Municipal bond buyers spent most of Wednesday in a defensive stance as the Federal Reserve met to decide the course of monetary policy.

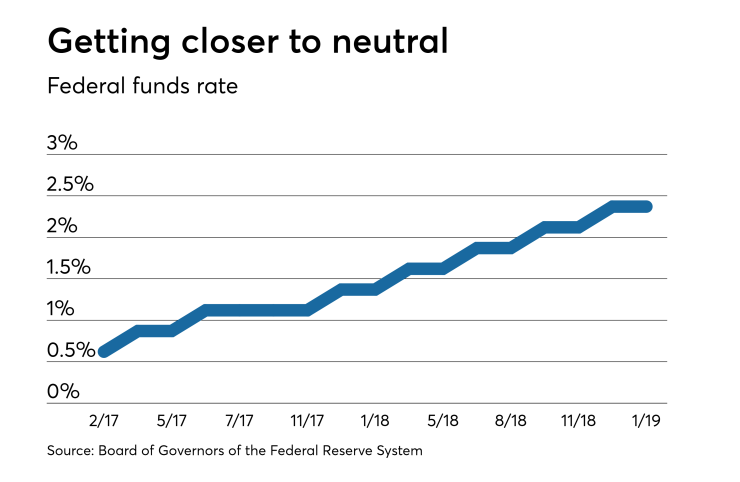

The Federal Open Market Committee voted unanimously to keep the target range for the federal funds rate at 2.25% to 2.5%. The Fed “will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support” a strong labor market and inflation near 2%,” the FOMC said in a statement.

The Fed statement reads more like a pause than end of the hiking cycle, said one economist.

“The Fed has responded to increased concerns about the global economic outlook and deteriorating financial market sentiment since its December meeting by dropping the reference to ‘some further rate increases’ being considered appropriate and highlighting that they can afford to be patient in deciding on further moves,” said Brian Coulton, Fitch Ratings’ chief economist. “But they still sound fairly confident on the outlook for the U.S. economy itself and this reads more like a pause than a strong signal that they believe that they are the end of the hiking cycle. Barring a very significant global downturn we still see further rate increases later this year.”

Primary market

On Wednesday, Goldman Sachs priced and repriced the Orange County Health Facilities Authority’s $145.53 million of Series 2019B forward delivery hospital revenue refunding bonds and $100 million of Series 2019A hospital revenue refunding bonds for the Orlando Health Obligated Group. The deal is rated A2 by Moody’s Investors Service and A-plus by S&P Global Ratings.

Citigroup priced and repriced the El Paso Independent School District, Texas’ $241.375 million of Series 2019 unlimited tax school building bonds. The bonds, which are Permanent School Fund Guarantee Program insured, are rated triple-A by Moody’s and Fitch Ratings.

Wells Fargo Securities received the written award on American Municipal Power, Inc.’s $168.455 million of refunding Series 2019A project revenue bonds for the Prairie State Energy Campus. The deal is rated A1 by Moody’s Investors and A by S&P and Fitch.

JPMorgan Securities received the official award on the California Pollution Control Financing Authority’s $183.155 million of Series 2019 water furnishing revenue refunding bonds for the San Diego County Water Authority Desalination Project Pipeline. The deal is rated Baa3 by Moody’s and BBB-minus by Fitch.

RBC Capital Markets received the written award on the Douglas County School District, Number RE1, Colorado’s $249.975 million of Series 2019 general obligation bonds. The deal, which is Colorado State Intercept Program insured, is rated Aa1 by Moody’s and AA-plus by Fitch.

On Thursday, the New York Metropolitan Transportation Authority will sell over $1 billion of securities in four competitive sales.

The offerings consist of $200 million of Series 2019A Subseries 2019A-1 transportation revenue climate bond certified green bonds; $162.805 million of Series 2019A Subseries 2019A-2 transportation revenue climate bond certified green bonds; and $100 million of Series 2019A Subseries 2019A-3 transportation revenue climate bond certified green bonds.

The MTA will also sell $750 million of transportation revenue bond anticipation notes.

Moody's rates the bonds A1 and assigns a MIG1 rating to the BANs, S&P rates the bonds A and the BANs SP1, Fitch rates the bonds AA-minus and the BANs F1-plus and Kroll Bond Rating Agency assigns an AA-plus rating to the bonds and a K1-plus rating to the BANs.

Bond sales

Florida

Texas

Illinois

California

Colorado

Bond Buyer 30-day visible supply at $6.78B

The Bond Buyer's 30-day visible supply calendar decreased $780.5 million to $6.78 billion for Wednesday. The total is comprised of $2.27 billion of competitive sales and $4.51 billion of negotiated deals.

Secondary market

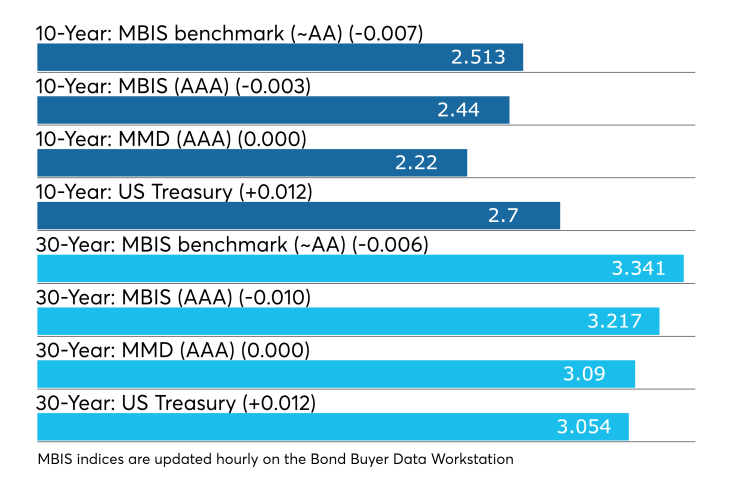

Municipal bonds were stronger Wednesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as one basis point in the one- to 30-year maturities.

High-grade munis were also stronger, with muni yields falling as much as one basis point across the curve.

Municipals were steady on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the 30-year muni maturity remaining unchanged.

Treasury bonds were mixed as stock prices traded higher.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 82.2% while the 30-year muni-to-Treasury ratio stood at 101.0%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 41,841 trades on Tuesday on volume of $13.67 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 13.613% of the market, the Empire State taking 13.387% and the Lone Star State taking 10.216%.

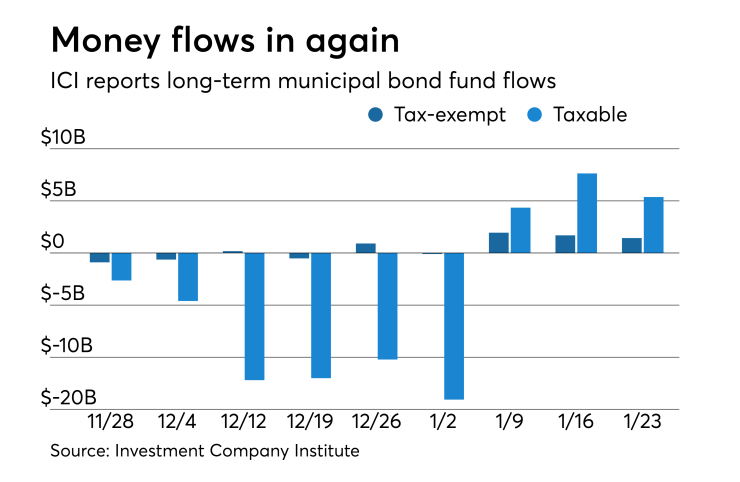

ICI: Long-term muni funds see $1.43B inflow

Long-term municipal bond funds and exchange-traded funds saw a combined inflow of $1.432 billion in the week ended Jan. 23, the Investment Company Institute reported on Wednesday.

This followed an inflow of $1.694 billion from the tax-exempt mutual funds in the week ended Jan. 16.

Long-term muni funds alone saw an inflow of $5.484 billion while ETF muni funds saw an outflow of $98 million in the week ended Jan 23.

Taxable bond funds saw combined inflows of $5.372 billion in the latest reporting week after experiencing inflows of $7.633 billion in the previous week.

ICI said the total combined estimated inflows into all long-term mutual funds and exchange-traded funds were $9.228 billion for the week ended Jan. 23 after inflows of $6.347 billion in the prior week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.