Municipals were weaker to start May with the one-year muni approaching 2% after one of the worst-performing Aprils in more than 30 years.

The asset class on Monday outperformed U.S. Treasuries, which saw yields rise to multi-year highs while equities rebounded from losses earlier in the day to end in the black.

Triple-A benchmarks were cut one to four basis points, depending on the scale, while UST yields rose four to six basis points three years and out. The moves in Treasuries pushed the five-year above 3% and the 10-year just shy of that level.

Muni to UST ratios were at 83% in five years, 92% in 10 years and 101% in 30, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the five at 81%, the 10 at 92% and the 30 at 103% at a 4 p.m. read.

The first four months of year have posed significant challenges for the municipal bond market due to increased UST market volatility, the appearance of less contained inflation and uncertainty heightened by geopolitical events, said John Miller, head of municipals at Nuveen.

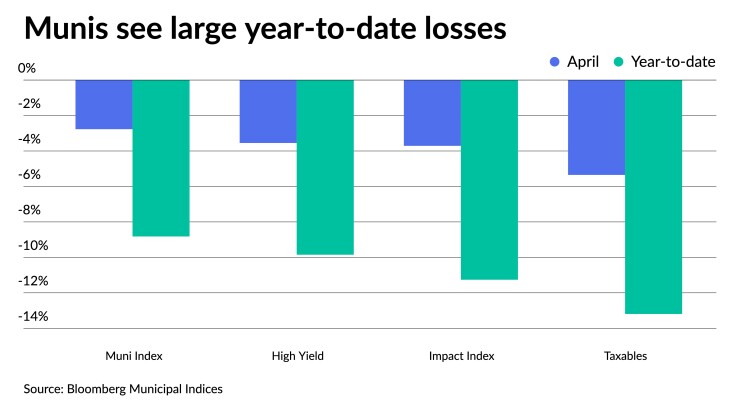

Indeed, municipal losses in April were severe, bringing the year-to-date figure to near 9%, and the largest losses posted on the Bloomberg Muni Index since its inception in the 1980s.

“Overall, municipal returns were driven primarily by duration and yield curve positioning, with the long end of the yield curve underperforming,” Miller said. Fundamentally, Miller said, “municipal credit quality is strong with favorable trends." The correction is simply not credit-driven.

The sharp rise of muni to UST ratios indicates munis underperformed USTs for the quarter. Miller said munis "ended 2021 relatively rich by historical standards, given the economic and credit quality recovery, moderate bond supply, 18 months of robust inflows and the prospect of higher taxes in 2022.”

He noted that many factors that “drove the richness of municipal bonds in 2021” remain today, including “strong fundamental credit trends, moderate bond supply, significant roll-off and tax rates more likely to rise than fall.”

"Municipals have been even more sensitive to the two factors that have changed: the interest rate environment and

State government tax revenue collections are historically high and increased 22% in 2021 compared to 2020, which is 20% above pre-pandemic levels in 2019, Miller said.

He noted that reserves have reached a record collective high at $82.3 billion while state pension funds are anticipated to be more than 80% funded for the first time since 2009.

States that have reported so far show a 26% revenue growth rate year-to-date, led by a 35% increase in California, he said.

“Given the strong revenue environment and record reserves, we believe municipal credit is well prepared for a recession in the event the Fed were to overtighten policy.”

Returns, supply and demand

The Bloomberg Muni Index posted a negative 2.77% return in April and losses of 8.82% year to date.

High-yield lost 3.55% for the month and 9.85% for 2022 while Bloomberg's Impact Index had 3.71% losses for April and 11.26% year-to-date.

Taxables lost 5.35% in April and 13.19% in 2022 so far.

"Even as other fixed income asset classes have struggled mightily this year, taxable municipal bonds are among the worst performers so far," noted Jason Wong, vice president of municipals at AmeriVet Securities.

Wong said taxable municipals have underperformed and have fallen by 12.6% so far this year, while tax-exempt bonds have fallen by just 8.7%, corporate bonds are down 12%, and Treasuries have declined by 8%.

"With a rising rate environment, taxable municipals have struggled to make any returns as they have an average duration of 9.2 years while investment grade corporates have an average duration of 8 years, and the longer out in the curve, you see the worst returns," Wong said.

With taxable bonds being down, so has issuance this year.

Thirty day visible supply is $12.71 billion, per Bond Buyer. How supply comes in the coming months is questionable, but what is certain is that municipal bondholders will receive $21 billion of principal and interest payments Monday and investors looking for reinvestment opportunities will find less than $7 billion on this week's new-issue calendar.

Last week's primary market volume was the

As the pace of redemptions accelerates in the coming weeks and months, investors may have difficulty finding bonds to reinvest in, CreditSights strategists said.

While they don’t expect that “the imbalance between reinvestment demand and new-issue supply will be enough the lift the performance of the Municipal Bond Index into positive territory,” they said they “anticipate improved relative performance for the municipal market in the months ahead.”

One of the primary drivers of the muni market's seasonal price return behavior is the seasonal increase in redemptions, they said.

While the municipal bond market yields will “react to the Treasury market, Fed action, inflation expectations and other external factors,” Luby and Ceffalio said demand has been building.

They said this is shown “by the significant volume of gross mutual fund buying reported for March, and also by the strong secondary market trading in muni [exchange-traded funds] and the steady inflow of primary market net asset flows.”

“With tax-exempt municipal yields higher in many spots than the after-tax yields of comparably rated corporate bonds, we expect opportunistic buying from insurance companies, banks and other taxable [investment-grade] credit investors,” they said.

Secondary trading

Georgia 5s of 2023 at 2.07%. North Carolina 5s of 2023 at 2.06%. Maryland 5s of 2023 at 2.03% versus 2.07%-2.04% Thursday. Columbus, Ohio 5s of 2025 at 2.41% versus 2.37% original. Howard County, Maryland 5s of 2025 at 2.44%.

New York City TFA 5s of 2025 at 2.65%. Ohio 5s of 2026 at 2.61%-2.59%. Ohio waters 5s of 2026 at 2.59%-2.54%.

Georgia 5s of 2027 at 2.51%. Washington 5s of 2028 at 2.75%-2.70%. Baltimore County, Maryland 5s of 2029 at 2.68%. Georgia 5s of 2030 at 2.67%-2.66% versus 2.69%-2.66% Wednesday.

San Francisco City and County 5s of 2031 at 2.73%-2.72% versus 2.74%-2.73% Thursday and 2.75% original. Texas waters 5s of 2031 at 2.89%.

Washington 4s of 2033 at 3.12%-3.11% versus 3.10% original. Los Angeles MTA 5s of 2035 at 3.03%-3.02%.

New York City TFA 5s of 2042 at 3.58%-3.57%.

AAA scales

Refinitiv MMD’s scale was cut one to four basis points at the 3 p.m. read: the one-year at 1.97% (+3 May roll) and 2.23% (+1 May roll) in two years. The five-year at 2.49% (+3, +1 May roll), the 10-year at 2.76% (+3, +1 May roll) and the 30-year at 3.09% (+4, no roll)

The ICE municipal yield curve was cut two to three basis points: 1.99% (+3) in 2023 and 2.30% (+3) in 2024. The five-year at 2.46% (+2), the 10-year was at 2.73% (+3) and the 30-year yield was at 3.15% (+3) at 4 p.m.

The IHS Markit municipal curve was cut three basis points: 1.99% in 2023 (+3) and 2.24% (+3) in 2024. The five-year at 2.46% (+3), the 10-year was at 2.72% (+3) and the 30-year yield was at 3.08% (+3) at 4 p.m.

Bloomberg BVAL was cut two to three basis points: 1.96% (+2) in 2023 and 2.22% (+2) in 2024. The five-year at 2.50% (+3), the 10-year at 2.73% (+3) and the 30-year at 3.04% (+3) at the close.

Treasury yields rose.

The two-year UST was yielding 2.732% (+1), the three-year was at 2.932% (+4), five-year at 3.014% (+5), the seven-year 3.041% (+6), the 10-year yielding 2.988% (+5), the 20-year at 3.246% (+5) and the 30-year Treasury was yielding 3.048% (+5) at the close.

Primary to come:

The Triborough Bridge and Tunnel Authority (/AA+/AA+/AA+) is set to price Thursday $945.3 million of payroll mobility tax senior lien refunding bonds, Series 2022C, serials 2040-2044, terms 2047, 2052 and 2057. Siebert Williams Shank & Co.

Presbyterian Healthcare Services, New Mexico, (Aa3/AA/AA/) is set to price Thursday $341 million of taxable corporate CUSIP bonds, Series 2022. J.P. Morgan Securities.

Nationwide Children's Hospital, Ohio, (Aa2//AA/) is set to price Tuesday $300 million of taxable corporate CUSIP bonds, Series 2022A. J.P. Morgan Securities.

North Carolina (Aa1/AA+/AA+/) is set to price Thursday $300 million of Build NC limited obligation bonds, Series 2022A, serials 2023-2037. Wells Fargo Bank.

The Maryland Economic Development Corporation (Baa3///) is set to price Tuesday $289 million of taxable U.S. Citizenship and Immigration Services Headquarters Project federal lease revenue bonds, Series 2022, serial 2035. Oppenheimer & Co.

Competitive:

Broward County School District, Florida, (Aa2/AA-/) is set to sell $262.730 million of general obligation school bonds, Series 2022, at 10 a.m. eastern Tuesday.

Seattle, Washington, (Aaa/AAA/AAA/) is set to sell $151.305 million of limited tax general obligation improvement and refunding bonds, Series 2022A, at 10:45 a.m. Tuesday.

Santa Clara County, California, is set to sell $237.995 million of Election of 2008 general obligation bonds, 2022 Refunding Series D (dedicated unlimited ad valorem tax bonds) at 11 a.m. eastern Thursday.