The Government Finance Officers Association is setting new virtual learning goals with its incoming president, Marion Gee, as he faces an altered world for his members in the wake of coronavirus.

Gee, finance director at the Metropolitan St. Louis Sewer District, is GFOA’s newly elected president as of this week. Though his goals have somewhat shifted due to the pandemic, Gee said the virus' effects highlight GFOA’s role as a facilitator for state and local governments to learn from one another and bring public finance issues to the broader community.

“The one thing that I would hope to get across is the need for us to really kind of lean on each other, especially during this time, to exchange ideas, don’t be afraid to ask questions,” Gee said. “Get in there and help out. We all have different levels of expertise but we can all learn from each other.”

Gee wants GFOA to provide issuers with information on COVID-19 related funding, financial resiliency best practices and overall be a resource for its members.

GFOA’s annual conference this month was originally supposed to be held in New Orleans, but is now virtual with over 40 sessions spread out for a month. Gee said they usually have the annual conference to be a facilitator to bring people together to share ideas.

“We really use our annual conference with that, but given that we couldn’t meet in person, there are other ways that we’re trying to fill that role,” Gee said.

GFOA is launching a new online learning management system by the end of this year to give members more on-demand training resources, Gee said.

“That is certainly important nowadays because a lot of jurisdictions will not allow our membership to travel — having webinars available and online learning will be critical moving forward,” Gee said.

The pandemic has shown that governments need to invest in training and professional development opportunities, Gee said.

GFOA also wants to continue to be an advocate for issuers on the Hill through advocating bringing back tax-exempt advance refundings, creating a direct-pay bond and getting rid of the cap on state and local tax deductions.

Lawmakers have worked to try to suspend a $10,000 federal limit on reducing SALT. Suspending the limit would make municipal bonds more attractive for high-income retail customers.

A direct-pay bond similar to the 2009 Build America Bonds program would be beneficial, Gee said, but he is concerned about sequestration on the subsidy payments the federal government put in place in subsequent years on BABs and could that happen again.

“So if something like that was proposed, I would personally advocate that that subsidy not be cut,” Gee said. “I think that [sequestration] creates uncertainty in the market when you have an instrument like that. It’s not to say it wasn’t beneficial, it was, you have to rely on whatever criteria is developed, is not going to be changed.”

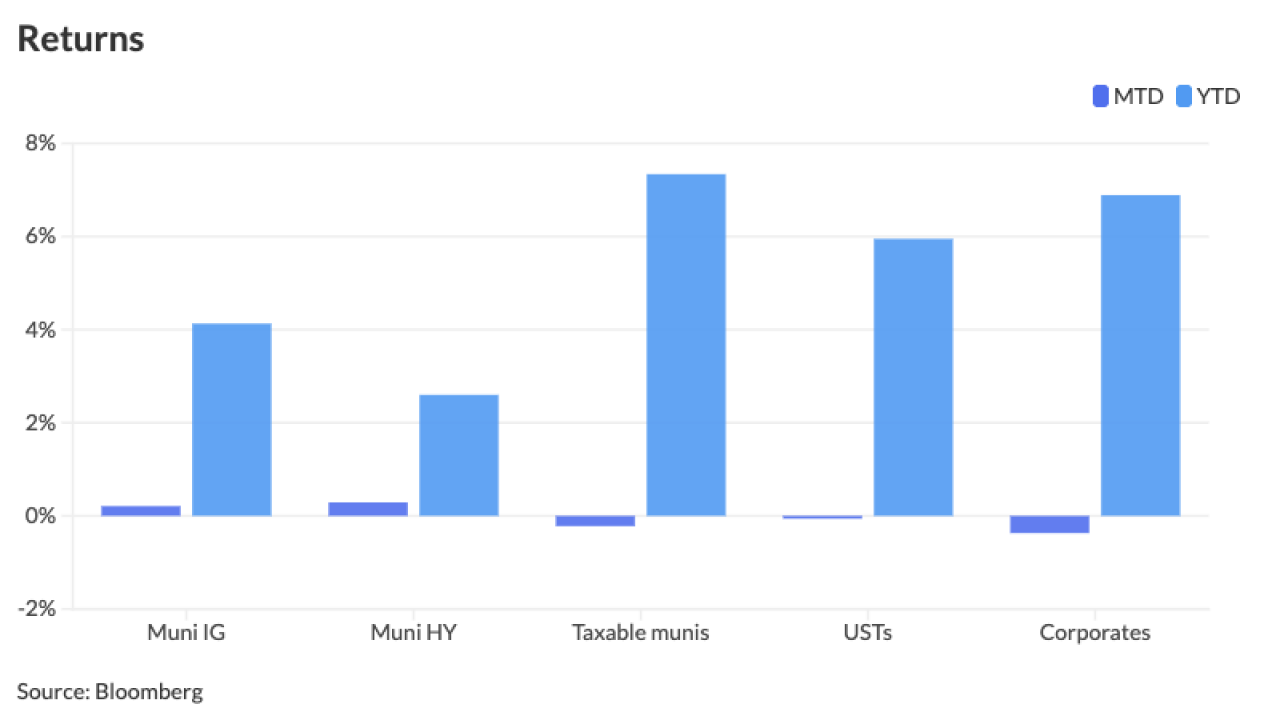

The taxable market has been doing relatively well on its own over the past year, leading to the notion that direct-pay bonds may face hurdles.

Gee called the taxable market growth an “anomaly” and a short-term solution, which is why he is pursuing advance refunding.

“We were very fortunate in that the taxable rates were such that there was an opportunity for a lot of folks to use that to do refundings of debt,” Gee said.

Gee wants to see federal funding more directly to local governments. Current legislation under the CARES Act funnels money to states and cities with larger populations where they then would give funds to smaller municipalities.

“You’re at the mercy of your particular state as to how much you get and how you can spend those funds,” Gee said. “I would like to see something made available so that those municipalities can apply and receive funding directly from the federal government.”

In his one-year term, Gee also wants to get high school and college students involved in public finance.

Western Kentucky-born Gee has an 18-year history with the GFOA. He was chair and co-chair of its Committee on Treasury and Investment Management committee and was an ex-offico for GFOA’s Committee on Governmental Debt Management.

Gee was not interested in public finance when he finished his accounting degree at the University of Louisville. His first job was working at an auditor public account office and then went to spend two decades in Lousiville, Kentucky as controller at the Louisville Water Co. and then went to work for its sewer utility as the director of finance.

In Louisville, he fell in love with public finance.

“It felt like I was contributing something,” Gee said. “You’re not really focused as much on profits, and certainly that’s important, but your main focus is on providing the services that your constituents and that your customers need. I really enjoyed that aspect of public finance. That’s what compelled me to stay in it.”

He later became San Antonio’s assistant finance director before moving to St. Louis about five years ago.

In his free time, Gee likes to watch college basketball and football, but also dabbles in theatre. His 18-year-old daughter recently graduated from a performing arts school, so the pair spent a lot of their time going back and forth to plays, including seeing Hamilton in Chicago.

“She’s broadened my horizons a little bit,” Gee said.