Municipals were quietly traded and little changed in the last session of 2023 while U.S. Treasuries were mixed and equities were in the red near the close.

The two-year muni-to-Treasury ratio Friday was at 59%, the three-year at 59%, the five-year at 59%, the 10-year at 59% and the 30-year at 86%, according to Refinitiv Municipal Market Data's 1 p.m. EST read. ICE Data Services had the two-year at 59%, the three-year at 59%, the five-year at 58%, the 10-year at 60% and the 30-year at 86% at 1:45 p.m.

The final session of 2023 "would indicate generic yields had a decent year given where levels opened in early January," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

However, the in-between time "carried much more volatility with the 10-year AAA BVAL trading between 2.05% and 3.63% — an additional 30 basis point yield range as compared to the average of the last five years," she said.

"The late-year rally — where the entire year's return came in the last 8 weeks — proved pivotal," she said.

Amidst chaotic markets, Olsan noted "secondary flows ran at $11.5 billion per day or 8% lower than 2022's pace."

Dealer inventories rose around 8% year-over-year, likely due to "daily bids wanteds coming in 46% above last year's pace and heavily influenced by tax-loss harvesting."

But the big story for munis "was the fair/good/less-fair shift that happened in relative value measures," she said.

Yield volatility during 2023 "created fluctuating ratio moves," Olsan said.

"The irony (and frustration) of a higher yield set for most of the year was that municipals outperformed at various yield pullback periods vis-à-vis USTs," she said.

When the 10-year UST "closed at the 2023 high of 4.99% in October with a 30 basis point backup in five sessions, similar AAA munis traded off about 20 basis points," she said.

The five-year and 10-year BVAL-UST average ratio in 2023 were 65% and 67%, respectively, with the 10-year ratio recently trending through 60%, she said.

Longer AAA munis held "higher values during the year, trading at a low of 83% (current level) and as high as 95% in March," she said.

"Additional relative value via seasoned calls and sub-5% structures" served as a reward for buyers, Olsan noted.

"Much-in-demand generic 5% structures with lockouts traded more dearly with lower ratios," she said.

2024 is "likely to hold a focus on where relative values are best obtained if a lower yield set prevails," she said.

"Will more supply create wider ratios along the curve or will demand in the asset class hold values to lower end of historicals," she said.

Over the last decade, which included two presidential elections, a pandemic and extensive tightening cycle, the five-year BVAL-UST ratio average is 79%, the 10-year value is 88% and the 30-year median ratio is 99%, she said. These are well above current levels, she noted.

"The 2024 election cycle could impact equity/bond flows as the year progresses, which would be one input (along with municipal supply) for relative value," she said.

Muni yearend performance

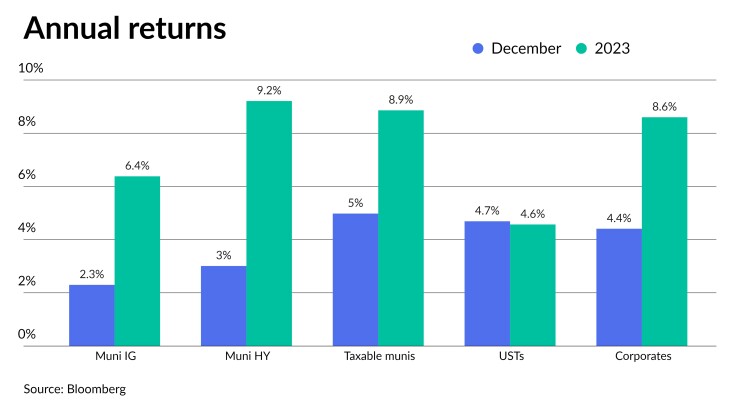

Municipals are poised to close out 2023 returning more than 6% for investment grades, above 9% and taxable munis in the black at nearly 9%.

The broad Bloomberg Municipal Index is returning 2.30% month to date and 6.38% year to date. The Bloomberg high-yield index is in the black at 3.01% for December and 9.21% in 2023. The taxable index is at positive 4.98% for the month and 8.86% year-to-date. The Bloomberg Impact Index is at positive 2.63% and 7.25% year-to-date.

The short index is returning 0.34% in December and 3.43% for the year. The 10-year investment grade range (8-12y) is at positive 2.30% and 5.76% year-to-date while the best performer is the long index (22+) at 3.40% in December bringing year-to-date returns to 9.30%.

The GO Index is returning 2.13% in December and 5.59% in 2023 while the Revenue Bond Index is at positive 2.44% in December and 6.56% in 2023.

USTs are in the black at 4.69% in December and 4.57% year-to-date while Corporates are returning 4.41% this month and 8.60% in 2023.

This performance is a dramatic rebound from 2022's losses. The broad Bloomberg Municipal Index saw losses of 8.53%, high-yield lost 13.10%, taxables lost 18.11% and the impact index lost 11.96%.

Total municipal supply for 2023

Issuance will get off to a slow start during the first week of January.

The new-issue muni calendar is estimated at $220 million next week with $173.2 million of negotiated deals on tap and $49.9 million on the competitive calendar, according to Ipreo and The Bond Buyer.

There are no deals above $100 million.

The largest deal is $62.5 million of water revenue bonds from the Truckee Meadows Water Authority, Nevada, followed by $55.7 million of education revenue bonds from the Maricopa County Industrial Development Authority, both in the negotiated market.

Quincy, Massachusetts, leads the competitive calendar with $50.9 million of GO bond anticipation notes.

Bond Buyer 30-day visible supply sits at $7.61 billion.

Secondary trading

Tennessee 5s of 2024 at 3.07% versus 3.15% Thursday and 2.98% Wednesday. California 4s of 2024 at 2.74% versus 2.84% Tuesday. Nevada 5s of 2024 at 2.77% versus 2.91% Tuesday.

Wake County, North Carolina, 5s of 2029 at 2.22%-2.21%. Massachusetts Clean Water Trust 5s of 2030 at 2.18%. NY State Urban Development Corp. 5s of 2030 at 2.31%-2.27%.

Cook County High School District No. 204, Illinois, 5s of 2033 at 2.54%.

Massachusetts Transportation Fund 5s of 2053 at 3.68% versus 3.70% on 12/22. NYC TFA 5.5s of 2053 at 3.47%-3.84% versus 3.56%-3.55% on 12/20 and 3.75% on 12/13.

AAA scales

Refinitiv MMD's scale was unchanged: The one-year was at 2.67% and 2.52% in two years. The five-year was at 2.28%, the 10-year at 2.28% and the 30-year at 3.42% at 1 p.m.

The ICE AAA yield curve was unchanged: 2.74% in 2024 and 2.54% in 2025. The five-year was at 2.24%, the 10-year was at 2.29% and the 30-year was at 3.42% at 1:45 p.m.

Bloomberg BVAL was unchanged: 2.57% in 2024 and 2.48% in 2025. The five-year at 2.19%, the 10-year at 2.25% and the 30-year at 3.34% at 1:45 p.m.

Treasuries were mixed.

The two-year UST was yielding 4.251% (-3), the three-year was at 4.010% (-3), the five-year at 3.848% (+1), the 10-year at 3.880% (+4), the 20-year at 4.193% (+5) and the 30-year Treasury was yielding 4.029% (+5) at 2 p.m.