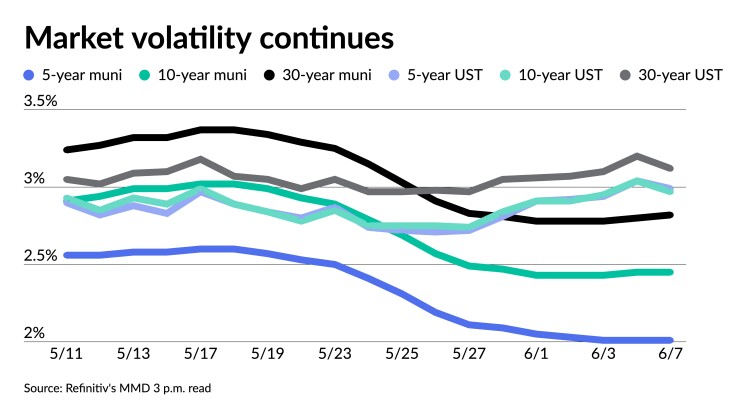

Municipals again saw a stronger short end of the yield curve and some pressure out long in light trading Tuesday as U.S. Treasuries were better and equities ended in the black.

Triple-A benchmarks were bumped up to three basis points five years and in and cut up to two basis points on the long end, depending on the scale. USTs saw bumps of four to seven basis points five years and out.

Muni-to-UST ratios were at 67% in five years, 84% in 10 years and 90% in 30, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the five at 67%, the 10 at 82% and the 30 at 92% at a 4 p.m. read.

In the primary, BofA Securities priced for the County of Los Angeles, California, (MIG 1/SP-1+/F1+/) $900 million of 2022-23 tax and revenue anticipation notes, with 4s of 6/2023 at 1.65%, noncall.

J.P. Morgan Securities priced for the Public Finance Authority, Wisconsin, (/AA-/AA/) $198.365 million of Cone Health healthcare system revenue bonds, Series 2022A, with 5s of 10/2052 at 4.00% and 4s of 2052 at 4.35%, callable in 10/1/2032.

Jefferies priced for Harris County, Texas, (Aa2//AA/) $194.620 million of toll road first lien revenue refunding bonds, Series 2022A, with 5s of 8/2023 at 1.53%, 5s of 2027 at 2.10%, 5s of 2032 at 2.67% and 5s of 2033 at 2.77%.

In the competitive market, Seattle, Washington, (Aa1/AA+//) sold $117.165 million of drainage and wastewater system improvement and refunding revenue bonds, to Morgan Stanley & Co., with 5s of 9/2022 at 1.28%, 5s of 2027 at 2.02%, 4s of 2032 at 2.63%, 4s of 2037 at 3.25% and 4s of 2042 at 3.60%, callable in 9/1/2032.

Despite triple-A benchmarks weakening on the long end, Nuveen strategists Anders S. Persson and John V. Miller expect the trend of munis’ strong performance to continue.

Munis are relatively cheap versus USTs and on an absolute basis.

“Most important, supply and demand is expected to show a negative imbalance of -$33 billion for the summer, they said. “Reinvestment money is historically outsized during summer months, while new issuance is typically undersized.”

Bond Buyer 30-day visible supply sits at $13.65 billion while net negative supply is at $28.152 billion, per Bloomberg data.

“Favorable bond valuations and higher yields, combined with strong credit fundamentals, are offering an attractive opportunity for municipal bonds,” they said.

They noted that for 10-year triple-A munis have more than doubled from one year ago, and it seems that USTs may be settling into a new range after reaching as high as 110% in mid-May.

“Elevated ratios are often short-lived, but can offer compelling relative and absolute value,” they said. “We have seen that rebound recently, with ratios now at approximately 90%. Municipal yields also dropped by almost 40 basis points on average in May, suggesting that this window may be closing.”

Muni-UST ratios are around 20 ratios lower in the last two weeks, “reversing almost all of prior 2022 underperformance,” said Matt Fabian, a partner at Municipal Market Analytics.

“The nominal spread between 10-year muni taxable, which will more closely track Treasuries, and tax-exempt offered-side benchmarks is now its widest at +141 basis points in at least four years,” he said.

In large part, this is due to the “product scarcity amid two weeks of strong June reinvestment buying and last

He noted that “net supply dropped to $6.5 billion or roughly half its weekly average since March 1.”

“Secondary net supply will be even worse as the main supplier of such this year — the mutual funds raising cash for outflows — are now a buyer, which suggests that, at least for now, secondary supply will either be via very short-term gains takers or scarce,” he said.

Exchange-traded fund “net creations were negative last week, a potential signal of fixed-income caution, but also maybe a combination of a holiday-lull in retail interest and longer-term fund manager liquidations of 'cash alternative' positions in non-cash ETFs,” Fabian said.

Looking ahead, he said, “positive momentum is considerable and scarcity still reigns: two large reinvestment months lie ahead and both new-money and refunding issuance are apt to underwhelm.”

Secondary trading

Maryland 5s of 2023 at 1.51%. Loudoun County 5s of 2023 at 1.62%-1.58%. Tennessee 5s of 2024 at 1.88%-1.78%.

Columbia University 5s of 2025 at 1.85%-1.82%. Maryland 5s of 2027 at 2.06%-2.04%. Columbus, Ohio, 5s of 2028 at 2.18%-2.17%.

California 5s of 2032 at 2.64%. Princeton 5s of 2032 at 2.48%-2.44% versus 2.46% Monday. Georgia 5s of 2033 at 2.54%.

Arlington County, Virginia, 5s of 2039 at 2.76%-2.75%. Washington 5s of 2046 at 3.12% versus 3.11%-3.10% Monday. New York City TFA 5s of 2051 at 3.55%-3.54%.

AAA scales

Refinitiv MMD’s scale saw a mix of bumps on the short end and cuts on the long end at the 3 p.m. read: the one-year at 1.44% (-3) and 1.72% (-3) in two years. The five-year at 2.01% (unch), the 10-year at 2.45% (unch) and the 30-year at 2.82% (+2).

The ICE municipal yield curve saw bumps inside 10 years and cuts on the long end: 1.43% (-1) in 2023 and 1.75% (-2) in 2024. The five-year at 2.03% (-1), the 10-year was at 2.42% (flat) and the 30-year yield was at 2.91% (+2) at a 4 p.m. read.

The IHS Markit municipal curve was cut up one to two basis points on the 10- and 30-year: 1.45% (unch) in 2023 and 1.75% (unch) in 2024. The five-year at 2.02% (unch), the 10-year was at 2.47% (+2) and the 30-year yield was at 2.81% (+1) at 4 p.m.

Bloomberg BVAL saw a one basis point bump on the short end: 1.50% (-1) in 2023 and 1.78% (-1) in 2024. The five-year at 2.09% (unch), the 10-year at 2.46% (unch) and the 30-year at 2.83% (unch) at a 4 p.m. read.

Treasuries rallied out long.

The two-year UST was yielding 2.738% (+1), the three-year was at 2.916% (-1), the five-year at 2.990% (-4), the seven-year 3.022% (-6), the 10-year yielding 2.984% (-6), the 20-year at 3.358% (-7) and the 30-year Treasury was yielding 3.130 (-7) at the close.

Primary to come:

Atlanta, Georgia, (Aa3//AA-/) is set to price Wednesday $578 million of AMT and non-AMT airport general revenue bonds consisting of $179.51 million of exempts, Series 2022A; $118.145 million of exempts, Series 2022C; $218.165 million, Series 2022B; and $61.95 million of AMT bonds, Series 2022D. Goldman Sachs & Co.

The Texas Water Development Board (/AAA/AAA/) is set to price Wednesday $254.125 million of state revolving fund revenue bonds, New Series 2022. Piper Sandler & Co.

The Prosper Independent School District, Texas, is set to price Thursday $200 million of fixed-rate unlimited tax school building bonds, Series 2022. Piper Sandler & Co.

The New York City Housing Development Corp. is set to price Wednesday $160.765 million of sustainable development multi-family housing revenue bonds, Series C-1. Wells Fargo Bank.

The Iowa Student Loan Liquidity Corp. (/AA//) is set to price Thursday $155.700 million of senior student loan revenue bonds, consisting of $128.500 million of taxables, serials 2023-2032, term 2039 and $27.200 million of AMT bonds, Series B, serials 2029-2032. RBC Capital Markets.

The Conroe Independent School District, Texas, (Aaa/AAA//) is set to price Wednesday $147.075 million of unlimited tax school building bonds, Series 2022A, serials 2023-2047, insured by the Permanent School Fund Guarantee Program. Raymond James & Associates.

The Public Utility District No. 1, Washington, (Aa2/AA//) is set to price Thursday $103.220 million of wells hydroelectric revenue bonds, consisting of $36.555 million of Series A, serials 2023-2038 and $66.665 million of Series B, serials 2038-2052. Barclays Capital.

The Brazoria County Industrial Development Corporation, Texas, is set to price Thursday $100 million of Aleon Renewable Metals Project solid waste disposal facilities revenue bonds, Series 2022, term 2042. Citigroup Global Markets.

The Minnesota Housing Finance Agency (Aa1/AA+//) is set to price Wednesday $100 million of taxable social residential housing finance bonds, 2022 Series G, serials 2023-2034, terms 2037, 2039 and 2047. RBC Capital Markets.

Competitive:

Maryland (Aaa/AAA/AAA/) is set to sell $335.180 million of general obligation bonds state and local facilities loan of 2022, First Series A Bidding Group 1, at 10 a.m. eastern Wednesday.

The state is also set to sell $303.040 million of general obligation bonds state and local facilities loan of 2022, First Series A Bidding Group 3, at 11 a.m. Wednesday.

The state is additionally set to sell is set to sell $261.780 million of general obligation bonds state and local facilities loan of 2022, First Series A Bidding Group 2, at 10:30 a.m Wednesday.

The state is set to sell $150 million of taxable general obligation bonds state and local facilities loan of 2022, First Series B, at 11:30 a.m. eastern Wednesday, as well.

South Carolina (Aaa/AA+/AAA/) is set to sell $101.255 million of Clemson University general obligation state institution bonds, Series 2022A, at 10:15 a.m. eastern Thursday.