Municipals were steady to weaker in spots as a $1 billion competitive deal from Pennsylvania took focus in the primary and outflows from mutual funds intensified. U.S. Treasuries reversed some of Tuesday's losses and equities made gains.

The two- and three-year muni-UST ratios are around 66% to 67%. The five-year was at 71%, the 10-year at 84% and the 30-year at 103%, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the five at 70%, the 10 at 85% and the 30 at 99% at a 3:30 p.m. read.

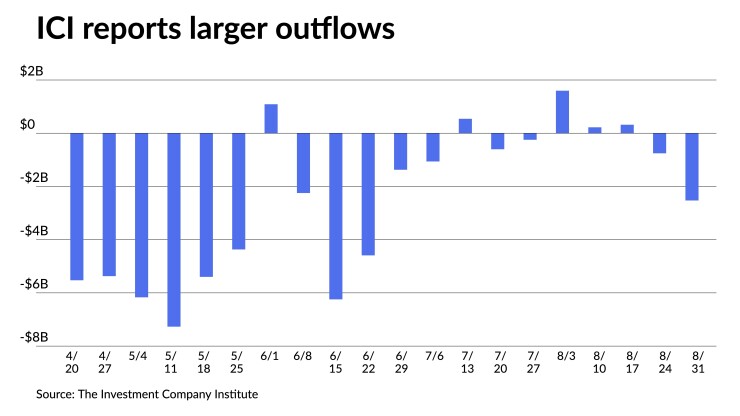

The Investment Company Institute reported $2.527 billion of outflows from muni bond mutual funds in the week ending Aug. 31 compared to $765 million of outflows the previous week.

Exchange-traded funds saw outflows of $72 million versus $337 million of outflows the week prior, per ICI data.

In the competitive market Wednesday, Pennsylvania (Aa3/A+/AA-/) sold $1 billion of general obligation bonds to BofA Securities, with 5s of 10/2023 at 2.37%, 5s of 2027 at 2.60%, 5s of 2032 at 3.00%, 4s of 2037 at par and 5s of 2042 at 3.81%, callable 10/1/2032.

"The commonwealth's bonds make up 6% of the market value of the unrefunded state GO bonds in the ICE Municipal Bond Index," said CreditSights strategists Pat Luby and John Ceffalio.

The Pennsylvania bonds, they noted, "have a shorter composite duration than the state GO peer group (4.6 for the Keystone State, vs 5.3 for the state GOs)." So in the current "duration-averse market, it is not surprising that through the end of August, the composite [year-to-date] total return for Pennsylvania's bonds lead the peer group (-6.4% vs -6.8%), they said.

The spread for the 10-year BVAL Pennsylvania GO benchmark yield has widened by 10 basis points so far this year to +30, they said.

"While several higher-rated state's spreads have widened by more, we think that the wider spread currently available on Pennsylvania is appealing, will attract buyers and has room to tighten," according to Luby and Ceffalio.

In the negotiated market, RBC Capital Markets priced for the Joint School District No. 28J, Colorado, (Aa1///) $126.260 million of GO refunding bonds, Series 2022, with 5s of 12/2022 at 2.30%, 5s of 2027 at 2.52% and 5s of 2028 at 2.62%, noncall.

Triple-A tax-exempt benchmark curves continued to cheapen for the fifth week in a row last week, with yields rising across a steeper curve, noted Matt Fabian, a partner at Municipal Market Analytics.

"The latest cheapening followed other U.S. fixed income and equities, those reflecting more hawkish Fed comments and a related rise in the potential for a recession in the U.S., despite stronger ISM and steady employment numbers last week," he said.

Outflows from mutual funds and exchange-traded funds last week also pushed yields higher. This, Fabian said, is especially true for lower coupon bonds that had outperformed 4s and 5s earlier in August. Last week, 81% and 21% of customer-sold long 2s and 3s, respectively, were priced below 85 cents.

Mutual fund losses — headlined by long and high-yield strategies — have created "a massive readjustment without reasonable recent comparison and a good explainer why tax-exempt prices remain adrift and perhaps why the primary market has struggled to regain its footing," he said.

With nominal triple-A yields having regained or surpassed their highs from earlier in the year, Fabian said it is "likely that bank direct lending activity is robust, keeping supply away from the capital market."

Looking ahead, he noted, "the data do not suggest an easy rebound or even stability despite what would have been attractive nominal yields in most recent years."

Reinvestment in September of around $15 billion in tax-exempts "is among the weakest of the year, putting the demand burden on (hypothetical) fresh inflows and real money investors reallocating out of cash/shorts into more permanent positions: both unlikely while prices and flows remain volatile," he said.

Further, total trading volumes, he said, remained elevated in August, "suggesting that current prices are well discovered and may have some staying power even if market tone improves."

Fair value

"Tax-exempts appear fairly valued heading into September having outperformed Treasuries in August only in the 10yr spot (-2 ratios to 82%) while underperforming in 2yrs (+10 ratios to 66%) and 30yrs (+2.3 ratios to ~100%)," said Peter Block, managing director of credit strategy at Ramirez & Co.

On a credit/liquidity spread basis, however, the vast majority of muni credit sectors "appear cheap compared to three-year averages, with lower volatility GO, public power, and water/sewer indicating the best relative value vs the broader tax-exempt market," he said.

Muni credit quality appears to have peaked in the 2Q22, he said, and has "plateaued, evidenced by a trend of fewer S&P rating actions in total and upgrades slowing (190 upgrades in 2Q22 vs 305 in 1Q22)."

Block expects "rating actions to decelerate further into the end of 2022 as the Fed pursues more restrictive monetary policy."

Informa: Money market muni assets rise

Tax-exempt municipal money market funds saw inflows continue as $2.09 billion was added the week ending Monday, bringing the total assets to $103.34 billion, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for all tax-free and municipal money-market funds fell to 1.12%.

Taxable money-fund assets lost $5.09 billion to end the reporting week at $4.413 trillion of total net assets. The average seven-day simple yield for all taxable reporting funds rose to 1.92%.

Secondary trading

North Carolina 5s of 2023 at 2.33%-2.32%. Maryland 5s of 2024 at 2.38%. Washington 5s of 2024 at 2.38% versus 1.73% on 8/8. Georgia 5s of 2027 at 2.35%.

DC 5s of 2028 at 2.57%. Georgia 5s of 2029 at 2.53% versus 2.55%-2.53% Tuesday. California 5s of 2029 at 2.65% versus 2.53% on 8/30.

NY Dorm PIT 5s of 2033 at 3.27%.

NYC 5s of 2038 at 3.80% versus 3.82%-3.80% Tuesday and 3.60% on 8/31. Washington 5s of 2043 at 3.82%.

Indiana Finance Authority 5s of 2047 at 3.77% versus 3.45%-3.47% on 8/25. Harris County, Texas, 5s of 2047 at 3.93% versus 3.23% on 8/12.

AAA scales

Refinitiv MMD's scale was cut two basis points seven years and out at the 3 p.m. read: the one-year at 2.28% (unch) and 2.31% (unch) in two years. The five-year at 2.40% (unch), the 10-year at 2.74% (+2) and the 30-year at 3.50% (+2).

The ICE AAA yield curve saw cuts 10 years and out: 2.33% (-1) in 2023 and 2.36% (-1) in 2024. The five-year at 2.43% (flat), the 10-year was at 2.82% (+1) and the 30-year yield was at 3.49% (+3) at a 3:30 p.m. read.

The IHS Markit municipal curve saw small cuts out long: 2.26% (unch) in 2023 and 2.34% (unch) in 2024. The five-year was at 2.44% (unch), the 10-year was at 2.75% (unch) and the 30-year yield was at 3.48% (+2) at a 4 p.m. read.

Bloomberg BVAL was little changed: 2.34% (unch) in 2023 and 2.35% (unch) in 2024. The five-year at 2.38% (unch), the 10-year at 2.71% (unch) and the 30-year at 3.48% (+2) at 3:30 p.m.

Treasuries rallied.

The two-year UST was yielding 3.435% (-7), the three-year was at 3.490% (-8), the five-year at 3.362% (-9), the seven-year 3.346% (-8), the 10-year yielding 3.266% (-8), the 20-year at 3.664% (-10) and the 30-year Treasury was yielding 3.407% (-9) near the close.

Primary to come:

California (/AA-//) is set to price Thursday $2.5 billion of general obligation bonds, consisting of $1.3 billion of various purpose general obligation bonds and $1.2 billion of general obligation refunding bonds. Barclays Capital.

The Omaha Public Power District, Nebraska, (Aa2///) is set to price Thursday $405.520 million of electric system revenue bonds, consisting of $337.475 million of 2022 Series A and $68.045 million of 2022 Series B. J.P. Morgan Securities.

Kentucky (A1//A+/) is set to price Thursday $193 million of State Property and Buildings Commission Project No. 127 revenue bonds, Series A. Citigroup Global Markets.

The Maryland Economic Development Corp. (Baa2///) is set to price Thursday $178.455 million of taxable United States Citizenship and Immigration Services Headquarters Project federal lease revenue bonds, serial 2035. Oppenheimer & Co.

Competitive:

Dane County, Wisconsin, is set to sell $8.555 million of general obligation corporate purpose bonds, Series 2022B, and $76.435 million of general obligation promissory notes, Series 2022A at 11 a.m. eastern Thursday, and $14.560 million of taxable general obligation promissory notes, Series 2022C, and $47.435 million of AMT general obligation airport project promissory notes, Series 2022D, at 11:30 a.m. Thursday.