The municipal bond market saw dozens of deals hit the screens on Wednesday, with offerings from Massachusetts and New York issuers headlining the supply slate.

Primary market

Citigroup priced the

The deal was priced for retail investors on Tuesday.

“The preliminary 10-year yield (5% coupon) was 1.78% on the tax-free bonds and 2.03% for the AMT series, a 25 basis point yield pickup for investors who are not subject to the alternative minimum tax,” Janney Managing Director Alan Schankel noted on the retail pricing in a Wednesday market comment.

BofA Securities and Loop Capital Markets are co-managers on the deal, while PFM is the municipal advisor. Kaplan Kirsch Rockwell and Foley & Lardner are the bond counsel.

Barclays Capital priced and repriced the New York City Municipal Water Finance Authority’s (Aa1/AA+/AA+) $450 million of tax-exempt fixed-rate second general resolution revenue bonds for institutions. The deal was priced for retail investors on Tuesday.

BofA Securities priced the Michigan State Housing Development Authority’s (NR/AA/NR) $201.235 million of Series 2019A-1 rental housing revenue bonds non-AMT bonds.

JPMorgan Securities priced and repriced the Wylie Independent School District, Collin County, Texas’ (PSF: Aaa/NR/NR) $158.985 million of Series 2019A unlimited tax school building bonds

Wells Fargo Securities priced and repriced Charleston, South Carolina’s (Aaa/AAA/NR) $129.03 million of Series 2019 waterworks and sewer system capital improvement revenue bonds.

Wells Fargo priced the New York State Housing Finance Agency’s (Aa2/NR/NR) $82.37 million of Series 2019K affordable housing revenue sustainability bonds and Series 2019L affordable housing revenue climate bond certified/sustainability bonds.

Massports, Charleston, and the New York State Housing Finance Agency deals used BVAL AAA callable curve as the primary pricing.

The Charleston deal saw very strong reception, according to Edward Boyles, managing director at Wells Fargo.

"We were fortunate to have strong orders and subscription, giving us the ability to reprice to the good side," Boyles said. "The trend continues in terms of a good market for issuers to be going into."

He added that the deal was oversubscribed from top to bottom but wasn't convinced pricing the deal to BVAL was a factor in demand.

"I'm not sure it made a difference, for the most part, supply and demand and basic economic principles that were put to work in this case," he said. "BVAL is a good and useful index but I can't say the deal would have gotten better or worse if we had gone with MMD."

A southern trader added that in his opinion, the MMD and BVAL scales are not materially different enough, at this point in time, to where you would see pricing anomalies on deals, especially highly rated deals like Charleston water deal.

Various market participants made clear that throughout the course of planning to price a deal, multiple pricing tools are considered. However, come the actual pricing, a primary curve is chosen. MMD has been the go-to primary pricing tool for the vast majority of primary offerings, including those done this week.

BofA priced and repriced the Hawaiian Electric Co. and its subsidiary’s (Baa2E/NR/A-E) $150 million of refunding Series 2019 special-purpose revenue bonds for the State Department of Budget and Finance.

In the competitive arena, Virginia Beach, Virginia, (Aaa/AAA/AAA) sold $155.955 million of Series 2019A unlimited tax general obligation public improvement bonds. Morgan Stanley won the bonds with a true interest cost of 2.1062%. Proceeds will be used to finance various capital projects and to refund certain outstanding debt. Public Resources Advisory Group is the financial advisors; Kutak Rock is the bond counsel.

The Folsom Cordova Unified School District, Calif., (A2/AA-/NR) sold $150 million of Series D Election of 2007 GOs for School Facilities Improvement District No. 3. RBC Capital Markets won the bonds with a TIC of 3.4536%. Proceeds will be used to finance the acquisition, construction and repair of school district sites and facilities. KNN Public Finance is the financial advisors; Stradling Yocca is the bond counsel.

Houston, Texas, (NR/NR/F1+) sold $200 million of Series 2019 tax and revenue anticipation notes. JPMorgan and Wells Fargo won the deal.

Wednesday’s bond sales

Secondary market

Munis were stronger in late trade on the

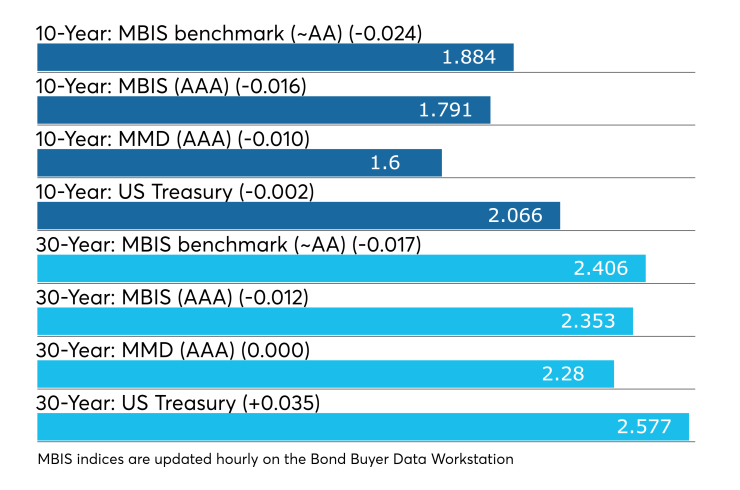

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO fell one basis pint to 1.60% while the yield on the 30-year remained unchanged at 2.28%.

"Municipal bonds are experiencing a curve-steepening rally today, along with the Treasury market," ICE Data Service said in a Wednesday market comment. "The ICE muni yield curve is two basis points lower in the short end out to six-year and one basis point lower out to 15-years. The longer end is within 1/2 basis point of yesterday’s levels. The curve is pivoting at the 20-year mark with longer maturities exhibiting a slight upward bias. Taxables are experiencing the same pivot with the one-year down almost eight basis points while the 30-year is up two basis points. Puerto Rico, high-yield and tobaccos are unchanged."

The 10-year muni-to-Treasury ratio was calculated at 77.6% while the 30-year muni-to-Treasury ratio stood at 88.7%, according to MMD.

Treasuries were mixed as stocks traded mixed. The Treasury three-month was yielding 2.194%, the two-year was yielding 1.828%, the five-year was yielding 1.838%, the 10-year was yielding 2.066% and the 30-year was yielding 2.577%.

"It was deja vu all over again in munis for June as inflows remained positive, yields fell and new supply was easily and eagerly absorbed,” ICE Data Services said in a monthly review. “Muni funds again had positive inflows for every week of the month. $33.19 billion worth of new issue paper came to market and was taken down swiftly by mutual funds flush with cash. Yields were one to three basis points lower per the ICE muni yield curve. Muni/Treasury ratios were mixed with the 10-year rising to 82% from 76% while the 30-year fell from 92% to 91%.”

Previous session's activity

The MSRB reported 38,811 trades Tuesday on volume of $12.05 billion. The 30-day average trade summary showed on a par amount basis of $11.69 million that customers bought $6.18 million, customers sold $3.55 million and interdealer trades totaled $1.97 million.

California, New York and Texas were most traded, with the Golden State taking 17.224% of the market, the Empire State taking 10.565% and the Lone Star State taking 9.258%.

The most actively traded security was the Los Angeles 2019 TRAN 5s of 2020, which traded 24 times on volume of $52.81 million.

CUSIP requests rise 5.2% in June

For the sixth straight month, requests for municipal CUSIPs increased, according to CUSIP Global Services.

Muni CUSIP requests rose 5.2% in June after gaining 41.4% in May, signaling an uptick in new issuance in the near term, the company said on Wednesday.

The aggregate total of all municipal securities — including municipal bonds, long-term and short-term notes, and commercial paper — increased to 1,513 last month from 1,438 in May.

“With the 10-year U.S. Treasury benchmark hovering at around 2%, municipal issuers are clearly taking advantage of the low rate environment to raise new debt," said Gerard Faulkner, director of operations for CUSIP Global Services. "Though activity across most asset classes was muted in June, municipal request volume may continue to increase in the second half of the year.”

Drilling down, request for municipal bond identifiers slipped to 1,105 in June from 1,195 in May, while long-term notes increased to 61 from 41 and short-term notes rose to 245 from 145 as commercial paper and other securities gained to 97 from 57.

On a year-over-year basis, total muni requests rose 7.5% to 6,708 from 6,238 in the same period in 2018 while muni bond requests were up 5.5% to 5,366 from 5,086 in the same time last year.

Among top state issuers, CUSIPs for scheduled public finance offerings from New York, California and Texas were the most active. Among leading state activity, CUSIP orders for scheduled public finance offerings from New York issuers were the most active in June with 236.

ICI: Muni funds see $1.6B inflow

Long-term municipal bond funds and exchange-traded funds saw a combined inflow of $1.626 billion in the week ended July 2, the Investment Company Institute reported on Wednesday.

It was the 26th straight week of inflows into the tax-exempt mutual funds and followed an inflow of $2.517 billion in the previous week.

Long-term muni funds alone saw an inflow of $1.456 billion after an inflow of $2.215 billion in the previous week; ETF muni funds alone saw an inflow of $170 million after an inflow of $302 million in the prior week.

Taxable bond funds saw combined inflows of $8.814 billion in the latest reporting week after inflows of $8.011 billion in the previous week.

ICI said the total combined estimated outflows from all long-term mutual funds and ETFs were $18.735 billion after inflows of $1.454 billion in the prior week. Equity funds saw the biggest outflows in the week, as investors withdrew $28.759 billion of cash from the funds.

Treasury sells notes

The Treasury Department auctioned $24 billion of 9-year 10-month notes with a 2 3/8% coupon at a 2.064% high yield, a price of 102.752671. The bid-to-cover ratio was 2.41.

Tenders at the high yield were allotted 2.74%. All competitive tenders at lower yields were accepted in full. The median yield was 2.030%. The low yield was 1.950%.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.