Municipal bonds were unchanged Monday as the markets resumed trading after the Christmas holiday break. Traders will again see an abbreviated trading week and another long weekend as the New Year’s holiday looms on Friday.

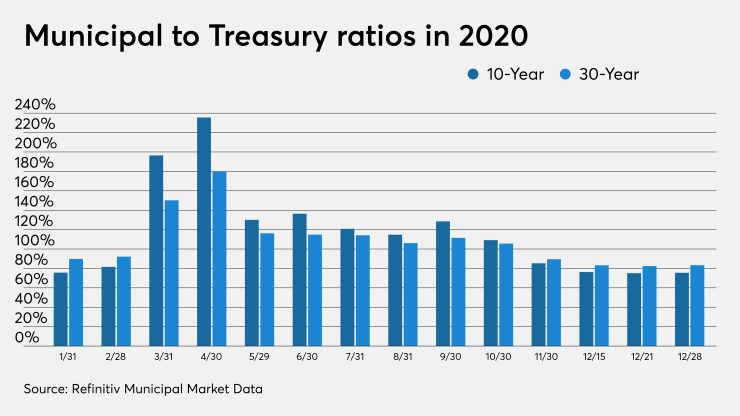

Yields on top-rated munis were flat Monday across AAA scales. Muni to U.S. Treasury ratios stood at 75.5% in 10-years and 83.3% in 30-years, according to Refinitiv MMD, and 74% in 10-years and 85% in 30-years, according to ICE Data Services. Ratios on the 10-year bonds have been below 80% for the month of December.

There are no negotiated or competitive deals over $25 million slated in the primary. Volume is estimated at $7.3 million in a calendar composed only of negotiated deals.

The final trading week of 2020 kicked off on a bullish note, Hussein Sayed, Chief Market Strategist at FXTM, said in a Monday market note.

“Although he described the $900 billion pandemic aid as a 'disgrace' last week, President Trump signed it into law on Sunday along with the $1.4 trillion spending bill," he wrote. “Passing the two packages means a partial government shutdown is avoided and millions of unemployed Americans will receive direct payments and other forms of assistance after two federal unemployment programs expired on Saturday.”

“We can finally breathe a big sigh of relief and say that chaos over the stimulus bill is over. A sell-off has been averted and this could provide one last boost to risk assets in the last four trading days of the year. However, investors shouldn’t get over-excited as most of it is probably already priced in,” Sayed said.

He added that the launch of mass vaccinations throughout Europe on Sunday was also bringing some hope that we are one step closer toward the end of the pandemic.

Treasury bonds were mixed as equities traded higher.

Refinitiv Lipper reports $1.3B inflow

Weekly reporting tax-exempt mutual funds saw $1.288 billion of inflows in the week ended Dec. 23, Refinitiv Lipper reported last week. It followed an inflow of $915.233 million in the previous week.

Exchange-traded muni funds reported inflows of $412.971 million, after inflows of $517.329 million in the previous week. Ex-ETFs, muni funds saw inflows of $874.670 million after inflows of $397.904 million in the prior week.

The four-week moving average remained positive at $849.028 million, after being in the green at $735.031 billion in the previous week.

Long-term muni bond funds had inflows of $821.870 million in the latest week after inflows of $675.478 million in the previous week. Intermediate-term funds had inflows of $107.211 million after outflows of $32.679 million in the prior week.

National funds had inflows of $1.141 billion after inflows of $881.132 million while high-yield muni funds reported inflows of $332.087 million in the latest week, after inflows of $276.790 million the previous week.

Bond Buyer indexes little changed

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell one basis point to 3.46% from 3.47% in the previous week.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields was unchanged at 2.12% from the prior week. The 11-bond GO Index of higher-grade 11-year GOs was steady at 1.65% from the week before. The Bond Buyer's Revenue Bond Index was flat at 2.57% from the prior week.

Secondary market

High-grade municipals were flat on Monday, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were steady at 0.13% in 2021 and 0.14% in 2022. Out longer, the yield on the 10-year muni was flat at 0.71% while the yield on the 30-year remained at 1.39%.

The ICE AAA municipal yield curve showed short maturities flat at 0.12% in 2021 and 0.14% in 2022. The 10-year maturity was unchanged at 0.70% and the 30-year yield was steady at 1.41%.

The IHS Markit municipal analytics AAA curve showed yields steady at 0.13% in 2021 and 0.14% in 2022. The 10-year was at 0.66% as the 30-year yield was at 1.36%.

Treasuries were mixed as stock prices traded higher.

The three-month Treasury note was yielding 0.09%, the 10-year Treasury was yielding 0.93% and the 30-year Treasury was yielding 1.67%. The Dow rose 0.80%, the S&P 500 increased 0.99% and the Nasdaq gained 0.98%.