The Magnolia State came to market with over $400 million of tax-exempt and taxable general obligation bonds on Thursday in a deal that closed out a busy week for the new-ssue sector.

Quarter-end concerns and hedging volatility added some challenges for the tax-exempt market, but it did not interfere with tax-exempt deal flow, according to Peter Delahunt, managing director of municipals at Raymond James & Associates.

“The volatility in the basis is challenging the liquidity in the market for dealers and hedge funds,” he said. “The divergence between two of the major triple-A benchmark scales — Municipal Market Data and BVAL — adds another wrinkle to pricing bonds.”

Regardless of the challenges, most of the week’s deals were well received, Delahunt said. “Liquidity may get tested as we head into quarter end.”

Primary market

Wells Fargo Securities priced the state of Mississippi’s (Aa2/AA/AA) $235.84 million of Series 2019C taxable GOs while Raymond James & Associates priced the state’s $166.69 million of Series 2019B GOs.

Co-managers included FTN Financial Capital Markets and Stephens for the taxable and Duncan-Williams and JPMorgan Securities for the tax-exempts. The financial advisor was Hilltop Securities while the bond counsel was Butler Snow.

Taxable proceeds will be used for economic development loans, grants and programs while tax-exempt proceeds will be used to finance capital improvements.

Raymond James also priced the Los Altos School District, Santa Clara County, California’s $144.37 million of Election of 2014 Series A GOs comprised of Series 2019A-1 (Aa1/AA+/NR) and Series 2019A-2 (Aa1/AA+/NR) GO taxable and (MIG1/SP1+/NR) GO bond anticipation notes.

Thursday’s bond sales

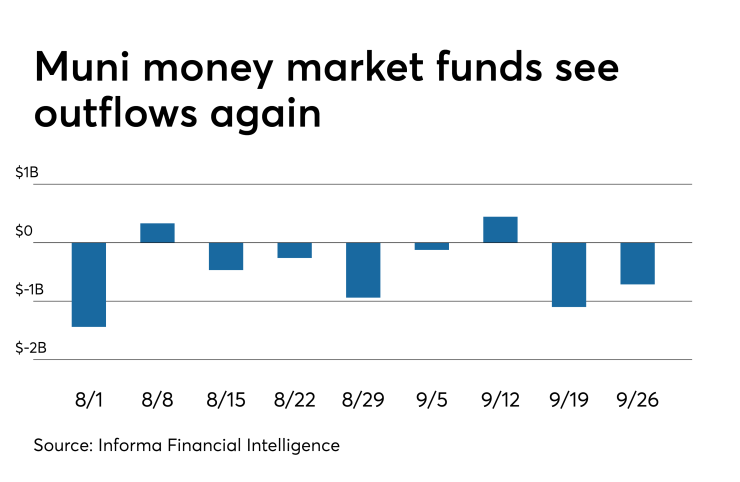

Muni money market funds see outflows again

Tax-exempt municipal money market fund assets declined by $713.4 million, lowering total net assets to $133.26 billion in the week ended Sept. 23, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 191 tax-free and municipal money-market funds increased to 1.02% from 0.92% from the previous week.

Taxable money-fund assets increased by $53.71 billion in the week ended Sept. 24, bringing total net assets to $3.254 trillion. The average, seven-day simple yield for the 807 taxable reporting funds slumped to 1.69% from 1.88% the prior week.

Overall, the combined total net assets of the 998 reporting money funds fell by $53.00 billion to $3.388 trillion in the week ended Sept. 24.

Secondary market

Munis were little changed on the

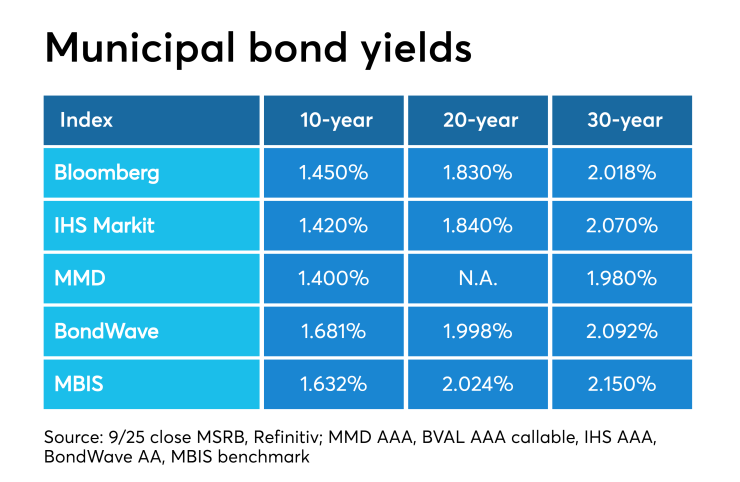

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year rose two basis points to 1.42% as the 30-year increased three basis points to 2.01%.

“The ICE muni yield curve remains inverted with the longer end up two basis points,” ICE Data Services said in a market report. “High-yield is unchanged on very light activity. Puerto Rico bonds are mixed, and the taxable sector is down four to five basis points.”

The 10-year muni-to-Treasury ratio was calculated at 84.2% while the 30-year muni-to-Treasury ratio stood at 94.4%, according to MMD.

Treasuries were stronger as stock prices traded lower. The Treasury three-month was yielding 1.836%, the two-year was yielding 1.651%, the five-year was yielding 1.572%, the 10-year was yielding 1.687% and the 30-year was yielding 2.132%.

“Investors threw Trump’s impeachment drama to the winds and focused on the progress made in trade discussions with Japan and the rising possibility of a trade deal between the U.S. and China amid the world’s most populated country announced it would buy soybeans and pork from U.S. farms earlier this week,” Ipek Ozkardeskaya, senior market analyst at London Capital Group, wrote in a market comment. “President Donald Trump said that there is a ‘good chance’ of reaching an agreement, following China’s commitment to purchase big amounts of U.S. farm products. But Donald Trump remains the major risk to the conclusion of any agreement. A tweet would suffice to shatter the market sentiment, again.”

Previous session's activity

The MSRB reported 35,275 trades Wednesday on volume of $15.22 billion. The 30-day average trade summary showed on a par amount basis of $11.17 million that customers bought $5.98 million, customers sold $3.24 million and interdealer trades totaled $1.95 million.

California New York and Texas were most traded, with the Golden State taking 14.535% of the market, the Empire State taking 11.382% and the Lone Star State taking 10.558%.

The most actively traded security on Wednesday was the New Jersey Transportation Trust Fund Authority Series 2019BB 3.5s of 2046. The bonds, originally priced at 96.786 cents on the dollar to yield 3.69%, were trading at a high price of 100 to yield 3.708% in 136 trades totaling $153.03 million. On Thursday, the bonds were trading at a high of 99.854 with a low yield of 3.508% in 100 trades totaling $6.28 million.

Bond Buyer yield indexes decline

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell four basis points to 3.59% for the week ended Sept. 26 from 3.63% in the previous week.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields fell 10 basis points to 2.66% from 2.76% from the week before.

The 11-bond GO Index of higher-grade 11-year GOs also dropped 10 basis points, to 2.20% from 2.30% the prior week.

The Bond Buyer's Revenue Bond Index declined 10 basis points to 3.14% from 3.33% last week.

The yield on the U.S. Treasury's 10-year note dropped to 1.71% from 1.79% the week before, while the yield on the 30-year Treasury decreased to 2.15% from 2.23%.

Treasury to sell bills next week

The Treasury Department said Thursday it will auction $45 billion 91-day bills and $42 billion 182-day discount bills Monday.

The 91s settle Oct. 3, and are due Jan. 2, 2020, and the 182s settle Oct. 3, and are due April 2, 2020. Currently, there are $62.001 billion 91-days outstanding and no 182s.

Treasury auctions bills, notes

The Treasury Department Thursday auctioned $45 billion of four-week bills at a 1.880% high yield, a price of 99.853778. The coupon equivalent was 1.914%. The bid-to-cover ratio was 2.70. Tenders at the high rate were allotted 99.25%. The median rate was 1.830%. The low rate was 1.800%.

Treasury also auctioned $40 billion of eight-week bills at a 1.860% high yield, a price of 99.710667. The coupon equivalent was 1.896%. The bid-to-cover ratio was 3.09. Tenders at the high rate were allotted 39.42%. The median rate was 1.845%. The low rate was 1.800%.

Treasury also auctioned $32 billion of seven-year notes, with a 1 5/8% coupon, a 1.633% high yield, a price of 99.947285.The bid-to-cover ratio was 2.49. Tenders at the high yield were allotted 61.62%. All competitive tenders at lower yields were accepted in full. The median yield was 1.590%. The low yield was 0.880%.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.