While municipal issuance

Municipal bond insurance grew 10.4% year-over-year in 2023 leading to the highest market penetration rate since 2008, despite the second year of down issuance.

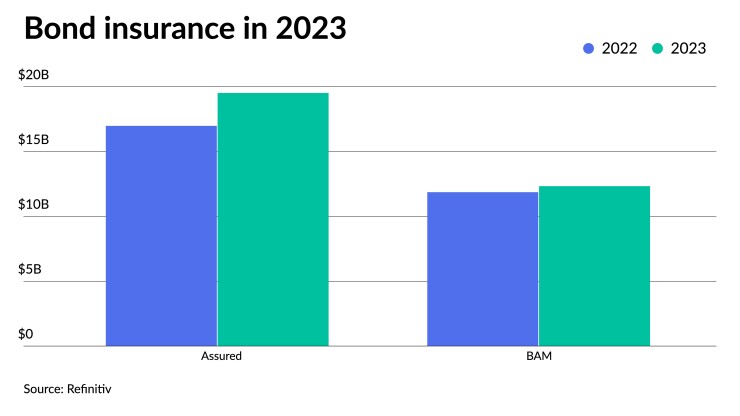

The top two municipal bond insurers wrapped $31.845 billion in 2023, up 10.4% from the $28.847 billion of deals in 2022, according to Refinitiv data.

The industry par amount for the top two insurers was achieved in 1,397 deals in 2023 versus 1,423 deals in 2022.

Insurance penetration for 2023 was 8.8%, the highest level since 2008.

Assured Guaranty accounted for a total of $19.516 billion in 645 deals for a 61.3% market share in 2023, compared to $16.980 billion in 648 deals for a 58.9% market in 2022.

.

Of the $3 billion increase in 2023, Assured accounted for 84.6% of the new issue par increase, said Robert Tucker, senior managing director of investor relations and communications at Assured.

The firm's 14.9% increase in bond insurance year-over-year was helped by several large deals — $1.1 billion of insurance on Dormitory Authority of the State of New York bonds, $800 million on

Furthermore, the firm insured 37 deals with at least a $100 million par amount for a total par of $10.4 billion, signaling "strong institutional demand for our product," he said.

"We believe this heightened demand has proven our product's value across a wide range of transaction sectors, rating levels and deal sizes," he said.

In the AA-rated space, the firm insured 81 AA transactions with a total par of $3.3 billion, 71 of which were insured in the primary market, according to Tucker.

Additionally, Assured has noticed growth in the single-A-rated space, "where insurance was used on more than 30% of 2023 municipal par sold, up from around 20% in the years prior to 2020," he said.

Build America Mutual insured $12.330 billion, or a 38.7% market share, in 752 deals during 2023, compared to $11.867 billion, or a 41.1% market share, in 775 deals in 2022.

The firm's "new-issue par grew even as the market contracted in 2023, supported by strong demand from institutional investors and growing interest from separately managed accounts and other buyers who use insurance as a tool to improve their portfolios' liquidity and ratings stability," said Mike Stanton, head of strategy and communications at BAM.

BAM's activity was "widely distributed geographically and across sectors, with insured transactions from 47 states, including 17 deals with par above $100 million, and more than 50 with par above $50 million," he said.

More than 23% of the insured par was rated AA or stronger, he noted.

Additionally, he said "more than 80% of the par was for new-money transactions, and that trend is continuing into 2024, reflecting strong voter support for bond referendums in 2023 and the opportunity to finance local contributions to broader projects tied to Federal infrastructure legislation."

Notable transactions "included $393 million across two

The rise in bond insurance in 2023, which the fourth quarter helped buoy to a year-over-year increase compared to the

"Investors have been more sensitive to the risk of unexpected economic developments since the onset of the pandemic in 2020, and that growth in recent years reflects both investors' appreciation of the benefits that bond insurance provides, especially during volatile economic or uncertain market conditions, and issuers' recognition of its cost-effectiveness and capacity to increase investor demand and market access," Tucker said.

And with higher interest rates and wider credit spreads, he said "there is greater potential for insurance to provide financing cost savings for issuers."

The increased utilization of bond insurance will continue, Stanton said, noting it is sustainable because insurance has become "more compelling to a wider range of buyers and issuers."

From the investor perspective, he said bond insurance is a tool they can use to manage their overall portfolios.

"It's rating stability and liquidity enhancement, in addition to credit enhancement," Stanton said.

As there is more utilization of bond insurance, he said "you're seeing more bonds traded in the marketplace, and particularly on the liquidity issue, that becomes kind of a reinforcing cycle." "The more investors are seeing an insurance trade in the marketplace, the more comfortable they are with valuations, the more likely they are utilizing going forward," Stanton said.

Tucker added: "The positive momentum we have seen in recent years will continue as insurance is increasingly utilized across a variety of transactions."

Additionally, he noted "that increased institutional demand will likely continue through the greater use of insurance on larger transactions."