Municipals were little changed ahead of the Fourth of July, while U.S. Treasuries were weaker and equities ended up.

Triple-A yields were steady, while UST yields rose three to eight basis points.

Municipal to UST ratios fell as a result. The two-year muni-to-Treasury ratio Monday was at 59%, the three-year at 61%, the five-year at 63%, the 10-year at 66% and the 30-year at 90%, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the two-year at 60%, the three-year at 63%, the five-year at 63%, the 10-year at 68% and the 30-year at 92% at 4 p.m.

Munis outperformed Treasuries "in what felt like the holiday week came early," Birch Creek Capital strategists said in a weekly report.

Trade volumes were down significantly, they noted, "with the average daily volume this week tracking at just 65% relative to the past year."

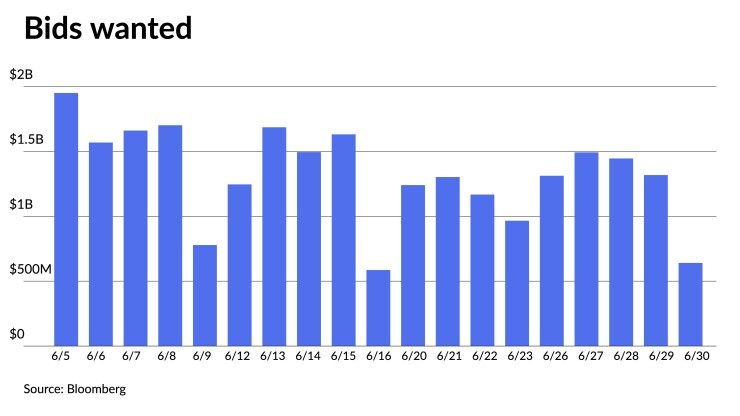

The heavy new-issue calendar and the remaining items on the Federal Deposit Insurance Corp. sale lists were the focus of accounts, they said.

Blackrock "officially wrapped up the sales process, selling 75% of the $6.9 billion tax-exempts this past month," according to Birch Creek Capital strategists.

Pat Luby, a CreditSights strategist, said the overhang of the FDIC list is done, which "removes a large imagined risk to the market."

"The reality of the FDIC list turned out to be much more constructive for the market than the original concerns but having that wrapped up allows traders and risk managers to be focused on what they need to do now in July," he said.

On the demand side, funds flows were mixed. Refinitiv Lipper reported $25.3 million was

"A lot of mutual fund investors remain on the sidelines, even though there has been some cautious buying going on," Luby said.

He expects to see an uptick in ETF flows in the coming month, believing this will be "driven by tactical investors wanting to make sure that money is invested while they wait for bonds to put to work."

"Dealers reported that accounts began putting cash to work ahead of July 1 coupons and maturities, which are expect to exceed the new-issue volume," they said.

As summer has officially set in, Birch Creek Capital strategists said "lower volumes, lighter primary issuance, and heavier reinvestment cash flows are likely going to contribute to a continued bout of muni relative performance."

While July volume will "basically lose a week" due to the Fourth of July in the middle of the week, Luby said there will still be a decent supply for the month. Next week, for instance, will see a lot of deals on the new-issue calendar, which will, in turn, create strong interest, he said.

Issuance for the first six months of the year averaged $29 billion, with issuance for the first half of the year at $174.8 billion. Tom Kozlik, managing director and head of public policy and municipal strategists at Hilltop Securities, continues to expect to see issuance average of $29 billion.

He doesn't see issuance topping $30 billion for July due to the combination of the holidays and the Federal Open Market Committee meeting.

Bond Buyer 30-day visible supply sits at $7.11 billion.

In the coming months, he believes issuance will continue to be choppy and uneven. However, he thinks the overall trend will improve for the rest of the year and into next year.

"As that investor sentiment improves, that's going to add to this theme of scarcity because there's aren't going to be as many bonds out there," he said.

However, there will still be negative net supply for the month and in August, according to Luby.

"The market from a seasonal perspective is poised to do pretty well because there's money to put to work and not enough supply," he said.

Come September, he believes net supply will turn positive.

"It's appropriate for investors to be thinking about putting money to work," he said. "While the seasonal technicals right now are favorable, it won't last forever."

May was a disappointment with significant negative returns for the month, while June saw positive returns, something Luby said is constructive for market sentiment.

The Bloomberg Municipal Index was at positive 1.00% for June and 2.67% year-to-date. Taxable munis returned negative 0.21% in June but positive 4.75% in 2023. High-yield returns were in the black at 1.77% for June and 4.43% year-to-date.

Secondary trading

New Mexico 5s of 2024 at 3.09% versus 3.14% Friday. Wisconsin 5s of 2024 at 3.08% versus 3.10% on 6/13. Ohio 5s of 2025 at 2.99% versus 2.99% original on 6/27.

DC 5s of 2029 at 2.69%. Florida BOE 5s of 2029 at 2.64% versus 2.65% on 6/21. Minnesota 5s of 2030 at 2.58% versus 2.61%-2.60% Friday and 2.56% Wednesday.

Maryland 5s of 2031 at 2.53% versus 2.55% Wednesday. Washington 5s of 2032 at 2.62% versus 2.64% on 6/21 and 2.65%-2.64% on 6/15. Iowa Finance Authority 5s of 2035 at 2.87%-2.86% versus 2.87%-2.88% on 6/21 and 2.89% on 6/15.

Massachusetts 5s of 2048 at 3.76%-3.78% versus 3.76% Friday and 3.76%-3.81% original on Thursday. Indiana Finance Authority 5s of 2053 at 4.07% versus 4.06% Friday and 4.09% Thursday.

AAA scales

Refinitiv MMD's scale was little changed: The one-year was at 3.05% (unch, no July roll) and 2.92% (unch, -1bp July roll) in two years. The five-year was at 2.62% (unch, no July roll), the 10-year at 2.56% (unch, no July roll) and the 30-year at 3.49% (unch) at 1 p.m.

The ICE AAA yield curve was flat: 3.02% in 2024 and 2.96% in 2025. The five-year was at 2.61%, the 10-year was at 2.56% and the 30-year was at 3.54% at 3 p.m.

The IHS Markit municipal curve was unchanged: 3.05% in 2024 and 2.93% in 2025. The five-year was at 2.62%, the 10-year was at 2.56% and the 30-year yield was at 3.49%, according to a 3 p.m. read.

Bloomberg BVAL was little changed: 2.99% in 2024 and 2.90% (unch) in 2025. The five-year at 2.59% (unch), the 10-year at 2.53% (unch) and the 30-year at 3.51% (+1) at 3 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.938% (+7), the three-year was at 4.575% (+8), the five-year at 4.189% (+7), the 10-year at 3.857% (+5), the 20-year at 4.079% (+3) and the 30-year Treasury was yielding 3.865% (+3) at 2 p.m.

Primary to come:

The Dallas Housing Finance Corp. is set to price daily $146.608 million of Fitzhugh Urban Flats social residential development revenue bonds, consisting of $71.985 million of senior lien bonds, Series 2023-A1; serial 2063, $55.115 of senior lien bonds, Series 2023-A2, serial 2063; and $19.508 million of convertible capital appreciation mezzanine lien bonds, Series 2023B, serial 2063. Citigroup Global Markets.

The corporation is also set to price daily $120.300 million of Midtown Park residential development revenue bonds, consisting of $89 million of Series 2023A and $31.300 million of Series 2023B. Goldman Sachs.

The Dickinson Independent School District, Texas (Aaa/AAA//), is set to price Thursday $110.005 million of PSF-insured unlimited tax schoolhouse bonds, Series 2023, serials 2025-2053. Wells Fargo Bank.

The Mississippi Home Corp. (Aaa///) is set to price Thursday $99.850 million of single-family mortgage revenue bonds, consisting of $70 million of non-AMT bonds, Series 2023C, serials 2028-2035, terms 2038. 2043, 2048; and $29.850 million of taxables, Series 2023D, serials 2024-2028, term 2053. Raymond James & Associates.

The Montana Board of Housing (Aa1/AA+//) is set to price Thursday $32 million of non-AMT single-family mortgage bonds, 2023 Series A, serials 2024-2035, terms 2038, 2043, 2048, 2053, 2053. RBC Capital Markets.

Competitive

The Nauset Regional School District, Massachusetts, is set to sell $91 million of unlimited tax GO school bond anticipation notes at 11 a.m. eastern Thursday.

The Fairport Central School District, New York, is set to sell $48.165 million of GO bond anticipation notes, Series 2023, at 11:15 a.m. Thursday.

Jersey City, New Jersey, is set to sell $45.926 million of taxable COVID-19 special emergency notes, Series 2023B, at 11:15 a.m. Thursday.

East Brunswick Township, New Jersey, is set to sell $45.360 million of bond anticipation notes, consisting of $26.760 million of bond anticipation notes and $18.600 water utility bond anticipation notes, at 11:30 a.m. Thursday.

Somerset County, New Jersey, is set to sell $38.962 of GOs, consisting of $35 million of general improvement bonds, Series 2023A; $1.966 million of county college bonds, Series 2023B; and $1.966 county college bonds, Series 2023C, at 11 a.m. Thursday.

The Guilderland Central School District, New York, is set to sell $29.499 million of bond anticipation notes at 10:30 a.m. Thursday.