The municipal bond market is gearing up for what should be a busy week, with a bunch of good sized deals and one mega deal.

Ipreo forecasts weekly bond volume will increase to at least $6.5 billion from a revised total of $5.7 billion in the prior week, according to updated data from Thomson Reuters. Ipreo’s estimates were calculated before the Chicago deal was approved for sale. The calendar is composed of $5.8 billion of negotiated deals and $703.3 million of competitive sales.

The Securitization Corp. was established last year to leverage city sales tax revenue to refund outstanding debt. Loop Capital Markets will be the lead manager on the deal, which is expected to price on Wednesday in the third sale since its inception.

The offering is comprised of $917.64 million of Series 2018C sales tax securitization bonds and $388.56 million of Series 2018D taxables sales tax securitization bonds and carries ratings of AA-minus by S&P Global Ratings and AAA by Fitch Ratings and Kroll Bond Rating Agency.

“With the $1.3 billion Chicago deal on the horizon, the municipal market was mildly firmer by two to three basis points on Friday,” said one New York trader. “Bid lists shrunk as well, as the market was and is focused on the Chicago deal whose selling points include: size, and the name recognition — and possibly yield. Demand will be a function of price, size creates interest.”

Additionally, there are 18 deals scheduled for this week that are $100 million or larger, with only one coming via the competitive route.

Secondary market

Municipal bonds were mostly stronger on Monday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell as much as one basis point in the nine- to 30-year maturities. The remaining maturities were weaker by less than one basis point.

High-grade munis were also mostly stronger, with yields calculated on MBIS' AAA scale falling as much as a basis point in the six- to 30-year maturities. The remaining maturities were weaker by less than one basis point.

Munis were unchanged on Municipal Market Data’s AAA benchmark scale, which showed steady yields on both the 10-year muni general obligation and the yield on 30-year muni maturity.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 87.3 while the 30-year muni-to-Treasury ratio stood at 100.3%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 34,010 trades on Friday on volume of $9.423 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 16.825%, the Empire State taking 13.076% of the market and the Lone Star State taking 9.61%.

Week's actively traded issues

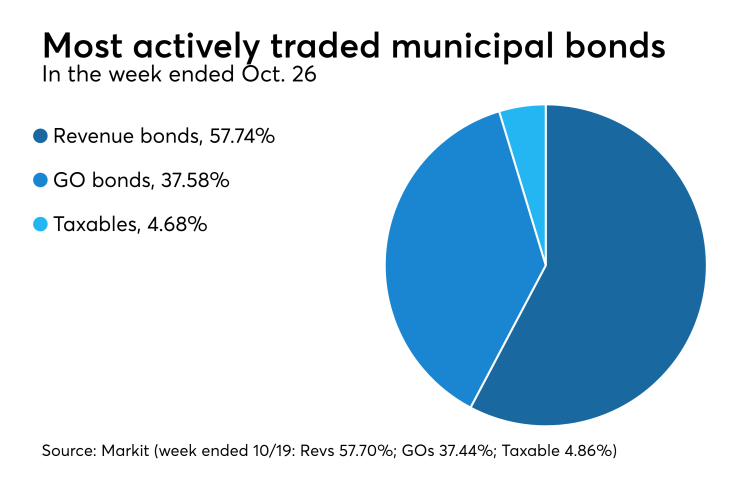

Revenue bonds comprised 57.74% of total new issuance in the week ended Oct. 26, up from 57.70% in the prior week, according to Markit. General obligation bonds made up 37.58%, up from 37.44% while taxable bonds accounted for 4.68%, down from 4.86%.

Some of the most actively traded munis in the week ended Oct. 26 were from Puerto Rico and Ohio issuers, according to Markit.

In the GO bond sector, the Puerto Rico 8s of 2035 traded 66 times. In the revenue bond sector, the Lucas County, Ohio, 4.125s of 2042 traded 49 times. And in the taxable bond sector, the Puerto Rico Sales Tax Financing Corp. 6.35s of 2029 traded nine times.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation. Click here for a brief tour of the Workstation, or contact Ziad Saba at 212-803-6079 for more information.