Municipal bonds finished out the first trading day of 2019 on the stronger side as continued volatility in the stock market promoted a better safe than sorry attitude among investors.

Munis were an exception to the global rout in 2018 as they outperformed other major asset classes, which posted low to negative returns.

Tax-exempt bonds returned just under 1%, as weekly demand for tax-exempts continued to outstrip supply, Peter Block, managing director of credit strategy wrote in a Dec. 17 report entitled “Municipal Market 2018 Review and 2019 Outlook.”

He said there were various catalysts for high correlation between all markets in 2018, but the common theme was the Federal Reserve.

“The U.S. central bank in 2018 began a concerted effort to curtail financial stimulus that began in response to the 2008 financial crisis that has helped result in one of the longest bull markets in decades,” Block wrote. The volatility occurred as investor outlooks for global economic growth and corporate profits turned sharply lower beginning in September, “exacerbated by rising U.S. interest rates and the Trump-induced U.S.-China trade war.”

The Fed, in trying to combat inflation in 2018, however, began to “taper” its balance sheet and since December 2015 has increased the Fed Funds rate eight times in 25 basis-point increments, resulting in rates trending higher over the past two years. The Fed raised the benchmark rate by another 25 basis points on Dec. 19, marking the ninth rate hike since 2015 and fourth increase in 2018 with its target range of 2.25%-2.50%.

According to Block, the Fed has appeared to have achieved a neutral rate at this point, with the core PCE running at 1.8% year over year — just below the Fed’s target range of 2%.

The 10-year Treasury peaked at 3.24% on Nov. 8, but has since retreated to 2.67% as of Jan. 2. Estimates for the 10-year Treasury are 3.32%, indicating relatively range-bound rates for most of 2019, Block said. “We think this indicates a still strong, but slowing, U.S. economy in 2019 as a bullish sign for equities and fixed income generally, including munis in particular as we head into 2019.”

Morgan Stanley Wealth Management analysts said year-to-date gains and minimal credit detours led to positive municipal bond performance in 2018.

“Moving forward [into 2019], many of the same constructive dynamics discussed at the onset of 2018 are once again apparent,” Morgan Stanley Executive Director Matthew Gastall, and Vice President Monica Guerra wrote in a Dec. 19 monthly report. “These include benign credit conditions, healthy reinvestment demand, modestly depressed supply due to the limitations placed on the abilities to advance-refund debt, a flatter yield curve, and personal income tax reductions passed during the Tax Cuts and Jobs Act that had a manageable impact on bond demand.”

Potential changes to the tax-exemption were assuaged and relative-value ratios, which measure where municipals trade versus their Treasury counterparts, have returned closer to their historical levels.

“This development suggests that municipals should trade in a manner consistent to their historical relationship with the broader fixed income environment,” the analysts said. “Our market also stands upon the brink of another potential 'January Effect,' the annual period when primary volume often declines while reinvestment demand increases.”

According to Guerra and Gastall, investors should include reviewing yield-curve positioning, sector and state diversification, credit quality, coupon structure, and tax exposure.

“As the yield curve continues to flatten, remain vigilant with maintaining the appropriate exposures to cash and look to blend high-quality taxable counterparts in the very shortest maturities where yields have risen in USTs more than in munis,” the analysts wrote.

Others looked back at the year quarter by quarter as a road map to what’s ahead in 2019.

After a declining municipal volume, rising yields, and significant mutual fund inflows in the first quarter, the second quarter brought with it improving volume and rising trade tensions with China that created global volatility as muni-to-Treasury ratios trended lower and mutual fund flows remained positive, Ivan Gulich, senior vice president at Loop Capital wrote in a Dec. 19 municipal strategy report.

As the third quarter arrived, rising municipal yields continued amid a hawkish Fed stance, new issuance remained solid — except for refundings — while positive fund flows ended in September sparking an eventual $6 billion exodus over 12 consecutive weeks, he noted.

The investment environment changed rapidly in quarter four, according to Gulich, including a stock market correction led by the technology sector, while oil prices fell by 36%.

Treasury yields surged in early October, as the 10-year yield hit a seven-year high on the strength of the economy, while a stock market rout boosted demand for safe haven investments.

Investor concerns grew along with increasing global volatility and the inversion of the front end of the Treasury curve.

“Some market participants boosted their inventories in anticipation of January reinvestment demand,” Gulich said. “ Anemic muni issuance in the second half of December and rising demand for safe-haven assets amid plunging stock market provide additional support for the muni market despite continuing muni fund outflows totaling $6 billion over 12 consecutive weeks.”

While refunding volume will remain depressed in 2019, it will likely gradually improve year-over-year because current refundings “are no longer being cannibalized by advance refundings,” Loop strategist Chris Mier wrote in the same report as Gulich.

The variation in new issue volume in the past was attributed mostly to refunding volume that was driven by interest rate levels and the relative shape, curvature and slope of the municipal and Treasury yield curves, he noted.

“The elimination of advance refundings made muni issuance less sensitive to interest rates,” Mier wrote. “Much of the new money issuance is not driven by rate levels, but capital plans and budgetary needs. Current refundings almost always produce savings due to the curve roll-down effect. Thus, muni issuance should be more predictable going forward,” Mier said.

Mier said based on the firm’s forecasting model and its interest rate expectations, new issue volume in 2019 will reach about $340 billion. “Our assumption is that municipal interest rates will average close to year-end levels for all of 2019,” he said.

Secondary market

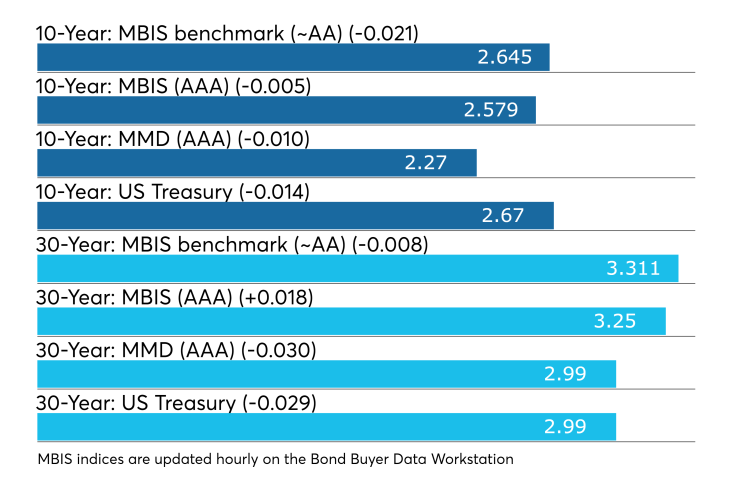

Municipal bonds were stronger on Wednesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as two basis points in the one- to 30-year maturities.

High-grade munis were mostly stronger, with yields calculated on MBIS' AAA scale falling eight basis points in the one-year, three basis points in the two- and three-year, two basis points in the four-year and as much as one basis point in the five- to 26-year maturities and rising as much as a basis point in the 27- to 30-year maturities.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation declining by one basis point while the 30-year muni maturity dropped three basis points in the year-end rollover.

Treasury bonds were stronger amid continuing stock market volatility. The Treasury 30-year was yielding 2.99%, the 10-year yield stood at 2.67%, the five-year was at 2.50%, the two-year was at 2.50% while the Treasury three-month bill stood at 2.42%.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 85.3% while the 30-year muni-to-Treasury ratio stood at 100.3%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Primary market

This week’s calendar is mostly empty, with only about $18 million of deals going up for sale. The biggest deal of the week is a competitive note sale as Jersey City offers $83.4 million of bond anticipation notes on Thursday.

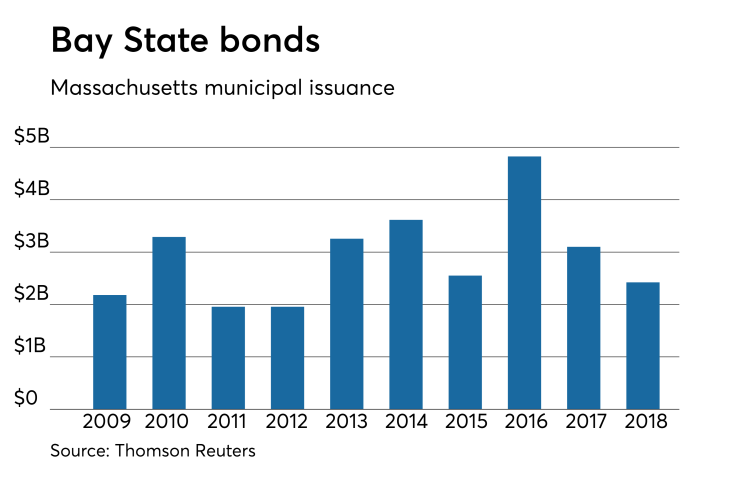

Next week’s slate is building, with Bank of America Merrill Lynch set to price Massachusetts $967 million of tax-exempt and taxable general obligation and GO refunding bonds in the negotiated sector.

Since 2009, Massachusetts has sold over $29 billion of bonds, with the most issuance occurring in 2016 when it offered $4.83 billion of securities. It sold the least amount in 2011 and 2012 when it issued $1.96 billion of bonds in each of those years.

Also next week, Wells Fargo Securities is expected to price the New Jersey Transportation Trust Fund Authority’s $500 million of transportation program bonds and the state of Mississippi’s $279 million of gaming tax revenue bonds.

And Morgan Stanley is set to price Texas A&M University’s $220 million of tax-exempt and taxable revenue financing system bonds.