Municipal bonds showed some weakness in spots on bonds outside of seven years Wednesday as New York City priced $1.5 billion of taxable general obligation bonds and higher-grade competitive deals from Florida and Oregon easily found buyers.

Triple-A benchmark yields rose one basis point on bonds 2027 and out, the first time since Dec. 2 the market has seen some resistance to record low yields. Refinitiv MMD cut its benchmark by a basis point, while ICE and IHS Markit curves were little changed.

The Federal Reserve's decision to continue propping up bond markets, along with more positive news from Washington on a COVID-19 relief bill —

Larger bid-list totals reached a billion Tuesday but were more muted Wednesday as the market paused somewhat ahead of the Fed decision. Tuesday's bids-wanteds still show end-of-year positioning but with little yield pressure as rates hover near lows. New issues priced this week out long on various deals had lower coupons — 2s, 3s, and 4s — and in some cases yield less than where the 10-year triple-A benchmarks started 2020.

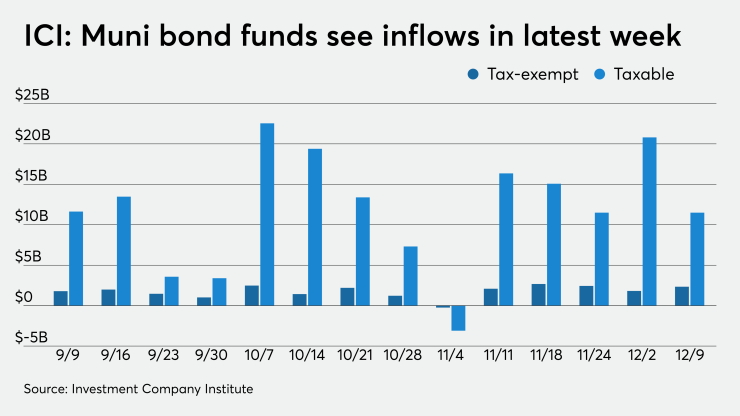

Meanwhile, technicals remain strong. ICI reported $2.3 billion of inflows into municipal bond mutual funds for the latest week, adding to the complete rebound the funds have made from the more than $50 billion pulled out in March and April.

The relationship between exempts and taxables is compelling and advantageous for issuers, though not for yield-seeking investors, partially why the primary has been the driver of the secondary.

Secondary trading showed high-grades exchanging hands at steady levels, or a basis point off from recent trading in some cases. Wake County, N.C., 5s of 2021 traded at 0.08%. Wake 5s of 2024 traded at 0.18%-0.17% and Wake 5s of 2025 traded at 0.20%-0.19%. Henrico County, Virginia, 5s of 2026 traded at 0.31%. New York City GO 5s of 2028 traded at 0.73% versus 0.74% Tuesday. New York City GO 5s of 2032 traded at 1.17%. The GOs yielded 1.62% back in late August when they originally priced. New York City GO 5s of 2033, traded at 1.21%.

Maryland GO 5s of 2028 traded at 0.51%. Fairfax County, Virginia, 5s of 2029 traded at 0.66%. Forsythe County, Georgia, 5s of 2030 traded at 0.69%, on point with current 10-year AAA levels.

Out longer, lower-coupon bonds were trading tighter still than recent levels. Oklahoma 3s of 2039 traded at 1.47%-1.42% versus 1.53% Thursday and a 1.64% original yield.

Primary market

Jefferies LLC priced $1.5 billion of taxable general obligation bonds for New York City (Aa2/AA/AA-/), serials in 2022-2036 and 2021-2028.

The city said the refunding achieved about $205 million in total debt service savings, with around $33 million and $172 million of debt service savings in fiscal 2021 and 2022, respectively. Refunding savings on a present value basis total $196 million or 14.3% of the refunded par amount, the city said.

Indications of interest took place on Tuesday, and the city received $5.2 billion of investor indications, representing approximately 3.5 time the bonds offered for sale.

Given the strong demand, final spreads were reduced by two basis points for the 2021 maturity, four basis points for maturities in 2022 through 2025, eight basis points for the 2026 maturity, five basis points for the 2027 maturity, 10 basis points for maturities in 2028 through 2031, eight basis points for the 2032 maturity and five basis points for maturities in 2033 through 2037.

Following coupon setting, final stated yields ranged from 0.301% in 2021 to 2.473% in 2037. The all-in interest cost for the taxable bonds was 1.780%.

The Multnomah County School District #1J-B school guaranty insured (Aa1/AA+//) underlying (Aa2/AA-//) sold $345.7 million of school building bonds to Citigroup Global Markets. Bonds mature from 2022 with a 5% coupon yielding 0.16%, 5s of 2028 at 0.53%, 5s of 2030 at 0.75%, 3s of 2035 yielding 1.36%, 2s of 2040 at 1.91%, 2s of 2045 at 2.11% and 2.125% coupon bonds in 2046 with a yield of 2.15%.

The Florida Department of Transportation Financing Corp. (Aa1/AA+/AA+/) sold $160 million of revenue bonds to J.P. Morgan Securities. Bonds yield 0.13% in 2021 with a 5% coupon, 0.24% in 2025 with a 5% coupon, 0.77% in 2030 with a 5 handle and 3s of 2035 yield 1.26%.

On Tuesday, BofA Securities priced $273.6 million of taxable wastewater system revenue refunding bonds for the City and County of Honolulu, Hawaii, (Aa2///AA/). All bonds priced at par with 2023 yielding 0.30%, 2030 at 1.473%, 2035 at 2.073% and 2045 at 2.624%.

On Tuesday, RBC Capital Markets priced $182 million of Collin and Denton County unlimited tax school building and refunding bonds, insured by the Permanent School Fund Guarantee program for the Frisco Independent School District (Aaa/AAA//). Bonds in 2021 with 3% coupon yield 0.12%, 3s of 2025 at 0.29%, 4s of 2030 at 0.84%, 4s of 2035 at 1.14%, 4s of 2040 at 1.32%, 4s of 2045 at 1.47% and 4s of 2051 at 1.61%.

Also on Tuesday, KeyBanc Capital priced $150 million of Bard College revenue bonds for Dutchess County Local Development (/BB+//). The bonds mature in 2040 with a 5% coupon and yield 4.125%, 5s of 2045 yield 4.25% and 5s of 2051 yield 4.375%.

The Texas PAB Surface Transportation Corp. is still to come with $1.18 billion of taxable LBJ Infrastructure Group LLC I-635 managed lane project senior lien revenue refunding bonds with a Baa3 rating from Moody's Investors Service on Thursday. The 2020C senior lien bond proceeds will be used to voluntarily repay about $1.1 billion of subordinate lien TIFIA loans. BofA Securities is lead manager.

ICI: Muni bond funds see $2.3B inflow

Long-term municipal bond funds and exchange-traded funds saw combined inflows of $2.338 billion in the week ended Dec. 9, the Investment Company Institute reported Wednesday.

In the previous week, muni funds saw an inflow of $1.815 billion, ICI said.

Long-term muni funds alone had an inflow of $1.859 billion in the latest reporting week after an inflow of $1.380 billion in the prior week.

ETF muni funds alone saw an inflow of $479 million after an inflow of $435 million in the prior week.

Taxable bond funds saw combined inflows of $11.495 billion in the latest reporting week after an inflow of $20.803 billion in the prior week.

ICI said the total combined estimated inflows from all long-term mutual funds and ETFs were $12.009 billion after an inflow of $12.553 billion in the previous week.

Secondary market

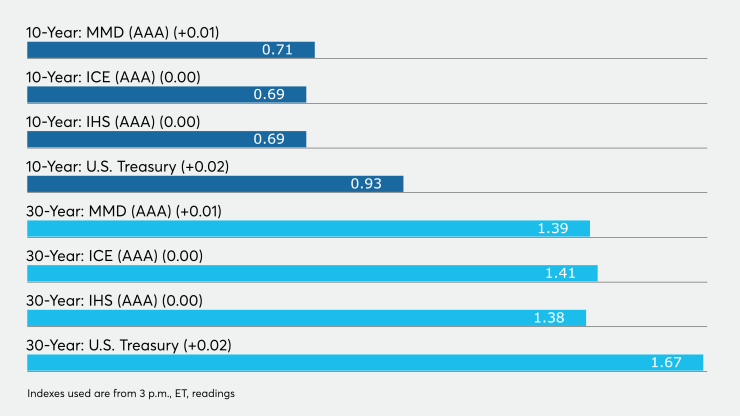

High-grade municipals were little changed, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were at 0.13% in 2021 and 0.14% in 2022. The yield on the 10-year remained at 0.70% while the yield on the 30-year was at 1.40%, up a basis point.

The 10-year muni-to-Treasury ratio was calculated at 76% while the 30-year muni-to-Treasury ratio stood at 83%, according to MMD.

The ICE AAA municipal yield curve showed short maturities at 0.13% in 2021 and 0.14% in 2022. The 10-year maturity was at 0.70% while the 30-year yield was little changed at 1.41%.

The 10-year muni-to-Treasury ratio was calculated at 76% while the 30-year muni-to-Treasury ratio stood at 85%, according to ICE.

The IHS Markit municipal analytics AAA curve showed short yields at 0.11% and 0.12% in 2021 and 2022, respectively, and the 10-year steady at 0.69% as the 30-year yield was at 1.38%.

Treasuries rose slightly on new stimulus talks as equities were mixed. The 10-year Treasury was yielding 0.92% and the 30-year Treasury was yielding 1.66%. The Dow fell 19 points after being up throughout the day, the S&P 500 rose 0.26%, while the Nasdaq gained 0.56%.

Informa: Money market muni funds fell $850M

Tax-exempt municipal money market fund assets fell $849.7 million, bringing total net assets to $107.39 billion in the week ended Dec. 14, according to the Money Fund Report, a publication of Informa Financial Intelligence.

In the week ended Dec. 7, tax-free fund assets increased by $506.4 million.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds remained at 0.01% from the previous week.

Taxable money-fund assets decreased $29.12 billion in the week ended Dec. 15, bringing total net assets to $4.143 trillion.

The average, seven-day simple yield for the 781 taxable reporting funds remained at 0.02% from the prior week.

Overall, the combined total net assets of the 966 reporting money funds fell $29.97 billion in the week ended Dec. 15.