Munis strengthened Friday as the threat of a government shutdown roiled financial markets.

“Municipal bonds are trading relatively unchanged but firm today as very positive market technicals keep demand steady,” said Michael Pietronico, chief executive officer, Miller Tabak Asset Management. “There is likely some money coming in from the stock market, which likely should support mutual fund flows into early 2019.”

Secondary market

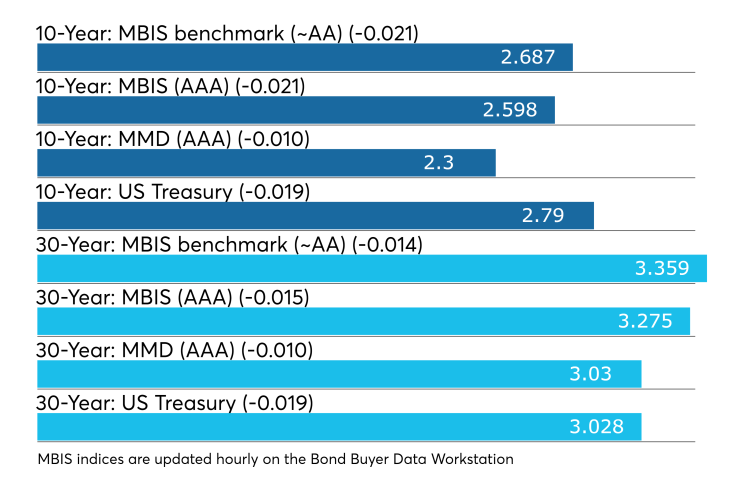

Benchmark muni yields dropped no more than two basis points across curve.

High-grade munis were also stronger, with yields calculated on MBIS' AAA scale decreasing by as many as two basis points in the three- to 30-year maturities. The remaining two maturities saw yields increase by less than a basis point.

Municipals were a bit stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general and the 30-year muni maturity one basis point lower.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 82.4% while the 30-year muni-to-Treasury ratio stood at 100.0%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Primary market

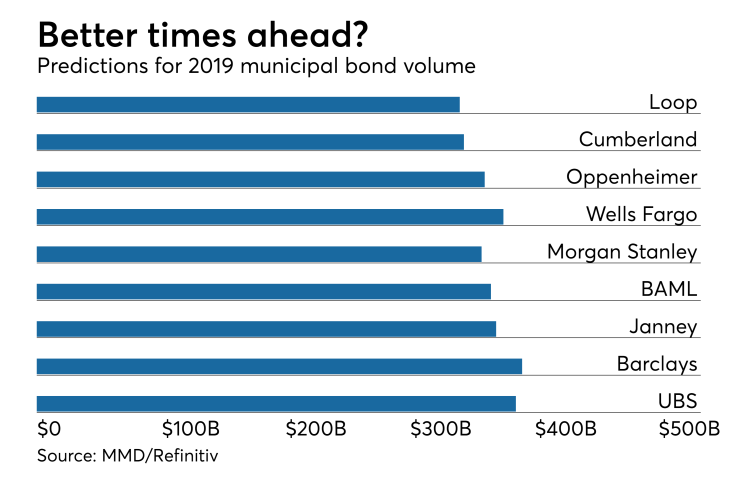

There are no bond sales next week, as issuance for 2018 has come to an end. At this point, munis sold this year total $319.804 billion in 8,531 transactions, a far cry from the $436.345 billion in 11,668 deals in 2017.

An MMD survey of various subscribers, including dealers and some buy-side firms, found that most expect volume to be 10%-15% higher in 2019 than this year. While new money is expected to be flat, current refundings are not expected to be cannibalized by advance refundings.

The muni research team at Wells Fargo said seea "year of transition" in 2019.

“We see 2019 as a transitional year as capital market volatility increases driven by credit and economic cycles that appear to be long in the tooth,” wrote Randy Gerardes, George Huang and Roy Eappen, senior analysts, in a commentary. “We think credit quality in the municipal market will remain stable and actually expect continued solid revenue performance amid a softening economic landscape. The result could be a virtuous investment cycle in 2019, with constrained bond issuance in high tax and issuance states, but limited income tax deductibility options for high earners. This makes for a positive backdrop for investment performance in municipal bonds for 2019, in our view.”

The Wells research team is optimistic that muni fund performance will improve next year, following a difficult 2018.

“We believe the continuation of a comparably tight supply environment, fewer interest rate hikes and flight to quality amid equity and Treasury market volatility should benefit munis,” the report said. “The result could be net muni fund inflows offering a good technical foundation, which should drive performance for the overall Muni sector next year.”

One popular topic of conversation has been advance refunding, a mechanism eliminated by tax reform that had been used by issuers to take advantage of historically low interest rates.

“We do not expect advance refundings to return to the market in 2019, but we do note that $37 billion in Build America Bonds are callable in 2019 and 2020 under an optional redemption provision,” the Wells researchers wrote. “Given current interest rates, many of these bonds could be refunded with tax-exempt bonds at their call date. For perspective between 2013 and 2016, advance refundings comprised an average of about 21.7% of total annual volume.”

Lipper: Muni bond funds report inflows

Investors in municipal bond funds put cash in for the first time in 13 weeks, according to Lipper data released on Thursday.

Exchange traded funds reported inflows of $525.959 million, after inflows of $642.771 million in the previous week. Ex-ETFs, muni funds saw outflows of $270.928 million after outflows of $959.288 million in the previous week.

The four-week moving average remained negative at -$283.038 million, after being in the red at -$429.855 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $376.356 million in the latest week after inflows of $417.609 million in the previous week. Intermediate-term funds had outflows of $448.643 million after outflows of $1.024 billion in the prior week.

National funds had inflows of $386.916 million after outflows of $134.066 million in the previous week. High-yield muni funds reported outflows of $3.931 million in the latest week, after inflows of $160.424 million the previous week.

The weekly reporters saw $255.031 million of inflows in the week ended Dec. 19 after outflows of $316.517 million in the previous week.

Previous session's activity

The Municipal Securities Rulemaking Board reported 47,066 trades on Thursday on volume of $13.948 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 16.695% of the market, the Empire State taking 13.05% and the Lone Star State taking 9.816%.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.