Municipal bond buyers continued to see more supply come to market on Wednesday, with some large negotiated deals pricing into a stable yield environment.

"Coming into today, we have had nine straight down days for the muni market. With the backdrop of continued fund flows still and November supply historically lower than October, demand has been solid this week," one Southern trader said. "Absent any headline risk from the impeachment process, China, Brexit, etc., we may have found a comfortable yield range to absorb all of the uptick in supply. "

Primary market

Attention turned to the negotiated market as several large deals hit the screens.

Jefferies priced

JPMorgan Securities priced the

Raymond James & Associated priced the Santa Monica-Malibu Unified School District, Calif.’s (Aaa/AA+/NR/NR) $115 million of Election of 2012 Series E general obligation bonds.

Morgan Stanley priced

Piper Jaffray circulated an indications of interest wire on the Pennsylvania Turnpike Commission’s $280.255 million of taxable (A3/NR/A-/A+) turnpike subordinate revenue refunding bonds First Series of 2019 and taxable (A2/NR/AA-/AA-) motor license fund-enhanced turnpike subordinate special revenue refunding bonds First Series of 2019.

Barclays Capital received the official award on the San Francisco Bay Area Rapid Transit District, Calif.’s (NAF/AA+/AA+/NAF) $303.31 million of sales tax revenue bonds.

BofA Securities received the official award on the Montgomery County Economic Development Authority, Va.’s (Aa2/AA-/NR/NR) $157.655 million of Series 2019B taxable revenue and refunding bonds and Series 2019A tax-exempt revenue bonds for the Virginia Tech Foundation.

One deal that seemed to struggle a bit was the Pennsylvania turnpike deal, according to one market source. "I don’t care for the subordinate series, so I passed," said one Mid-Atlantic trader. "It seems like the deal is struggling a bit, especially on the subs. It makes sense. But the motor license series seemed to be more favored, out of the two."

On Thursday, market attention returns to the competitive arena where several big deals are on tap.

New York’s Empire State Development (Aa1/NR/AA+/NR) is selling $1.7 billion of state sales tax revenue bonds in five offerings for the New York State Urban Development Corp.

The deals consist of $448.465 million of Series 2019A Bidding Group 2 bonds, $417.69 million of Series 2019A Bidding Group 3 bonds, $283.94 million of Series 2019A Bidding Group 1 bonds, $282.825 million of taxable Series 2019B Bidding Group 1 bonds and $233.78 million of taxable Series 2019B Bidding Group 2 bonds. Public Resources Advisory Group is the financial advisor; Nixon Peabody and Bryant Rabbino are the bond counsel.

Also set for sale are Montgomery County, Md.’s (Aaa/AAA/AAA) $320 million of consolidated public improvement bonds of 2019 Series A, the Tulsa Public Facilities Authority, Okla.’s $113.895 million of capital improvement revenue bonds and the City and County of San Francisco, Calif.’s $112.585 million of Series 2019R-1 refunding certificates of participation.

In the negotiated arena, JPMorgan is expected to price Kaiser Permanente's (NR/AA-/AA-/NR) $1 billion of corporate CUSIP taxables and to remarket $748 million of the California Health Facilities Financing Authority's revenue bonds issued through the Statewide Communities Development Authority for Kaiser Permanente.

On Tuesday, Massachusetts (MIG1/SP1+/F1+/NR) sold $1.4 billion of general obligation revenue anticipation notes in three competitive offerings. The net effective interest rate was in the range of 1.19%-1.22%, with seven individual firms being awarded bonds in the sale.

JPMorgan Securities purchased $1.06 billion of the RANs and the other buyers were Barclays Capital ($55 million), Goldman Sachs ($50 million), Jefferies ($25 million), Loop Capital ($25 million), Morgan Stanley ($85 million) and RBC Capital Markets ($100 million).

“There was very strong demand for the offering, with 13 individual firms submitting bids in an aggregate amount of $8.85 billion, which resulted in a highly competitive sale and allowed the commonwealth to achieve near historical low cost of financing,” the state Treasurer’s Office said in an email sent to The Bond Buyer. “This successful sale continues to demonstrate strong and diverse investor demand for the commonwealth’s general obligation notes and bonds.”

Wednesday’s municipal sales

Secondary market

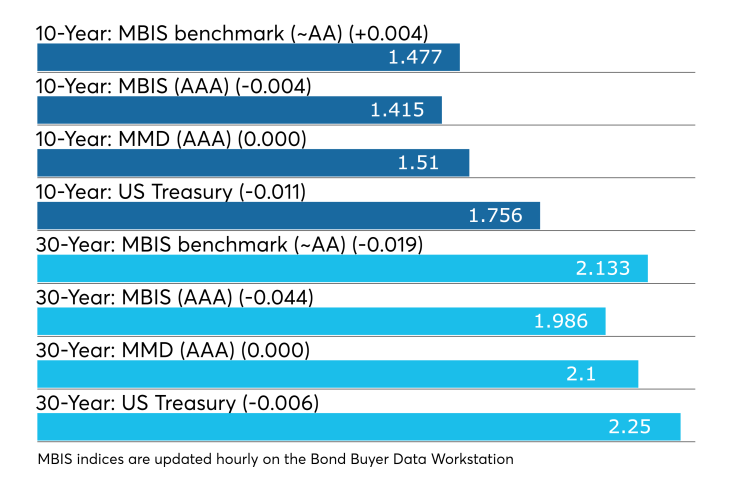

Munis were mixed on the MBIS benchmark scale, with yields rising by less than one basis point in the 10-year maturity and falling by a basis point in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10- and 30-year remained unchanged at 1.51% and 2.10%, respectively.

“The ICE muni yield curve is flat to up one basis point as the market continues to focus on the heavy new issue calendar for the week,” ICE Data Services said in a market comment. “Puerto Rico is unchanged though the commonwealth 8% GO bellwether bonds are up 1/8 point. Tobaccos are mixed and high-yield is unchanged in quiet trading. Taxables are down two basis points.”

The 10-year muni-to-Treasury ratio was calculated at 85.7% while the 30-year muni-to-Treasury ratio stood at 93.3%, according to MMD.

Stocks were trading lower as Treasuries strengthened. The Treasury three-month was yielding 1.664%, the two-year was yielding 1.567%, the five-year was yielding 1.579%, the 10-year was yielding 1.756% and the 30-year was yielding 2.250%.

Previous session's activity

The MSRB reported 32,355 trades Tuesday on volume of $8.94 billion. The 30-day average trade summary showed on a par amount basis of $10.75 million that customers bought $5.87 million, customers sold $3.00 million and interdealer trades totaled $1.87 million.

New York, California and Texas were most traded, with the Empire State taking 15.447% of the market, the Golden State taking 11.899% and the Lone Star State taking 9.34%.

The most actively traded securities were the Rutgers University, N.J.’s taxable 2019R GO 3.27s of 2043, which traded 27 times on volume of $31.21 million.

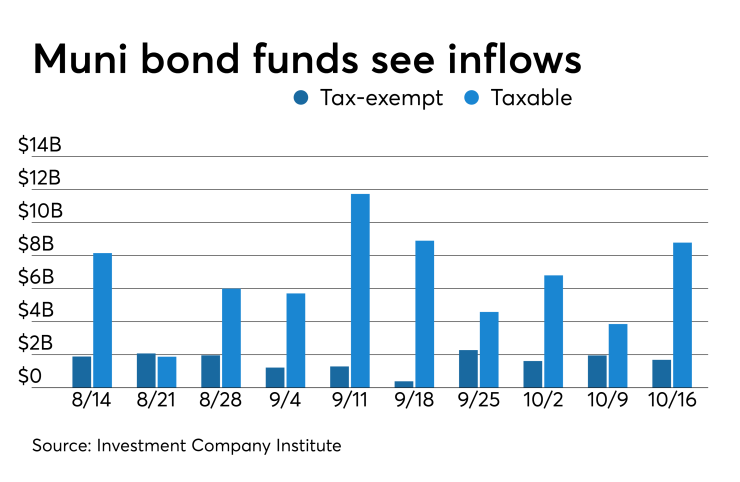

ICI: Muni funds see $1.7B inflow

Long-term municipal bond funds and exchange-traded funds saw a combined inflow of $1.687 billion in the week ended Oct. 16, the Investment Company Institute reported on Wednesday.

It was the 42nd straight week of inflows into the tax-exempt mutual funds and followed an inflow of $1.953 billion in the previous week.

Long-term muni funds alone saw an inflow of $1.520 billion after an inflow of $1.692 billion in the previous week; ETF muni funds alone saw an inflow of $167 million after an inflow of $261 million in the prior week.

Taxable bond funds saw combined inflows of $8.786 billion in the latest reporting week after inflows of $3.856 billion in the previous week.

ICI said the total combined estimated inflows from all long-term mutual funds and ETFs were $10.685 billion after revised outflows of $5.968 billion in the prior week.

Treasury auctions notes

The Treasury Department Wednesday auctioned $41 billion of five-year notes, with a 1.50% coupon, a 1.570% high yield, a price of 99.664649. The bid-to-cover ratio was 2.41.

Tenders at the high yield were allotted 41.35%. All competitive tenders at lower yields were accepted in full. The median yield was 1.528%. The low yield was 1.360%.

Treasury also auctioned $20 billion of two-year floating rate notes with a high discount margin of 0.300%, at a 0.300% spread, a price of par. The bid-to-cover ratio was 2.58.

Tenders at the high margin were allotted 46.35%. The median discount margin was 0.270%. The low discount margin was 0.240%.

The index determination date is Oct. 21 and the index determination rate is 1.630%.

Are we out of the trade woods yet?

Over the near-term, it will be important to assess fresh data points as they are released and to re-evaluate the economic risks within the context of a still-unresolved trade conflict, according to Jeffrey Lipton, managing director of credit research at Oppenheimer & Co. Inc.

"For now, the risk-on/risk-off dynamic is not likely to see a great deal of clarity until we have a more substantive and impactful trade resolution in hand," he said. "Yet we do see continued flows into fixed income as a way to preserve a degree of portfolio stability. Even after a deal is inked, the effects will take some time to materialize and filter throughout the economy."

He added that as the FOMC meets next week, the U.S./China trade developments will be a key discussion point. In our view, the accord should not alter the Fed’s course given its limited and uncertain nature. "It would be prudent for Chair Powell and team to remain focused on a longer term tariff solution that could actually become accretive to growth expectations and renew business sentiment."

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.