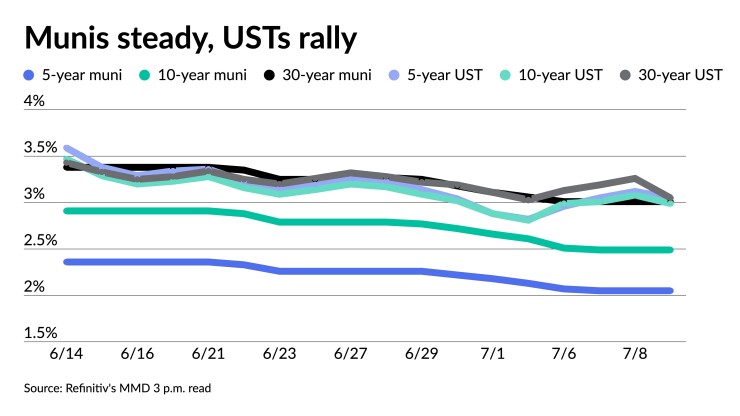

Municipals were mostly steady to firmer in spots, underperforming a U.S. Treasury rally out long, while equities posted losses.

Triple-A benchmarks were bumped up to three basis points, depending on the scale, while USTs were bumped eight to 10 basis points five years and out, pushing ratios higher.

As municipal yieldshad fallen for the third consecutive week, it was a potential indication “that we may start to see a recovery and some positive sentiment toward tax-exempt bonds,” said Jason Wong, vice president of municipals at AmeriVet Securities. "The start of the second half of the year has become somewhat favorable to munis as we have started to see retail investors start to dive back into the markets with yields at attractive levels."

He noted 10-yearmuni yields dropped 12 basis points since last Tuesday and now stand at 2.49% as of Monday%, outperforming USTs andmoving ratios below 83% last week.

Muni to UST ratios on Monday were at 67% in five years, 83% in 10 years and 95% in 30 years, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the five at 66%, the 10 at 85% and the 30 at 95% at a 3:30 p.m. read.

“Ratios have slowly turned to favor munis since their highs back in mid-April when [the 10-year] hit a high of 104.45% which was also when we saw yields at its highest for the year when they were at 2.97%," Wong said. "With yields falling again, we did see the muni curve flatten slightly by just one basis point to 129 basis points."

"This is positive news as investors and issuers want stability in the muni markets," Wong said.

"So far, for the month of July, munis have returned about 1.2% but still have a loss of about 8% this year," he said. "With the CPI number coming on Wednesday, we should expect to see a very active secondary market as investors try to gauge if inflation has been brought under control."

However, last week’s strong outperformance of exempts relative to taxables “means that demand from banks and insurance companies cannot be counted on to help clear this week's new deals (unless deals get priced at a concession to the market),” said CreditSights strategists Pat Luby, John Ceffalio and Sam Berzok.

The $11-billion-plus calendar is the largest in eight weeks and includes two large high-grade issuers — $2.2 billion of revenue bonds from the

The calendar also includes $542 of non-AMT Dallas Fort Worth International Airport joint revenue refunding bonds from the Cities of Dallas and Fort Worth, Texas. This deal should attract good demand as only a third of municipal airport bonds are non-AMT bonds, "so there is a modest scarcity-premium for non-AMT airport bonds.”

Mutual fund outflows have continued in the latest week, and net flows have been negative in 20 of the last 21 weeks, per Refinitiv Lipper data.

“Mutual fund redemptions have obscured the incredibly large amount of new money going into muni mutual funds,” they said.

“With $45 billion in redemptions coming this month and a small 30-day visible supply we could see a very active secondary market as investors need to put money to work,” Wong said.

Due to the strong level of demand operating in the background, CreditSights strategists said, “a slowdown in mutual fund redemptions could lead to a powerful outperformance of munis, although if prices rise too much and drive yields dramatically lower, the demand from income-oriented investors could slow down.”

With the strength of demand for new issues in the front part of the yield curve, they will be watching to see if “bonds in the 10-20 year range of this week's deals have to get priced at a wide concession to be able to clear the market.

They noted there could “be some good buys — especially if tax-exempt yields hit parity with comparably rated corporate bond after-tax yields, which could greatly expand demand.”

Secondary trading

Georgia 5s of 2023 at 1.36%. Maryland 5s of 2023 at 1.33%. North Carolina 5s of 2023 at 1.30%. NYC 5s of 2024 at 1.84%. Washington 5s of 2025 at 1.84%.

Triborough Bridge and Tunnel Authority 5s of 2028 at 2.25%. NYC 5s of 2028 at 2.32%. South Carolina 5s of 2029 at 2.28%. Georgia 5s of 2029 at 2.30%.

TBTA 5s of 2032 at 2.66%. Montgomery County, Pennsylvania 5s of 2034 at 2.66%.

California 5s of 2041 at 3.09%. Washington 5s of 2044 at 3.26%. California 5s of 2047 at 3.26%. LA DWP 5s of 2052 at 3.31%.

AAA scales

Refinitiv MMD’s scale was unchanged at the 3 p.m. read: the one-year at 1.47% and 1.79% in two years. The five-year at 2.05%, the 10-year at 2.49% and the 30-year at 3.01%,

The ICE municipal yield curve was firmer in spots: 1.47% (-1) in 2023 and 1.78% (-3) in 2024. The five-year at 2.04% (-3), the 10-year was at 2.50% (-2) and the 30-year yield was at 3.03% (flat) at a 3:30 p.m. read.

The IHS Markit municipal curve was unchanged: 1.47% in 2023 and 1.81% in 2024. The five-year at 2.05%, the 10-year was at 2.49% and the 30-year yield was at 3.01% at a 3 p.m. read.

Treasuries were firmer.

The two-year UST was yielding 3.082% (-4), the three-year was at 3.119% (-3), the five-year at 3.055% (-9), the seven-year 3.072% (-10), the 10-year yielding 2.998% (-10), the 20-year at 3.435% (-9) and the 30-year Treasury was yielding 3.182% (-8) at 3:30 p.m..

Primary on Friday:

RBC Capital Markets priced for the

Primary to come:

The District of Columbia (Aa1/AAA//) is set to price Wednesday $1.453 billion of revenue bonds, consisting of $666.740 million of tax-exempts, Series 2022A, serials 2031-2047; $139.395 million of taxables, Series 2022B, serials 2026-2031 and $647.090 million of tax-exempts, Series 2022C, serials 2023-2037. BofA Securities.

The Colorado Health Facilities Authority (/AA+//) is set to price Wednesday $1.075 billion of revenue bonds, consisting of $478.945 million of bonds, Series 2022A; $197.860 million of long-term bonds, Series 2022B; $197.850 million of refunding long-term bonds, Series 2022C and $200 million of refunding floating rate notes, Series 2022D. J.P. Morgan Securities.

The Cities of Dallas and Fort Worth, Texas, (A1/A+/A+/AA/) are set to price Tuesday $542.460 million of non-AMT Dallas Fort Worth International Airport joint revenue refunding bonds, Series 2022B. Jefferies.

Harris County, Texas, (Aaa//AAA/) is set to price Wednesday $425.025 million, consisting of $102.725 million of tax and subordinate lien revenue refunding bonds, Series A; $233.220 million of unlimited tax road refunding bonds, Series B and $89.080 million of permanent improvement refunding bonds, Series C. Estrada Hinojosa & Co.

The Massachusetts Development Finance Agency (A1///) is set to price Thursday $361.510 million of Northeastern University issue revenue refunding bonds, Series 2022. Morgan Stanley & Co.

The San Antonio Independent School District, Texas, (Aaa//AAA/) is set to price Tuesday $322.450 million of unlimited tax school building bonds, Series 2022, serials 2023-2052, insured by the Permanent School Fund Guarantee Program. Raymond James & Associates.

The River Islands Public Financing Authority Improvement No. 1, California, (/AA//) is set to price Tuesday $287.850 million, consisting of $207.735 million of tax-exempt special tax refunding bonds, Series 2022A-1; $3.980 million of taxable special tax refunding bonds, Series 2022A-2; $15.980 million of tax-exempt subordinate special tax refunding bonds, Series 2022B-1 and $60.155 million of tax-exempt special tax bonds, Series 2022B-2. HilltopSecurities.

The Klein Independent School District, Texas, (Aaa/AAA//) is set to price Wednesday $145.340 million of unlimited tax schoolhouse bonds, Series 2022, serials 2023-2047, insured by the Permanent School Fund Guarantee Program. Ramirez & Co.

The City of Phoenix Civic Improvement Corporation, Arizona, (Aa2/AAA/AA+/) is set to price Tuesday $142.275 million of subordinated excise tax revenue bonds, Series 2022. J.P. Morgan Securities.

The Trinity River Authority of Texas (/AAA/AAA/) is set to price Tuesday $126.020 million of regional wastewater system revenue bonds, Series 2022, serials 2024-2042. Citigroup Global Markets.

The Massachusetts Port Authority (Aa2/AA/AA/) is set to price Tuesday $124.730 million of green AMT revenue bonds, Series 2022-A, serials 2028-2042. UBS Financial Services.

Competitive:

The Miami-Dade County School District is set to sell $270.800 million of general obligation school bonds, Series 2022A, at 10 a.m. eastern Tuesday.

The New York State Thruway Authority is set to sell $154.225 million of taxable state personal income tax revenue bonds, Series 2022B, at 10 a.m. eastern Wednesday.

The New York State Thruway Authority is set to sell $360.365 million of state personal income tax revenue bonds, Series 2022A, Bidding Group 4, at 12 p.m. Wednesday.

The New York State Thruway Authority is set to sell $364.250 million of state personal income tax revenue bonds, Series 2022A, Bidding Group 5, at 12:30 p.m. Wednesday.

The New York State Thruway Authority is set to sell $428.870 million of state personal income tax revenue bonds, Series 2022A, Bidding Group 3, at 11:30 a.m. Wednesday.

The New York State Thruway Authority is set to sell $430.380 million of state personal income tax revenue bonds, Series 2022A, Bidding Group 1, at 10:30 a.m. Wednesday.

The New York State Thruway Authority s set to sell $455.885 million of state personal income tax revenue bonds, Series 2022A, Bidding Group 2, at 11 a.m. Wednesday.