Municipal bonds experienced another significant rally Thursday, with yields dropping another 60 basis points across the curve, leaving them down 1.5% since the Federal Reserve announced its quantitative easing measures that include purchasing municipals on March 20.

The recent strengthening has led to a light at the end of the tunnel for the barren primary market, where activity had ground to a halt amid the recent massive sell-off.

Price and trading patterns continued to improve Thursday as dramatic shifts in the municipal market provided much-needed strength on the heels of the government’s $2 trillion stabilization package.

The one-year municipal was yielding near 3% just last Friday morning and now has fallen to 1% by some AAA benchmark reads. The aggregate yield changes are drastic for the municipal market that has been whipsawed by the coronavirus pandemic as it hit the U.S.

The Missouri Health and Educational Facilities Authority’s $450 million taxable deal for The Washington University priced the largest deal in the primary since issuers began sidelining their deals two weeks ago. The deal was eight times oversubscribed and the issuer and its team looked to the corporate bond market for guidance on bringing it to market. The deal was upsized and had at least one foreign buyer.

There are more Preliminary Official Statements being released that indicate issuers are preparing to reopen the primary market.

Lipper reported $13.7 billion of outflows out of municipal bond mutual funds, a significant figure but one slightly lower than expected that signals the Fed moves have helped. Overall, the funds in aggregate have lost nearly all the inflows they had accumulated for 2020, said Kim Olsan, senior vice president at FHN Financial.

“In perhaps a sign of oversold conditions, activity this week has moved levels back towards those of a week ago,” she said. “As the market attempts to calibrate yields and spreads, there has been a 75% jump in average daily volume, running at $28 billion traded per day vs. $16 billion between March 2 and March 9.”

This market is adapting to a rapidly changing environment.

“The market is moving so fast that a lot of dealers are pulling bid lists as prices improve,” Dan Heckman, senior fixed-income strategist at U.S. Bank Wealth Management, said Thursday afternoon as he noted that marked price improvements followed large bumps in the municipal scale in the prior two days.

“The Fed’s steps to back stop have been the biggest reason in my opinion” for the reversal, Heckman said.

“We’ve seen very strong buying activity since the Fed stepped in on Monday to provide liquidity to the short end of the market and continued hopes that a stimulus package is imminent,” said Dan Urbanowicz, director and fixed income portfolio manager at Washington Crossing Advisors.

“The buying has been concentrated on higher-grade credits in the secondary market with the primary market virtually shut down this week due to market volatility,” Urbanowicz added.

Demand has heightened this week, as evidenced by the lack of higher-quality bonds available for sale, according to Heckman, as well as the flow of crossover buyers emerging over the past two days with the 10-year municipal to Treasury ratios exceeding 300%, Urbanowicz said.

But, the market strength is not without some concerns, sources said.

“The rally seems to have gone a bit overboard [Thursday], however, with record unemployment claims announced this morning and such uncertainty still surrounding the coronavirus and its effect on individual credits and the economy,” Urbanowicz said.

In addition, Heckman said that the market will soon see a supply-demand deficit “if it’s not already there as the new-issue market is still not back to normal.”

However, the primary market saw one of the first large pricings in over two weeks, as Wells Fargo priced the Missouri Health and Educational Facilities Authority’s Washington University’s (Aa1/AA+/NR/NR) $450 million of taxable educational facilities revenue bonds.

The bonds [CUSIP: 60636AVL4] were priced at par as a 2050 bullet maturity to yield about 185 basis points above the comparable Treasury security.

“The deal was eight times oversubscribed, with over total investors including one foreign investor,” said Sally Bednar, head of muni capital market strategy at Wells Fargo Securities. “It is a testament to the high quality of credit that issuer has, has their outlook been confirmed and with a stable outlook — which says a lot because this is a time when agencies are putting these types of credits on creditwatch.”

Washington University has experience reopening the muni market as Thursday was not the first time. Back in the Fall of 2008, they came and reopened the muni market after the financial crisis.

“They have a seasoned team that is used to working in dislocated markets, and we set a path to stay nimble but yet firm. We were ready to go but not having to go, if the time was not right,” she said. “We told investors that we were gathering information and would price when we felt comfortable and last night we made the decision to price.”

She said that they had seen corporate issuers come to market on Wednesday and used that as their base case.

“We felt good about the book and went out with an original size of $300 million and upsized to $450 million and we were able to tighten by 27.5 basis points,” she said. “We felt good about our chances of doing that, as Mastercard came in with a corporate deal on Wednesday and from price whisper to launch, they tightened their deal by 50 basis points.”

She added that not only did they want to time it right market condition wise but they also wanted to get out ahead of the backlog of deals that will undoubtedly come next week and the following week.

“Another thing that helped us, is that Treasuries have held firm and steady the past 24 hours, especially the 30-year.”

Meanwhile, it is becoming increasingly clearer that municipal credit will be put under a harder lens as rating agencies are beginning to downgrade credits, and issue credit watches. Already this week the New York MTA was downgraded by S&P Global.

“Aside from technical considerations, credit quality will become more relevant for those issuers whose revenues depend more heavily on the daily flow of life among commuters—trains, tolls, airports, restaurants, hotels—generating sales tax revenues,” Olsan noted.

Secondary markets

Munis were stronger Thursday on the MBIS benchmark scale, with yields falling by 68 basis points in the 10-year and by 51 basis points in the 30-year maturity. High-grades were also stronger, with yields on MBIS' AAA scale decreasing by 64 basis points in the 10-year maturity.

Muni yields fell on Refinitiv Municipal Market Data’s AAA benchmark scale, as the yield on both the 10-year and 30-year muni GO were 60 basis points lower to 1.34% and 1.92%, respectively.

"It is clear that the unanimous vote of the Senate to pass the $2.2 trillion CARES Act has instilled a certain level of confidence in the U.S. markets that is bearing itself out in a continuation of muni buying that began on Tuesday," said Gregg Saulnier, municipal analyst at Refinitiv. "Between the attractive muni/tsy ratios which would imply tax-exempt outperformance over time, coupled with a lack of supply for two and half weeks and very few secondary offerings, buyers are aggressively reaching for quality blocks up and down the yield curve. After a rough few weeks, it’s just great to see a two-sided market with solid flow again, particularly given that participant communication is not optimal right now with everyone so spread out and working remotely."

BVAL saw the one-year yield fall by 58 basis points as of publication, the 10-year was 55 basis points lower and a 53 basis point bump in the 30-year.

On the ICE muni yield curve late in the day, the 10-year yield was down 56 basis points to 1.33%, while the 30-year was lower by 55 basis points to 1.89%.

The 10-year muni-to-Treasury ratio was calculated at 165.4% while the 30-year muni-to-Treasury ratio stood at 139.1%, according to MMD.

Stocks were in the green for the third day in a row Thursday and Treasury yields were lower and the three month was still in negative yielding territory.

The Dow Jones Industrial Average was up about 4.28%, the S&P 500 index was higher by 4.52% and the Nasdaq gained roughly 3.83% late in the session on Thursday.

The three-month Treasury was yielding -0.050%, the Treasury two-year was yielding 0.274%, the five-year was yielding 0.495%, the 10-year was yielding 0.823% and the 30-year was yielding 1.405%.

“High-yield credits are also much better, by at least 30 basis points with some sectors better than that. Taxables are much improved, dramatically outperforming Treasuries and comparable corporate bond sectors,” ICE said.

ICE said the Senate’s unanimous approval of the stimulus bill gave a bid to issues linked to airlines and healthcare among others. The Cal Health Kaiser Foundation 5% bonds due 2047 (13032UMP) traded 135 basis points better on Thursday than two days ago.

However, ICE said that Puerto Rico issues were a mixed bag.

ICE cited the Commonwealth GOs: the 8% due 7/1/35 (74514LE8) were up 1 point to $56 ¼; GO’s pre-2011 dated (74514LTW) were down 7 3/8 points to $63 ¼; GO’s 2011 dated (74514LYW) were down 7 3/8 points to $62 1/8; and GO’s 2012 dated (74514LB7) down 6 5/8 points to $58 5/8.

The Public Buildings Authority revenue bonds pre-2011 dated (745235VR) were down 5 points to $81 ¾; the revenue bonds 2011 dated (745235P7) were down 5 ¾ points to $85-net; and revenue bonds 2012 dated (745235R3) were down 5 points to $76 ¾.

The new COFINA Sales Tax revenue bonds (74529JPX) 5% of 2058 were up 3.778 to $95.568 (5.27%)

The GDB Debt Recovery Authority (36829QAA) bonds were up 1 point to $57 ¾.

Olsan also pointed to recent trades that provide “one of the more telling indications of the market’s volatility and good proxies of the overall tone is trading in two active credits in short- and long-dated bonds — Texas Revenue Anticipation 2020 notes and Buckeye OH Tobacco bonds of 2055.”

She noted that the Texas issue traded down to 0.50% and reached a high 3.85% last week, only to retreat to more recent high prints of 2.35%.

The nonrated Buckeye Tobacco traded to a high yield on March 9 of 4.85% but climbed to high prints on March 20 of 7.46%.

Wednesday, the high trade yield was 6.35%.

“A new lower yield set is still favorable to USTs but hard bogeys of 3%- and 4%-yields appear to have faded for the time being,” she said. “In the near-term, the market may become more institutionally focused as individuals assess their next moves in the sector.”

Muni money market funds see even bigger outflows

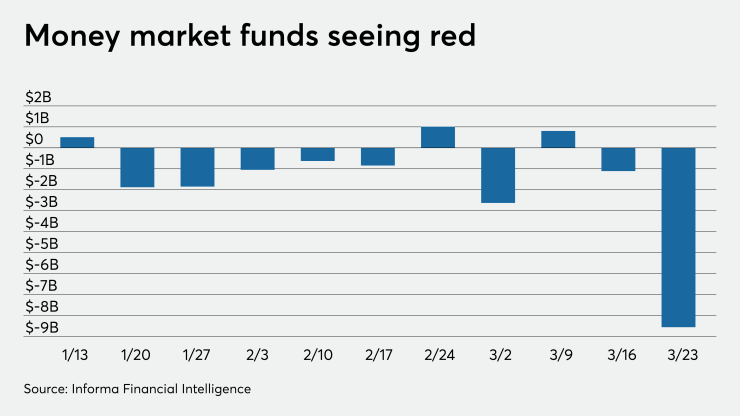

Tax-exempt municipal money market fund assets decreased by $8.56 billion, lowering their total net assets to $124.43 billion in the week ended March 23, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds jumped to 3.35% from 0.86% in the previous week.

Taxable money-fund assets were up $268 billion in the week ended March 24, bringing total net assets to $3.983 trillion. The average, seven-day simple yield for the 797 taxable reporting funds was dropped to 0.48% from 0.81% the prior week.

Overall, the combined total net assets of the 984 reporting money funds grew by $259.44 billion to $4.108 trillion in the week ended March 24.

The week’s asset surge was the largest single-week increase since iMoneyNet began tracking money-fund assets in 1998, surpassing last week’s short-lived all-time one-week increase and reaching an all-time high for total assets, exceeding the prior highest-ever money-market fund asset total of $3.848 trillion in the week ending Jan. 13, 2009.

Christine Albano and Chip Barnett contributed to this report.