Louisiana came to market this week amid major volatility and rising oil prices with $121 million of bonds backed by gasoline and fuel taxes.

The state issued the $121.25 million of Series 2022A tax-exempt gasoline and fuels tax second lien revenue refunding bonds priced to the

Proceeds will be used to refund the state’s outstanding Series 2017 D-2 gasoline and fuels tax second lien revenue refunding bonds.

Morgan Stanley priced

Morgan Stanley received the official award on the issue on Tuesday. Lamont Financial Services Corp. was the financial advisor and Foley & Judell LLP served as bond counsel.

The refunding into SOFR index notes anticipates the upcoming change in Libor [the London interbank offered rate] as it will become SOFR for all trades next year, a spokesperson for state Treasurer John Schroder told The Bond Buyer.

“The state has seized the moment to position our debt and restructured the related swaps to the same index. We are retiring the debt earlier than before to shorten the average life and also modifying the swaps to reflect that as well,” the spokesperson said. “We expect that this approach will save the state several million dollars over the life of the bonds and the swap.”

In conjunction with the sale, swaps associated with the bonds will be transferred to PNC Bank N.A., where there is a substitution of a new contract for a previous one, with the interest rate swap based on SOFR.

SOFR is one of several alternative interbank offered rates intended to replace Libor and is expected to be the one that will be most used by municipalities. However, some entities, including the Iowa Finance Authority, have been using the SIFMA rate.

In January, J.P. Morgan

Interest payments on the Louisiana debt will be made monthly, with the bonds secured by a second lien on the state’s pledged gasoline and fuels taxes after interest on the first lien bonds is paid.

About $2.53 billion of first and second lien gasoline and fuels tax debt is outstanding.

At the Feb. 22 meeting of the state

“At the same time we are refinancing the debt, we are also restructuring related swaps with PNC,” she said.

“Debt service on all of the fuels tax bonds is about $140 million this year and it increases to about $220 million in 2042 and $228 million in 2043,” Folse said. “By moving the amortization schedule up, we are able to save up to $5.8 million overall and reduce that debt service in 2042 and 2043 by about $10 million in each of those years.”

This is paying the debt off quicker, she said.

The deal was rated Aa3 by Moody’s Investors Service and AA-minus by S&P Global Ratings.

Moody’s said the bonds “benefit from strong legal provisions that include constitutional protections of revenues for transportation purposes, no appropriation risk, and healthy current coverage by pledged revenues. The senior lien on pledged revenues is closed except for refundings.”

The transportation-related revenues pledged to the bonds are tied to the energy-dependent state's volatile economic and financial condition, the rating agency noted.

Moody’s has a stable outlook on the bonds.

“The outlook reflects our expectation that revenue trends will continue to provide adequate and stable coverage of debt service,” Moody’s said.

The municipal market has been highly volatile over the past few weeks, but on average rates have been trending higher since the start of the year.

The 10-year AAA-rated muni GO bond has risen 67 basis points since January. On Tuesday, the 10-year finished at 1.71%, up from 1.53% on March 1 and 1.04% on Jan. 3, according to Refinitiv MMD.

The gasoline and oil markets have been volatile as well, with prices rising fast at the pump and oil trading at $110 per barrel Wednesday.

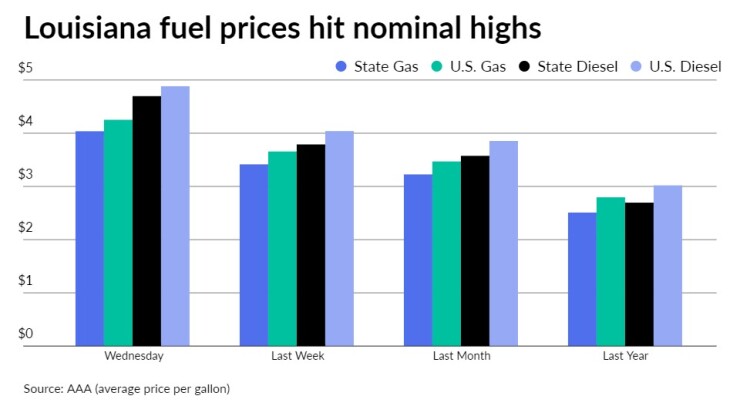

In Louisiana, the average price per gallon of regular gas hit a record high of $4.047 on Wednesday, up from $3.415 a week ago, $3.226 a month ago and $2.509 last year, according to AAA.

The average price per gallon of diesel is $4.047, up from $3.789 a week ago, $3.575 a month ago and $2.695 last year. The highest previous recorded price in the state for diesel was $4.766 a gallon on July 17, 2008, AAA said.

Nationally, the average price of a gallon of gas costs a non-inflation-adjusted record high of $4.252, up from $3.656 a week ago, $3.469 a month ago and $2.795 last year.

While gas prices have been rising fast over the past year due to higher demand and supply chain issues post-COVID, along with the rising rate of inflation, the Russian invasion of Ukraine has pushed them up to even higher levels.

Louisiana is the 25th largest state with 4.6 million residents and has the 26th largest state gross domestic product. It is heavily dependent upon the energy industry — oil and gas refineries being major industries — as well as fishing and farming.

The state has below average wealth, with 2020 per capita personal income equal to 85% of the U.S. level and among the highest poverty rates in the country.

In December, the state's unemployment rate stood at 4.8%, down sharply from a pandemic high of 13.1% in April 2020. The COVID-19 virus left almost 17,000 dead in the state, which experienced more than 1.2 million cases of the coronavirus.

Separately, the state tentatively plans to competitively sell up to $300 million of general obligation new money and refunding bonds on March 30, Folse said, with an anticipated closing date of April 19.

In January, the state came to market with over $650 million of

Instead, Wells Fargo Corporate & Investment Banking priced the $651 million of Series 2022A taxable first lien gasoline and fuels tax revenue refunding bonds. Folse said the January refinancing saved the state about $3.4 million annually.