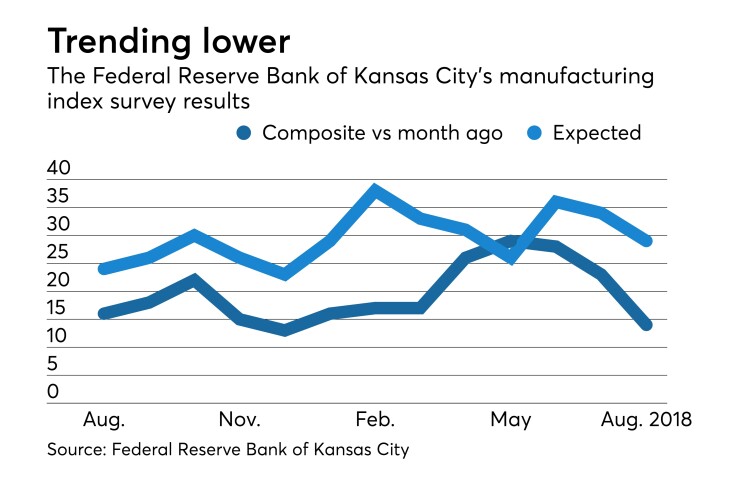

Respondents to the Federal Reserve Bank of Kansas City's monthly manufacturing survey reported slightly weaker activity in August, while future expectations did well despite concerns about trade and tariffs.

"Our composite index came down a bit again in August," said Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City. “But the pace of growth in regional factories is still at the solid levels that prevailed in late 2017 and early 2018.”

Growth expectations “remained solid, despite continued concerns about trade and tariffs,” according to the survey. “Price indexes moderated somewhat.”

The composite index dropped to 14 in August from 23 in July, while the production index slid to 10 from 22, volume of shipments grew to 18 from 12, the volume of new orders index fell to 9 from 21, and the backlog of orders index dipped to 8 from 9. The new orders for exports index declined to negative 1 from positive 6 and the supplier delivery time index slid to 19 from 28.

The number of employees index fell to 14 from 26, while the average employee workweek index dropped to 1 from 14. The prices received for finished product index remained at 27, while the prices paid for raw materials index decreased to 44 from 52.

As for the inventories indexes, materials held at 17, while the finished goods slid to 9 from 11.

In projections for six months from now, the composite index dipped to 29 from 34, and the production index slid to 44 from 49. The shipments fell to 40 from 52, while new orders decreased to 36 from 37, and the backlog of orders index dropped to 16 from 29. The new orders for exports index crept to 9 from 8, and the supplier delivery time index fell to 21 from 29.

The number of employees index was at 33, off from 42 last month, while the average employee workweek index climbed to 15 from 13. The prices received for finished product index fell to 28 from 43, and the prices paid for raw materials plunged to 40 from 68. The capital expenditures index was at 28, down from 38 the prior month.

As for the inventories indexes, materials declined to 11 from 15, while the finished goods index gained to 10 from 7.

The Tenth Federal Reserve District includes Kansas, Colorado, Nebraska, Oklahoma, Wyoming, northern New Mexico and western Missouri.