Municipals were little changed Friday as the market took a breather ahead of one of the largest new-issue calendars of the year with bellwether names coming in four deals that total over $1 billion each. U.S. Treasuries returned to a flight-to-safety bid and made gains while equities closed the week mixed.

The new-issue muni calendar soars to an estimated $11.486 billion next week with $7.537 billion of negotiated deals on tap and $3.949 billion on the competitive calendar.

On the heels of an upgrade from KBRA to AAA,

The competitive calendar is led by Massachusetts with $1.5 billion of general obligation bonds in five deals, followed by $1.2 billion of state sales tax revenue bonds from the Empire State Development in four deals.

Volatility led to swings in USTs this week, as govies rallied about 20-30 basis points on the back of the weekend's developments in the Middle East, as well as some supportive statements by policymakers, then "gave back quite a bit of ground after stronger CPI and PPI data releases, and rallied again on Friday on geopolitical concerns," according to a Barclays PLC weekly report.

Barclays' rate strategists Mikhail Foux, Clare Pickering and Mayur Patel "point to higher term premia and heavy Treasury supply in 2H23 as the main reasons for recent UST underperformance."

Outside of the current flight to quality, they said "the economy remains relatively strong, and pressure on rates will likely persist if the crisis in the Middle East remains contained."

Munis surprised to the upside this week, they noted.

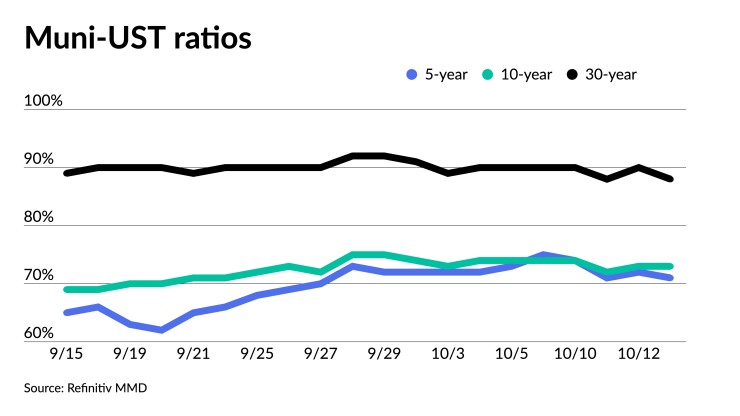

"The market felt a bit vulnerable going into this week but has performed remarkably well, as tax-exempts not only kept pace with the UST rally, but outperformed by a wide margin after the post-CPI Treasury selloff, with MMD-UST ratios declining along the curve," they said.

The two-year muni-to-Treasury ratio Friday was at 70%, the three-year was at 70%, the five-year at 71%, the 10-year at 73% and the 30-year at 88%, according to Refinitiv Municipal Market Data's 3 p.m., ET, read. ICE Data Services had the two-year at 70%, the three-year at 71%, the five-year at 70%, the 10-year at 71% and the 30-year at 88% at 4 p.m.

As valuations got richer after muni outperformance, Barclays strategists said they expect munis to be "truly tested in the next several weeks, with supply picking up, as widely expected during this time of the year," they said.

Bond Buyer 30-day visible supply sits at $17.8 billion.

Some investors have already begun "preparing for that, trimming their positions, and bid-wanted activity has reached its highest point this year, as a number of investors have been selling into strength," they said.

For munis, challenges around liquidity persist, said Stephen Shutz, head of tax-exempt fixed income at Brown Advisory.

"Generally you can transact; it's fine," he said. "However, sourcing bonds can become particularly challenging."

Supply is low, and while "deals are getting done reasonably well, regardless of the intraday moves and rates, but when you had a couple of days of strong moves lower in interest rates, you know, there was a scarcity of sellers," Shutz said.

Furthermore, a week ago there seemed to be a scarcity of buyers, he noted.

And while supply appears to be picking up in the fall, "it hasn't been that heavy and the deals continue to be well subscribed," he noted.

It tends to be higher-quality deals generally this year, and there have been fewer triple-B or non-rated high-yield deals in the market, according to Shutz.

High-grade deals are getting bought.

The Triborough Bridge and Tunnel's

The "deal activity, while it's below sort of five-year and longer averages in terms of the volume of new-issue supply, from a technical standpoint, it seems like the deals are continuing to get done pretty easily," he said.

For demand, until muni fund flows reverse and start to become positive, "you'll just continue to see the long end at cheaper relative value because there are not enough natural buyers of long-duration munis right now," he said.

"You don't have insurance companies, or other corporate type investors involved in long maturity munis, so mutual fund and portfolio managers are really the only ones buying and, they've been net sellers over the last couple of years," Shutz said.

And since mutual fund flows have not returned, Shutz said this keeps the curve "pretty steep."

However, Barclays strategists noted has "the muni index yield curve has notably dis-inverted in the front end, and the long end has continued outperforming since early summer, as tax-exempt issuance remains front-loaded."

They expect these dynamics to continue, and the curve still "has about 15-20bp to normalize to its pre-selloff levels," they said.

They think "that investors should be relatively long in November; however, as municipal valuations have become richer this week, rates remain volatile, and supply should be quite heavy in the next several weeks, the muni market would likely come under pressure."

If valuations cheapen enough, Barclays strategists said it might be a good buying opportunity.

AAA scales

Refinitiv MMD's scale was unchanged: The one-year was at 3.61% and 3.53% in two years. The five-year was at 3.29%, the 10-year at 3.36% and the 30-year at 4.24% at 3 p.m.

The ICE AAA yield curve was softer in spots: 3.62% (unch) in 2024 and 3.56% (unch) in 2025. The five-year was at 3.33% (unch), the 10-year was at 3.35% (unch) and the 30-year was at 4.28% (+2) at 4 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 3.64% in 2024 and 3.56% in 2025. The five-year was at 3.33%, the 10-year was at 3.37% and the 30-year yield was at 4.25%, according to a 3 p.m. read.

Bloomberg BVAL was little changed: 3.65% (unch) in 2024 and 3.58% (unch) in 2025. The five-year at 3.34% (unch),the 10-year at 3.41% (unch) and the 30-year at 4.38% (unch) at 4 p.m.

Treasuries improved.

The two-year UST was yielding 5.052% (-2), the three-year was at 4.815% (-3), the five-year at 4.639% (-6), the 10-year at 4.619% (-9), the 20-year at 4.971% (-10) and the 30-year Treasury was yielding 4.762% (-11) at the close.

Primary to come:

Connecticut (Aa3/AA/AA-/AAA/) is set to price Wednesday

The New York City Transitional Finance Authority (Aa1/AAA/AAA/) is set to price Wednesday $1 billion of future tax-secured tax-exempt subordinate bonds, Fiscal 2024 Series C, serials 2025-2048, term 2053. Ramirez & Co.

The California Community Choice Financing Authority (Aa3///) is set to price next week $600 million of green clean energy project revenue bonds, Series 2023F. Goldman Sachs.

The Wellstar Health System, Georgia, is set to price Wednesday $547.190 million of revenue bonds and revenue anticipation certificates, consisting of $296.195 million of Series 2023A (A2/A+//), terms 2048 and 2053; $56.935 million of Series 2023B (Aa1/AAA//), serials 2024-2043; $114.130 million of Series 2023A (A2/A+//), serials 2024, 2027-2032, 2041-2043 and 2053; and $79.93 million of Series 2023A (A2/A+//), term 2053. BofA Securities.

The Oklahoma Turnpike Authority (Aa3/AA-/AA-/) is set to price Tuesday $500 million of Oklahoma Turnpike System second senior revenue bonds, serials 2032-2043, terms 2048 and 2053. RBC Capital Markets.

The School District of Philadelphia is set to price Wednesday $400 million of tax revenue anticipation notes, Series A of 2023-2024, serials 2024. BofA Securities.

The school district (A1//A+/) is also set to price Wednesday $332.450 million of GOs, consisting of $284.995 million of Series A, serials 2024-2043, term 2048, and $47.495 million of Series B, serials 2024-2043, term 2048. RBC Capital Markets.

The West Virginia Hospital Finance Authority (Baa1/BBB+//) is set to price Thursday $384.555 million of hospital refunding and improvement revenue bonds (Vandalia Health Group), Series 2023B, serials 2040-2043, terms 2048 and 2053. BofA Securities.

San Antonio, Texas (Aa2/AA/AA/), is set to price Tuesday $297.230 million of Electric and Gas Systems revenue refunding bonds, New Series 2023C, serials 2024-2044. Siebert Williams Shank & Co.

Charlotte, North Carolina (Aaa/AAA/AAA/), is set to price Thursday $219.785 million of GO refunding bonds, Series 2023B, serials 2024-2043. PNC Capital Markets.

The Arlington County Industrial Development Authority, Virginia (/AA+/AA+/), is set to price Wednesday $165.635 million of taxable Series 2023A and tax-exempt Series 2023B County Barcroft Projects revenue bonds, J.P. Morgan Securities LLC.

The New Mexico Finance Authority (Aa1/AAA//) is set to price Wednesday $162.945 million of Public Project Revolving Fund senior lien revenue bonds, Series 2023B. Morgan Stanley.

The Brownsburg 1999 School Building Corp., Indiana (/AA+//), is set to price Thursday $160.1 million of ad valorem property tax first mortgage bonds, serials 2027-2043. Stifel, Nicolaus & Co.

Cape Coral, Florida (/AA//), is set to price Thursday $138.085 million of Build America Mutual-insured utility improvement assessment refunding bonds (North 1 West Area), Series 2023. Morgan Stanley.

The Washington State Housing Finance Commission (/BBB//) is set to price Thursday $134.06 million of Seattle Academy of Arts and Sciences Project nonprofit revenue and refunding revenue bonds. Piper Sandler & Co.

The Colorado School of Mines Board of Trustees (A1/A+//) is set to price Thursday $133.53 million of institutional enterprise revenue bonds, consisting of $50.06 million of fixed-rate bonds, Series 2023C, and $83.47 million of term-rate bonds, Series 2023D. Morgan Stanley & Co.

The Conroe Independent School District is set to price Thursday $104.98 million of unlimited tax refunding bonds, consisting of $92.225 million of PSF-insured bonds, Series 2023A, and $12.755 million on non-PSF-insured bonds, Series 2023B. Piper Sandler & Co.

The Ohio Water Development Authority (Aaa/AAA//) is set to price Tuesday $100 million Series 2023A fresh water revenue bonds, serials 2032-2036, terms 2037, 2038, 2039, 2040 and 2041. Loop Capital Markets.

The New Mexico Mortgage Finance Authority (Aaa///) is set to price Thursday $100 million of tax-exempt non-AMT single family mortgage program Class I bonds, 2023 Series D, serials 2025-2035, terms 2038, 2043, 2048, 2053 and 2054. RBC Capital Markets.

Competitive

The City and County of San Francisco (Aa1/AA+/AA/) is set to sell $103.92 million of taxable Affordable Housing and Community Facilities Projects certificates of participation, Series 2023A, at 11:15 a.m. eastern Tuesday, and $79.345 million of tax-exempt Multiple Capital Improvement Projects certificates of participation, Series 2023B, at 11:45 a.m. Tuesday.

Massachusetts (Aa1/AA+/AA+/) is set to sell $550 million of GOs, consolidated loan of 2023, Series D, at 11 a.m. eastern Tuesday; $275 million of GO bonds, consolidated loan of 2023, Series B, at 10 a.m. Tuesday; $260 million of taxable GOs, consolidated loan of 2023, Series E, at 11:30 a.m. eastern; $200 million of GOs, consolidated loan of 2023, Series C, at 10:30 a.m. Tuesday; and $188.705 million of GO refunding bonds, Series C, at 12 p.m. Tuesday.

The Empire State Development, New York (Aa1//AA+/) is set to sell $377.825 million of state sales tax revenue bonds, Series 2023A (Bidding Group 2 bonds), at 11 a.m. eastern Thursday; $347.595 million of state sales tax revenue bonds, Series 2023A (Bidding Group 4 bonds), at 12 p.m. Thursday; $270.365 million of state sales tax revenue bonds, Series 2023A (Bidding Group 3 bonds), at 11:30 a.m. Thursday; and #213.51 million of state sales tax revenue bonds, Series 2023A (Bidding Group 1 bonds), at 10:30 a.m. Thursday.