Municipals were little changed throughout most of the curve in secondary trading Wednesday as the primary took focus with the sale of $1.2 billion of general obligation bonds from New York City in two deals. U.S. Treasuries were weaker and equities rallied.

The two-year muni-UST ratio was at 59%, the three-year at 59%, the five-year at 60%, the 10-year at 64% and the 30-year at 89%, according to Refinitiv MMD's 3 p.m. ET read. ICE Data Services had the two-year at 59%, three-year at 58%, the five-year at 59%, the 10-year at 65% and the 30-year at 90% at 3 p.m.

Since the end of last week's Federal Open Market Committee meeting, "we have witnessed a see-saw movement of sorts in UST bond prices," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

UST yields moved lower "for a couple of trading sessions, held close to steady along many maturities last Friday, and advanced higher, breaking from [year-to-date] lows, during Tuesday's trading session to finish closer to where they were, or even higher, for three-month and out tenors at the end of FOMC day," he said.

Longer-term maturities, meanwhile, showed smaller rate increases.

"The flight-to-quality trade appeared to reverse course as easing bank contagion fears materialized, and we suspect some profit-taking ensued," Lipton said. "Tuesday's bond market selling pressure can be linked to uneasiness ahead of this week's GDP and PCE reports."

The UST market "is expected to remain pressured this week given a heavy corporate calendar, yet the flight-to-quality bid is far from over and it would not be a surprise to see even lower odds for a May rate hike, thus bringing on further divergence between the markets and the Fed," he said.

Recession appears to be "embedded in the Treasury's curve inversion, yet there is still plenty of inflationary sensitivities to go around," according to Lipton.

The bond market, he noted, "wants the Fed to begin the rate-cutting cycle soon, as it believes that further tightening against a backdrop of banking stress could plunge our economy into a deep and protracted recession."

For now, UST yields will likely stay range-bound, "with shorter tenors … likely to respond downward to a Fed pivot, should one come about, and the curve will be assessed for any steepening bias," he said.

Federal Reserve Board Chair Jerome Powell's congressional testimony earlier this month "brought about a 2s/10s inversion of over 100 basis points on March 8 for the first time in over 40 years, as bets on a likely recession accelerated and notions of extended rate volatility took hold," Lipton said.

Muni price movements "remain tethered to the vagaries of the U.S. Treasury bond market, yet the asset class has been able to flex a noted degree of independence," he said.

The UST bond market "seeks conviction, preferring to back away its response from the next headline, data point, FOMC meeting, or from the next banking shoe to fall, but munis seem to reflect a demand proposition against thinner supply of primary and secondary product," he noted.

With the end of the month approaching, he said, muni market participants "should be pleased with both [month-to-date] and [year-to-date] returns against an unrelenting backdrop of volatility." However, he concedes "that light primary volume, given the weariness over FOMC and banking stress, is playing a hand in performance."

While munis underperform USTs on both time measures, Lipton is "not all that disappointed given that munis generally underperform a [UST] bond market rally and that the asset class is exceeding expectations."

Lipton believes "munis are well-poised to preserve the flashing green through April as long as constructive technicals and market sentiment for a sputtering central bank tightening campaign hold in."

The flight-to-quality bid, he said, "will likely be more than just a casual visitor with munis expected to be a key beneficiary given the inherently defensive attributes offered by the asset class."

Reinvestment needs, which have been seasonably light, will be changing in the coming months.

Lipton expects to see "a pick-up in new-issue supply should Fed messaging become more issuer-friendly, with the potential for lower interest rates a likely deal sweetener."

While this is not absolute, he anticipates "more normalized rate movements, and for this to occur we need to see less volatility and more investment conviction."

He theorizes that "any tax-season-related selling will take a back seat to a host of macro-level concerns over the next several weeks."

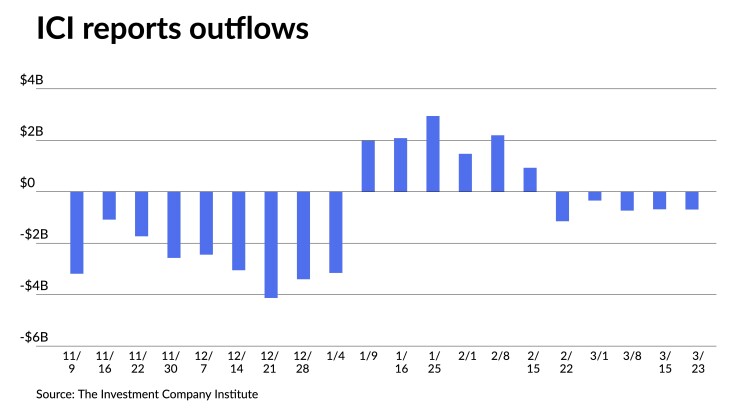

Outflows continued, with the Investment Company Institute reporting investors pulled $693 million from mutual funds in the week ending March 22, after $684 million of outflows the previous week.

Exchange-traded funds saw inflows of $115 million after $20 million of outflows the week prior, per ICI data.

In the primary market Wednesday, RBC Capital Markets priced for New York City (Aa2/AA/AA/AA+/) $950 million tax-exempt GOs, Fiscal 2023 Series E, Subseries E-1, with 5s of 4/2025 at 2.40%, 5s of 2026 at 2.32%, 5s of 2034 at 2.61%, 5s of 2038 at 3.26%, 5.25s of 2043 at 3.73%, 5.25s of 2047 at 3.87% and 4s of 2050 at 4.31%, callable 4/1/2033.

Barclays Capital priced for the Michigan State Housing Development Authority (Aa2/AA+//) $314.865 million of social non-AMT single-family mortgage revenue bonds, Series 2023A, with all bonds pricing at par — 2.85s of 12/2023, 3.1s of 6/2028, 3.125s of 12/2028, 3.75s of 6/2033, 3.8s of 12/2033, 4.25s of 12/2038, 4.7s of 12/2043, 4.9s of 12/2048 and 4.95s of 12/2053 — except 5.5s of 12/2053 at 3.75%.

In the competitive market, New York City (Aa2/AA/AA/AA+/) sold $240 million of taxable GOs, Fiscal 2023 Series E, Subseries E-2, to Wells Fargo Bank, with all bonds pricing at par: 4.45s of 4/2026, 4.57s of 2028, 4.65s of 2029 and 4.9s of 4/2034, callable 4/1/2033.

Anchorage, Alaska, sold $125 million of 2023 GO tax anticipation notes, to J.P. Morgan Securities, with 4.25s of 12/2023 at 2.75%, noncall.

Secondary trading

New York State Dormitory Authority PIT 5s of 2024 at 2.52%-2.50%. NYC 5s of 2024 at 2.59%. Maryland 5s of 2024 at 2.56%-2.54%.

Oregon 5s of 2028 at 2.25%-2.23%. Illinois Finance Authority 5s of 2028 at 2.50%. Massachusetts 5s of 2029 at 2.23% versus 2.19% Friday.

Columbus, Ohio, 5s of 2031 at 2.27%. California 5s of 2032 at 2.31%. Maryland 5s of 2034 at 2.41% versus 2.37% Friday and 2.48% original on 3/16.

Washington 5s of 2047 at 3.61% versus 3.81% on 3/10. San Jose Financing Authority, California, 5s of 2047 at 3.45%. Los Angeles Department of Water and Power 5s of 2052 at 3.67%-3.65% versus 3.68% on 3/16 and 3.77% on 3/10.

AAA scales

Refinitiv MMD's scale was cut at one-year: The one-year was at 2.51% (+2) and 2.40% (unch) in two years. The five-year was at 2.22% (unch), the 10-year at 2.29% (unch) and the 30-year at 3.35% (unch) at 3 p.m.

The ICE AAA yield curve was weaker at one-year: 2.54% (+5) in 2024 and 2.43% (flat) in 2025. The five-year was at 2.21% (flat), the 10-year was at 2.31% (flat) and the 30-year was at 3.39% (-1) at 4 p.m.

The IHS Markit municipal curve was unchanged: 2.47% in 2024 and 2.38% in 2025. The five-year was at 2.21%, the 10-year was at 2.27% and the 30-year yield was at 3.33%, according to a 4 p.m. read.

Bloomberg BVAL was little changed: 2.47% (unch) in 2024 and 2.41% (unch) in 2025. The five-year at 2.23% (unch), the 10-year at 2.29% (unch) and the 30-year at 3.35% (unch).

Treasuries were weaker.

The two-year UST was yielding 4.087% (+4), the three-year was at 3.890% (+4), the five-year at 3.678% (+3), the seven-year at 3.642% (+4), the 10-year at 3.567% (+2), the 20-year at 3.911% (+2) and the 30-year Treasury was yielding 3.773% (+1) at 4 p.m.

Primary to come:

The City of San Diego Public Facilities Financing Authority's (Aa2/NR/AA/NR) $226.81 million of Series 2023A senior water revenue bonds. Morgan Stanley. Pricing on Thursday.

The Republic Services Inc. (NR/BBB+/NR/NR) $115 million of remarketing, refunding of Series CMFA and PEDFA. BofA Securities. Pricing on Thursday.