Municipal yields rose on the back of U.S. Treasuries as the asset class could no longer ignore the large swings in its taxable counterpart.

Triple-A benchmark curves cut yields anywhere from four to 10 basis points.

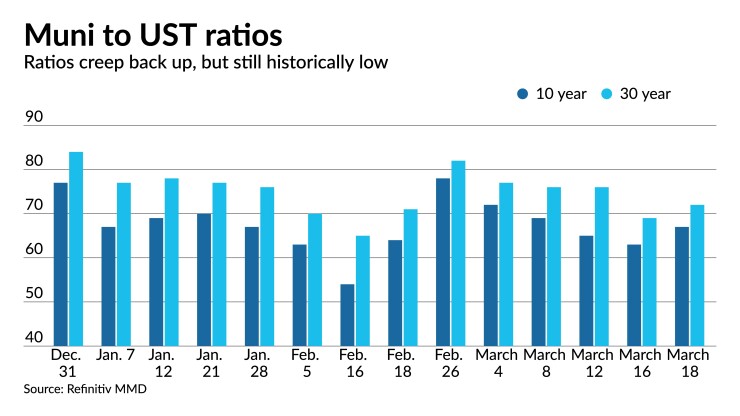

Municipal to UST ratios rose with Thursday's 10-year at 67% and the 30-year at 72%, according to Refinitiv MMD, while ICE Data Services showed ratios at 66% in 10 years and 74% in 30. The moves Thursday on the short end pushed ratios to 193% in one year and 122% in two years, according to ICE.

Looking at the volatility experienced since the beginning of the year, munis still are outperforming UST by larger margins. UST 10-year has risen 60 basis points since the start of January, while the 30-year has seen an 80-basis point increase. Munis in 10-years have climbed about 45 basis points, depending on the scale, and 30-year bonds have slowly risen just north of 40 basis points.

More positive news came from Refinitiv Lipper reporting $1.276 billion of tax-exempt municipal bond mututal fund inflows for the week ending March 17, after $1.092 billion of inflows the week prior.

Flows will be an important indicator for how retail handles the volatility and subsequent headlines in the next few weeks.

In the primary, Morgan Stanley & Co. priced $1.86 billion of tax-exempt personal income tax bonds for the Dormitory Authority of the State of New York (/AA+/AA+/). In a repricing, yields rose three to seven basis points.

The exempt series, $1.855 billion, saw bonds in 2025 with a 5% coupon yield 0.47%, 5s of 2026 at 0.68%, 5s of 2031 at 1.60%, 5s of 2036 at 1.93%, 4s of 2041 at 2.33%, 4s of 2047 (the largest tranche, $123 million) yield 2.49%, and 3s of 2051 at 2.73%.

Details on a planned $302 million of taxable PITs were not available.

"DASNY, with its size and coming into the big spike in UST, might have been priced a tad on the cheap side to begin, so the cuts were not as severe as the secondary moves," a New York trader said. "Bringing a multibillion deal in a market like today's is no picnic. I'd say it did well."

RBC Capital Markets priced $800 million of health facilities revenue bonds on behalf of BJC Health System for the Missouri Health and Educational Facilities Authority (Aa2/AA//). The first series, $334.6 million of Series 2021A bonds, saw 4s of 2024 yield 0.64%, 4s of 2026 at 0.78%, 5s of 2031 at 1.54%, 2.25s of 2036 at 2.45%, 3s of 2041 at 2.53%, 4s of 2046 at 2.40% and 3s of 2051 at 2.74%.

The second, $242.8 million of Series 2021 B bonds, 4s of 2051 with a 4% coupon yield 0.84% with a mandatory tender on 5/1/2026. The third, $223 million in Series 2021 C, 5s of 2052 yield 1.17% with a mandatory put in 5/1/2028.

No details on whether it repriced were available.

In the competitive market, Spokane School District No. 81, Washington, (Aaa/AA+//) (Aa3/AA// Washington State School District Credit Enhancement Program) unlimited tax general obligation improvement refunding bonds to JPMorgan Securities LLC. Bonds in 2021 with a 5% coupon yield 0.12%, 5s of 2022 at 0.15%, 4s of 2027 at 1.03%, 4s of 2029 at 1.30%, 4s of 2037 at 1.71% and 4s of 2040 at 1.83%.

The arrival of significant supply this week fared well with the buy side crowd, and boosting demand and aiding market performance, despite Thursday’s Treasury sell-off, buy-side sources said.

The primary market appeared to be less reactive than the secondary market, especially for issues rated A-minus and below, according to Jim Conn, portfolio manager for Franklin Templeton Fixed Income’s municipal bond team.

“Selling had been very benign in the municipal bond market until this morning,” he said Thursday.

Municipal bond prices in the secondary market for triple-A- and double-A-rated, larger trading names pulled back in line with U.S. Treasury prices in early action on Thursday, while Monday through Wednesday saw much more temperate moves, according to Conn.

“Highly rated investment grade muni bonds, historically, have traded with greater correlation to U.S. Treasury moves than lower and non-rated offerings,” he said.

Meanwhile, he said investor participation remained firm for new issues in the lower investment-grade categories and high-yield space, with some issues in that universe repriced with lower yields due to heavy subscriptions.

“Despite the sell-off on Thursday morning, it appears that the yield relationship between the markets will remain intact,” he said.

Secondary market

Trading clearly showed market weakness, especially in the belly of the curve.

New York City TFA 5s of 2022 traded at 0.25%. Charlotte, North Carolina, 5s of 2025 traded at 0.40% versus 0.38% Wednesday.

California GO 5s of 2026 at 0.65% versus 0.60%-0.58% Wednesday. Baltimore County 5s of 2027 at 0.74%. New York City GO 5s of 2027 at 0.83%. Washington GO 5s of 2028 at 0.96%.

New York City water 5s of 2031 at 1.33% versus 1.19%-1.18% Monday and 1.22% original. Washington Suburban Sanitation District, Maryland, 5s of 2032 at 1.21% versus 1.17% Friday. Columbus, Ohio, 5s of 2032 at 1.24$.

California 5s of 2034 at 1.46%-1.45% versus 1.39%-1.35% Wednesday and 1.35% original. Cal 5s of 2035 at 1.50%-1.49% versus 1.42%-1.39% Wednesday and 1.39% original. Cal 5s of 2036 at 1.54%-1.53% versus 1.43% original.

Washington 5s of 2040 traded at 1.70%.

High-grade municipals were cut seven to nine basis points across Refinitiv MMD's scale. Short yields rose to 0.18% in 2022 and to 0.19% in 2023. The 10-year at 1.16% and the 30-year at 1.81%.

The ICE AAA municipal yield curve showed short maturities rise eight basis points to 0.18% in 2022 and nine basis points to 0.22% in 2023. The 10-year rose 10 to 1.14% while the 30-year yield rose seven to 1.80%.

The IHS Markit municipal analytics' AAA curve showed yields rose eight basis points to 0.14% in 2022 and to 0.19% in 2023, the 10-year rose to 1.06%, and the 30-year to 1.74%.

The Bloomberg BVAL AAA curve showed yields rise to 0.12% in 2022 and at 0.17% in 2023, while the 10-year rose eight basis points to 1.12%, and the 30-year yield rose nine to 1.82%.

The 10-year Treasury ended at 1.71% and the 30-year Treasury was yielding 2.46% at the close. The Dow fell 145 points while the S&P 500 fell 1.51% and the Nasdaq lost 3.03%.

Economy

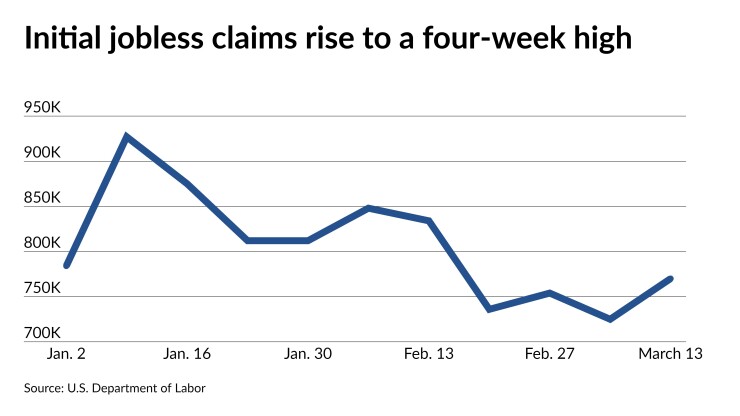

Once again on the surface the numbers released Thursday suggested a mixed picture of the economy, but analysts warned to not read too much into the labor numbers since they can be “volatile.”

Initial jobless claims unexpectedly jumped to 770,000 on a seasonally adjusted annual basis in the week ended March 13 from a revised 725,000 a week earlier, the Labor Department reported Thursday.

The March 6 read was first reported as 712,000. Economists polled by IFR Markets expected 700,000 claims in the week.

Meanwhile, the Federal Reserve Bank of Philadelphia's manufacturing Business Outlook Survey indicated the sector strengthened further in March.

The general activity index hit a near 50-year high of 51.8 in March soaring from 23.1 in the prior month, surpassing the 23.1 economists predicted.

Just looking on the surface “could lead to erroneous conclusions,” said KC Mathews, executive vice president and chief investment officer at UMB Bank. The blip in claims could be explained by poor weather in late February and early March, he said, but the labor market recovery will continue.

Sarah House, senior economist at Wells Fargo Securities, agreed. “Claims can be noisy week to week,” but have been on a “downward trend,” suggesting while the “recovery remains on track it won’t be completely smooth.”

March nonfarm payrolls number could show a gain of between 200,000 and 300,000 jobs, Mathews said, and the unemployment rate could tick down to 6%, due to more people exiting the labor force, especially through retirement.

While the strength in the manufacturing report “suggests robust recovery,” he added, and “dovetails into our forecast” for GDP growth of 6% this year — with upside risk, that could bring it to 8%, much like the numbers from 50 years ago.

But it was the Philly Fed that “stoked” House’s attention. “It underscores the general strength of manufacturing,” despite “underlying constraints.”

The survey’s prices paid index surged to 75.9 from 54.4, while prices received climbed to 31.8 from 16.7.

Although one regional survey number shouldn’t offer much, the Philly survey, along with the Empire State manufacturing survey released earlier this week, and the Institute for Supply Management manufacturing survey all suggest “prices are climbing,” she said.

But the Philly and New York surveys offer a look at prices received, which show whether the increases can be passed along, House noted. And those also show an upward trend.

While these numbers “right now are not worrisome since rises in services prices have been muted, if this keeps up with the broader reopening, it could be more worrisome," she said. But, for now, inflation remains “relatively contained at a relatively benign level.”

Turning back to the reports, continued claims decreased to 4.124 million in the week ended March 6 from 4.142 million a week earlier.

The four-week moving average fell to 746,250 in the week ended March 13 from an upwardly revised 762,250 a week earlier.

The claims report “speaks to the widespread challenges caused by the year-old economic downturn, as some 18 million Americans received some form of jobless assistance in the latest week,” said Mark Hamrick, senior economic analyst at Bankrate.

Also released Thursday, the Leading Economic Index grew 0.2% in February after a 0.5% gain a month earlier, while the coincident index dipped 0.1% after a 0.2% rise, and the lagging index climbed 0.2% after a 2.3% drop a month earlier, the Conference Board reported Thursday.

Economists estimated a 0.4% increase in the leading index.

“The U.S. LEI continued rising in February, suggesting economic growth should continue well into this year,” said Ataman Ozyildirim, senior director of economic research at The Conference Board. “Indeed, the acceleration of the vaccination campaign and a new round of large fiscal supports are not yet fully reflected in the LEI. With those developments, The Conference Board now expects the pace of growth to improve even further this year, with the U.S. economy expanding by 5.5 percent in 2021.”

Christine Albano and Aaron Weitzman contributed to this report.