Fresh off another 25 basis point increase in the fed funds rate, the muni market firmed again, with new issuance pretty much curtailed until the New Year.

Secondary market

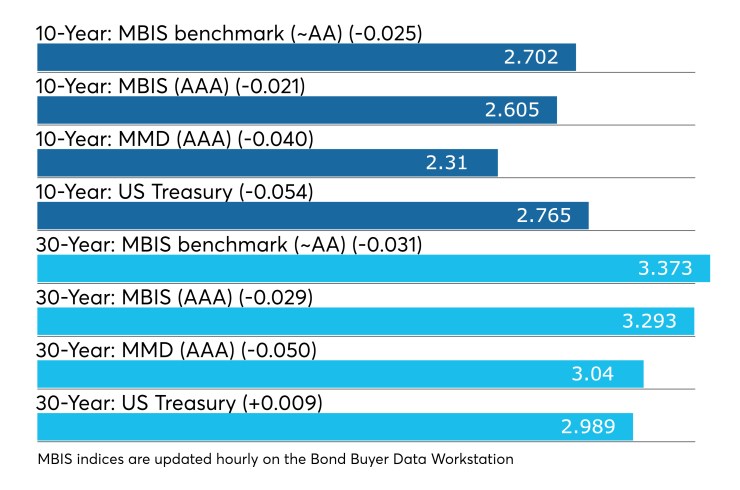

Municipal bonds were stronger on Thursday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields dropped no more than three basis points in the one-year and the four- to 30-year maturities. The two lone maturities saw yields higher by no more than one basis point.

High-grade munis were also stronger, with yields calculated on MBIS' AAA scale decreasing by as many as two basis points in the four- to 30-year maturities. The remaining three maturities saw yields increase by less than a basis point.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation between two and four basis points lower and the 30-year muni maturity falling between three and five basis points.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 84.5% while the 30-year muni-to-Treasury ratio stood at 102.7%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Ramirez looks at supply and demand for 2019

Ramirez released a 2019 municipal market outlook earlier this week and forecasts volume next year at $342 billion, or an 8% gain year-over-year: a net increase of $25 billion.

“Our projected increase in gross supply in 2019 is driven primarily by new money of $250 billion up 14% year-over-year, which partially offsets lower year-over-year volume of currently-callable tax-exempts down 7%,” said Peter Block, managing director and the head of municipal strategy group at Ramirez.

The smaller universe of currently callable tax-exempts is largely due to the lower issuance of tax-exempts in 2009 and 2010, issued with 10-year par calls versus higher issuance during those years of federally-subsidized Build America Bonds with optional and extraordinary make-whole calls, he said.

“We estimate that approximately 73% of BABs were issued with both optional and extraordinary (lower cost, but still high priced make whole calls versus only 27% of BABs issued with par calls,” he said. “To date, the vast majority of BABs refunded for savings have been on BABs with par calls. BABs with extraordinary make whole calls remain uneconomic to exercise, despite the fact that most of these calls have been operative since 2013 following Congressional sequestration of some BAB interest subsidies.”

He added, short of significantly higher BAB subsidy sequestrations by Congress and/or a sharp downturn in U.S. economic growth and lower rates, they expect most BABs to remain outstanding.

“This ‘BAB factor’, combined with elimination of advance refundings implies that muni issuance in the foreseeable future will be driven more by issuer’s new money needs vs significant opportunities to refund outstanding debt.”

Demand for munis should be strong overall in 2019 and, much as the asset class was in 2018, driven primarily by retail investors, according to Block.

“In the 12-month period ended Sept. 30, 2018, retail ownership posted a net change of +0.39%, or +$9.93 billion, to $2.56 trillion, although composition of holdings shifted slightly in favor of mutual and money market funds over individuals and SMAs,” he said.

Block also said mutual funds and money market funds in aggregate gained a net $25 billion of assets (3%) to $831 billion in the prior 12 months, while individuals/SMAs lost a net $17 billion (1%) to $1.67 trillion.

“The small shift to mutual and money market funds from over the past year indicates to us that retail continues to favor professional management,” he said. “On the other hand, banks have decreased ownership of Munis by $30 billion, or 5% year-over-year, due to the TCJA tax cuts, which has made munis less attractive to hold.”

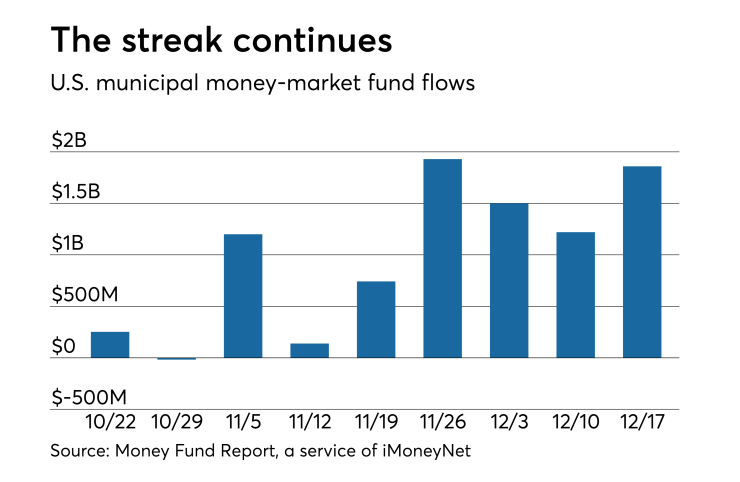

Muni money market funds keep booming

Tax-free municipal money market fund assets increased $1.86 billion, raising their total net assets to $142.66 billion in the week ended Dec. 17, according to the Money Fund Report, a service of iMoneyNet.com.

The average seven-day simple yield for the 190 tax-free and municipal money-market funds dipped to 1.22% from 1.23% last week.

Taxable money-fund assets increased $7.42 billion in the week ended Dec. 18, bringing total net assets to $2.823 trillion.

The average, seven-day simple yield for the 804 taxable reporting funds nudged up to 1.91% from 1.90% last week.

Overall, the combined total net assets of the 994 reporting money funds gained $9.28 billion to $2.966 trillion in the week ended Dec. 18.

Previous session's activity

The Municipal Securities Rulemaking Board reported 46,630 trades on Wednesday on volume of $12.119 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 15.557% of the market, the Empire State taking 14.435% and the Lone Star State taking 10.179%.

Treasury auction TIPs

The Treasury Department Thursday auctioned $14 billion of four-year four-month inflation-indexed notes with a 5/8% coupon, at a 1.129% high yield, an adjusted price of 99.660353.

The bid-to-cover ratio was 2.80.

Tenders at the high yield were allotted 80.29%. All competitive tenders at lower yields were accepted in full.

The median yield was 1.100%. The low yield was 1.000%.

Treasury auctions bills

Treasury also auctioned $40 billion of four-week bills at a 2.360% high yield, a price of 99.823000.

The coupon equivalent was 2.397%. The bid-to-cover ratio was 2.68.

Tenders at the high rate were allotted 33.26%. The median rate was 2.320%. The low rate was 2.280%.

Treasury also auctioned $30 billion of eight-week bills at a 2.375% high yield, a price of 99.637153.

The coupon equivalent was 2.417%. The bid-to-cover ratio was 2.98.

Tenders at the high rate were allotted 65.45%. The median rate was 2.350%. The low rate was 2.315%.

Treasury auctions announced

The Treasury announced these auctions:

$32 billion seven-year notes selling on Dec. 27;

$41 billion five-year notes selling on Dec. 26;

$40 billion two-year notes selling on Dec. 24;

$18 billion one-year 10-month notes selling on Dec. 26;

$36 billion 182-day bills selling on Dec. 24; and

$39 billion 91-day bills selling on Dec. 24.

Treasury said it will conduct auctions on Monday, even though President Trump declared it a holiday.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.