Municipal triple-A benchmarks showed slight weakness Thursday but another round of inflows into municipal bond mutual funds propped up the market and signaled that fundamentals are strong.

Triple-A benchmark yields rose one basis point in spots around four to seven years while municipal to UST ratios closed at 61% in 10 years and 67% in 30 years on Thursday, according to Refinitiv MMD, while ICE Data Services had the 10-year at 60% and the 30 at 67%.

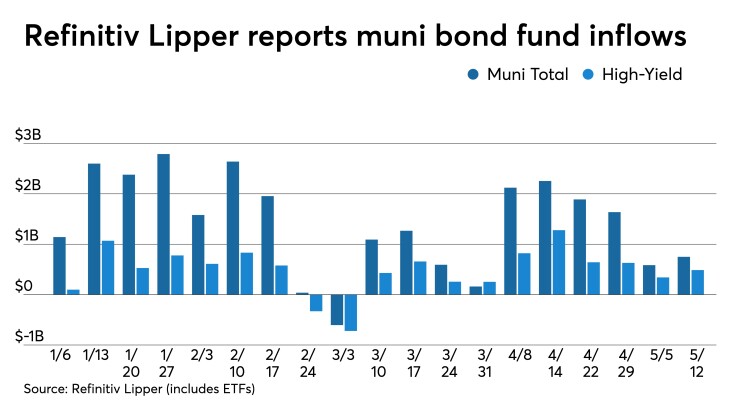

Refinitiv Lipper reported $750 million of inflows into municipal bond mutual funds for the week ending May 12 while high-yield funds saw $487 million of inflows. This follows $584.1 million and $341.4 million, respectively, the week prior.

"From a technical standpoint, the 10-year around 1% seems to be the sweet spot, albeit slightly grudgingly, for investors. We saw new-issues pricing this week around that level. It really is hard to ignore how rich valuations are but the fundamentals of munis are strong, so I'm not sure how I see munis correcting to higher yields, save for some major outside effect," a New York trader said.

The primary was quiet with only a few large deals, including a $121.9 million St. John's University revenue bonds from the Dormitory Authority of the State of New York (A3/A-//), priced by Morgan Stanley & Co. Bonds in 2022 with a 4% coupon yield 0.05%, 5s of 2023 at 0.20%, 5s of 2026 at 0.70%, 4s of 2031 at 1.38%, 4s of 2036 at 1.66% and 4s of 2048 at 2.00%. The Erie County Industrial Development Agency, New York (Aa3/AA//) led by Citigroup Global Market Inc. priced $109.4 million of school facility refunding revenue bonds (City School District of the City of Buffalo Project). The first tranche, $80.6 million, saw 5s of 2025 yield 0.44%, 5s of 2026 at 0.58%, 5s of 2031 at 1.23%, and 5s of 2032 at 1.33%. The second, $28.8 million, saw 5s of 2022 at 0.14%, 5s of 2023 at 0.18% and 5s of 2024 at 0.28%. Noncallable.

Some larger state-specific new issues are on tap for next week including Colorado, Connecticut, West Virginia, and high-grade Prince George's County, Maryland, all of which should again gauge investor appetite for the GO at current levels.

Secondary trades and scales

Maryland 5s of 2022 traded at 0.10% versus 0.11% Monday. Los Angeles DWP 5s of 2025 at 0.39%. Georgia 5s of 2026 at 0.52%. New York City TFA 5s of 2027 at 0.74%-0.72%. Seattle 5s of 2028 at 0.82% versus 0.76% original.

LA DWP 5s of 2029 at 0.84%. California 5s of 2029 at 1.01%-1.00% verus 0.94%-0.93% Tuesday. Delaware 5s of 2029 at 0.84%. South Carolina 5s of 2030 at 0.87%. Wisconsin 5s of 2030 at 1.04%. Florida PECO 5s of 2032 at 1.16%. Washington 5s of 2032 at 1.18%.

Columbus, Ohio 5s of 2035 at 1.24%. Baltimore County, Maryland 5s of 2038 at 1.24%. Lamar, Texas ISD 3s of 2042 at 1.72%-1.60% versus 1.68%-1.67% Monday.

On Refinitiv MMD’s AAA benchmark scale, yields were steady at 0.09% in 2022 and 0.13% in 2023. The yield on the 10-year sat at 1.01% and the 30-year at 1.59%.

The ICE AAA municipal yield curve showed yields at 0.10% in 2022 and 0.16% in 2023, the 10-year at 1.01%, up one basis point while the 30-year sat at 1.60%.

The IHS Markit municipal analytics AAA curve showed yields rise one bp to 0.10% in 2022 and 0.13% in 2023, the 10-year rose one to 0.97% and the 30-year rose one to 1.57%.

The Bloomberg BVAL AAA curve showed yields rise to 0.08% in 2022 and 0.10% in 2023, up two, with the 10-year at 0.98%, up four, and the 30-year yield rose to 1.60%, also up four.

The 10-year Treasury was yielding 1.67% and the 30-year Treasury was yielding 2.40% near the close. Equities rose after a few days of selling off with the Dow gaining 433 points, the S&P 500 rose 1.22% and the Nasdaq gained 0.72%.

More inflation numbers

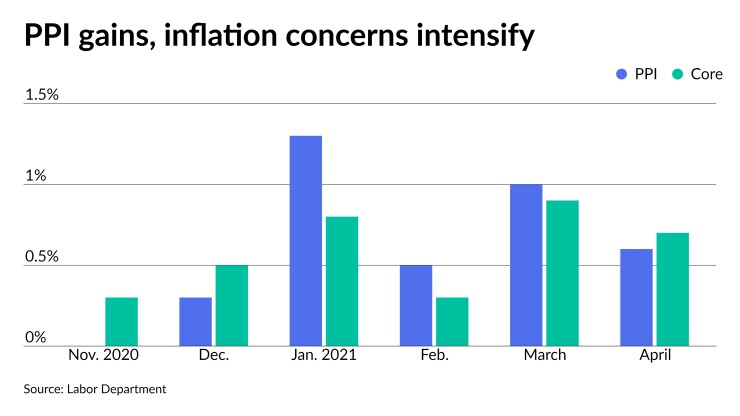

The producer price index rising more than expected on the heels of an upside surprise in the consumer price index has at least one expert questioning the Federal Reserve’s stance.

The report “highlights the acceleration of rising production costs,” said Mickey Levy, Berenberg chief economist for the U.S., Americas and Asia, and a member of the Shadow Open Market Committee. “There is mounting anecdotal evidence that businesses are raising product prices. If, as we expect, aggregate demand in the economy remains strong, businesses will have flexibility to increase prices further.”

And if that is the case, higher inflation is in the pipeline. “When will the Federal Reserve change its tune and acknowledge that the rise in inflation is more than temporary?” he asked. “It runs the risk of losing credibility if it delays and inflation pressures persist.”

PPI gained 0.6% in April, while the core index climbed 0.7%, with the headline number up 6.2% for the year, its biggest gain the data started being tracked in November 2010. The core climbed 4.1% in the 12 months.

Economists polled by IFR Markets expected the headline number to rise 0.3% and the core to increase 0.4% for the month, with 5.9% and 3.7% gains, respectively for the annual numbers.

“The hotter-than-expected gains in consumer and producer prices this week are prompting us to upwardly revise our inflation forecasts over the balance of the year,” said Scott Anderson, chief economist at Bank of the West. “Even so, one month of price spikes does not fundamentally alter our view that the recent surge in prices will prove transitory longer-term.”

And while no one is certain if inflation will be transitory, investors should be prepared.

“Although it is unknown how transitory the recent acceleration in inflation will last, it is clear that investors need to have some protection against price increases on the goods and services they buy,” said Charles Self III, chief operating, compliance and investment officer at iSectors, LLC. “There’s two types of inflation: ‘cost-push’ that comes from increasing raw material and labor costs and ‘demand-pull’ resulting from high demand from consumers and business.”

The former suggests slow economic growth, while the latter results from accelerating growth.

“Commodities are the best inflation protection investment in a 1- to 3-year timeframe in either scenario,” he said. “Assuming we are experiencing a demand-pull inflation scenario, investors should continue to hold equities since in the long term, equities are likely to outperform all other assets due to the earnings growth companies are experiencing.”

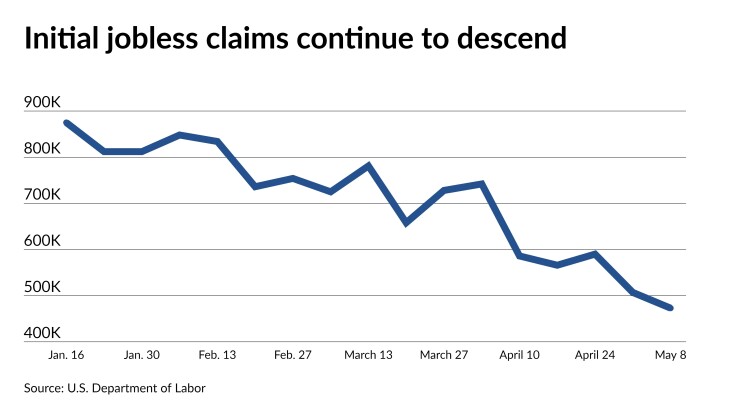

Separately, Initial jobless claims fell to a new pandemic low of 473,000 on a seasonally adjusted annual basis in the week ended May 8 from an upwardly revised 507,000 a week earlier, first reported as 498,000.

Economists expected 500,000 claims in the week.

Continued claims decreased to 3.655 million in the week ended May 1 from an upwardly revised 3.700 million a week earlier, initially reported as 3.690 million.

Economists expected 3.640 million continued claims.

“We got some welcome news on new jobless claims as the headline numbers have been moving in the right direction, showing improvement,” said Mark Hamrick, senior economic analyst at Bankrate.

While the numbers are still elevated, “other pressing issues are now competing for attention,” such as a rise in gas prices brought on by pipeline shutdown, since reopened, and inflation.

“The lack of gasoline supply in the Eastern U.S. has resulted in panic buying and along with the reopening of the economy, prices have risen more than expected, raising worry whether the Federal Reserve might have underestimated the risks of inflation."

Waller: Need more data

The Federal Reserve will remain patient since it will take time to determine if its dual mandate is in sight, according to Federal Reserve Board Gov. Christopher Waller.

“We need to see several more months of data before we get a clear picture of whether we have made substantial progress towards our dual mandate goals,” he said on a webcast.

He discounted the not as strong as expected employment report and the higher than projected consumer and producer price indexes, “a month does not make a trend — the trend for the economy is excellent.”

While many aspects of the labor market have improved, he said, in some areas, it remains “far from recovering to its pre-pandemic level.”

Turning to the inflation data, Waller said, “the factors putting upward pressure on inflation are temporary, and an accommodative monetary policy continues to have an important role to play in supporting the recovery.”

While he expects “inflation to overshoot our 2% longer-run goal in 2021,” Waller doesn’t foresee “sustained, high rates of inflation.”

“I expect the FOMC to maintain an accommodative policy for some time,” he added. “We have said our policy actions are outcome based, which means we need to see more data confirming the economy has made substantial further progress before we adjust our policy stance.”