Kroll Bond Rating Agency has expanded its public finance team with the addition of four municipal bond veterans, stepping up its challenge to the big-three rating agencies.

Earlier this week, the firm hired Marina Roytelman as associate director of its financial guaranty group from Standard & Poor's, where she was a credit analyst. Roytelman will report to managing director Paul Kwiatkoski, the founder of FG Research LLC, who was hired along with Fitch Ratings' James George last month. They joined senior director Harvey Zachem, formerly of HSBC Global Asset Management, who came on board in December.

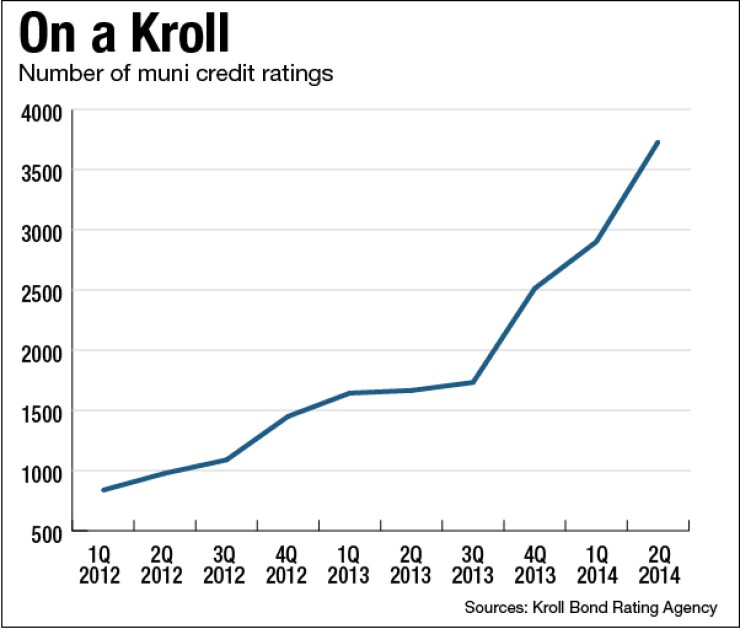

"As a company we're growing and increasing market share across the board," Kathleen Kennedy, senior director at Kroll said. "We rated our first transaction back in June of 2011, so it's only been three years and we're now well-known, accepted by investors and making a footprint in the rating agency sector."

Kroll's strategy is to solidify its foothold by providing "thought leadership" and publishing in-depth research reports that may provide investors with more of a voice in the industry.

"Meeting with investors is our number one goal as the investors are the end user of our ratings," Kennedy said. "They're looking for transparent and in-depth research, which will provide them with more color and overall assist them with making an easier investment decision. Investors want to be able to pick up the phone should they have a question on a credit and discuss with us how we got to our rating and what parameters we used to get there. Responsiveness, transparency and timeliness are our main goals and what we are trying to provide."

Including the new hires, Kroll's public finance sector consists of 10 muni analysts, two sales representatives and two technical employees, who also cross over into the structured finance department. Bill Bankey, formerly of Deutsche Bank, joined the public finance team as the issuer relations point person last August.

"Our analysts have a lot of experience across various sectors," said senior managing director Karen Daly. "This enables us to have more of a holistic world view. You can take your learnings from a water and sewer bond, or a sales tax bond, or a GO bond and transfer those learnings when thinking about airports or other types of revenue bonds."

Kroll rates every depository institution in the United States as well as a few overseas on a quarterly basis using an A through E rating scale.

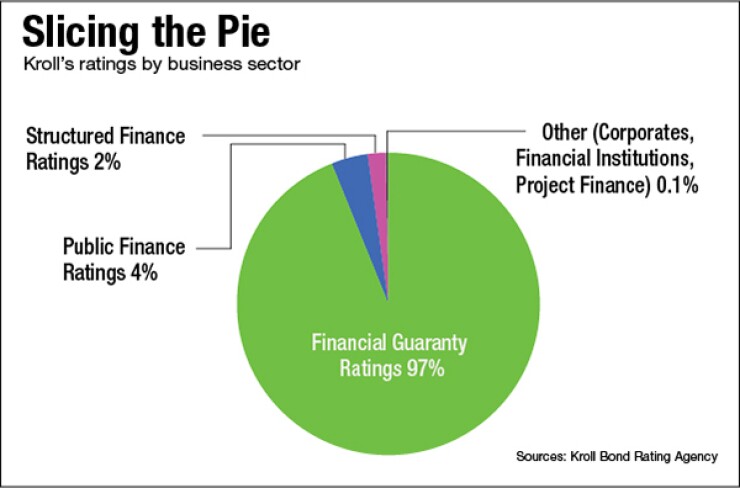

The agency has issued 81,000 muni ratings including the insured ratings of MAC, the public finance platform of Assured Guaranty, and National, the public finance platform of MBIA. The firm has rated about $225 billion across all sectors of the company, which is the equivalent of rating 2,000 issuers.

In 2013, Kroll issued 3,845 ratings across all sectors. By comparison S&P's U.S. Public Finance division alone issued 18,847 ratings last year and Moody's Investors Service's Public Finance division issued 15,700 ratings.

Among Kroll's recent inroads, the firm issued ratings for Dallas Fort Worth Airport, Chicago Transit Authority and Chicago Park District. For each issuer, Moody's rating was removed and Kroll was used in its place.

Mike Phemister, vice president of the treasury at Dallas Fort Worth Airport said the decision to drop Moody's was made long before it knew Kroll would be rating airports.

"Moody's does not understand how critical airports are to the local economy," he said. "They didn't give management enough credit. After meeting with them in the fall for what they call a transparency meeting, it was clear that they did not understand our business anymore."

Phemister said that the decision to include Kroll came later in the process.

"Kroll published a 30 page report with our credit rating and no one else does that," he said. "They provided new insight with the report and added value to our rating."

According to Daly, Kroll strives to tell the story of the credit in a way that is accessible and easy for investors at all levels to understand. The rating agency says that its 20 to 30 page reports are part of what differentiates itself from Moody's, S&P and Fitch.

"If you notice in our reports, very different from our competitors, we spend a lot of time discussing the budget process and how management has reacted to challenges in the past and how they hope to react to challenges in the future," said Jim Nadler, Kroll's president and chief operating officer. "That's critical, because that's going to make the difference between understanding real risk going forward in the market."

All of the rating agency's research is available at no cost on its website.

Patrick Early, chief municipal analyst and managing director at Wells Fargo Advisors, said Fitch took a similar approach when it was "trying to make a splash in the industry."

"It comes down to more than just the quality of the ratings and a good research product," Early said. "A big challenge for a new agency is being represented by retail brokerage firms; we see Moody's and S&P's ratings. It's not as transparent to the investor what Kroll might think of a particular issuer. An institutional buyer can contact Kroll, but for a lot of retail investors if they feel like they've gotten what they need from what's in front of them they won't go searching for more info."

Kroll places a lot of emphasis on management in its rating methodology. With management having played a significant factor in the post 2008 period, it is a key rating determinate in all sectors.

"Our approach in the public finance space gives an elevated voice to the role of management that also differentiates us," Daly said. "Management plays a huge role in determining the fate of municipal issuers. We meet with management when we rate issuers and it's something we're going to continue to pay a lot of attention to."

Although the other rating agencies do offer management discussion in their reports, Early said "having another agency that takes the role of management seriously is good for all of us."

With over 25-years of financial guaranty experience, Kwiatkoski is the point person for new and existing ratings. George is the director of public finance, the same title at Fitch Ratings for four years. His current focus is on general obligation bonds.

Zachem has over 20-years of experience in public finance and credit risk management and is responsible for infrastructure, transportation, tax and revenue backed debt, and GOs. Previously, he was vice president and senior analyst at, the HSBC unit, focused on municipal, sovereign, and sub-sovereign portfolio credits.

Kwiatkoski, and Zachem report to Daly, while George reports to Kate Hackett head of GOs. The public finance division is based in Kroll's New York office.

Kroll also has an office in Mount Airy, Maryland that focuses on an investor paid bank service and an office outside of Philadelphia in Dresher, PA that focuses on the surveillance of commercial mortgage backed securities.

Going forward, Kroll expects muni risk to be idiosyncratic. In the past, rating agencies urged bond insurers to diversify their portfolios in order to receive a higher rating. The notion that munis don't default is a thing of the past and has changed the relationship between investors and rating agencies.

"Rating agencies are referees; they're not players in the game," Nadler said. "We're not on the field, we're not the coaches. You will hear us commenting on whether we think credits are too low or too high, and also on the role of the rating agency. We feel strongly that post-crisis rating agencies need to get back to the subjective role of being an observer."