the heaviest of the year in terms of cash returning to investors and looking for a new home.”

“From a supply-demand perspective, new issuance could see a near-term uptick in subscription interest,” he said.

Rai said it's hard for him to believe it's a flight to safety causing this dramatic outcome for tax-exempts.

“We remain exposed to the rates market and that market could see some bearish pressure," he said.

Over 15 weeks, municipal bond mutual funds lost a net total of $34.2 billion of assets, an average of $2.3 per week, according to Refinitiv Lipper. But last week, estimated net inflows

Rai said he wants to see a few more weeks of positive flows before saying the trend has reversed.

CreditSights Senior Strategists Pat Luby and John Ceffalio attribute the positive mutual fund flows for the most recent week as most likely "a result of a slowdown in mutual fund redemptions, rather than a significant increase in new purchases."

Gross purchases of muni mutual funds were heavy in April and May, and they said the “$36 billion of purchases in April were the most since at least December 2008.”

They noted that “opportunistic investors who stepped up to buy mutual funds in those months are more likely to have paused in the week ended June 1, rather than to have stepped up their purchases.”

Secondary trading

Florida Board of Education lottery 5s of 2023 at 1.51%-1.50%. Montgomery County, Maryland 5s of 2025 at 1.95%-1.90%.

Maryland 5s of 2027 at 2.08%. Baltimore County 5s of 2028 at 2.16%. California 5s of 2030 at 2.55%-2.54%. New York City 5s of 2030 at 2.61%.

Austin, Texas, waters 5s of 2031 at 2.56%. Harvard 5s of 2032 at 2.49%-2.45% versus 2.44% Tuesday. California 5s of 2032 at 2.59%-2.58%. Boston 5s of 2034 at 2.62%-2.61%.

California 5s of 2047 at 3.12%-3.10%. New York City TFA 5s of 2047 at 3.51%-3.50% versus 3.43%-3.42% Friday.

AAA scales

Refinitiv MMD’s scale was cut two basis points 10 years and out at the 3 p.m. read: the one-year at 1.47% (unch) and 1.75% (unch) in two years. The five-year at 2.01% (-unch), the 10-year at 2.45% (+2) and the 30-year at 2.80% (+2).

The ICE municipal yield curve saw up to three basis point cuts: 1.44% (unch) in 2023 and 1.77% (unch) in 2024. The five-year at 2.04% (+1), the 10-year was at 2.43% (+2) and the 30-year yield was at 2.89% (+3) at a 4 p.m. read.

The IHS Markit municipal curve was cut two basis points on the 10- and 30-year: 1.45% (unch) in 2023 and 1.75% (unch) in 2024. The five-year at 2.02% (unch), the 10-year was at 2.45% (+2) and the 30-year yield was at 2.80% (+2) at 4 p.m.

Bloomberg BVAL saw up to a one to three basis point cuts five years and out: 1.51% (unch) in 2023 and 1.79% (unch) in 2024. The five-year at 2.10% (+1), the 10-year at 2.46% (+1) and the 30-year at 2.83% (+3) at a 4 p.m. read.

Treasuries sold off.

The two-year UST was yielding 2.729% (+8), the three-year was at 2.933% (+8), the five-year at 3.036% (+9), the seven-year 3.075% (+11), the 10-year yielding 3.040% (+10), the 20-year at 3.425% (+11) and the 30-year Treasury was yielding 3.192 (+10) at the close.

Primary to come:

Atlanta, Georgia, (Aa3//AA-/) is set to price total of $578 million of AMT and non-AMT airport general revenue bonds consisting of $179.51 million of exempts, Series 2022A; $118.145 million of exempts, Series 2022C; $218.165 million, Series 2022B; and $61.95 million of AMT bonds, Series 2022D. Goldman Sachs & Co.

Case Western Reserve University, Ohio, (Aa3/AA-//) is set to price Tuesday $350 million of taxable corporate CUSIP bonds, Series 2022C, term 2122. Barclays Capital.

The Public Finance Authority, Wisconsin, (/AA-/AA/) is set to price Tuesday $255.530 million of tax-exempt and taxable Cone Health health care system revenue bonds, Series 2022. J.P. Morgan Securities.

The Texas Water Development Board (/AAA/AAA/) is set to price Wednesday $254.125 million of state revolving fund revenue bonds, New Series 2022. Piper Sandler & Co.

Harris County, Texas, (Aa2//AA/) is set to price Tuesday $200.870 million of toll road first lien revenue refunding bonds, Series 2022A, serials 2023-2033. Jefferies.

The Prosper Independent School District, Texas, is set to price Thursday $200 million of fixed rate unlimited tax school building bonds, Series 2022. Piper Sandler & Co.

The New York City Housing Development Corp. is set to price Wednesday $160.765 million of sustainable development multi-family housing revenue bonds, Series C-1. Wells Fargo Bank.

The Iowa Student Loan Liquidity Corp. (/AA//) is set to price Thursday $155.700 million of senior student loan revenue bonds, consisting of $128.500 million of taxables, serials 2023-2032, term 2039 and $27.200 million of AMT bonds, Series B, serials 2029-2032. RBC Capital Markets.

The University of North Carolina at Chapel Hill (Aaa/AAA/AAA/) is set to price Tuesday $150.925 million of general revenue refunding bonds, consisting of $100 million of Series 2019A and $50.925 million of Series 2019B. Wells Fargo Bank.

The university is also set to price $100 million of the Board of Governors of the University of North Carolina general revenue bonds, Series 2012B. Wells Fargo Bank.

The Conroe Independent School District, Texas, (Aaa/AAA//) is set to price Wednesday $147.075 million of unlimited tax school building bonds, Series 2022A, serials 2023-2047, insured by Permanent School Fund Guarantee Program. Raymond James & Associates.

The New Hampshire Municipal Bond Bank (/AA+//) is set Tuesday $129.685 million of bonds, 2022 Series C, serials 2023-2042, terms 2047 and 2052. Raymond James & Associates.

The Public Utility District No. 1, Washington, (Aa2/AA//) is set to price Thursday $103.220 million of wells hydroelectric revenue bonds, consisting of $36.555 million of Series A, serials 2023-2038 and $66.665 million of Series B, serials 2038-2052. Barclays Capital.

The Brazoria County Industrial Development Corporation, Texas, is set to price Thursday $100 million of Aleon Renewable Metals Project solid waste disposal facilities revenue bonds, Series 2022, term 2042. Citigroup Global Markets.

The Minnesota Housing Finance Agency (Aa1/AA+//) is set to price Wednesday $100 million of taxable social residential housing finance bonds, 2022 Series G, serials 2023-2034, terms 2037, 2039 and 2047. RBC Capital Markets.

Competitive:

Seattle, Washington, (Aa1/AA+//) is set to sell $118.765 million of drainage and wastewater system improvement and refunding revenue bonds, Series 2022, at 10:45 a.m. eastern Tuesday.

Maryland (Aaa/AAA/AAA/) is set to sell $335.180 million of general obligation bonds state and local facilities loan of 2022, First Series A Bidding Group 1, at 10 a.m. eastern Wednesday.

The state is also set to sell $303.040 million of general obligation bonds state and local facilities loan of 2022, First Series A Bidding Group 3, at 11 a.m. Wednesday.

The state is additionally set to sell is set to sell $261.780 million of general obligation bonds state and local facilities loan of 2022, First Series A Bidding Group 2, at 10:30 a.m Wednesday.

The state is set to sell $150 million of taxable general obligation bonds state and local facilities loan of 2022, First Series B, at 11:30 a.m. eastern Wednesday, as well.

South Carolina (Aaa/AA+/AAA/) is set to sell $101.255 million of Clemson University general obligation state institution bonds, Series 2022A, at 10:15 a.m. eastern Thursday.