The Municipal Electric Authority of Georgia voted unanimously Monday to move forward with construction of two nuclear reactors at Plant Vogtle.

Three of four co-owners that invested in units 3 and 4 have agreed to move forward with the project, a decision required because of last month’s announcement that the completion cost has escalated by more than $2 billion. That brings the total project cost to about $27 billion.

MEAG’s board spent a more than an hour in private discussion Monday, before publicly announcing its approval was based on a complete analysis of its new completion cost as well as its “impact on the lives of people across Georgia as well as a significant portion of Florida and Alabama.”

In addition to examining a financial analysis, MEAG board member L. Keith Brady, who is mayor of Newnan, Georgia, also said risks related to future carbon emission costs and diversifying fuel generation were also considered.

There was no public discussion about specific cost estimates that MEAG may have developed as part of its deliberations.

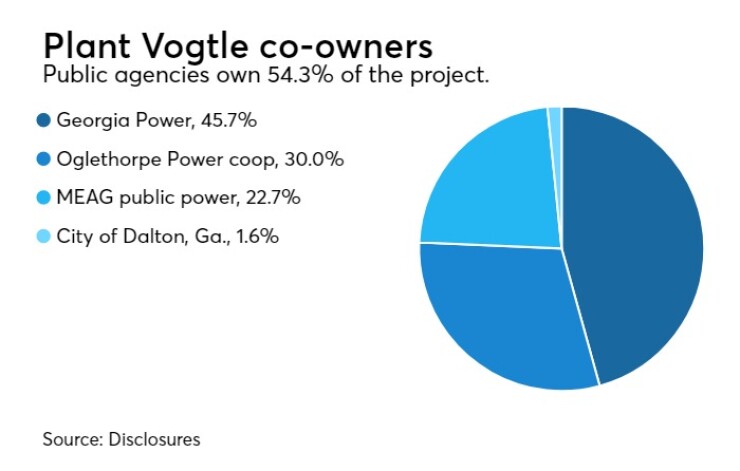

MEAG owns a 22.7% ownership interest in the project. To finance its costs to date, MEAG has issued $2.9 billion of Project J, M and P Vogtle revenue bonds and $1.2 billion of U.S. Department of Energy loan guarantees outstanding as of Dec. 31, 2017.

Georgia Power Co., an investor-owned utility that owns 45.7% of the project and is taking the lead on construction, had already determined it wanted to complete the reactors. GPC said it planned to absorb its half of the $2 billion increase without seeking a rate increase from the Georgia Public Service Commission.

The city of Dalton, Georgia, which owns a 1.6% stake, has also voted for construction to continue, according to MEAG.

A critical “yes” vote by Oglethorpe Power Corp., is necessary for the project to move forward. Affirmative votes from owners of at least 90% of the Vogtle project are needed to move forward.

Oglethorpe, a cooperative with 38 members in Georgia and a 30% interest in the project, did not respond to a request for information about when a vote would be taken.

Last month, Oglethorpe said in a release that the increase in construction cost on its budget for Units 3 and 4 at Plant Vogtle was expected to be “muted” due to a conservative contingency in the existing $7 billion budget for the project.

Last week, MEAG held a public hearing to take testimony for and against the project.

A representative of Alabama’s PowerSouth said it supported continuing construction. PowerSouth has a take-or-pay power purchase agreement with MEAG to pay for a portion of debt service and nuclear-generated power over 20 years.

JEA of Jacksonville, Florida, which also has a 20-year PPA with MEAG, has filed a lawsuit in a Florida state court seeking to repudiate its agreement. MEAG has filed a federal suit seeking to enforce the PPA.

JEA purchased a full-page advertisement in Georgia’s Marietta Daily Journal telling readers that “the Plant Vogtle nuclear expansion project is a mistake that will cost you and your children for years to come. Act now to stop this historic misuse of your money.”

On Monday, JEA

JEA said it has its payments timely under the PPA, and “JEA’s board and management intends to continue to do so unless and until a court invalidates the Vogtle PPA.”

Last week, JEA asked the Federal Energy Regulatory Commission to weigh in on the 20-year power purchase agreement, even though both utilities are typically exempt from FERC’s review.

Georgia Gov. Nathan Deal sent letters to each co-owners last week asking them to move forward with the project.

The Department of Energy, which has loan guarantees with GPC, MEAG and Oglethorpe, also wrote to the owners saying that if the project were to be canceled, the agency could accelerate repayment of their obligations.

A similar twin reactor project in South Carolina was scuttled last year because of rising costs.