Municipal bonds held steady Thursday with a few firmer trades out longer, but the story remains the same — a supply-demand imbalance with the demand component creating an ideal rate environment for issuers, an outperformance of U.S. Treasuries and benchmark yields that just won't budge.

Triple-A benchmark yields held at levels that have stayed nearly the same since the start of December. Meanwhile, Refinitiv Lipper reported another $992 million of inflows into municipal bond mutual funds.

Meanwhile, new issues fared quite well this week with deals repricing and investors not wondering if, but by how much. New York Transportation Corporation JFK Terminal project bonds saw yields 15 to 30 basis points better in repricing.

The Puerto Rico Aqueduct and Sewer Authority

"If you look at the PRASA deal — a 275 basis point spread over triple-As — it's kind of hard to believe investors stomached a 4% yield on near 30-year debt, Puerto Rico credit, unrated at that," a New York trader said. "If there is ever a story to tell about 'yield hunger' in 2020, we saw it this week."

Although bid list volume is trending higher into the end of the year, its share as measured against overall demand isn’t that much of a threat, said Kim Olsan, senior vice president at FHN Financial.

"From a technical perspective, if the 10-year AAA spot holds in this current range into the end of the month, it will be the lowest year-end closing yield ever, beating out 2019’s 1.44% ending level," she said. "As 2021 begins, buyers will be faced with an enduring process as to where to position along the curve given portfolio constraints, what couponing to allocate (1s vs 2s, 3s vs 4s) and what mix of credit makes most sense."

"There is, however, some slowing in turnover of newly bought intermediate bonds — especially 5% coupon, natural AAA state names trading flat to AAA spots and PSF-backed Texas schools offered at less than +10/AAA — where such obvious value isn’t immediately present with both ratios and yields concentrated in the 0.70% range," she said.

Short coupons flashed across screens this week, continuing a trend toward lower-coupon bonds out longer attempting to lure retail, especially in the competitive space.

"Past 10 years, variety in couponing and call dates offer more flexibility across a broader range of inquiry," Olsan said pointing to new issues out of Florida (the issuer forever on the day-to-day calendar saw an opening Wednesday) and Georgia, which showed the flexibility required from issuers and bidders.

Florida’s Turnpike sale offered 2s, 3s, 4s and 5s across a 30-year maturity schedule and Georgia’s Road and Toll issue priced A2/AA revenue bonds at a maximum spread of +32/AAA in the 2032 maturity.

Current spreads in 10-year BBB revenue bonds are 40 basis points lower than in the early summer period, but are well off the +60/AAA range from the start of the year, she noted.

"Sustained low yields can be expected to continue to draw allocations, particularly with what should be improving revenue models later in 2021," Olsan said.

The primary market next week will be led by recently downgraded New York City's $1.5 billion of taxable GOs.

Connecticut will also bring its $800 million GO deal, and $437 million of Harris County, Texas, toll road bonds are expected. The Illinois Finance Authority will bring $425 million of green bonds and $330 million will come from the New York City Health and Hospitals.

Citi: 2021 may see $4.1T market, shift from 5% AAA GOs

Municipals bond issuance is forecast to rise to record levels in 2021, bringing the total size of the muni market to $4.1 trillion, attendees at Citi’s 2021 Municipal Market Outlook Conference were told Thursday.

Total gross issuance of municipal bonds is predicted to climb to $550 billion next year with net issuance rising to $145 billion, the most in more than 10 years, said Vikram Rai, CFA and head of credit research at Citi.

On top of

Citi noted that since the Treasury Department has failed to renew its backing of the Federal Reserve’s Municipal Liquidity Facility, all of the new issuance will take place in the public arena.

Additionally, Rai said, because 5% AAA general obligation bonds make up only 27% of the tax-exempt bonds outstanding, it was likely that Citi would stop using them as the benchmark in their research projections. Rai noted revenue bonds are about twice the size of the GO sector and only about 8% of revenue bonds are rated AAA.

Currently, AA bonds make up 55% of the outstanding bonds, A rated bonds are at 9% Baa at 3% and high-yield unrated bonds at 6%.

“We feel stale prints are becoming a more prevalent problem and flat spread curves for AA-AAA and A-AAA MMD do not inspire confidence given that it is impossible for tradeable spreads to be so flat and uniform in a liquid market,” Citi said in an accompanying report.

Secondary market

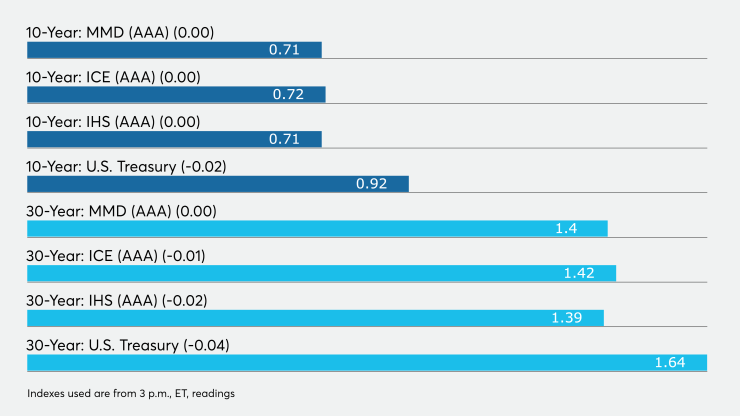

High-grade municipals were unchanged, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were at 0.13% in 2021 and 0.14% in 2022. The yield on the 10-year at 0.71% while the yield on the 30-year was at 1.41%.

The 10-year muni-to-Treasury ratio was calculated at 78% while the 30-year muni-to-Treasury ratio stood at 85%, according to MMD.

The ICE AAA municipal yield curve showed short maturities at 0.13% in 2021 and 0.15% in 2022. The 10-year maturity was at 0.70% while the 30-year yield was little changed at 1.42%.

The 10-year muni-to-Treasury ratio was calculated at 77% while the 30-year muni-to-Treasury ratio stood at 86%, according to ICE.

The IHS Markit municipal analytics AAA curve showed short yields at 0.11% and 0.12% in 2021 and 2022, respectively, and the 10-year steady at 0.69% as the 30-year yield was at 1.39%.

Treasuries fell and equities were weaker. The 10-year Treasury was yielding 0.91% and the 30-year Treasury was yielding 1.64%. The Dow lost 45 points, the S&P 500 fell 0.04%, while the Nasdaq rose 0.06%.