Municipals were little changed to open the first full week of September ahead of a growing new-issue calendar, while U.S. Treasuries were weaker and equities ended in the black.

Even after investors received an infusion of $18 billion of matured and called bond proceeds on Sept. 1, muni prices have continued to weaken, said CreditSights strategists Pat Luby and John Ceffalio. However, they noted, performance improved over the prior week.

"The ICE Municipal Bond Index closed down for the sixth week in a row, posting a total return of -0.23%," they said. "For the week ended Friday, the Index returned -0.96%."

With only four days of trading last week, secondary trading was at $30 billion for the week. However, bids wanted rose to $4.8 billion versus $4.7 billion from the prior week, per Bloomberg data.

Continuing in the same vein as August, in the first week of September saw yields rise.

"Yields on 10-year notes rose by 5.4 basis points in the past week to 2.73," said Jason Wong, vice president of municipals at AmeriVet Securities. "In the last 30 days we have seen yields rise across the curve by an average of 57 basis points."

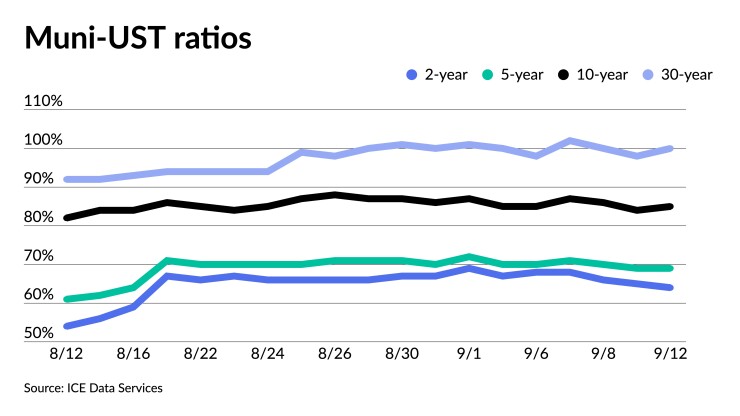

But even as yields rose, munis outperformed UST, with the 10-year ratio yielding 82.37% compared to 83.89% from the prior week, he said. Additionally, the yield curve is started to steepen once again "as the gap between short-term notes and long-term notes steepen by 7.1 basis points to 117 basis points," he said.

Over the past three weeks, ratios have stabilized.

Two- and three-year muni-UST ratios are around 64% to 65%. The five-year was at 69%, the 10-year at 81% and the 30-year at 100%, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the five at 69%, the 10 at 85% and the 30 at 100% at a 4 p.m. read.

This, he said, is despite rising yields, which have gone up by "an average of 28 basis points," Wong said, adding that only 30-year bonds moved by three percentage points in the same period.

With 30-year ratios above 100%, Wong noted, "investors should start looking at the long end due to relative cheapness towards Treasuries even though the long end has lost roughly 16% this year based off the stabilization of ratios."

However, he said munis could see a rebound before year-end.

In the primary market, Barclays Capital priced for the Board Of Regents of the University of Texas System (Aaa/AAA/AAA/) $373.170 million of permanent university fund bonds, Series 2022A, with 5s of 7/2024 at 2.32%, 5s of 2027 at 2.53%, 5s of 2032 at 2.93%, 5s of 2034 at 3.20%, 5s of 2042 at 3.65% and 4s of 2042 at 4.03%, callable 7/1/2032.

Who owns munis?

"The market value of munis owned by households declined by less than the overall market" in the second quarter of the year, suggesting "an increase in the notional amount of bonds owned," CreditSights strategists said.

The value of munis owned by individual investors decreases by 2.1%, while the value of the overall market declined by 3.6%, per the Federal Reserve.

"It is impossible to know with precision exactly what the driver of the change was, but based on conversations that we have had with market participants, we suspect that part of the likely growth in household ownership came from the shift of assets out of mutual funds into separately managed accounts," they said.

Meanwhile, U.S. banks and non-US investors seem to have added munis, though they noted "it is impossible to know from the Fed data if any changes in holdings" were from increases in taxables or tax-exempts.

Broker/dealer holdings dropped to more than $10 billion. The primary dealers held $7.2 billion of munis on June 29. This, they said, indicates that the "non-primary dealers were carrying 29% of the total dealer inventory." That is the highest percentage since the third quarter of 2019 "when the non-primary dealers held 31% of the total dealer inventory," they said.

Secondary trading

Georgia 5s of 2023 at 2.26%-2.25% versus 2.31%-2.30% Wednesday. Washington 5s of 2023 at 2.33%-2.32%. Maryland 5s of 2024 at 2.33% versus 2.36% Friday.

California 5s of 2027 at 2.48%-2.49%. DC 5s of 2029 at 2.67% versus 2.67%-2.66% Wednesday.

DC 5s of 2037 at 3.42%-3.39%.

NYC TFA 5s of 2047 at 4.13%-4.12% versus 4.13% Thursday.

AAA scales

Refinitiv MMD's scale was unchanged at 3 p.m. read: the one-year at 2.28% and 2.31% in two years. The five-year at 2.40%, the 10-year at 2.74% and the 30-year at 3.50%.

The ICE AAA yield curve was bumped one to two basis points: 2.29% (-2) in 2023 and 2.32% (-1) in 2024. The five-year at 2.40% (-1), the 10-year was at 2.79% (-1) and the 30-year yield was at 3.48% (-1) at a 3:30 p.m. read.

The IHS Markit municipal curve was unchanged: 2.26% in 2023 and 2.34% in 2024. The five-year was at 2.44%, the 10-year was at 2.75% and the 30-year yield was at 3.48% at a 4 p.m. read.

Bloomberg BVAL was cut up to one basis point: 2.34% (+1) in 2023 and 2.35% (unch) in 2024. The five-year at 2.39% (+1), the 10-year at 2.72% (+1) and the 30-year at 3.48% (unch) at 3:30 p.m.

Treasuries were weaker.

The two-year UST was yielding 3.567% (+1), the three-year was at 3.606% (+1), the five-year at 3.454% (+1), the seven-year 3.431% (+3), the 10-year yielding 3.355% (+4), the 20-year at 3.743% (+4) and the 30-year Treasury was yielding 3.503% (+4) near the close.

Primary to come:

The Utility Debt Securitization Authority, New York, is set to price Thursday $876.200 million of restructuring bonds, consisting of $65.800 million of taxable, Series 2022T; $719.435 million of tax-exempts, Series 2022TE-1; and $90.885 million of green tax-exempts, Series 2022TE-2. Goldman Sachs & Co.

The North Texas Tollway Authority is set to price Wednesday $667.185 million of system revenue refunding bonds, consisting of $480.330 million of first tier bonds (A1/AA-//), Series 2022A, serials 2024-2026 and 2036-2040, and $186.855 million of second tier bonds (A2/A+//), Series 2022B, serials 2024-2029. Siebert Williams Shank & Co.

The Black Belt Energy Gas District, Alabama, (Baa1//A-/) is set to price Tuesday $491.015 million of gas project revenue bonds, 2022 Series F. Goldman Sachs & Co.

The Public Finance Authority, Wisconsin, (Aa3/A//) is set to price Tuesday $451.700 million of Duke Energy Progress Project pollution control revenue refunding bonds, consisting of $410 million of non-AMT bonds, Series 2022A, and $41.700 million of AMT bonds, Series 2022B. J.P. Morgan Securities.

The Port Authority of New York and New Jersey is set to price Thursday $450 million of consolidated bonds, consisting of $250 million, Series 233, and $200 million, Series 234. Citigroup Global Markets.

The Los Angeles Community College District, California, (Aaa/AA+//) is set to price Wednesday $400 million of 2016 Election general obligation bonds, consisting of $300 million, Series C-1, serials 2023-2026, and $100 million, Series C-2, serial 2023. Citigroup Global Markets.

The issuer is also set to price Thursday $375 million of 2008 Election general obligation bonds, consisting of $200 million of tax-exempts, Series L-2, serials 2025-2037, and $175 million of taxable, Series L-2, serials 2023-2025. Ramirez & Co.

Colorado Springs, Colorado, (Aa2/AA+//) is set to price Tuesday $286.275 million, consisting of $124.205 million of utilities system refunding revenue bonds, Series 2022A, and $162.070 million of utilities system improvement revenue bonds, Series 2022B. J.P. Morgan Securities.

Bon Secours Mercy Health, Ohio, (A1/A+/AA-/) is set to price Thursday $211.565 million, Series 2022B, consisting of $106.740 million, Series B-1, and $104.825 million, Series B-2. J.P. Morgan Securities .

The healthcare system (A1/A+/AA-/) also is set to price Thursday $189.110 million, Series 2022A, consisting of $93.785 million, Series SC, and $95.325 million, Series VA. J.P. Morgan Securities.

Austin, Texas, (/AAA/AA+/) is set to price Tuesday $164.955 million, consisting of $155.700 million of public improvement and refunding bonds, Series 2022, serials 2023-2042, and $9.255 million of public property finance contractual obligations, Series 2022, serials 2023-2029. Raymond James & Associates.

The Texas Department of Housing and Community Affairs (Aaa/AA+//) is set to price Wednesday $150 million of social non-AMT residential mortgage revenue bonds, Series 2022 B. Jefferies.

Sarasota County, Florida, (/AA+/AA+/) is set to price Wednesday $132.720 million of utility system revenue bonds, Series 2022, serials 2028-2042, terms 2047 and 2052. Citigroup Global Markets.

The Mississippi Business Finance Corporation is set to price Friday $100 million of green Enviva Inc. Project exempt facilities revenue bonds, Series 2022. Citigroup Global Markets.

Competitive:

The California Department of Water Resources (Aa1/AAA//) is set to sell $264.325 million of Central Valley Project water system revenue bonds, Series BF, at 11:30 a.m. eastern Tuesday.

Norwood, Massachusetts, is set to sell $100 million of unlimited tax general obligation school program, Chapter 70B bonds, at 11 a.m. Tuesday.

Los Angeles (Aa2/AA/AAA/) is set to sell $389.435 million of taxable social general obligation bonds, Series 2022-A, at noon eastern Thursday.