The municipal bond market took a breather on Thursday as the last of the week’s larger deals came and went.

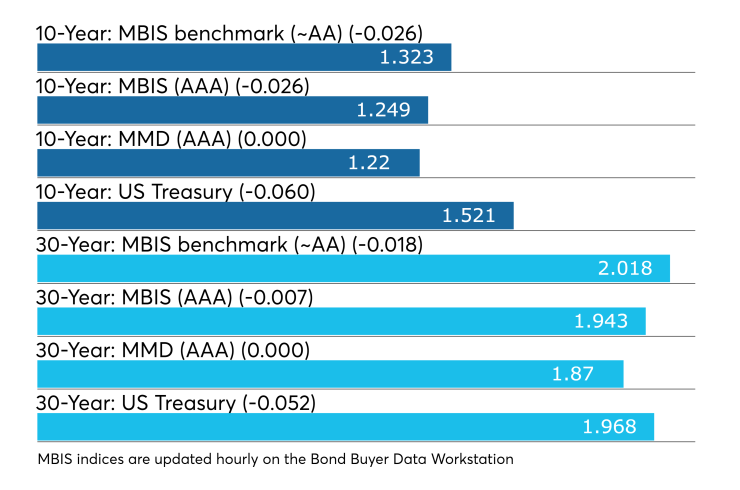

The 10- and 30-year muni GOs both remained at the record low levels set on Wednesday of 1.22% and 1.87%, respectively, according to the final read of Refinitiv Municipal Market Data’s AAA benchmark scale.

On the

“The belly of the ICE muni yield curve is outperforming the ends of the curve today, but movement is still lagging the Treasury market,” ICE Data Services said in a Thursday market comment. “High-yield and tobaccos are stable.”

Market participants were taking a look at the recent geopolitical tensions and weighing what’s coming next.

“In reality, the straightforward question of ‘Is there a recession coming?’ might be too simplistic,” said Deepak Puri, chief investment officer for the Americas at Deutsche Bank Wealth Management. “One must not only consider the level of these interest rates or term premiums, but also the level of GDP as well as other key economic indicators in order to make a full assessment.”

He said the firm was still not seeing the materialization of a U.S. recession just yet. However, he added that the Treasury yield curve inversion shouldn’t be ignored, because “a negative sloping yield curve will certainly dampen animal spirits” and have a detrimental impact on investors’ psyche.

“We should continue to expect heightened levels of volatility in global markets as market participants continue to price in the lingering trade tensions between the U.S. and China, a global economy that continues to show more cracks in its armor, and further uncertainty on what next steps the Fed will take,” Puri said. “Investors should consider taking profits and recalibrating their portfolios as well as investments that have non-linear structures which tend to outperform in times of heightened volatility with limited upside. Lastly, investors should always be mindful of any short-term liquidity requirements as well as their respective time horizons for their portfolios.”

In late trading, the Treasury three-month was yielding 1.900%, the 2-year was yielding 1.494%, the 5-year was yielding 1.413%, the 10-year was yielding 1.521% and the 30-year was yielding 1.968%.

The 10-year muni-to-Treasury ratio was calculated at 79.8% while the 30-year muni-to-Treasury ratio stood at 94.4%, according to MMD.

Michael Pietronico, CEO of Miller Tabak Asset Management, said his firm believes that the 10-year Treasury note yield will bottom at 0.98% and afterward will trade in a range of 1.25% to 1% for roughly three years.

"We expect another 40 basis point rally in long-term tax-free bond yields before a small correction occurs," he said. "We expect municipal bond yields to remain at historic lows for a number of years also."

He said reasons for the drop in rates have been the ongoing China-U.S. trade war, the rapidly slowing Chinese and Europe economies, the European Central Bank stimulus plans and that fact that the U.S. Federal Reserve will be lowering rates for the next 12 months.

"Thirty-year Treasury bond rates falling below 2% are no big deal, as it remains one of the cheapest sovereign bonds in the world," Pietronico said. "We do not expect a massive pickup in municipal bond issuance due to rates falling."

Municipal yields have been moving lower, primarily in response to falling Treasury bond yields, according to Alan Schankel, managing director and municipal strategist at Janney.

"It would not surprise me to see yields fall further in coming months, although I do not see negative yields as likely in this economic cycle," Schankel said. "Fed fund futures project a 100% probability of a 25 to 50 basis point cut from the FOMC in September, which would likely pull shorter-term rates lower, and lack of inflationary pressures in the system suggest to me that long rates could drop further, especially if we see further signs of economic slowing on the horizon."

Schankel noted that he does not think many issuers are on the sidelines awaiting lower rates, so, unfortunately, recent rate reductions will not boost municipal bond issuance, except on the margins.

Cheaper muni ratios are especially appealing to the crossover buyer, so this is a dynamic worth monitoring, according to Jeffrey Lipton, head of municipal research and strategy at Oppenheimer & Co. Inc.

“Should weekly new-issue volume ebb, we can reasonably expect ratios to resume their march toward richer levels, possibly reaching new lows for the year, thus providing a buying opportunity at this time,” Lipton said in a weekly research report. “Pent-up demand for the product is likely to continue in the face of diminishing supply despite anticipated easing of reinvestment needs.”

He added that as investors continue to see the appeal of taxable munis for foreign buyers in search of yield, and with so much of global sovereign debt showing negative yields, munis certainly meet the need.

“As we expect demand for munis to remain strong and tax-exempt yields to see further downward pressure through year-end, applying the appropriate investment strategy may be challenging,” he said. “For the more conservative investors, we continue to stress that credit quality should not be compromised given the need to fortify portfolios ahead of the next down-cycle.”

Primary market

FTN Financial Capital Markets priced the Corpus Christi Independent School District, Nueces and San Patricio Counties, Texas’ (PSF: Aaa/AAA/NR) $175.325 million of Series 2019 unlimited tax school building and refunding bonds.

JPMorgan Securities priced the Development Authority of Fulton County, Georgia’s (A/2NR/A+) $131.565 million of taxable Series 2019B revenue bonds for the Georgia Tech Athletic Association project.

Citigroup priced the South Dakota Housing Development Authority’s (Aaa/AAA/NR) $99 million of Series 2019B homeownership mortgage bonds not subject to the alternative minimum tax.

Barclays Capital received the official award on the Airport Commission of the City and County of San Francisco’s (A1/A+/A+) $1.156 billion of revenue bonds for the San Francisco International Airport.

The Airs were freed to trade Thursday. One of the most active securities were the Series 2019E AMT 4s of 2050, originally priced at 112.14 to yield 2.57%, were trading at a high of 112.869 cents on the dollar, a low yield of 2.49%, in 61 trades totaling $105.33 million, according to the EMMA website. The Series 2019E AMT 5s of 2050, originally priced at 112.354 to yield 2.39%, were trading at a high price of 122.74 cents on the dollar, a low yield of 2.35%, in 50 trades totaling $157.315 million. And the Series 2019E AMT 5s of 2045, originally priced at 123.031 to yield 2.32%, were trading at a high of 123.42 cents on the dollar, a low yield of 2.28%, in 38 trades totaling $93.57 million.

Citigroup received the award on the Los Angeles County Public Works Authority, California’s (Aa2/AA+/AA) $251.89 million of Series 2019E1 and Series 2019E2 lease revenue bonds.

BofA Securities priced Hawaii’s (A2/A+/A) $194.71 million of taxable Series 2019A airports system customer facility charge revenue bonds.

Thursday’s bond sales

Muni CUSIP requests fall in July

Municipal CUSIP requests decreased in July, the first decline this year, CUSIP Global Services reported on Thursday.

The total of all municipal securities — including municipal bonds, long-term and short-term notes and commercial paper — dropped 15.9% to 1,273 from 1,513 in June. Requests for municipal bond CUSIPS fell to 963 in July from 1,105 in June.

“The steady monthly increases in municipal bond CUSIP request volume have ebbed for the first time this year,” said Gerard Faulkner, director of operations for CUSIP Global Services. “With interest rates still holding at historic lows, we fully expect municipal issuance activity to maintain a healthy volume, but we will be watching this metric closely in the coming weeks and months.”

On a year-to-date basis, municipal request volume was up 8.1% to 7,891 through July compared to 7,380 in the same time in 2018.

Among top state issuers, Texas, New York and California were the most active in July. Texas led the pack with 174 requests in July.

Previous session's activity

The MSRB reported 34,498 trades Wednesday on volume of $15.95 billion. The 30-day average trade summary showed on a par amount basis of $10.79 million that customers bought $5.45 million, customers sold $3.31 million and interdealer trades totaled $2.03 million.

California, Texas and New York were most traded, with the Golden State taking 15.2% of the market, the Empire State taking 15.085% and the Lone Star State taking 12.252%.

The most actively traded security was the Puerto Rico Sales Tax Financing Corp. restructured A-2 4.329s of 2040, which traded 33 times on volume of $60.48 million.

BB indexes continue to descend

In the week ended Aug. 15, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices fell three basis points to 3.57% from 3.60% the previous week.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields dropped 12 basis points to 3.10% from 3.22% the week before. It is at its lowest level since Sept. 29, 2016, when it was at 3.06%.

The 11-bond GO Index of higher-grade 11-year GOs sank 12 basis points to 2.64% from 2.76% the previous week. It is at its lowest level since Sept. 29, 2016, when it was at 2.64%.

The Bond Buyer's Revenue Bond Index shrunk 12 basis points to 3.58% from 3.70% the week before. It is at its lowest level since Nov. 3, 2016, when it was at 3.44%.

The yield on the U.S. Treasury's 10-year declined to 1.53% from 1.72% and the 30-year Treasury's dropped to 1.98% from 2.24%.

Muni money market funds see outflow

Tax-exempt municipal money market fund assets lost $468.6 million, bringing total net assets to $136.00 billion in the week ended Aug. 12, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 191 tax-free and municipal money-market funds dropped to 0.94% from 1.01% in the previous week.

Taxable money-fund assets gained $10.04 billion in the week ended Aug. 13, bringing total net assets to $3.175 trillion, the ninth consecutive week that the taxable total has reached or exceeded $3 trillion.

The average, seven-day simple yield for the 809 taxable reporting funds declined to 1.80% from 1.86% the prior week.

Overall, the combined total net assets of the 1,000 reporting money funds rose $9.57 billion to $3.311 trillion in the week ended Aug. 13.

Treasury auctions bills

The Treasury Department Thursday auctioned $55 billion of four-week bills at a 2.040% high yield, a price of 99.841333. The coupon equivalent was 2.077%. The bid-to-cover ratio was 2.47. Tenders at the high rate were allotted 80.26%. The median rate was 1.990%. The low rate was 1.920%.

Treasury also auctioned $40 billion of eight-week bills at a 1.950% high yield, a price of 99.696667. The coupon equivalent was 1.989%. The bid-to-cover ratio was 3.05. Tenders at the high rate were allotted 26.72%. The median rate was 1.940%. The low rate was 1.900%.

Treasury to sell bills

The Treasury Department said Thursday it will auction $45 billion 91-day bills and $42 billion 182-day discount bills Monday.

The 91s settle Aug. 22, and are due Nov. 21, and the 182s settle Aug. 22, and are due Feb. 20, 2020. Currently, there are $35.998 billion 91-days outstanding and no 182s.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.