Want unlimited access to top ideas and insights?

Illinois paper is gaining ground due to scant supply and a hunger for yield combined with recent fiscal developments that should help the state hold on to its investment grade rating in the near term.

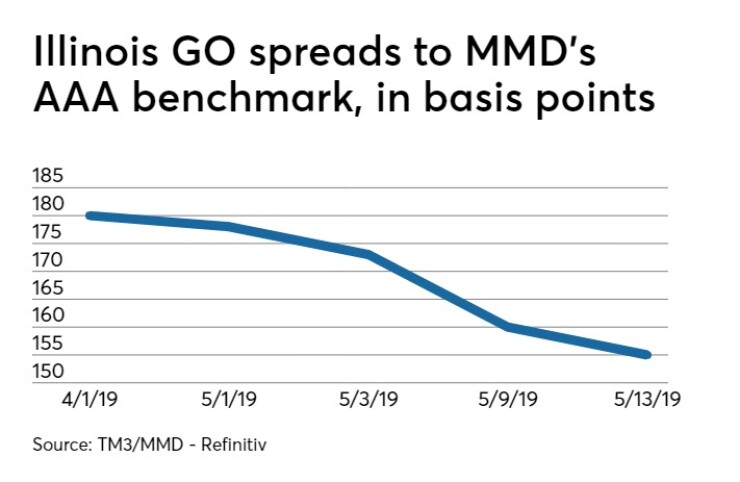

Investor appeal has driven a narrowing of state spreads that remain the highest among states. They fluctuate in tandem with market appetites and state fiscal developments that stand to influence its weak ratings that are just one to two notches above junk.

Municipal Market Data tightened state spreads by 10 to 20 basis points along the curve late last week.

“Presumably yield-hungry investors feel that the sixth-largest state (in terms of population) has an appealing spread that might tighten should its tax structure change,” MMD senior market strategist Dan Berger wrote in a column Friday.

Maturities late last week settled at a 160 basis point spread to MMD’s AAA benchmark on maturities between 2027 and 2034, compared to a prior spread of 173 bps. The 2021 shrunk to 100 bps from 120. Long bonds narrowed to 155 bps from 166 bps.

The narrowing continued this week. On Monday, Berger said the 10-year shaved another five basis points of the spread leaving it at 155 bps over MMD. “It could get even lower as investors seeking ‘value’ are chasing higher-yielding debt,” Berger said Tuesday.

The 10-year spread is closing in on Illinois’ three-year low of 153 basis points over MMD on July 20, 2018.

On May 1, the Illinois Senate voted to send a constitutional amendment to voters to allow progressive income tax rates which could raise $3.4 billion of new annual revenue under first-year Gov. J.B. Pritzker’s accompanying rate proposal. House approval is still needed to put the measure to the ballot in 2020.

The state opened May with its 10-year generally trading at a 178 bp spread and 168 bps on the long end. By the end of the week, after the market digested the graduated tax vote, the 10-year was set at a 173 bp spread and long bond at 166 bps.

Last Wednesday, the state announced a $1.5 billion revenue windfall for April and the administration canceled plans to re-amortize the state’s pension funding schedule, which would have lowered its 2020 pension contribution by $1.1 billion. The proposal had concerned some analysts, who believed it threatened the state’s investment-grade status. The state also dropped plans to issue $2 billion of pension obligation bonds although that was not viewed as a rating threat.

Rating agencies have offered positive assessments of the latest developments, even though they provide only short-term salve to the state’s deep fiscal woes. The positive sentiments, coupled with what market participants describe as a dearth of supply and hunt for high-yielding paper, drove the more recent narrowing.

“I think trade activity has reflected both newsworthy events," such as the Senate’s passage of the graduated tax and the administration’s decision to make the full $9 billion 2020 pension contribution, said IHS Market strategist Edward Lee. “IHS Markit has noted that trade activity has been positive during the course of these events.”

“The municipal market is up as a whole,” he added.

One trade Monday of a taxable 2035 bond settled at 316 bps over Treasuries compared to a prior trade of 320 bps. A tax-exempt 2020 bond narrowed to a spread of 62 bps from 83 and a tax-exempt 2026 bonds narrowed to 141 bps from 149 bps, Lee said.

One buyside firm said in a report that Illinois had especially benefitted from low supply as spreads on one 2026 bond tracked had fallen to a spread of 160 bps at the end of April from 185 bps in February. “Credit spread tightening cannot be ignored. This is true even at the lowest end of investment grades,” said one firm.

RATING AGENCIES

Rating agency analysts have generally viewed the additional revenue that would come from Pritzker's progressive income tax proposal — if it clears the House and wins voter support on the 2020 ballot — as a positive. Moody’s Investors Service said the most positive impact would come from bolstering pension funding. It rates the state one notch above junk at Baa3 with stable outlook.

The April cash windfall and pension funding decisions also have drawn generally favorable reviews from the rating agencies although they are accompanied by warnings that the state can’t count on such numbers going forward. Stronger receipts reflect stronger national growth trends, the recent stock market rally, and changes to withholding following the federal Tax Cuts and Jobs Act.

The state’s “unexpected” April collections that led “to the governor's subsequent decision not to extend the pension plans' amortization period in fiscal 2020, signals likely near-term credit stability,” S&P Global Ratings wrote in a report published Monday.

“However, this budgetary reprieve might be temporary, and the state will need further progress toward structural balance and addressing pension liabilities to maintain an investment-grade rating,” the report added. S&P rates the state one notch above junk at BBB-minus with a stable outlook.

The Pritzker administration was facing pushback from lawmakers on the pension re-amortization so the decision to drop it in the wake of the latest revenue numbers eases pressure on efforts to get his rest of his agenda — led by the graduated tax — through the legislature. The session ends at the end of May.

“Although Illinois' pension plans require additional funding on top of its current ramp to achieve healthier funded levels, without the amortization extension, it at least avoids repeating the pattern of deferring pension costs, a key contributor to the state's current fiscal distress,” S&P said.

The state revised fiscal 2019 estimates up by $1.4 billion which will go to cover the current-year$1.6 billion gap. That eases pressures on the state’s $6.5 billion bill backlog which plays prominently as a factor in the state’s rating profile.

The elimination of the deficit “addresses part of Fitch's rating sensitivities related to the negative outlook,” Fitch wrote in a report published Friday. “Fitch has indicated that we would lower the state's issuer default rating if Illinois returned to a pattern of deferring payments for near-term budget balancing.” Fitch rates Illinois BBB with a negative outlook.

Fiscal 2020 estimates were raised by $800 million.