Municipal yields were steady across the curve as rising U.S. Treasury yields took some of the shine off of a two-day muni rally, but inflows continued to hit records with another multi-billion week.

Refinitiv Lipper reported $2.79 billion of inflows into municipal bond mutual funds for the week ending Jan. 27, a record. It was the sixth week in a row of $1 billion-plus inflows and the third week in a row of $2 billion-plus inflows.

This comes after the Investment Company Institute reported two weeks in a row of $3-plus billion inflows.

"While funds have a trackable metric, it is safe to assume that other investor categories are faced with more cash to put to work than tax-exempt bonds that are available," noted Kim Olsan, senior vice president at FHN Financial, adding that upcoming deals via POS releases suggests several upcoming taxable issues totaling $2 billion.

Chicago Board of Education bonds were repriced to lower yields by as much as 37 basis points, showing just how far investors will go for any incremental yield.

Munis shrugged off the UST moves.

“We had a 1% on the 10-year, and then we saw a sell-off from there,” said a North Carolina trader. The benchmark, 10-year Treasury bond was at a 1.057% just before the close of trading. "We will see how we trade off of this over the next few days and whether this correction sell-off will gain some steam or not."

Municipals as a percentage of Treasuries fell to 67% in 10 years and 76% in 30 years, according to Refinitiv MMD. Ratios fell three basis points to 66% in 10 years and one basis point to 78% in 30, according to ICE Data Services data.

Overall, triple-A municipal yield scales ended steady and little changed.

There was little selling pressure to speak of, and few large new issues with “marquee” names and broad market interest priced Thursday.

Amid new issues, there is an ongoing willingness by underwriters to write lower coupons and an acceptance by investors of those coupons, the trader noted.

In the secondary market, meanwhile, there was decent two-way flow on Thursday, he said.

“Bids have tightened because there is little in the way of anything with decent yield,” he said, pointing to well-known, recognizable credits in the healthcare sector as an example.

The airport sector, according to the trader, is extremely “quiet.”

“Spread compression continues given the lack of paper around,” he added. “Folks are looking for anything with incremental yield.”

Primary market

J.P. Morgan Securities LLC repriced $560 million of unlimited tax general obligation and refunding GOs for the Board of Education of the City of Chicago (NR/BB-/BB/BBB-/). Yields across the deal were lowered by 22 to 37 basis points. Bonds in 2021 with a 5% coupon yield 0.58%, 5s of 2022 at 0.73%, 5s of 2030 at 1.74%, 5s of 2031 at 1.94%, 5s of 2036 at 2.15%, 5s of 2041 at 2.24%.

The Florida Department of Education sold $272.6 million of PECOs to BofA Securities. Bonds in 2022 with a 5% coupon yield 0.07%, 5s of 2026 at 0.25%, 5s of 2031 at 0.79%, 2s of 2036 at 1.40%

Secondary market

Trading showed several firmer prints on high-grades and recent deals continued to trade up. Columbus, Ohio, GO 5s of 2023 traded at 0.12%-0.13%. Cal GO 5s of 2022 at 0.09%. Prince George's County, Maryland, 5s of 2027 at 0.30%. Iowa green bond 5 of 2033 at 0.94%. Maryland GO 5s of 2033 at 0.88%. Fairfax County, Virginia, GO 2s of 2033 at 1.19%-1.15%, original yield 1.23%. Washington, D.C., income tax bond 5s of 2033 at 0.89% versus 0.91% Wednesday.

Baltimore County, Maryland, 4s of 2034 at 0.92% versus 0.98% Wednesday. Fairfax County 2s of 2034 at 1.23% versus 1.30% original. NYC GO 5s of 2038 at 1.45% versus 1.49%-1.48% Wednesday. Washington GO 5s of 2041 at 1.36%-1.35% versus 1.45%-1.35% Wednesday. Prosper, Texas, ISD 2s of 2046 at 1.86%-1.73% versus 1.87%-1.67% Wednesday, 1.96% Tuesday and 2.02% original. NYC Water 5s of 2048 traded at 1.61%-1.60%.

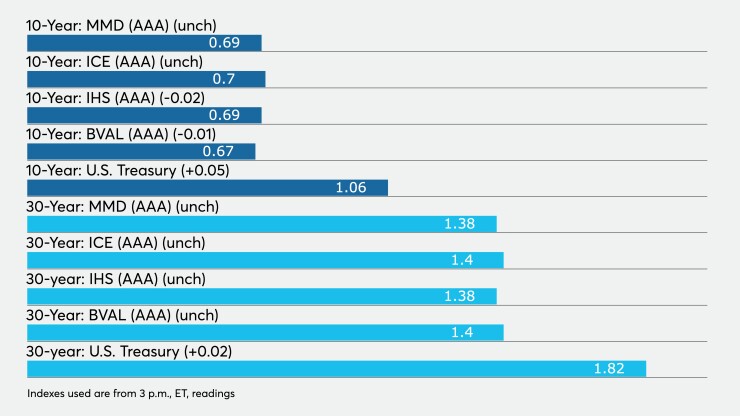

High-grade municipals were steady, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were at 0.09% in 2022 and 0.10% in 2023. The 10-year sat at 0.69% and the 30-year at 1.38%.

The ICE AAA municipal yield curve showed short maturities steady at 0.09% in 2022 and 0.10% in 2023. The 10-year was at 0.70% while the 30-year yield sat at 1.40%.

The IHS Markit municipal analytics AAA curve showed yields at 0.11% in 2022 and 0.12% in 2023 while the 10-year remained 0.69% and the 30-year yield at 1.38%.

The Bloomberg BVAL AAA curve showed yields at 0.08% in 2022 and 0.10% in 2023, while the 10-year was at 0.67% and the 30-year yield at 1.40%.

The three-month Treasury note was yielding 0.09%, the 10-year Treasury was yielding 1.06% and the 30-year Treasury was yielding 1.32% near the close. The Dow sprung back 372 points, the S&P 500 rose 1.2% and the Nasdaq fell 0.24%.

GDP levels out in Q4, but 2020 was worst in over seven decades

The COVID-19 pandemic made 2020 the worst for the U.S. economy since 1946.

Gross domestic product in 2020 fell 3.5%, the first annual contraction since the financial crisis, after a 2.2% expansion in 2019.

In the fourth quarter of 2020, GDP rose 4.0%, according to the advance estimate, after a 33.4% rebound in the third quarter, which followed the 31.4% plunge in the second quarter. Economists polled by IFR Markets expected that gain.

The personal consumption expenditures price index rose 1.5% in the quarter, after a 3.7% gain in the third quarter, while the core PCE index, the Federal Reserve’s favored measure of inflation, was up 1.4%, after a 3.4% rise a month earlier.

"The coronavirus and related policies upended the economy, and despite trillions in aid, remains the largest threat to growth in 2021,” said Stifel Chief Economist Lindsey Piegza.

And while some believe the vaccination program will lead to further economic growth, she said, “the vaccination process appears more complicated than anticipated, falling short both in terms of timing and distributions, as well as new developing risks of additional variants of the disease, the economy may face a bumpier, longer pathway back to some semblance of normal."

The report “marks a normalization after Q3’s historic +33.4% read, which was largely a bounce back from the Q2 COVID-induced lockdowns,” said George Boyan, president of Leumi Investment Services.

Business investment (up 13.8%) and residential investment (up 33.5%) were key drivers of growth, he said. “Consumption rose by just 2.5% as CARES Act funding has been largely utilized coupled with Congress’ delayed passage of additional stimulus,” he noted. “Auto sales slowed, but was offset by a 4.0% increase in service consumption.”

And while first quarter growth may not reach the same level as Q4, Boyan expects “a further bounce back in H2 as vaccination rates continue to climb and COVID restrictions continue to wane.”

But, the market considers the rise “really old news,” according to Duane McAllister and Lyle Fitterer, senior portfolio managers at Baird Advisors, with all eyes on 2021 growth.

“The stimulus that was passed in late 2020 combined with potentially further stimulus, combined with re-openings across the country will accelerate GDP growth as we move through the quarter and the year,” they said. “With the strong growth outlook in 2021, we expect that municipalities will benefit from an equally strong rise in tax revenues as well. This will boost the fundamental backdrop for municipal credit, supporting the impressive demand we have witnessed in recent months.”

“The slowdown in economic activity in December resulting from the intensification of the pandemic was milder than initially feared (and concentrated in certain services sectors), setting a solid starting point for activity in 2021,” said Roiana Reid, U.S. economist at Berenberg Capital Markets. “We expect economic growth to accelerate this year as vaccines become more widely distributed and pent-up demand is released.”

“The details of the report tell the story of a moderating recovery,” said Christian Scherrmann, U.S. Economist at DWS Group. “Consumption in particular disappointed in what is usually its strongest season.”

Separately, initial jobless claims declined to 847,000 in the week ended Jan. 23 from and upwardly revised 914,000 a week earlier, first reported as 900,000.

Economists expected 860,000 claims in the week.

The number of continuing claims fell to 4.771 million in the week ended Jan. 16 from 4.974 million the week before.

Also released Thursday, the Leading Economic Index rose 0.3% in December, in line with expectations, after a 0.7% gain in November, The Conference Board said.

The coincident index climbed 0.3% after 0.1% growth in November, while the lagging index added 0.1% after a 0.1% increase a month earlier.

“The U.S. LEI’s slowing pace of increase in December suggests that U.S. economic growth continues to moderate in the first quarter of 2021,” according to Ataman Ozyildirim, senior director of economic research at The Conference Board. “Improvements in the U.S. LEI were very broad-based among the leading indicators, except for rising initial claims for unemployment insurance and a mixed consumer outlook on business and economic conditions. While the resurgence of COVID-19 and weak labor markets remain barriers to growth, The Conference Board expects the economy to expand by at least 2.0% (annual rate) in Q1 and then gain momentum throughout the year.”

New home sales were up 1.6% in December to a seasonally adjusted 842,000 pace from 829,000 in November.

Economists expected 860,000 sales.

The housing sector has been a bright spot in the economy, thanks to ultralow mortgage rates.

Finally, manufacturing activity in the Kansas City region expanded at a faster pace in January than December.

“Regional factories reported more growth in January,” said Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City. “COVID-19 vaccination is a key factor in manufacturers’ overall business outlook for 2021, but with less impact on hiring and capital spending in the near-term.”

The composite index climbed to 17 in January from 14 in December. While the composite index for conditions expected in six months rose to 24 from 17.

Christine Albano contributed to this report.