Municipal bonds sold off by as much as 10 basis points outside of five years but triple-A benchmarks were cut across the curve as customer selling pressure increased again and investors are demanding more yield as economic data shows an improving economy and federal stimulus more likely.

Trading to higher yields was swift out of the gates. Large blocks of high grades, such as Maryland, Georgia and Washington, traded as much as 20 basis points higher than prints from last week and double-digit higher than benchmark yields Monday. Participants were sending a signal that tax-exempt yields have been too rich.

North Carolina GO 5s of 2022 traded at 0.08%. Howard County, Maryland, 5s of 2023 traded at 0.20% versus 0.10% original yield. New York Dorm NYU 5s of 2025 at 0.46%. Florida PECO 5s of 2024 at 0.42%-0.40%. Oregon 5s of 2025 at 0.47%-0.46%. Delaware GO 5s of 2026 at 0.44%. Montgomery County, Maryland, 5s of 2026 at 0.53%-0.52%. Anne Arundel County, Maryland, 5s of 2027 at 0.65%.

Maryland 5s of 2027 at 0.63% versus 0.42% Wednesday. Howard County, Maryland, 5s of 2028 at 0.71% versus 0.51% Thursday. Georgia GO 5s of 2028 traded at 0.75%-0.74%. Washington GO 5s of 2030 at 1.00%-0.99%. California 5s of 2030 at 1.05% versus 0.69%-0.68% on Feb. 11.

Austin, Texas, ISD 5s of 2033 at 1.16% versus 1.13% Thursday. Washington GO 5s of 2041 at 1.57% versus 1.45% Friday. NYC Transitional Finance Authority 4s of 2042 at 1.86%-1.85%. New York City water 5s of 2048 at 1.88%-1.75%.

"Even though fund flows have been positive and the new-issue calendar appears to be manageable, the weakness in the bond markets coupled with the prospect of a slowdown in reinvestment demand suggests to us that a more cautious stance is appropriate," said Patrick Luby of CreditSights.

Municipal bond yields had been marching progressively lower since the end of October and post-election demand for tax-exempts drove the muni/Treasury yield ratios to record lows.

From 2011 to 2020, 30-year municipal to U.S. Treasuries ratios never fell below 84% and averaged 103%. The 30-year muni/UST ratio is at 74% Monday. The 10-year at 70%, according to Refinitiv MMD.

ICE Data Services showed ratios rose four basis points to 68% in 10 years and up three basis points to 75% in 30. BVAL showed 10-year ratios steady at 62% and at 73% in 30 years.

"When compared to comparable taxable bonds, yields on tax-exempt munis are still unattractive to corporate investors that pay the lower 21% federal income tax rate, and are unattractive even at a 27% tax rate as had been proposed by then-candidate Biden," Luby wrote. "Demand in the market for tax-exempt municipals, is therefore still dependent on individual investors — either directly for individual bonds or indirectly via mutual funds and ETFs."

Taxable municipals are on better footing than the tax-exempt market, despite the richness.

“The municipal market is still very rich, so buyers are very cautious especially with a good calendar this week,” a New York underwriter said.

This week there will be a lot of investor focus on the Regents of the University of California $3 billion tax-exempt and taxable deal combined with other California issuers to reach near $4 billion of the total $10 billion calendar.

Economy gains

The economic data released Monday showed economic strength with further improvement ahead.

The Leading Economic Index rose 0.5% in January after a 0.4% gain in December, the Conference Board reported.

The coincident index climbed 0.2% in January and 0.1% in December, while the lagging index fell 0.6% after 0.5% growth the month before.

“While the pace of increase in the U.S. LEI has slowed since mid-2020, January’s gains were broad-based and suggest economic growth should improve gradually over the first half of 2021,” according to Ataman Ozyildirim, senior director of economic research at the think tank.

The Conference Board now expects GDP to rise 4.4% this year.

Separately, the national activity index rose to 0.66 in January from 0.41 in December, the Federal Reserve Bank of Chicago announced. The index’s three-month moving average fell to 0.47 from 0.60 and the diffusion index slid to 0.34 from 0.49.

The indexes suggest above average economic growth.

All components — production-related, employment-related, personal income and housing, and sales, orders and inventories — were positive in January, but only the personal income and housing category increased from December.

Also on Monday, the Federal Reserve Bank of Dallas reported “activity expanded at a markedly faster pace” in the region in February, as the production index increased to 19.9 in February from 4.6 in January, “indicating a sharp acceleration in output growth.”

Capacity use gained to 16.5 from 9.2, new orders rose to 13.0 from 6.3, unfilled orders climbed to 12.4 from 5.7, shipments grew to 16.1 from 13.5, employment fell to 12.7 from 16.6, the general business activity index jumped to 17.2 from 7.0, and the company outlook crept to 10.7 from 10.3.

Looking six months ahead, the general business activity index gained to 33.9 from 29.6, and the company outlook rose to 32.3 from 27.7, while the production index slid to 40.2 from 43.7 and the employment index fell to 30.8 from 31.9.

Secondary market

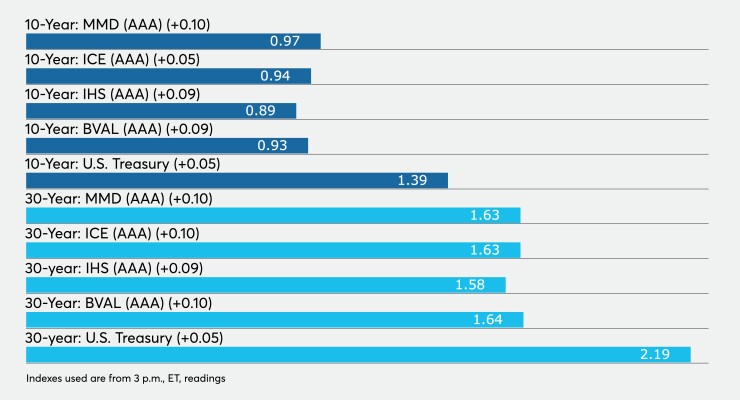

High-grade municipals were weaker across the scale, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were at 0.08% in 2022 and 0.14% in 2023, both up two basis points. The 10-year rose to 0.93% and the 30-year to 1.58%, both 10 basis point cuts.

The ICE AAA municipal yield curve showed short maturities at 0.09% in 2022 and 0.16% in 2023. The 10-year rose nine basis points to 0.94% while the 30-year yield rose 10 to 1.63%.

The IHS Markit municipal analytics AAA curve showed yields at 0.12% in 2022 and at 0.13% in 2023 while the 10-year rose nine basis points to 0.89% and to 30-year rose nine to 1.58%.

The Bloomberg BVAL AAA curve showed yields at 0.08% in 2022 and up two basis points to 0.14% in 2023, while the 10-year rose nine basis points to 0.93%, and the 30-year yield rose 10 basis points to 1.63%.

The three-month Treasury note was yielding 0.09%, the 10-year Treasury was yielding 1.38%, up five basis points from Friday, and the 30-year Treasury was yielding 2.19%, up five basis points near the close. Equities ended the day mixed with the Dow up 106 points, the S&P 500 off 0.46% and the Nasdaq down 1.89%.

Primary market

The Regents of the University of California (Aa2/AA/AA/) has several large deals with Jefferies LLC running the books on all of them.

It is set to price $1.09 billion taxable general revenue bonds in two series. The first, $615.6 million, serials 2022-2041, term 2051. The second series, $475 million, serials in 2051.

The Regents of the University of California will also price $892.9 million of limited project revenue bonds 2021 Series Q (Aa3/AA-/AA-/), serials 2022, 2024, 2032-2041, terms 2046, 2051 and 2056.

The Regents of the University of California will price $448.9 million of taxable limited project revenue bonds 2021 Series R (Aa3/AA-/AA-/), serials 2022-2041, term 2051.

The Regents of the University of California is set to price $397.4 million of limited project forward delivery revenue bonds 2022 Series S (Aa3/AA-/AA-/, serials 2023-2042.

The Regents of the University of California (Aa2/AA/AA/) is set to price $289.8 million of general revenue bonds 2021 Series BH, serials 2022-2041, terms 2046, 2051.

The San Diego County Regional Transportation Commission (//AA/) is set to price $537.4 million of subordinate sales tax revenue short-term notes (limited tax bonds) 2021 Series A, serials 2022. Citigroup Global Markets Inc. heads the deal.

The New York City Municipal Water Finance Authority (Aa1/AA+/AA+/) is set to price $523 million of water and sewer system second general resolution revenue bonds, Fiscal 2021 Series CC, $221 million of Series CC-1, terms 2051, $150 million of Series CC-2, serials 2027-2028 and $152 million of Series CC-3, terms 2032. Barclays Capital Inc. is head underwriter and the deal is set for Tuesday.

The Indianapolis Local Public Improvement Bond Bank (A2//A+) is set to price $390.1 million of revenue bonds on Tuesday. BofA Securities is lead underwriter.

The Bucks County Industrial Development Authority, Pennsylvania, (/BB+//) is set to price $261.6 million of Grand View Hospital Project hospital revenue bonds, Series 2021 on Tuesday. BofA Securities is bookrunner on the deal.

The Sacramento County Sanitation Districts Financing Authority, California, (Aa2/AA/AA-/) is set to price $258.2 million of refunding revenue bonds Wednesday. BofA Securities is head underwriter.

The Municipal Improvement Corp. of Los Angeles (/AA-//AA) is set to price $256 million of taxable capital equipment and real property lease revenue refunding Series 2021-A bonds on Wednesday. Goldman Sachs & Co. LLC is bookrunner.

The New York City Housing Development Corp. (Aa2/AA+//) is set to price $212 million of taxable multifamily housing revenue bonds on Wednesday. Serials 2024-2032, terms 2036, 2041, 2046. Citigroup Global Markets Inc. is head underwriter.

The New York City Housing Development Corp. will also price $181.3 million of exempt multifamily housing revenue bonds, $167.5 million Series A-1, serials 2026-2033, terms 2036, 2041, 2044, and Series A-2, $13.7 million, serials 2025-2026. Barclays Capital Inc. is bookrunner.

The San Mateo-Foster School District, San Mateo County, California, (Aaa/AA+//) is set to price $145 million of Election of 2020 general obligation bonds, Series A and election of 2015 general obligation bonds, Series B on Wednesday. RBC Capital Markets will run the books.

The Nebraska Public Power District (A1/A+/A+/) is set to price $139 million of general revenue forward delivery bonds, Series 2021 A, serials 2023, 2025, 2027, 2030-2040, Series 2021 B, serials 2023, 2029-2041, terms 2044, on Tuesday. BofA Securities is head underwriter.

The Upper Merion Area School District, Montgomery County, Pennsylvania, is set to price $129.5 million of general obligation bonds and school revenue bonds in two series on Tuesday. The first series, $99.76 million of Series 2021A (Aa1///) serials 2022-2026, 2039-2051, terms 2032, 2038.

The second series, $29.76 million of Series 2021B (Aa3///), serials 2022-2051. RBC Capital Markets is bookrunner.

The California Public Finance Authority (/BBB-//) is set to price $118.6 million of Henry Mayo Newhall Hospital refunding revenue bonds on Tuesday. Insured by Assured Guaranty Municipal Corp. Ziegler is head underwriter.

The Clear Creek Independent School District (Aaa//AAA/) is set to price $108.7 million of unlimited tax school building bonds, PSF guaranteed, on Wednesday. Piper Sandler & Co. is head underwriter.

The Northeast Ohio Regional Sewer District (Aa1/AA+//) is set to price $107 million of taxable wastewater improvement refunding revenue bonds on Tuesday. BofA Securities will run the books.

Worcester, Massachusetts, (Aa3/AA-//) is set to price $101.7 million of taxable general obligation ballpark project bonds in two series on Wednesday. The first series, $88 million of taxable bonds, serials 2022-2036, terms 2039. The second series, $13.6 million of taxable general obligation refunding bonds, serials 2023-2036, terms 2042, 2050. UBS Financial Services Inc. is head underwriter.

The San Francisco Unified School District is set to price $100 million of tax and revenue anticipation notes, serial 2021, on Tuesday. Stifel, Nicolaus & Company Inc. is head underwriter.

Competitive market

Mecklenburg County, North Carolina, (Aaa/AAA/AAA/) is set to sell $225 million of general obligation school bonds at 11 a.m. Tuesday.

Brookline, Massachusetts, (Aaa/AAA//) is set to sell $167.9 million of general obligation municipal purpose loan of 2021 bonds at 11 a.m. Wednesday.

Maryland (//AAA/) is set to sell three competitive loans Wednesday. The first, $207.4 million of GOs, at 10 a.m. The second, $217.5 million of GOs, at 10:30 a.m. The last, $50 million of taxable general obligation bonds at 11 a.m.