Want unlimited access to top ideas and insights?

The municipal market was once again pummeled as financial and government systems around the world grapple with the growing COVID-19 pandemic.

The short end of the municipal curve was again down by as much as 25 basis points by some reads in the 1- to 5-year on Tuesday with sources citing confusion, dislocated pricing, and benchmarking as trades showed selling pressure on the short end of the curve as investors fought for cash.

Meanwhile, New York City may follow San Francisco and enact a “shelter in place” order within 48 hours, the Mayor Bill de Blasio said Tuesday afternoon, which will likely further disrupt the country’s financial capital.

The Federal Reserve Board moved to bolster confidence and liquidity in U.S. financial markets Tuesday as it established a commercial paper funding facility to support up to $1 trillion for the flow of credit to both businesses and households.

The New York Fed’s Open Market Trading Desk said Tuesday it will conduct additional overnight repurchase agreement operations for same-day settlement each afternoon in the amount of $500 billion for the remainder of this week from 1:30 p.m. to 1:45 p.m.

Additionally, the amount for the overnight repo operations conducted each morning for the remainder of this week will increase to $500 billion.

The federal government looks likely to provide a stimulus package that could include direct payments to U.S. citizens.

“Beyond historic” is how one New York municipal trader described Tuesday’s municipal market as selling soared to record levels.

“Investors are accumulating cash,” the trader said as he worked from home Tuesday, pointing to data early this week to show the excessive amount of cash investors are building amid the coronavirus pandemic that is impacting the market with mounting pressure and volatility.

He noted that the two-year muni-Treasury ratio was over 300% Tuesday morning, beating historic levels.

“A bear flattener is in place as heavy short-end bids-wanted are moving levels by the hour,” said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

Olsan noted that on Monday, short, fixed-coupon implied yields adjusted much higher while longer bonds gave up 3-4 basis points.

"In some cases bidders, needing liquidity, are selling bonds to a single bid," she said. "The overall bid total is not representative of bonds trading from bid lists as the most liquid of credits is likely to draw the best bid.”

Olsan noted that emerging value was evident for available cash, noting that on Monday, pre-refunded California bonds due in 2028 traded +45/AAA and short AAA/UST-backed escrowed bonds were trading at multiples of their U.S. Treasury counterparts.

Bloomberg’s municipal bids-wanted platform rose to 8,885 on Monday, an all-time high since records began in 1996.

Those bids represent $2.3 billion in total par, still above the yearly average of $697 million, but down from a record high of $2.8 billion hit on Thursday, according to Bloomberg.

A total of $24 billion in municipal bonds were traded on Monday, more than double the yearly average, but down lightly from Thursday’s 10-year high of $29.8 billion, according to Bloomberg, quoting trade data from the Municipal Securities Rulemaking Board.

“The muni market is dealing with a major liquidity issue, as the front-end is for sale and spreads are all over the place and longer out trading spreads are better but not reflective of traditional trading spreads,” said one Texas trader.

He said he thought that the longer part of the curve was off 10 to 20 basis points Monday, though Tuesday it still had not improved and may be off more especially in the 10- to 15-year area. He also said he is also hearing SIFMA may reset north of 4%, possibly 5% in the future.

Meanwhile, some participants continue to float the idea of the Fed purchasing munis and the Bond Dealers of America said it is monitoring whether to pursue it.

“The municipal market is clearly suffering. BDA member firms have told us that dealer inventories are full in many cases, that some customers can’t get trades done, selling pressure continues, and hedging in the Treasury market is no longer reliable,” said BDA CEO Mike Nicholas. Nicholas said the BDA is meeting with member firms to consider approaching the Fed and or the Treasury Department about “market-driven solutions to the current issues in the municipal market.”

Taxables also take a hit

It seems like just yesterday when taxables were ruling the roost but now with everything that has taken place, tax-exempts are now “way” more attractive than taxables, sources said.

“Like everything else, the taxable market is completely dislocated,” said one taxable trader. “You’ve got the muni taxable market, the corporate investment grade market and then muni credit corporate CUSIP market and they are all floating around separately. Tax-exempts have been beaten up so much, that they are way more attractive than taxables.”

He noted that back in as early as February, there was a 40%-50% crossover ratio, with mom and pop and SMA and flight-to-safety — buying taxable and they traded well but now, exempts are trading at 90%, well behind taxables and there is resistance to buying taxables from crossover accounts that can buy both exempts and taxables, since insurance companies are buying exempts.

“It’s a bizarre time right now in our market,” he said “There is both pressure and support on tax-exempts at the same time. Nothing is consistent, nothing is the same and nothing makes sense.”

He also said that right now, it all depends on what set of eyes is looking at what set of products at a time.

“It’s hard to make sense of it all; the bottom line is right now tax-exempts are very cheap, relative to the taxable component,” the taxable trader said. “The absolute rate of Treasuries are just so low, it doesn’t make sense and is not the defining factor of why you buy and sell.”

He continued to say that on the long end, it’s a little bit of a different story.

“Out longer, people are buying assets at these wider spreads because they know in six months from now, the investors and products will be there.”

Secondary market

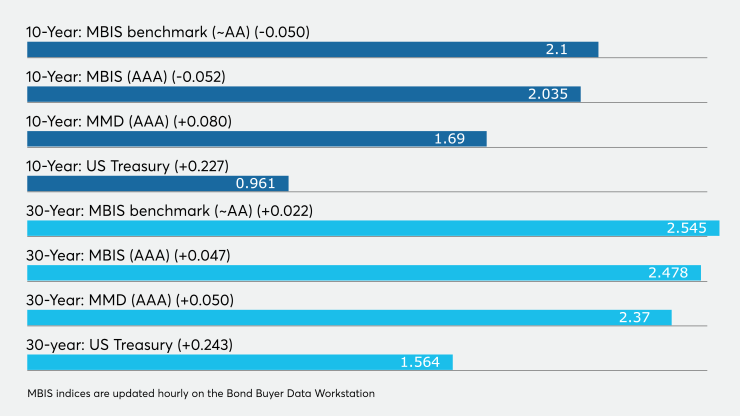

Munis were mixed on Tuesday on the MBIS benchmark scale, with yields falling five basis points in the 10-year and rising by two basis points in the 30-year maturity. High-grades were also mixed, with yields on MBIS' AAA scale decreasing by five basis points in the 10-year maturity and increasing by four basis points in the 30-year maturity.

Munis were weaker on Refinitiv Municipal Market Data’s AAA benchmark scale, as the yield on the 10-year muni GO was eight basis points higher to 1.69%, while the 30 year GO increased five basis points to 2.37%. The short ended was hammered for the second day in a row, as yields rose as much as 15 basis points in the one through six year maturities.

ICE was off by 20 to 22 basis points in the 1-5 year range, 15 to 9 in the 6-10 year range. The long bond was off by four basis points.

BVAL saw the one-year cut by 19 as of publication, the two-year cut 16 and 7 basis points cut in 10-years with 4 basis point cuts on the long bond.

“I feel like there is a disconnect between the level of cuts on MMD/BVAL yesterday and the actual levels that bonds were clearing at … especially in the front end of the curve,” said Eric Kazatsky, municipal strategist at Bloomberg Intelligence. “The tone/market color I have received from around the market yesterday were that rates easily could have been cut by 30 and no one would have argued it was too much.”

The 10-year muni-to-Treasury ratio was calculated at 172.8% while the 30-year muni-to-Treasury ratio stood at 152.5%, according to MMD.

“The ratio doesn’t matter anymore,” said a taxable trader. “On Monday the two-year muni/taxable ratio was trading at 230%, three weeks ago it was 65%. That says it all right there.”

Stocks bounced back Tuesday, as all three major averages were up at least 3%, while Treasury yields were mostly higher. Stocks are added sharply to their gains their early gains after President Donald Trump and his team announced more measures to combat the COVID-19 outbreak.

The Dow Jones Industrial Average was up about 3.56%, the S&P 500 index was lower by 4.51% and the Nasdaq lost roughly 4.76% late in the session on Tuesday.

The three-month Treasury was yielding 0.183%, the Treasury two-year was yielding 0.457%, the five-year was yielding 0.640%, the 10-year was yielding 0.961% and the 30-year was yielding 1.564%.

Christine Albano, Chip Barnett and Lynne Funk contributed to this report.