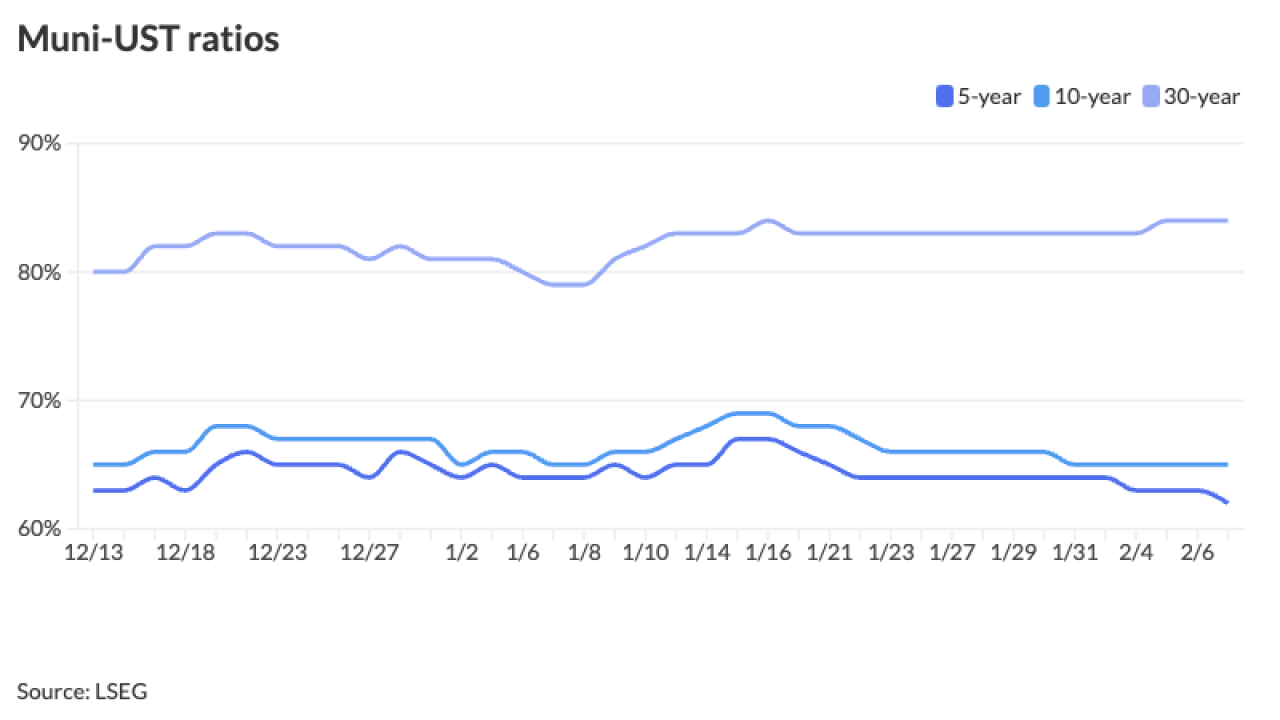

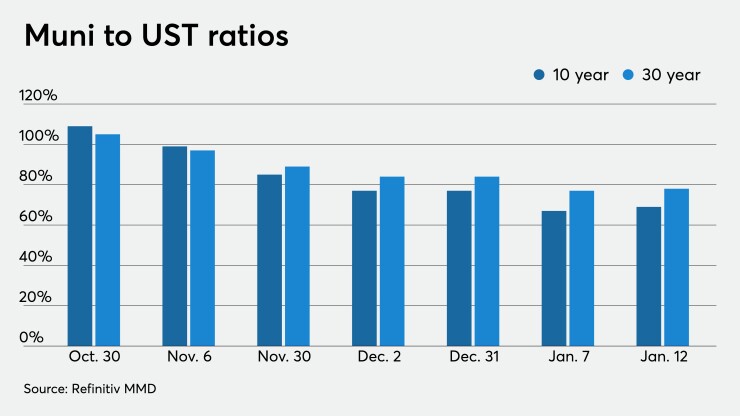

Municipal triple-A yield curves were weaker by a basis point on bonds three years and out Tuesday as new issues began to trickle in and U.S. Treasuries pared back the day's earlier losses. The disconnect between munis and UST continues and ratios hover at 10-year lows.

On Tuesday, the municipal to Treasury ratios sat at 69% in 10 years and 78% in 30 years, according to Refinitiv MMD. Ratios were 68% in 10 years and 79% in 30 years, according to ICE Data Services.

Municipal outperformance is keeping the market extraordinarily expensive with municipal to Treasury ratios near all-time lows and credit spreads only “fairly valued” across the board, according to Peter Block, managing director of credit strategy at Ramirez & Co.

“We expect this low value muni paradigm to persist until new-issue supply increases meaningfully, likely in February and/or fund inflows meaningfully weaken or reverse,” Block wrote in the Jan. 11 report.

Gross supply of $7.7 billion is expected for this week, along with a 30-day visible net supply of negative $5.4 billion reflecting $6.8 billion of announced supply against a loss of $12.2 billion of maturities and calls.

Ramirez projects a small decline in municipal gross supply in 2021, down 4.6% to $449 billion, although somewhat higher than the average net supply of $106 billion given the $114 billion decline in reinvestment (maturities and calls) estimated at $343 billion in 2021 versus the $457 billion in 2020.

“We expect very modest returns in 2021 with limited upside, given the expectation of a growing economy and rising rates compounded by strong net supply and the possibility of elevated retail fund outflows,” Block wrote.

All scenarios depend heavily on the path of interest rates given the current levels of extraordinary rich valuations of most bonds, he noted.

“The results of our modeling exercise indicate that investors in 2021 should be slightly more defensive versus 2020,” Block said. “We like lower convexity bond structures — higher coupons with shorter effective duration, shorter calls and/or maturities, and good-to-improving credit quality of mid-A to AA range in the transportation, dedicated tax, and healthcare sectors.”

Overall, the political and economic outlook is headed in a positive direction, Block noted, adding, consensus estimates for 2021 indicate interest rates and inflation will be higher by year-end.

“The COVID-19 vaccine roll outs, while slow to begin during the 2020 holiday season, will likely accelerate mid-year,” Block wrote. “This factor, together with meaningful fiscal stimulus in the short-term, should bolster chances that U.S. economic growth accelerates sooner rather than later in 2021, likely quarter three to quarter four.”

“While we expect the Fed to remain accommodative in 2021 with short-term rates anchored at 0%, monetary policy has a relatively high likelihood of being more hawkish by year-end, particularly if growth accelerates,” he added.

Greater economic growth expected later in 2021

Federal Reserve Bank presidents also see growth in the second half, although they are not expecting rate hikes.

The economy will grow a little in the first half of 2021 before greater growth later in the year, according to Federal Reserve Bank of Boston President Eric Rosengren.

“Although it seems likely to me that the economy will, at best, continue to grow modestly until there is widespread vaccination, I believe a more robust economic recovery — supported by expansionary monetary and fiscal policy — is likely to follow,” he told the Greater Boston Chamber of Commerce according to prepared text released by the Fed.

He also sees no change in the fed funds rate target, which is now in a range between zero and 0.25%, or the Fed’s asset purchases.

The recovery will be held back by the remnants of the virus — the limited financial flexibility of municipalities and other problems that “have actually been deferred,” such as stresses in commercial real estate and the loans backing them that won’t show until later.

But, he said he remains optimistic.

“Policymakers must continue to find ways to support those individuals and firms that have been disproportionately and severely impacted by the pandemic.”

Separately, Federal Reserve Bank of Cleveland President Loretta Mester agreed the second half will see a stronger recovery. “In the near term, the current surge in virus cases will likely weigh on economic activity this winter as it is managed through social distancing and targeted shutdowns, albeit ones that are less severe than those last spring,” she said in a videoconference, according to text released by the Fed. “But as the surge is brought under control and more people become vaccinated, I expect economic activity to pick up. Assuming that most people are vaccinated by the third quarter of the year, people and businesses will feel it is safe to re-engage in a broad range of activities and I expect a strong pickup in economic activity in the second half of this year.”

Further, she expects above-trend growth “the next few years,” with unemployment falling and inflation “gradually rising.”

But, some workers will need to find new jobs, sometimes in a different industry. Also, shopping, dining and firm’s office space needs could be permanently altered, she said. “Those changes, as well as the need to re-establish more robust supply chains, could necessitate structural changes to the economy that will take time to unfold.”

Also speaking Tuesday, Federal Reserve Bank of Kansas City President Esther George said the vaccines, more fiscal support and continued monetary policy accommodation have raised her “confidence in the recovery, notwithstanding near-term turbulence.”

The pandemic and the reactions to stop its spread “are likely to leave an imprint on the economic outlook for years to come,” she said in prepared remarks.

“An exceptionally uncertain economic outlook, with the chance of both downside and upside surprises, creates a complicated and difficult environment for monetary policy,” George added. “While the vaccine promises an eventual end to the virus’ hold on the economy, there remains a substantial gap to be bridged before we get there. With the most recent fiscal package, the economy could get the necessary momentum to bridge this gap and prevent standard recessionary dynamics from taking hold before we reach the safety of widespread vaccination.”

Accommodative monetary policy is appropriate, she said, noting, “It is too soon to speculate about the timing of any change in this stance.”

In data released Tuesday, the National Federation of Independent Business’ small business optimism index fell to 95.9 in December from 101.4 in November. The read is below the index’s historical average of 98.

“This month’s drop in small business optimism is historically very large and most of the decline was due to the outlook of sales and business conditions in 2021,” according to NFIB Chief Economist Bill Dunkelberg. “Small businesses are concerned about potential economic policy in the new administration and the increased spread of COVID-19 that is causing renewed government-mandated business closures across the nation.”

Primary market

Morgan Stanley & Co. LLC re-priced $168.6 million of sales tax revenue bonds for Cook County, Illinois, (NR/AA-/NR/AAA) with bumps of five to 15 basis points from original pricing wires.

Bonds with 5% coupons in 2031 yielded 1.21% (-8 bps from morning scale), 5s of 2036 at 1.54% (-5 bps) and 5s of 2041 at 1.79% -11 bps, priced to the call in Nov. 15, 2030.

BofA Securities won $157 million of exempt GOs from Multnomah County, Oregon (/AAA//). Bonds mature in 2027 to yield 0.40%, 0.53% in 2028 and 0.65% in 2029, all with 5-handles.

Secondary market

“It’s kind of a typical quiet beginning of the year,” a Minnesota trader said. “There’s not a lot of supply, but there’s decent inquiries because rates are so low people are looking for value wherever they can find it.”

Buy side investors are flush with cash and sitting on the sidelines waiting to spend their Jan. 1 redemption proceeds on the heartier volume of supply expected at month's end or in February, the trader noted. In the meantime, they are dabbling in the secondary market and buying credits from large, attractive names, such as Ohio’s Buckeye Tobacco Settlement Financing Authority bonds and Puerto Rico paper, as well as other “distressed or funky stuff,” which has some extra yield, he said.

“Outside of that, the pretty liquid stuff is trading well,” he added. Overall, the municipal bond market was mostly unchanged on the day.

High-grade municipals were a basis point off on bonds outside of three years, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were steady at 0.13% in 2022 and 0.14% in 2023. The 10-year at 0.78% and the 30-year at 1.47%.

The ICE AAA municipal yield curve showed short maturities weaker at 0.14% in 2022 and at 0.17% in 2023. The 10-year was a basis point higher at 0.76% while the 30-year yield rose to 1.49%.

The IHS Markit municipal analytics AAA curve showed yields at 0.14% in 2022 and 0.15% in 2023 while the 10-year rose to 0.76% and the 30-year yield at 1.46%.

The three-month Treasury note was yielding 0.09%, the 10-year Treasury was yielding 1.13% and the 30-year Treasury was yielding 1.88%. The Dow rose 64 points, the S&P 500 rose 0.02% and the Nasdaq rose 0.22%.

Primary market still to come

J.P. Morgan Securities LLC is set to price $1.3 billion of corporate CUSIP taxable refunding bonds for Baylor Scott & White Holdings (Aa3/AA-/NR/NR) Thursday.

Loop Capital Markets is set to price $442 million of turnpike subordinate revenue bonds for the Pennsylvania Turnpike Commission (A3/A/A-/A+).

The Virginia College Building Authority is set to sell $356.9 million of taxable educational facilities revenue refunding bonds on Wednesday.

Barclays Capital Inc. is set to price $340 million of general obligation refunding bonds for Cook County, Illinois, (A2/A+/A+/) on Thursday.

Goldman Sachs & Co. LLC is set to price $300 million of taxable bond for the Trinity Health Credit Group (Aa3/AA-/AA-/) on Tuesday.

Barclays Capital is set to price $250 million of electric system general revenue notes for the Long Island Power Authority (A2/A/A/) on Wednesday.

Jefferies LLC is set to price $250 million of Texas Veterans Land Board (Aaa///) variable rate demand bonds with terms in 2051 on Tuesday.

RBC Capital Markets is set to price $175 million of taxable revenue refunding bonds for the California Statewide Communities Development Authority (A1/A+/A-/) (California Independent System Operator Corp. Project green bonds) with serials 2022-20235 and terms in 2039.

Stifel, Nicolaus & Company, Inc. is set to price $171.6 million of taxable and tax-exempt refunding bonds for the City of Yuma, Arizona (/AA-/AA-/).

BofA Securities is set to price $147 million of taxable pension obligation bonds for the City of El Cajon, California, (/AA//) on Wednesday.

BofA is set to price $127.6 million of St. Luke’s University Health Network Hospital revenue bonds for the Bucks County Industrial Development Authority, Pennsylvania (A3/A-//).

Fremont, California, Unified School District is set to sell $126.5 million of general obligation bonds on Wednesday. Barclays Capital is set to price $100 million of taxable general obligation refunding bonds for the Fremont USD on Thursday.

Raymond James & Associates, Inc. is set to price $124.9 million of Stevenson University revenue refunding bonds for the Maryland Health and Higher Educational Facilities Authority (NR/BBB-/NR/), serials 2029-2041, terms 2046, 2051 and 2055.

Ziegler is set to price $120 million of Springpoint Senior Living Project revenue refunding bonds for the National Finance Authority (NR/NR/BBB+/) Wednesday.

J.P. Morgan Securities LLC is set to price $100 million of corporate CUSIP taxable bonds for American University (A1/A+/NR/NR) Thursday.

Gary Siegel contributed to this report.