The collective health of 11 pension systems that cover Chicago and Cook County and local general government workers across the state mostly held steady in 2020, propped up by healthy investment returns and rising contribution levels for some of the funds that still fall short of actuarial standards.

Overall the results for 2020 laid out in the state legislature’s Commission on Government Forecasting and Accountability

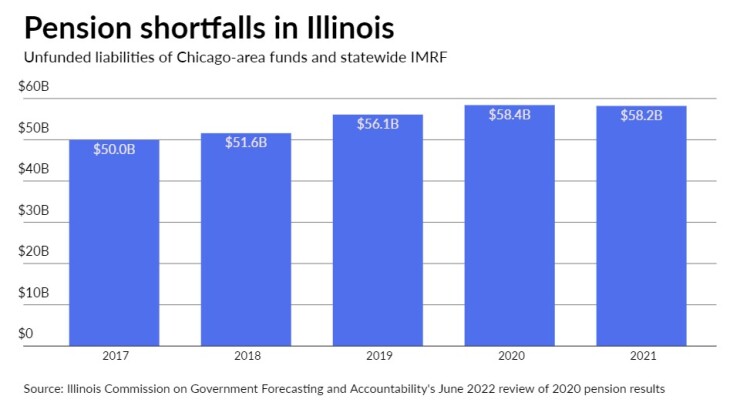

Although it's a modest shift, the collective results from the funds do reverse a trend of rising unfunded liabilities.

Overall, the 11 funds closed out 2020 with $58.2 billion of unfunded liabilities, just slightly better than the collective tab of $58.4 billion for 2019 in last year’s report. Most exceeded their assumed rates of return in the 6% to 7% range but fell short of the robust returns above 15% most saw in 2019, so the pain of a potential drop this year in market returns may hurt down the road.

Local pension pressures weigh heavily on local government ratings and decision-making, driving some governments to issue risky pension obligation bonds, raise taxes, cut services, and privatize assets. On the benefit side, state and local governments have few options given state constitutional protections against the diminishment or impairment of promised benefits.

“Pension plans have made little funding progress in recent years and their costs have been rising, pressuring municipalities' budgets,” S&P Global Ratings wrote in a 2021 special pension brief, “Single-Employer Pension Plans Are Straining Illinois Municipalities Credit Quality.”

Statutory multiplier formulas based on employee payments — not based on actuarial requirements — are blamed for city and state underfunded pensions although some funds have phased in actuarially based contributions.

The improving health of Cook County’s system and the Illinois Municipal Retirement Fund that covers non-public safety employees who work in local governments across the state offset growth in the unfunded tab for eight funds that mostly rely on Chicago’s property tax base.

Chicago’s four funds along with the Chicago Transit Authority, Chicago teachers’ fund, Chicago Park District, and the Water Reclamation District of Greater Chicago saw their unfunded tab rise to $48.6 billion for a collective 33.9% funded ratio compared to $46.9 billion in 2019. The funded ratio was 34% in 2019.

The overall statewide burden totals is much higher after adding in the

Chicago’s Municipal Employees' Annuity and Benefit Fund carried $13.87 billion of unfunded liabilities into 2020 compared to $13.28 billion and a 22.3% funded ratio which showed some slight erosion from 23.2% in 2019. The fund assumes a 7% rate of return and hit 10% in 2020 compared to 16.8% a year earlier.

“The unfunded liability increases due to contributions being less than normal cost plus interest cost,” the report said. Actuarially based contributions began this year under the city’s pension funding overhaul that phased in higher contributions to the municipal and laborers funds over five years until reaching an actuarial formula with a 90% target set for 2058. Despite the shift, the fund isn’t expected to hit even a 50% funding level until 2051.

Chicago’s Laborers' Annuity and Benefit Fund mostly held steady in 2020 closing out the year with $1.56 billion of unfunded liabilities and funded ratio of 43% compared to $1.55 billion and a funded ratio 42.6% in 2019. The fund saw a 15.5% rate of return compared to 18% the year before. It assumes 7.25%.

While actuarial contributions began this year that put the fund on a path to 90% funded status in 2058 it won't hit 50% until 2051.

Chicago’s Policemen's Annuity and Benefit Fund mostly held steady and saw a slight improvement in the funded ratio. It carried $11.3 billion of unfunded liabilities and a 23.1% funded ratio compared to $11.1 billion and a 22.3% funded ratio in 2019.

The fund exceeded its 6.75% assumed rate seeing a 12.3% return, which was down from 16.3% in 2019.

The fund along with the firefighters' has received actuarially based contributions since 2020 after a five-year ramp in payments and is slated to hit a 90% funded ratio required by state law in 2055 but it will take until 2043 to hit even a 50% funded ratio.

Chicago’s Firemen's Annuity & Benefit Fund closed out 2020 with $5.29 billion of unfunded liabilities, up slightly from $5.12 billion a year earlier but the funded ratio improved to 19.4% from 18.2%. The fund assumes a 6.75% return on investments and captured 11.4%, down from 19.6% in 2019.

It will take until 2043 to hit at least a 50% funded ratio on the road to 90% funded in 2050.

A state-approved

Similar legislative action on the police fund could come next year. Chicago’s chief financial officer, Jennie Huang Bennett, has warned the change could carry a

Only one of the four funds has posted on their websites results for 2021. Chicago will include the actuarial reports in its 2021 annual financial report published later this month or in July.

The Chicago Park Employees' Annuity and Benefit Fund's unfunded liabilities rose to $848 million from $821 million while the funded ratio dipped to 28.7% from 29.9% in 2019. The parks assume a 7.25% rate of return and exceeded it at 9.3% compared to 17% in 2019. "Unfunded liability increased due to total contributions being less than normal cost, plus interest cost," the report reads.

A pension

The Public School Teachers' Pension Fund had a $12.83 billion tab and 46.7% funded ratio, slightly worse than the $12.23 billion tab and 47.4% funded ratio in 2019. The fund lacked the strong double-digit returns seen by other systems over 2019 and 2020 recording a 4.5% return in 2020 and 5.5% in 2019 while assuming a 6.75% return.

State legislation has the fund on track for a 90% funded ratio in 2059 but it will take until 2038 just to hit 50% based on projections.

The Chicago Transit Authority closed out fiscal 2020 with $1.72 billion of unfunded liabilities and a funded ratio of 53.3%, holding mostly steady from $1.7 billion in 2019 with some improvement in the past funded ratio of 52.6%. The fund assumes an 8.5% return and its 2020 earnings fell short at 7.6% after seeing a 15.7% return in 2019.

The Metropolitan Water Reclamation Fund saw improvement on both fronts with its unfunded liabilities trimmed slightly to $1.16 billion in 2020 from $1.18 billion and its funded ratio of 57.3% from 55.9% in 2019. The fund assumes a 7.25% rate of return which it met at 9.2% compared to 18.3% a year earlier.

The system’s funded status has further improved for 2021 to 58.7%, according to the district, and it’s aiming to reach 65% by 2026. Illinois Gov. J.B. Pritzker

Cook County recorded $6.66 billion of unfunded liabilities in 2020 and a funded ratio of 63.9%, an improvement from $6.97 billion and a funded ratio of 61.2% in 2019. Cook assumes a 7.25% rate of return and saw a return of 12.7% for 2020, compared to 19.1% in 2019.

Funded ratios been on slow rise since the county began

Still, projections forecast looming insolvency in 2048 because the supplemental payments have not yet been set in state statute with negotiations still ongoing between the pension fund, union, and county on legislation.

Cook County Forest Preserve District saw its unfunded liabilities grow to $145.4 million from $139.9 million and funded ratio slip just slightly to 59.1% from 59.3%. The fund assumes a 7.25% rate of return and exceeded that at 11.4% for 2020 compared to 18.6% in 2019.

Under the current funding policy the Cook County Forest Preserve Pension Fund is projected to run out of assets by 2042 if all future assumptions are met and no additional contributions are made," the report warned.

The district is banking on voter approval of a referendum slated for the November ballot that would raise its property tax rate allowing it both to fund land acquisition and improvements, stabilize its finances, and to raise pension contributions.

“The County Board should be prepared to take swift action if the Forest Preserves’ upcoming property tax referendum does not pass,” said Chicago Civic Federation President Laurence Msall said in the organization’s review of the county’s 2022 budget.

The Illinois Municipal Retirement Fund- saw its unfunded liabilities shrink to $2.9 billion from $4.4 billion and its funded ratio grow to 94.1% from 90.7%. The system assumes a 7.25% rate of return and topped it at 14.8% compared to 19.6% in 2019.