The Wisconsin Center District is asking bankers for financing structure ideas to cover a $250 million convention center expansion that would ideally bypass the need for any state action on taxes.

Broker-dealers have until May 1 to submit proposals under a

Investment bankers are being chosen to work on the development and construction of a convention center expansion that includes assisting with the development of a financing plan that provides the maximum amount of proceeds for the project, according to the RFQ.

“A financing plan has not been crafted yet,” said John Mehan, a managing director at Robert W. Baird & Co. Inc., municipal advisor to the district. “Our approach is to invite ideas based on the known revenue sources and existing debt obligations. The selected investment bank will work with representatives of the Wisconsin Center District and Baird to review options and develop a plan for consideration.”

Potential financing proposals based on specific repayment streams and securities are a requirement of any firm seeking a senior manager role. The district has not ruled out tax increases that would require state approval but it would like to bypass the state, given the Republican legislative majorities' opposition to tax hikes being sought by new Gov. Tony Evers, a Democrat, and growing tensions between the two sides over a new budget.

“The district intends to complete this financing for construction to begin third quarter 2020. Other details and timelines are under development,” reads the RFQ.

The district has eyed an expansion for years, releasing studies that support the need for and benefits of expansion, but financing has been elusive. Backers of the expansion argue that both renovations of the current facilities, which were built in 1998 and 2000, and additional space are needed to remain competitive with other cities and keep current shows and conventions as well as draw new events.

Various consultants’ reports point to expansion and renovation projects recently completed, underway, or being contemplated by competing venues in Columbus, Indianapolis, Louisville, Kansas City, Cincinnati, Grand Rapids, and St. Louis, and expansions that are done or underway to Wisconsin facilities in Green Bay, La Crosse, and Madison.

The district last June released a report commissioned from Crossroads Consulting Services LLC and the architectural firm Populous that laid out plans for a roughly $250 million expansion and facelift for current facilities. It included renderings for an expansion of ballroom, exhibit, and meeting space that would broaden the facilities to more than 400,000 square feet from the complex’s current 266,000 square feet.

The report estimated the local impact of spending by those attending events at the convention center could grow to more than $100 million within three years of completion from a current annual level of $69 million.

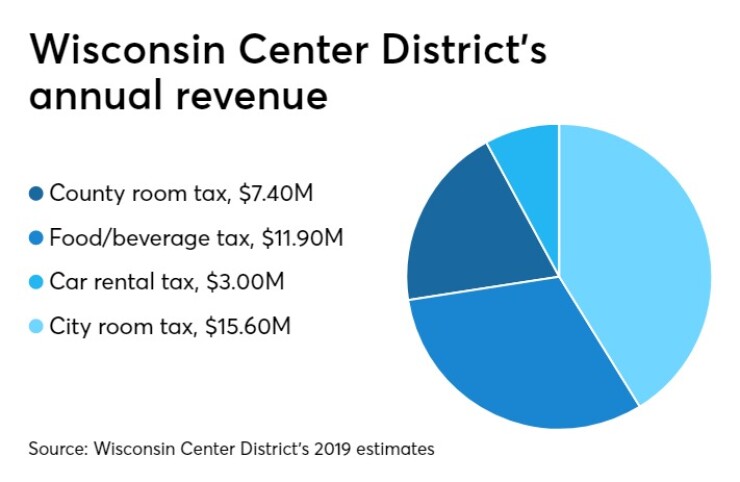

The district receives revenue from a tax on hotel rooms, local food and beverages, and car rentals. Specifically, it collects a 2.5% tax on rooms, 3% on car rentals, and 0.5% on food and beverage sales in Milwaukee County. It also receives a 7% hotel room tax collected in Milwaukee.

Annual tax revenue collected by the district on hotel rooms, rental cars, and food & beverage is projected to grow to between $3.4 million and $3.7 million from $2.2 million depending on the extent of renovations/expansion projects.

Revenue from the sales tax, income tax, and rental vehicle fee that benefits the state government would be expected to grow to between $8.1 million and $8.8 million from $5.5 million if the center expands, according to the report.

The county room, food and beverage and car rental taxes are “restricted” and collections can only be used for debt service, while the additional city hotel tax is unrestricted and can be used for debt service or other costs.

They repay the original convention center debt and additional basketball arena debt added in 2016. The district closed out 2017 with $364 million of long-term debt that is fully retired in 2046.

The existing taxes aren't expected to generate enough money to repay all of the new debt needed for the proposed expansion and possible upgrades to existing facilities while also covering administrative expenses, officials said.

A

About $145 million of annual revenues are projected by 2060. Tax growth has varied depending on the tax from a low of 3.33% on car rentals over the last 10 years to a high of 5.44 % on room taxes.

The district was first established by state legislation in 1994 to build and operate the convention center, now known as the Wisconsin Center, in downtown Milwaukee, and continue operating existing venues which are now known as the University of Wisconsin-Milwaukee Panther Arena and Miller High Life Theatre.

In 2015, the state expanded the district’s authority to issue debt and serve as owner of a new basketball arena for the Milwaukee Bucks. The district in 2016 sold $200 million of debt to help finance the $500 million arena. The Fiserv Forum opened in 2018.

The district is run by a 17-member board appointed by the governor, Milwaukee County executive, Milwaukee mayor and Milwaukee Common Council president. It can issue bonds and collect taxes within strict limits established by statute.

The district is at the maximum on most of its taxes under its existing authority with room only to raise the basic room tax to 3% from its existing 2.5%, which could generate about $1 million annually. It could raise the car rental tax but that’s conditioned on the state meeting a moral obligation pledge on the center’s 1999 bonds.

A higher food and beverage tax remains on the table but it would require state approval and district officials would like to avoid delays that could ensue by requiring state legislative approval.

Republicans have voiced little support for tax hikes and tensions are escalating between Evers, a Democrat, and the GOP leadership of the Assembly and Senate. The GOP has slammed Evers’ two-year operating budget proposal and rejected his capital package, which did not include funds for the convention center. They are focused on crafting their own versions for consideration so any tax increases being sought by the district could get pushed to the backburner.

The district plans to establish a committee to review qualifications and it will report to the board with recommendations. Senior managers' responses are asked to include relevant experience financing other convention center facilities, to provide a case study, additional potential revenue streams, and to discuss the most critical challenges.

Any financing should not exceed 40 years and may include a mix of obligations secured be specific revenue sources, a mix of public offering, private placement, or other bank loans/products, and a mix of fixed-rate obligations and variable-rate products.

Proposals are also asked to consider the value of a potential state moral obligation pledge and insurance. The district is also asking bankers for direction on any possible restructurings or other options to address a shortfall in “restricted” revenue collections between 2020 and 2027.

That doesn’t mean there’s a debt service shortfall because when the “unrestricted” revenue that comes from the additional city hotel tax there’s sufficient revenues to cover debt service.

The three restricted revenues account for $22.4 million of the $38 million expected this year and unrestricted funds account for $15.6 million.

“Although the general resolution allows the district to utilize restricted and unrestricted revenues to pay for debt service on the district’s obligations, the district’s intent is to utilize only restricted revenues for debt service with unrestricted revenues utilized for operations,” says the RFQ. “As such, proposers should assume that only restricted revenues are available for the plan of finance.”