Municipal bond buyers saw more supply head their way on Tuesday, led by issuers in New York, Minnesota and Michigan.

Primary market

RBC Capital Markets held a second day of retail orders on New York City’s $809.555 million of general obligation bonds. The deal includes Fiscal 2019 Series A and B tax-exempt GOs and Fiscal 1994 Series H, Subseries H3 GOs. The deal will be priced for institutions on Wednesday.

Also on Wednesday, the city is competitively selling $60 million of taxable Fiscal 2018 Series C GOs.

The deals are rated Aa2 by Moody’s Investors Service, and AA by S&P Global Ratings and Fitch Ratings.

Jefferies priced the New York Triborough Bridge and Tunnel Authority’s $273 million of Series 2018B general revenue refunding bonds for institutions on Tuesday after holding a one-day retail order period.

The deal is rated Aa3 by Moody’s, AA-minus by S&P and Fitch and AA by Kroll Bond Rating Agency.

JPMorgan Securities is expected to price the Wisconsin Health and Educational Facilities Authority’s $1.23 billion issue for the Advocate Aurora Health Credit Group. The deal is rated Aa3 by Moody’s and AA by S&P and Fitch.

Bank of America Merrill Lynch is set to price the California Statewide Communities Development Authority’s $366 million of Series 2018A revenue bonds for the Loma Linda Medical Center on Tuesday. The deal is rated BB-minus by S&P and BB by Fitch.

Piper Jaffray is expected to price Houston’s $320 million of Series 2018D combined utility system first lien revenue refunding bonds on Tuesday. The deal is rated Aa2 by Moody’s and AA by Fitch.

In the competitive arena on Tuesday, Minnesota offered $619.37 million of GOs in three sales.

Citigroup won the $397.37 million if Series 2018 various purpose bonds with a true interest cost of 3.1023%.

Morgan Stanley won the $206 million of Series 2018B trunk highway bonds with a TIC of 2.9989%. Morgan Stanley also won the $16 million of Series 2018C taxable various purpose bonds with a TIC of 3.3851%.

Public Resources Advisory Group is the financial advisor and Kutak Rock is the bond counsel. The deals are rated Aa1 by Moody's and AAA by S&P and Fitch.

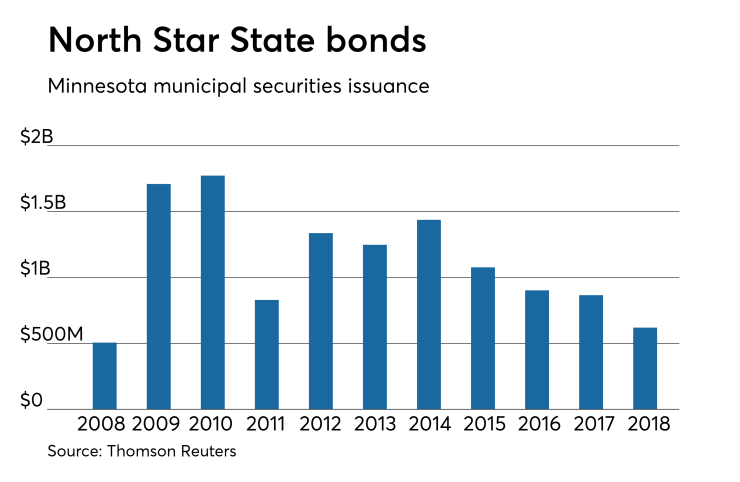

The North Star State has sold over $12 billion of bonds since 2008, with the most issuance occurring in 2010 when it offered $1.8 billion of debt. It sold the least amount of bonds in 2008 when it issued $506.1 million of debt.

Michigan sold $149.2 million of environmental program GOs. Bank of America Merrill Lynch won the bonds with a TIC of 3.2243%.

Robert W. Baird is the financial advisor and Dickinson Wright is the bond counsel. The deal is rated Aa1 by Moody’s and AA by S&P and Fitch.

Tuesday’s bond sales

New York

Michigan

Minnesota

The healthy new issue supply this week should do well, Peter Block, managing director at Ramirez & Co., wrote in a weekly municipal report on Monday.

He cited the NYC GO deal and the Wisconsin health offering. “These transactions should do well given generally shorter maturities,” he said. Competitively, he said, Minnesota’s $619 million of GOs would also be enticing.

“We think YTD gross supply is higher than our projection at this point due primarily to higher-than-projected new money of $107 billion at 60% of the total and 16% ahead of our mid-year projection of $92 billion,” Block said. “Actual new money supply is likely running higher versus our projection due to still favorable borrowing costs and higher demand than expected, particularly in still high-tax states like California, New York, Illinois, Massachusetts,” Block added.

“The very strong demand has had the effect of compressing spreads, which to a degree mitigates some MMD rate increases, thereby lowering overall borrowing costs,” he continued.

For now, Block maintains the firm’s full-year supply projection at $317 billion as it believes new money issuance will likely decelerate as rates move higher for the balance of the year.

Over the next 30 days, net muni market supply is negative $16.64 billion, comprised of $10.74 billion new issuance and $27.4 billion of maturing and called bonds combined, according to Block. “The states that stand to experience the largest change in outstanding debt include Texas, California, New Jersey, New York, and Minnesota.

Secondary market

Municipal bonds were mostly weaker on Tuesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields rose less than one basis point in the one-year and six- to 30-year maturities, fell less than a basis point in the two- to four-year maturities and remained unchanged in the five-year maturity.

High-grade munis were also mostly weaker, with yields calculated on MBIS’ AAA scale rising less than one basis point in the one-year and seven- to 30-year maturities, falling less than a basis point in the two- to five-year maturities and remaining unchanged in the six-year maturity.

Municipals were mixed on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation remaining unchanged while the yield on the 30-year muni maturity rose one basis point.

Treasury bonds were weaker as stocks traded higher.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 84.5% while the 30-year muni-to-Treasury ratio stood at 98.6%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Bond Buyer 30-day visible supply at $10.6B

The Bond Buyer's 30-day visible supply calendar decreased $465.8 million to $10.60 billion for Tuesday. The total is comprised of $2.81 billion of competitive sales and $7.79 billion of negotiated deals.

Previous session's activity

The Municipal Securities Rulemaking Board reported 34,270 trades on Monday on volume of $10.87 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 14.761% of the market, the Empire State taking 11.788% and the Lone Star State taking 10.018%.

Treasury sells $70B 4-week bills

The Treasury Department Tuesday auctioned $70 billion of four-week bills at a 1.905% high yield, a price of 99.851833.

The coupon equivalent was 1.934%. The bid-to-cover ratio was 2.65.

Tenders at the high rate were allotted 32.20%. The median rate was 1.890%. The low rate was 1.860%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.