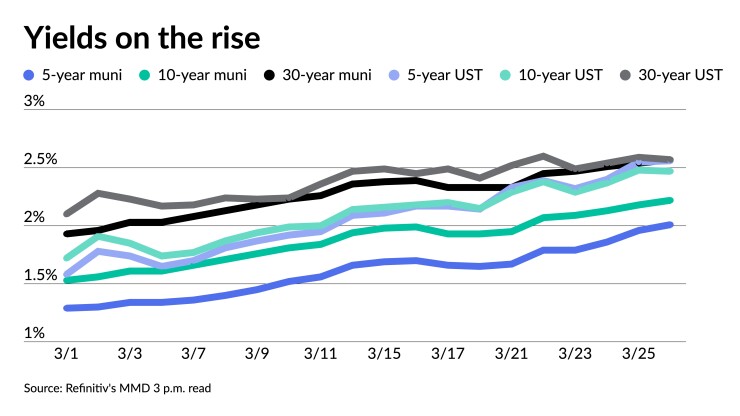

Municipals were weaker Monday, moving the five-year muni above 2% while the U.S. Treasury curve inverted and equities ended in the black.

Triple-A municipal yield curves saw cuts up to six basis points on the short end while the three- and five-year UST ended higher than the 30-year.

Muni to UST ratios were at 78% in five years, 90% in 10 years and 100% in 30, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the five at 77%, the 10 at 93% and the 30 at 103% at 4 p.m.

As

Fund outflows continued for the sixth week in a row, totaling negative $1.5 billion, bringing the year-to-date total to negative $12.86 billion. The amount of investor bids wanteds in competition has remained staggeringly large, nearly double the three-year average — including one day with $1.6 billion — indicating persistent market liquidity imbalance, he said.

Institutional bids wanted volume on Bloomberg was the heaviest since the week ended April 3, 2020. The total par amount out for the bid was $6.3 billion, more than double the 52-week average of $3.1 billion and 20% more than the previous week's total, according to CreditSights strategists Pat Luby and John Ceffalio.

Although trade volumes have risen this year, they said

“No doubt some market participants are using the liquidity of the ETFs in order to be able to sell quickly, but we note that even though mutual fund flows are net negative and bid wanted volumes have risen, investors have been net buyers of munis and muni ETFs this year, although the pace of buying has slowed down,” they said.

Last week, customer "buy" trades outnumbered "sell" trades by an average of $1.5 billion each day, down significantly from the $1.7 billion average for the week ended March 18, they said. In 2021, "buys" exceeded "sells" by an average of $2.4 billion per day and has dropped to $2 billion per day this year, as of March 25. Even though muni mutual funds have lost $23 billion this year, muni ETF holdings have climbed by $3.4 billion, as of March 23, according to CreditSights strategists.

Last week, the ICE muni credit indexes narrowed their spreads, although variances in length distort some of the market's relative moves, they said.

The 10-year BVAL triple-B yield, for example, concluded Friday at +111 to the triple-A, after finishing the previous Friday at +112. The improvement in Illinois GOs, which tightened by nine basis points in 10-years, aided the triple-B benchmark and the Triple-B Index. The ICE Triple-B Index, by comparison, tightened by five basis points.

The 10-year single-A GO benchmark yield spread widened from +28 on March 18 to +32 on March 25, while the single-A revenue yield decreased from +51 the week prior to +50 on Friday. Last week, the ICE Single-A Index tightened by seven basis points.

The price assessments that drive the movement of the indexes do not yet completely depict

“We expect that this week's new issues will be priced to quickly clear the market, pressuring primary market spreads wider,” they said.

Due to a smaller buyer base offering less liquidity, credit spreads continue to widen, particularly on less protective structures and/or poorer assets, according to Block.

He noted that coupon spreads have also widened with the spread between a 5% and 4% coupon at around 25 basis points.

“Credit spreads are also likely to continue widening as investors take a defensive posture and increase credit quality," Block said. “Our base case through at least April is for tax-exempt underperformance on waning investor demand, driven by volatility, inflation, higher rates, and seasonal factors taxes."

Secondary trading

California 5s of 2023 at 1.78%-1.75%. Maryland 5s of 2023 at 1.58%. North Carolina 5s of 2023 at 1.60%-1.62%. Maryland 5s of 2024 at 1.88%-1.85%. Wisconsin 5s of 2024 at 1.96%-1.92%.

NYC TFA 5s of 2025 at 2.15%. Wake County, North Carolina, 5s of 2025 at 1.89%-1.84% versus 1.57% a week ago. Hawaii 5s of 2026 at 2.13%-2.11%. Minnesota 5s of 2026 at 2.06%-2.04%.

Columbus, Ohio, 5s of 2027 at 2.09%-2.10%. New York City 5s of 2027 at 2.29%. Triborough Bridge and Tunnel Authority 5s of 2027 at 2.14%-2.12%.

NYC TFA 5s of 11/2029 at 2.38%. California 5s of 2029 at 2.41%-2.40% versus 2.22% Tuesday. Maryland 5s of 2033 at 2.34% versus 2.37% Friday.

NYC TFA 5s of 2037 at 3.03% versus 1.80% in the mid-January pricing. Ohio 5s of 2039 at 2.55% versus 2.52% Friday.

Triborough Bridge and Tunnel Authority 5s of 2051 at 3.13%-3.16% versus 3.13% Friday, 3.12% Thursday, 3.00%-2.99% Tuesday and 2.95%-2.94% a week ago. New York City water 5s of 2052 traded at 3.25%-3.24%. They traded at 2.94%-2.93% on Tuesday.

AAA scales

Refinitiv MMD's scale saw three to five basis point cuts at the 3 p.m. read: the one-year at 1.56% (+5) and 1.77% in two years (+5). The five-year at 2.01% (+5), the 10-year at 2.22% (+4) and the 30-year at 2.57% (+3).

The ICE municipal yield curve was cut two to six basis points: 1.53% (+6) in 2023 and 1.79% (+5) in 2024. The five-year at 1.98% (+4), the 10-year was at 2.26% (+2) and the 30-year yield was at 2.63% (+2) in a 4 p.m. read.

The IHS Markit municipal curve was cut four to five basis points: 1.53% (+5) in 2023 and 1.75% (+4) in 2024. The five-year at 2.02% (+4), the 10-year at 2.22% (+4) and the 30-year at 2.62% (+4) at a 4 p.m. read.

Bloomberg BVAL saw two to five basis point cuts: 1.52% (+5) in 2023 and 1.76% (+5) in 2024. The five-year at 2.01% (+5), the 10-year at 2.23% (+3) and the 30-year at 2.57% (+2) at a 4 p.m. read.

Treasury yields rose on the short end and equities ended in the black.

The two-year UST was yielding 2.333%, the three-year was at 2.570%, five-year at 2.549%, the seven-year 2.543%, the 10-year yielding 2.453%, and the 30-year Treasury was yielding 2.545% at the close. The Dow Jones Industrial Average gained 95 points or 0.27%, the S&P was up 0.71% while the Nasdaq gained 1.31% at the close.

Learning from history

After the recent Federal Reserve rate hike, yields have risen and the yield curve flattened.

“Such behavior is not unusual,” said Ned Davis Research Chief Global Macro Strategist Joe Kalish. “Although cases are limited, the decline in Treasury bond futures thus far exceeds the median decline between the first and second Fed rate hike since 1980.”

Looking at past hiking cycles, he said, yields trend higher after the first rate increase, and are “flat to modestly higher” in the weeks after the second hike. “Credit spreads tended to meander in the weeks surrounding the second rate hike,” he added.

Since 1980, rates were lifted at least twice six times, and in each case “the yield curve flattened between the first and second rate hikes,” Kalish noted. “In cases with a short time span between hikes, the curve flattened a median 13 bp, a little more than what we have seen thus far, although the curve is a lot flatter today than in most other cases.”

In nearly all hiking cycles since 1964, he said, “the yield curve continued to flatten in the weeks and months leading up to the second rate hike and following that hike.”

Where do yields go from here? Mark Dowding, Chief Investment Officer at BlueBay Asset Management, said, “Although we can see how yields may rise further in coming days, based on our medium-term views, in the short term it is possible that rates have sold off as much as they need to.”

Last year, he said, yields peaked “at the end of March and we wonder whether there may be a repeat of this pattern in 2022.”

And while quarter-point hikes “may do little to slow growth or inflation in the coming year, with real rates remaining deep in negative territory,” he said, he believed the Fed’s plan to simultaneously do quantitative tightening, would make the panel “less inclined to become overly aggressive on rates, especially against a backdrop of ongoing geopolitical uncertainty.”

But should the Fed move to half-point rate hikes, it will create a more unpredictable situation. “Financial markets have become addicted to policy support in recent years and could be vulnerable if retail faith in buying stocks is challenged in weeks to come,” Dowding said.

“A more aggressive Fed creates a more challenging backdrop for risk assets,” he added. “A gradual hiking cycle appeared to constitute little risk to ongoing expansion, but a more unpredictable path for rates will inevitably raise recession risks. This uncertainty may also demand a more sustained increase in risk premia — a factor that may also be supported by ongoing geopolitical risks, which seem unlikely to disappear any time soon.”

Primary to come:

The California Health Facilities Financing Authority (Aa3/AA-/AA-/) is set to price Tuesday $1.050 billion of taxable social No Place Like Home Program senior revenue bonds, Series 2022, serials 2024-2036, term 2040. Raymond James & Associates.

New York City Transitional Finance Authority (Aa1/AAA/AAA/) is set to price Wednesday $950 million of tax-exempt future tax-secured subordinate bonds, Fiscal 2022 Series F, Subseries F-1, serials 2024-2026 and 2035-2043, terms 2047 and 2051. Loop Capital Markets.

The Virgin Islands Matching Fund Special Purpose Securitization Corp. (///BBB) is set to price Wednesday $853.025 million of Matching Fund Securitization bonds, consisting of $793.025 million of bonds, Series 2022A, serials 2027-2032, term 2039 and $60 million of taxable bonds, Series 2022B, term 2026. Ramirez & Co.

San Antonio, Texas, Electric and Gas Systems (Aa2/AA-/AA-/) is set to price Tuesday $413.805 million of taxable revenue refunding bonds, New Series 2022, serials 2023-2037, terms 2042 and 2047. Wells Fargo Bank.

San Antonio Electric and Gas Systems (Aa2/AA-/AA-/) is also set to price Wednesday $109.110 million of revenue refunding bonds, New Series 2022, serials 2023-2025. Siebert Williams Shank & Co.

The Public Finance Authority, Wisconsin, is set to price Wednesday $411.870 million of Grand Hyatt San Antonio Hotel Acquisition Project hotel revenue bonds, consisting of $225.340 million of Senior Lien Series 2022A (/BBB-//) and $186.530 million of Subordinate Lien Series 2022B. Piper Sandler & Co.

Broward County, Florida, (Aa1/AAA/AA+/) is set to price Tuesday $375.435 million of Convention Center Hotel first tier revenue bonds, Series 2022, serials 2027-2042, terms 2047, 2050 and 2055. Citigroup Global Markets.

The Department of Water and Power of the City of Los Angeles (Aa2//AA-/AA) is set to price Wednesday $334.555 million of power system revenue bonds, 2022 Series B. Goldman Sachs.

Anaheim Housing and Public Improvements Authority, California, (/AA+/AA+/) is set to price Tuesday $274.960 million of revenue bonds, Series 2022-A; taxable revenue refunding bonds, Series 2022-B and revenue refunding bonds, Series 2022-C: consisting of $44.450 million of Series 2022A and $31.935 million of Series 2022C. J.P. Morgan Securities

University of Connecticut (Aa3/A+/A+/) is set to price Wednesday $220 million of general obligation bonds, 2022 Series A, serials 2023-2042. RBC Capital Markets.

Idaho Housing and Finance Association (Aa1/AA+/) is set to price Tuesday $189.395 million of sales tax revenue bonds, Series 2022A, serials 2023-2042, term 2047. Citigroup Global Markets.

The North Dakota Housing Finance Agency (Aa1///) is set to price Tuesday $125 million of non-alternative minimum tax social Housing Finance Program bonds, 2022 Series A, serials 2023-2034, terms 2037, 2042, 2046 and 2053. RBC Capital Markets.

The Board of Trustees of the University of Arkansas (Aa2///) is set to price Wednesday $103.300 million of the University of Arkansas for Medical Sciences Northwest various facilities revenue bonds, consisting of $95.145 million of Series 2022A, serials 2029-2042, terms 2047 and 2052 and $8.155 million of Series 2022B, serials 2026-2029. Raymond James & Associates.

Competitive:

Oklahoma City, Oklahoma, is set to sell $110 million of general obligation bonds, Series 2022, at 9:30 a.m. eastern Tuesday.

Danville, Virginia, (Aa3/AA-/AA-/) is set to sell $129 million of general obligation school bonds, Series 2022, at 10:45 a.m. Tuesday.

Louisiana is set to sell $36.960 million of general obligation refunding bonds, Series 2022-B, at 11:15 a.m. eastern Wednesday and $201.415 million of general obligation bonds, Series 2022-A, at 11 a.m. Wednesday.

Boston (Aaa/AAA//) is set to sell $334.315 million of general obligation bonds, 2022 Series A, at 10:30 a.m. Wednesday.

New York City Transitional Finance Authority is set to sell $137.340 million of future tax-secured taxable subordinate bonds, Fiscal 2022 Subseries F-3, at 11:15 a.m. eastern Thursday and $162.660 million of future tax-secured taxable subordinate bonds, Fiscal 2022 Subseries F-2, at 10:45 a.m. Thursday.