Municipals continued the move to lower yields Wednesday as new issues saw strong demand, negotiated deals repriced lower and competitive high-grades moved benchmarks as U.S. Treasuries pared recent losses and broader markets steadied.

Demand for new deals is strong as evidenced by a California general obligation retail offering and the New York City Municipal Water Authority deal. New York City waters are at levels nearly as tight to those pre-pandemic in February 2020. Ten-year bonds priced Wednesday were plus-17 basis points to AAA scales. Bonds priced last year in the 10-year were plus-12.

The focus on Washington, with the U.S. House passage of the

While the Investment Company Institute reported outflows — $568 million for the week ended March 3 — exchange-traded funds saw inflows, rebounding from outflows a week prior. It is likely the Refinitiv Lipper numbers coming Thursday may be more telling of where retail investors' minds are after a week of strength.

“There’s a new paradigm with money coming back into munis,” a New York trader said, noting the post-sell-off rebound triggered the firmness in municipals as the 10-year benchmark Treasury fell to 1.521% as of close of trading Wednesday with a 70% municipal to Treasury ratio.

“There was a fear with the 1.60% yield and inflation talk, and we started trading with the Nasdaq, but now everything has firmed up,” he said.

The municipal to UST 10-year was at 70% and the 30-year at 76%, according to Refinitiv MMD. ICE Data Services showed ratios at 67% in 10 years and 76% in 30. Bloomberg BVAL had the 10-year at 68% and the 30 at 80%.

Secondary trading was strong out of the gates with several high-grade names directly yields lower.

The primary had a stronger story to tell, though. In the largest deal of the week, California offered $1.9 billion of general obligation bonds to retail investors. Shorter five-year calls on 10-year bonds in one tranche saved the issuer 30 basis points to price at 1.01% (through AAAs) with a 5% coupon in 10-years landed at 1.31% (+26 to the AAA scale). Blocks of 5s of 2023 traded at 0.22% in the secondary. Blocks of 5s of 2030 traded at 1.15% versus 1.23%-1.20% Thursday.

California (and a lot of other issuers in the primary) went with smaller coupons out long — 2.5s in 2049 to yield 2.64% and 3s of 2049 at 2.44%. A split in 25 years, 3s of 2046 at 2.41% and 5s of 2046 at 1.89% (+21).

New York City Municipal Water Authority priced for institutions with 13 to 21 basis point bumps from its retail order period. A large block of NYC water 5s of 2050 traded out of the gates at 1.97% (+25 to AAAs). While the issuer isn't offering paper outside of 20 years, 4s of 2036 yield 1.65% and 3s of 2038 landed at 2.10% (+70).

BofA Securities priced for retail investors the GO offering for California (Aa2/AA-/AA/). The first series, $881 million, saw 4s of 2022 at 0.17%, 5s of 2031 at 1.01% (callable in 2026), 5s of 2036 at 1.56%, 3s of 2046 at 2.41%, 5s of 2046 at 1.89%, 2.5s of 2049 at 2.64% and 3s of 2049 at 2.44%. The second series, $966 million of non-callable GOs, saw 5s of 12/2021 at 0.12%, 5s of 2022 at 0.17%, 5s of 2026 at 0.61% and 5s of 2031 at 1.31%.

Loop Capital Markets priced for institutions $583 million of water and sewer system second general resolution revenue bonds for the New York City Municipal Water Finance Authority (Aa1/AA+/AA+/). Bonds in 2025 with a 5% coupon yield 0.48% (-5 basis points from retail), 5s of 2026 ($119 million, the largest tranche) yield 0.63% (-5), 5s and 3s of 2031 at 1.32% (-10), 4s of 2036 at 1.77%, and 3s of 2038 priced to yield 2.10% (-7).

Citigroup Global Markets Inc. priced $417 million of non-AMT and AMT revenue bonds for the Massachusetts Port Authority (Aa2/AA-/AA/). The non-AMT portion, $56 million, saw bonds in 2024 with a 5% coupon yield 0.27%, 5s of 2026 at 0.52%, 5s of 2036 at 1.26%, 5s of 2041 at 1.75%, 5s of 2046 at 1.91% and 5s of 2051 at 1.96%. The $350 million AMT portion had 5s of 2023 at 0.33%, 5s of 2026 at 0.75%, 5s of 2031 at 1.51%, 5s of 2036 at 1.83%, 5s of 2046 at 2.15% and 5s of 2051 at 2.20%.

In the competitive market, Anne Arundel County, Maryland, (Aa1/AAA//), sold $187 million and $69 million of consolidated general improvement Series 2021 to BofA Securities. Bonds in 2021 with a 5% coupon yield 0.07%, 5s of 2026 at 0.48%, 5s of 2031 at 1.10%, 3s of 2036 at 1.58%, 3s of 2041 at 1.81%, 3s of 2046 at 2.11%, 3s of 2050 at 2.15%.

Las Vegas (Aa1/AA//) sold $219.6 million of GO limited tax water refunding bonds to Mesirow Financial in a competitive deal with a true interest cost of 1.1789%, however, the full pricing scale was not yet released at the close of trading.

Omaha, Nebraska, Public School District #001 (Aa2/AA//) sold $140 million of unlimited tax GOs to Raymond James. Bonds in 2025 with a 5% coupon yield 0.41%, 5s of 2026 at 0.53%, 4s of 2031 at 1.19%, 1.75s of 2036 at 1.80%, 2s of 2041 at 1.97% and 2s of 2043 at 2.05%.

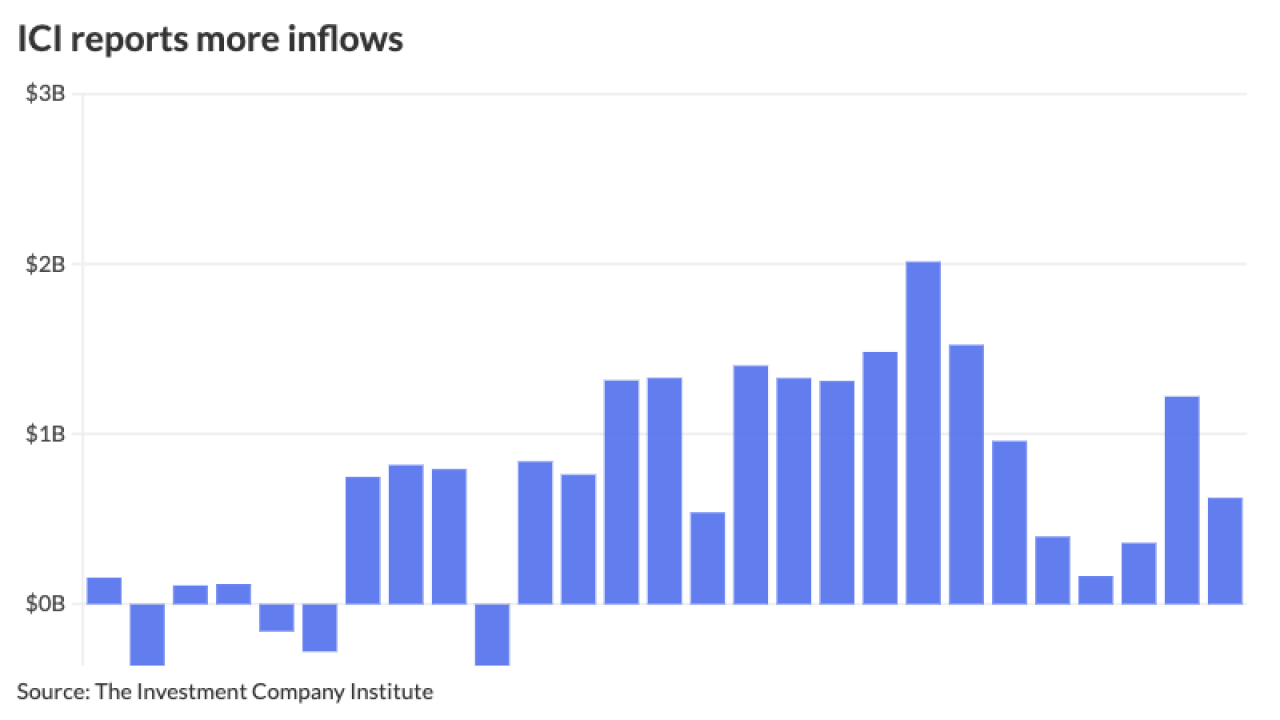

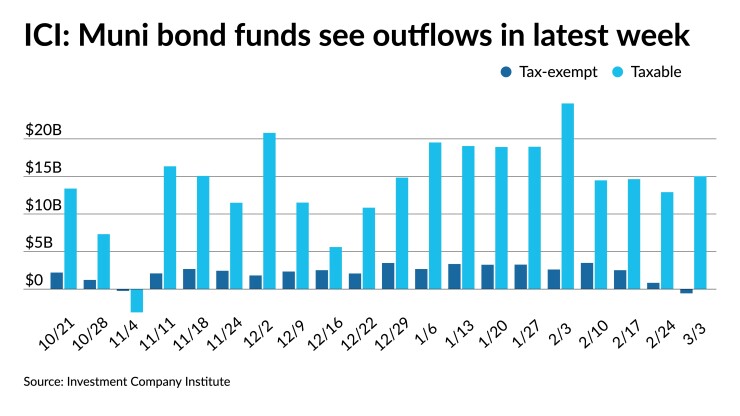

ICI reports outflows

The Investment Company Institute reported $568 million of outflows out of municipal bond mutual funds, but $306 million of inflows into exchange-traded funds for the week ending March 3.

Long-term municipal bond funds and exchange-traded funds saw combined $262 million of outflows in the week ended March 3, ICI reported Wednesday.

In the previous week, muni funds saw a revised inflow of $448 million, ICI said.

Long-term muni funds alone had an outflow of $568 million in the latest reporting week after an inflow of $846 million in the prior week.

ETF muni funds alone saw an inflow of $302 million after an outflow of $398 million in the prior week.

Taxable bond funds saw combined inflows of $14.335 billion in the latest reporting week after an inflow of $11.968 billion in the prior week.

Secondary market

Secondary trades showed stronger prints moving benchmark yields lower again. New York MTA 5s of 2022 traded at 0.25%-0.24%. California GO 5s of 2023 at 0.22%.

Cypress-Fairfax Texas ISD 5s of 2025 traded at 0.39%.

Further out past 10-years, Baltimore County, Maryland, 5s of 2032 traded at 1.15% versus 1.26%-1.25% Thursday. Baltimore County 5s of 2033 at 1.20% versus 1.25% Friday (original 1.30%). Maryland GO 5s of 2033 at 1.17% versus 1.32%-1.31% on March 1. Fairfax County, Virginia, 5s of 2033 at 1.17%. University of Washington 5s of 2033 at 1.25%-1.24%. Maryland GO 5s of 2034 at 1.23%-1.22% versus 1.33% on March 2.

New York City GOs, 5s of 2042 traded at 2.11%. New York City TFA 3s of 2046 at 2.48%. NYC TFA 4s of 2049 at 2.26%. New York City water 5s of 2050 at 1.97%.

New York City GO 5s of 2050 at 2.19% versus 2.24-2.29% Monday. Original 2.41%.

High-grade municipals were stronger across the curve, according to Refinitiv MMD. Short yields remained steady at 0.08% in 2022 but fell two basis points to 0.09% in 2023. The 10-year fell two basis points to 1.05% and the 30-year fell three basis points to 1.68%.

The ICE AAA municipal yield curve showed short maturities at 0.07% in 2022 and 0.12% in 2023. The 10-year fell two basis points to 1.02% while the 30-year yield fell three to 1.71%.

The IHS Markit municipal analytics' AAA curve showed yields steady at 0.06% in 2022 and 0.11% in 2023 with the 10-year at 1.00%, and the 30-year at 1.68%, both two basis points lower.

The Bloomberg BVAL AAA curve showed yields at 0.05% in 2022 and at 0.10% in 2023, while the 10-year fell three to 1.00%, and the 30-year yield fell three to 1.70%.

The 10-year Treasury ended at 1.52% and the 30-year Treasury was yielding 2.25% at the close. The Dow was up 464 points while the S&P 500 rose 0.60% and the Nasdaq fell 0.038%.

Inflation talk

The February consumer price index came in as expected, while the core was below expectations, and analysts expect bigger rises ahead.

“Total inflation was high in February while core inflation appears to still be tame for the time being,” said Bryce Doty, senior vice president and senior portfolio manager at Sit Fixed Income Associates.

CPIU was up 0.4% while the core rose 0.1%. Economists polled by IFR expected the 0.4% rise, but saw core growing 0.2% in the month. In January, CPI rose 0.3% and the core rate was flat. Compared to a year ago, CPI gained 1.7% while the core rose 1.4%.

The vaccine rollout and an economic rebound “is just beginning to be show up in the inflation data,” Doty added. “Core inflation will lag overall inflation, but we expect even core inflation to accelerate in the third and fourth quarters.”

Bond investors will have difficulty “to simply break even this year as rising inflation expectations will continue to drive longer term yields even higher as price declines could easily overwhelm the meager income offered by core bonds right now,” he said.

While yield may be found in taxable and “cyclical leisure and energy bonds,” Doty warned, “don’t get caught reaching for yield by going too far out the yield curve.”

“The main story in the underlying details was the firming in rents and owners' equivalent rents,” according to Morgan Stanley researchers. “This was notable because it suggests more persistent support for inflation in the months ahead if the recovery in shelter in inflation is sustained as we expect, and moreover, the main drags on CPI in February were concentrated in COVID-sensitive categories (e.g. airfares and hotels), which should be leading the rebound in the months ahead as well.”

Sarah House, senior economist at Wells Fargo Securities, agreed: “firming shelter costs in addition to the brightening demand outlook point to the trend in inflation strengthening more definitively soon.”

But, “Inflation remains tepid,” said Diane Swonk, chief economist at Grant Thornton. “It will pick up but we are still a long way from worrying about a persistent rise in inflation.”

Energy costs were about half of the gain, Wells Fargo’s House said, but “food prices continue to outpace broader inflation.”

Although this read is “generally subdued,” she said, “we expect to see more definitive strength in the coming months.”

While the disinflation from shelter costs “appear to be subsiding,” she said, cost pressures will soon be met by increased demand, especially for services. “Input costs according to the [Institute for Supply Management] manufacturing and services surveys are rising at the fastest pace since 2008. With spending picking up again, businesses are better positioned to pass on higher costs.”

Federal Reserve Board Chair Jerome Powell has said the Fed wants to see “actual” inflation before it will taper asset purchases or consider rate hikes.

Inflation going forward “depend critically on the magnitude of the pickup in the economy, whether it is sustained and product pricing behavior, which is influenced by inflationary expectations,” said Berenberg Capital Markets Chief Economist for the U.S. Americas and Asia Mickey Levy. “Inflationary expectations are already on the rise in anticipation of a reopening of the economy and the unprecedented pipeline of fiscal and monetary stimulus.”

Of course, the Fed has stated it’s more worried about the weakness in labor markets than the possibility of runaway inflation. Stifel Chief Economist Lindsey Piegza isn’t convinced that inflation won’t remain tame.

She called the gains in Wednesday’s report “the beginning of a reflation phase” resulting from last year’s declines. "After a few months of increased volatility, however, headline inflation is likely to lose momentum and reinforce the Fed’s somewhat nonchalant approach to inflation."

Also released Wednesday, the U.S. government ran a record $310.9 billion deficit in February up from a $162.8 billion shortage in January and a $235.3 billion deficit a year ago.The year-to-date deficit of $1.047 trillion is a record topping the $652 billion shortage in the same time last fiscal year.

Lynne Funk contributed to this report.